Range Resources (RRC) - Range Bound No More?

Written by Mark Malinowski with comments by Zac Mannes

In 2025 there was a lot of price action around everything surrounding uranium. From miners to refiners to fuel producers to small scale reactor companies. While some experienced significant appreciation in stock price it appears the sentiment got a little overheated as many names have now given back a large portion of that price change in the last couple of months.

While I won’t suggest I know all the reasons that many of those names increased in value, I do know that there is an expectation of significant increases in demand for power due to the booming spending happening in AI and specifically AI data centers. Many saw the signing of a deal between Microsoft (MSFT) and Constellation Energy (CEG) to refurbish the Three Mile Island nuclear facility as the start of this trend back in September 2024. This refurbishment project is now back stopped by a 1 billion government load as of Nov 18, 2025. This project, now named the Crane Clean Energy Center, is projected to start producing power for Microsoft by sometime in 2027 (originally 2028).

While that sounds great, many projects for small scale reactors to produce local power for AI data centers still face many hurdles. These hurdles include the fact that many companies do not have regulatory approval to build their reactors. Nor do many of these companies have experience building a full scale one. There are still amounts of opposition to building new reactors post the Fukushima failure. Meaning the cost and timeline estimates for these products to be producing power is likely higher and longer than originally anticipated.

That doesn’t mean I am bearish uranium, but rather that I see an opportunity for players in a different energy space in the near term.

So what does that mean? How will these power needs be met? Well one of the fastest (from the word go to power being produced), cheapest (initial upfront costs) and cleanest ways to produce power is by burning natural gas in a turbine. Large amounts of infrastructure to supply natural gas is already in place and the land foot print is relatively small. This makes it a very attractive proposition for companies looking for power.

Finding the place where fundamentals and technicals meet is something that we frequently see as a “sweet spot” in stock picking.

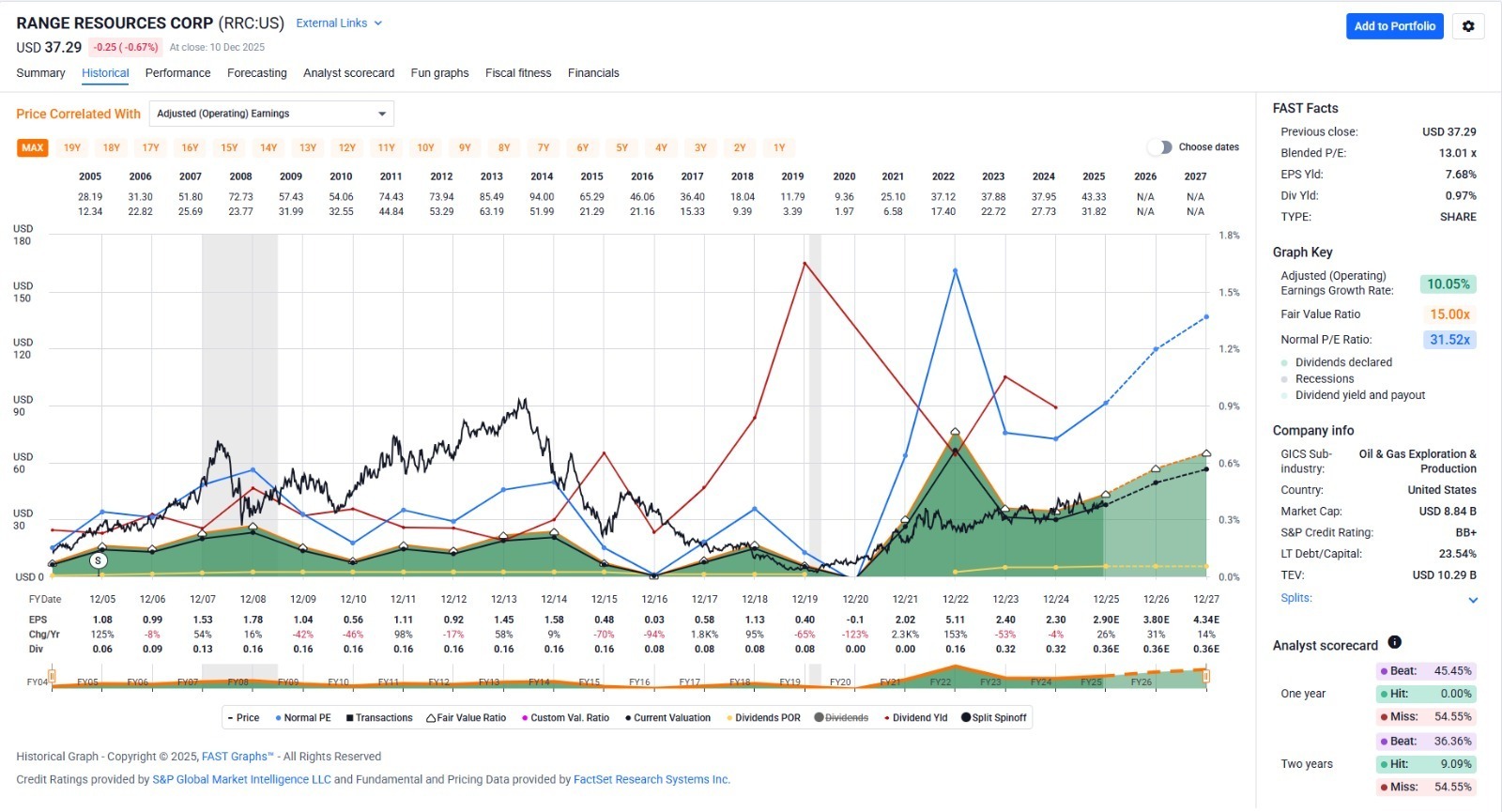

Range Resources (RRC) is a natural gas company, it has assets focused in the Marcellus Shale, but also in the Utica and Upper Devonian Shale formations of Pennsylvania. They have been operating in Pennsylvania since 2004 and have amassed a large core inventory of natural gas and natural gas liquids at 17 years of life.

They have also been successful at hedging their production against downside while being open to upside potential for natural gas. The company has slightly exceeded earnings estimates over the last 4 quarters.

Reported Quarter | Estimate ($ / share) | Actual ($ / share) | |

Q4 2024 | 0.61 | 0.68 | Beat $0.07/share |

Q1 2025 | 0.92 | 0.96 | Beat $0.04/share |

Q2 2025 | 0.64 | 0.66 | Beat $0.02/share |

Q3 2025 | 0.53 | 0.57 | Beat $0.04/share |

Q4 2025 | 0.72 | (Feb 2026) |

Their chart on the other hand has a grinding overlapping pattern over the past couple of years and is currently priced at the same price regions as it was in mid 2022. Had one purchased shares near the low at the end of 2022, one might see this stock in a more positive light but it certainly has under performed much of the market since that time.

In discussing this chart with Zac Mannes, Host of the Stock Waves service, he sees that bigger picture, the Wave P5 does not look complete. Immediate bullish potential is the highest probability if price can hold the $34.40 region. From an Elliott Wave and Fibonacci price level perspective, if 34.40 fails to hold, the potential for price to retest 27.XXs greatly increases.

At Elliott Wave Trader, we combine Elliott Wave Theory pattern recognition with Fibonacci price levels to identify price support, invalidation and ideal target ranges for all price vs time charts. Range Resources (and other individual natural gas stocks) and nuclear and technology companies are covered in our Stock Waves Service while our Metals, Miners and Agriculture Service has been covering uranium miners.

Our members received a Wave Setup for Range Resources when the 1-2 count was maturing but the continued higher highs and high lows continue to point to upside resolution if support levels can be held. What’s a Wave Setup? Well based on the structure, we identify support, invalidation, resistance and target levels based on the Elliott Wave Structure and Fibonacci retracement and projections.

Where will RRC target if it holds support? Well we can’t just give the setup away for free when our members pay for this analysis, but one can come to elliottwavetrader.net and see this and many other Wave Setups on a free trial. Not only that we provide education and access to analysts to teach members how to understand, and even perform the analysis themselves. There are multiple weekly videos teaching Elliott Wave analysis on charts and identifying potential setups Monday through Thursday (both long and short) to members of the Stock Waves Service. Previous analysis of hundreds of stocks are updated in our database for members to review at any time.