Nutrien (NTR/ NTR.CA) - Shrinking to Grow?

Written by Mark Malinowski with charts and commentary by Zac Mannes

Images Courtesy of the Nutrien Website.

Cheap natural gas and cheap wheat should mean cheap beef, right? If you’ve been to the grocery store only a handful of times in the past few years, you know that beef is nearly twice as expensive as it was at the start of 2020. Meanwhile wheat and natural gas are trading at almost half of the Jan 2020 value and that is not on a constant currency basis.

Some might suggest that demand for cereal crops and natural gas go hand in hand as increased demand for cereals should mean increased demand for fertilizer to produce it. But that isn’t always the case. There are separate markets for fertilizer and natural gas. Fertilizer companies have contracts and hedge their input costs to make sure their products can remain cost competitive and maximize their profits in changing market conditions.

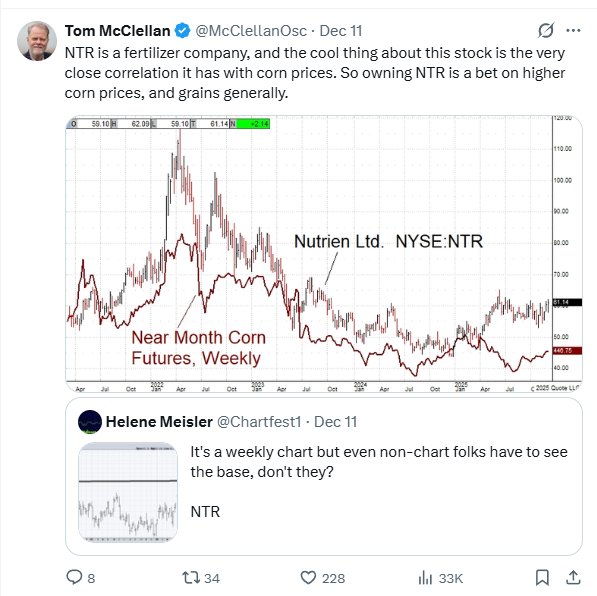

We have a lot of evidence to show that correlations can work but normally only for a very short period of time. As a result we treat every chart as an individual analysis with its own sentiment and its distinct position in the pattern of sentiment it is following, because one never knows when that correlation degrades or completely disconnects.

Fundamentals are one way to view how well a company is performing or expects to perform based on the information that they provide through regulatory required reporting. When looking at Nutrien we see a fairly flat projection in terms of its future adjusted earnings.

Holding steady income in a dividend paying stock may be exactly what folks are looking for but the pattern of sentiment we see in this stock shows the potential for a lot more up and down.

During the last year Nutrien has missed two of the earnings and then exceeded/ met two meet earnings targets, continued to pay their dividend at a sustainable rate and renewed their share repurchase program. They have also followed through on their plan to divest some of their far flung assets, most recently selling their equity stake in Profertil S.A. (Argentina). As a result they have gross proceeds from asset divestiture totalling US$900 million. As a result of these changes, they are focussing their capital on operations that they control in North America, South American and Australia.

They have also had some struggles with the Trinidad and Tobago operation shutting down due to lack of reliable and economic supply of natural gas from which they produce ammonia and urea. From the outside this might appear to be the Trinidad and Tobago National Energy Corporation putting a squeeze on Nutrien by implementing port restrictions. What the desired outcome is not certain but Nutrien has already stated that they do not see it impacting their overall production targets due to strong demand in the US and Canada.

When it comes to fundamental analysis there are always lots of measures and rules of thumb that suggest a stock is undervalued or overvalued and present a price that would represent a buying opportunity. When I got serious about investing and trading, I started asking questions like:

What if the stock never gets to that price? What if the stock breaks below that price? Should I sell? Should I buy more? What should I do? How do I know now is a good time to buy or sell Stock X?

While I do see the value in fundamental analysis, it is not where I put my time and effort into increasing my skills over the years. I moved on to technical analysis and finding ways to understand what signals the buyers and sellers are giving the market vs. trying to predict all of the balance sheet implications. I see all of these forces being applied by buyers and sellers interactions forming patterns and levels that can be viewed through the lens of Elliott Wave Theory and Fibonacci price levels.

Elliott Wave Technical Analysis of Nutrien

The Stock Waves and Metals, Miners and Agriculture services at Elliotto Wave Trader (elliottwavetrader.net) have tracked Nutrien for many years following it into the bottom in Q3 2024 depending on the chart you track CAD or USD.

Nutrien has been on an overlapping grinding run up since it bottomed in September 2024 (in CAD dollars), up approximately 40% over that time period.

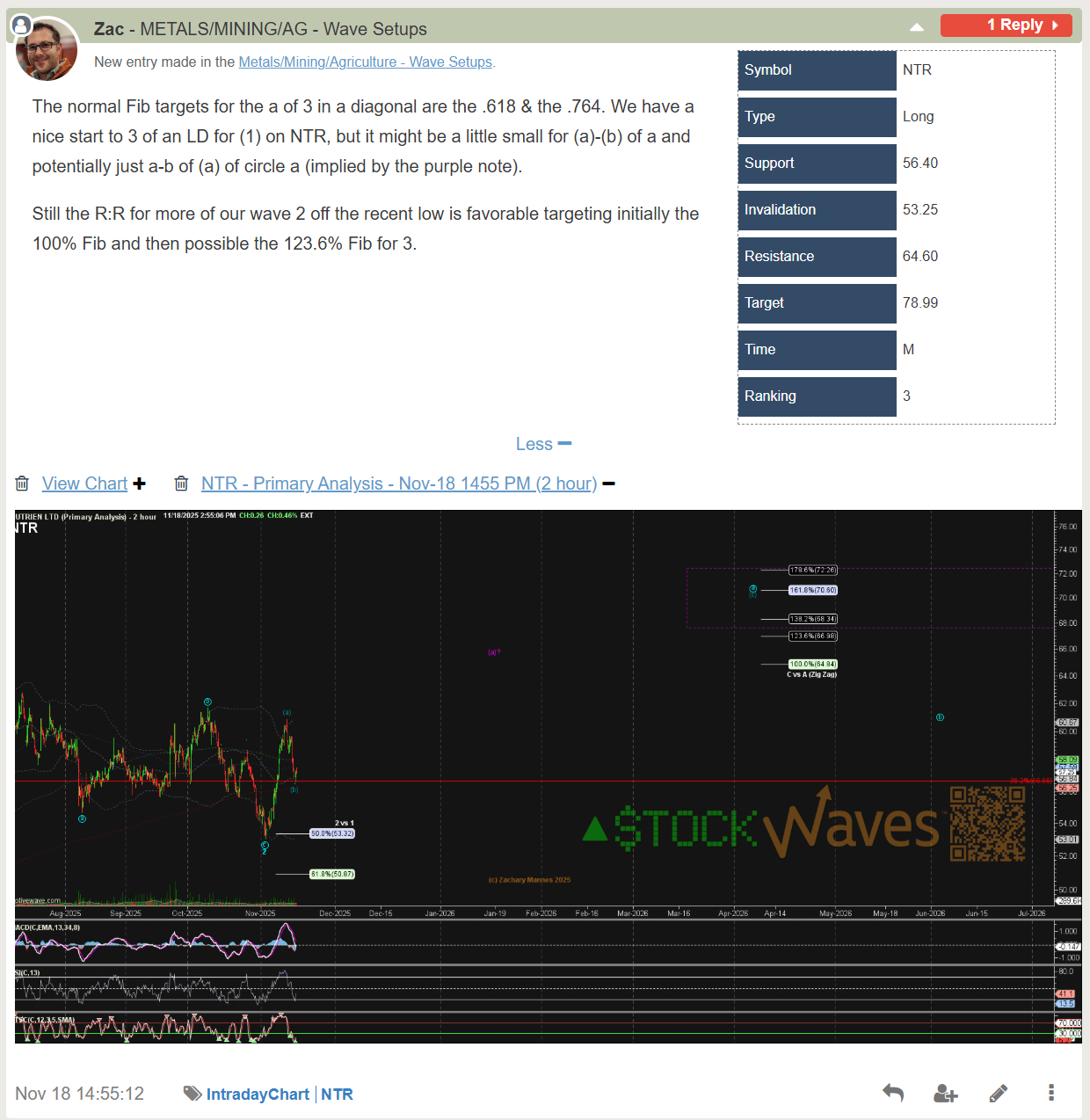

We gave the subscribers to our Metals, Miners and Agriculture (MMA) service an early Black Friday gift in the form of a Nutrien Wave Setup. Price has since tested support but not invalidation and progressed almost 9 USD higher as of writing, almost testing our resistance levels, noted in the Wave Setup.

What are Wave Setups?

For those who have not followed our work, Wave Setups are clearly defined parameters of support, resistance and invalidation based on Elliott Wave Theory and Fibonacci Price level principles for a specific. Subscribers choose for themselves if a Wave Setup is right for them and their risk tolerance.

Where does Nutrien go from here? Well I am certain there will be many twists and turns in the market between here and the Wave Setup potential target, we will continue to chart and track NTR and NTR.CA for our subscribers to present to them opportunities to take profit or add as they see fit. We also regularly track other fertilizer names and some certainly are maintaining a bullish posture according to our analysis, but not all charts are the same.

Come and check us out with a free trial of our services including indexes, individual equities, and commodities coverage at elliottwavetrader.net.