Odds Increasing Of Significant Bottoms in European Indices

In this weekend's World Markets round-up, we start with the European Indices, and then look at the Asia/Pacific markets.

The DAX Performance Index traded higher last week, making a new high above the one made at the end of last month and therefore exceeding resistance that should have held for a 4th wave bounce.

Therefore, odds now favor a bottom in place for primary wave 4 at the March low, and a potential leading diagonal up filling out since. If price starts off initially lower this week, 10090 - 9795 is support for blue wave (b) of a, below which opens the door to a retest of last week's low as red wave 2. If price is already in blue wave (c) of a, then 10925 - 111465 is the next fib resistance above as a potential target.

The FTSE 100 traded higher last week as well, exceeding the prior high made at the end of last month and invalidating the possible i-ii start to a 5th wave down.

Therefore, odds of a more significant bottom already in place have increased dramatically, however there is technically still room up to 6140 here while still being a 4th wave.

If more bullish, the same options as the DAX and STOXX can apply, either a 1-2 in place of a larger leading diagonal and now filling out wave 3, or completing a smaller LD as wave 1 at the next local high.

The Euro STOXX 50 also traded higher last week, making a new high above the one made at the end of last month and therefore exceeding resistance that should have held for a 4th wave bounce.

Like the DAX, odds now favor a bottom in place for primary wave B at the March low, and a potential leading diagonal up filling out since. If price starts off initially lower this week, 2800 - 2730 is support for blue wave (b) of a, below which opens the door to a retest of last week's low as red wave 2. If price is already in blue wave (c) of a, then 3090 is the next fib resistance above as a potential target.

The Nikkei 225 turned back up last week, holding the .618 retrace cited at 17515 for the bullish potential as a 1-2 off the March low and a bottom in place. Therefore, as long as the low made so far for this month holds, the blue count will remain operative as a potential 3rd up in progress.

Under that assumption, ideally last week’s high completed wave i of 3, which allows for more of a near-term pullback as wave ii of 3 with 18770 – 18335 as support. Otherwise, any sustained break above 19715 opens the door to wave iii of 3 already in progress, targeting 21110 at a minimum.

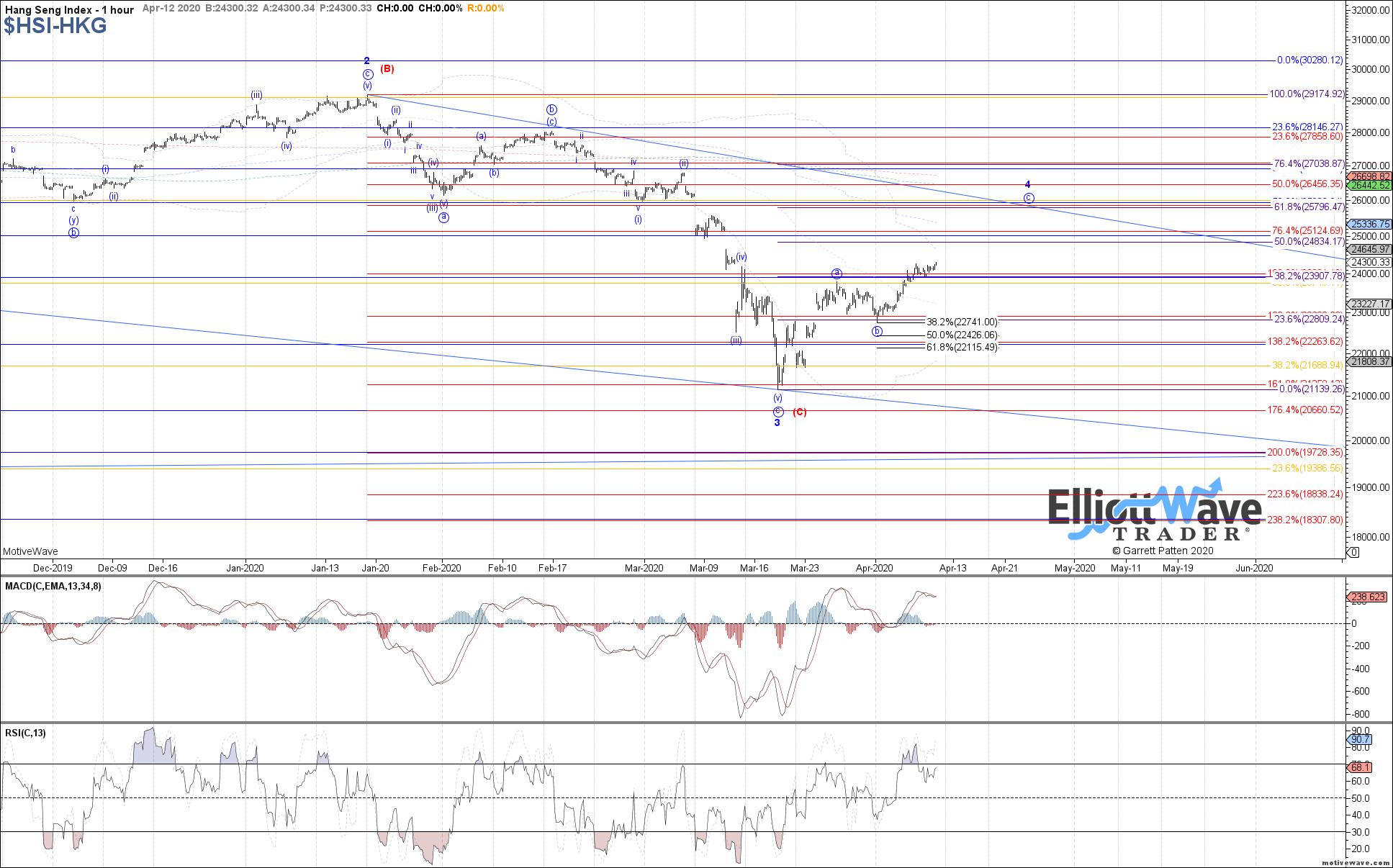

The Hang Seng Index traded higher last week as well, exceeding the prior high made at the end of last month and suggesting that blue wave c of 4 is underway. Under that assumption, there remains room for more near-term upside toward the 25000 ~ 26000 target before completing and potentially turning back down again.

Despite further upside from here expected, price may see a brief consolidation at the beginning of this week with 23700 – 23330 as support, though not required. A break back below 22740 would be needed to consider anything more immediately bearish at this time.

The Shanghai Composite Index turned back up last week as well, making a new local high above the high made at the end of last month. Despite this, both counts remain on the chart, but with room for higher still toward the 2850 – 2905 target resistance cited for blue wave ii.

As I noted last week though, the blue count is extremely bearish, and does not fit at all with what I am seeing on other markets, so it is difficult for me to view it as high probability right now. Even under the more bullish red count, it is possible that one more low is not needed and a bottom for wave (C) was already struck at the March low. If this pullback is corrective though, then 2760 – 2715 is support that should hold before turning back up above last week’s high.

The Nifty 50 also turned up last week, holding the .618 retrace cited as support for the possible 1-2 off the March low. With price making a new local high last week as well, a bottom in place at the March low is the operative count, with price now filling out blue wave 3. U

nder that assumption, it is still possible that price consolidates a bit more as wave ii of 3 though, with 8705 – 8450 as support if so. Otherwise, any sustained break above 9280 suggests that wave iii of 3 is already underway and targeting 10130 next.