Norwegian Cruise Line Holdings (NCLH) - Chasing your winter blues away?

Written by Mark Malinowski with charts and commentary by Zac Mannes and Lyn Alden

Some parts of the country have had an unusually warm winter this year, others have been really missing the sun. Cloudy and rainy weather has been locked in for weeks in some of the northern parts of the country. While vitamin-D certainly can help chase away those winter blues, nothing like a strong dose of warm weather and sunshine to do it “naturally.” Winter is a typical time for higher latitude North Americans to head out on a Caribbean cruise, European and Alaskan cruises definitely keep the cruise industry moving year round.

So, with people in a “cruising state-of-mind”, what does the fundamental picture look like for Norwegian Cruise Lines (NCLH)?

Fundamentals

Clearly the pandemic years were tough on NCLH with earnings initially falling off a cliff and then slowly recovering. As of December we can see that based on adjusted earnings, NCLH was trading pretty much right at fair value, but also that NCLH is projecting a slow and steady growth curve over the next few years.

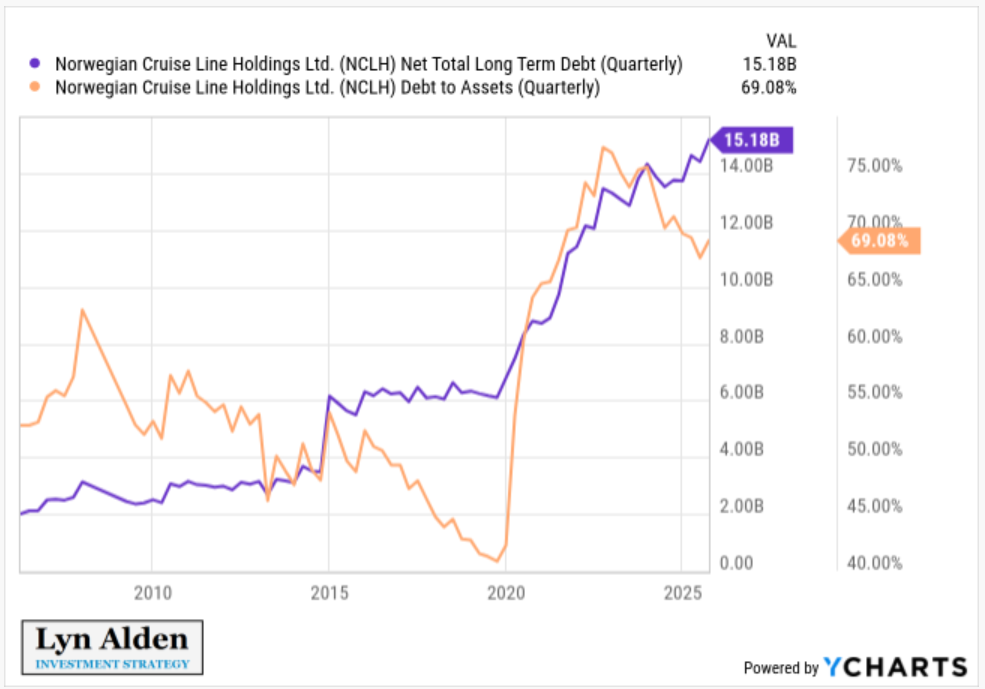

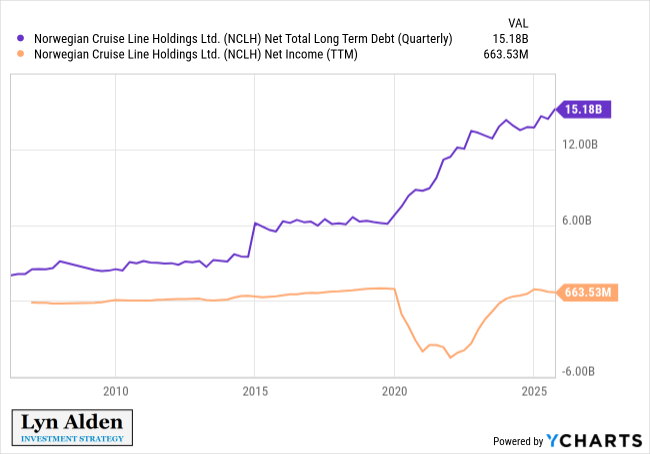

However, as Lyn Alden recently pointed out those lean years have led to more borrowing to enable that change in strategy with long term debt more than doubling over the last 6 years:

“I’m moderately bullish on NCLH and expect the price to trend upward in the years ahead. One of the biggest risks for investors to be aware of, however, is the increase in leverage ever since the pandemic. In addition to diluting shares, the company has issued quite a bit of debt, both in absolute terms and relative to their asset base and net income. Thus, I treat it as a rather risky stock and one to watch pretty closely, rather than treating it as a buy-and-forget type of investment.”

The increased debt to keep the company afloat and to change strategy and direction makes sense when looking at their balance sheet, marketing material and investments in new vessels.

The cruise ship industry continues shifting to target a younger mix of Millennials and Gen Z and multi-generational experiences. Cruise ships used to be referred to as “floating hotels,” but they continue to grow in scope and scale. The newer, larger ships reflect this strategy pretty clearly. The more time spent on the ships, the more cash they collect for add-on services and amenities. These amenities include more luxury restaurants, adventure parks, casinos, water slides, and higher energy entertainment. They are also offering short cruise itineraries to appeal to smaller budgets and shorter attention spans.

On the side of value, the fact that people can go on an all inclusive “fixed” price vacation (where the math is simple) appeals to many, including those who want a vacation, but know they lack the discipline to manage their costs in the “wild.”

So if the industry is continuing to see growth/ recovery, what does the technical picture look like?

Elliott Wave Analysis

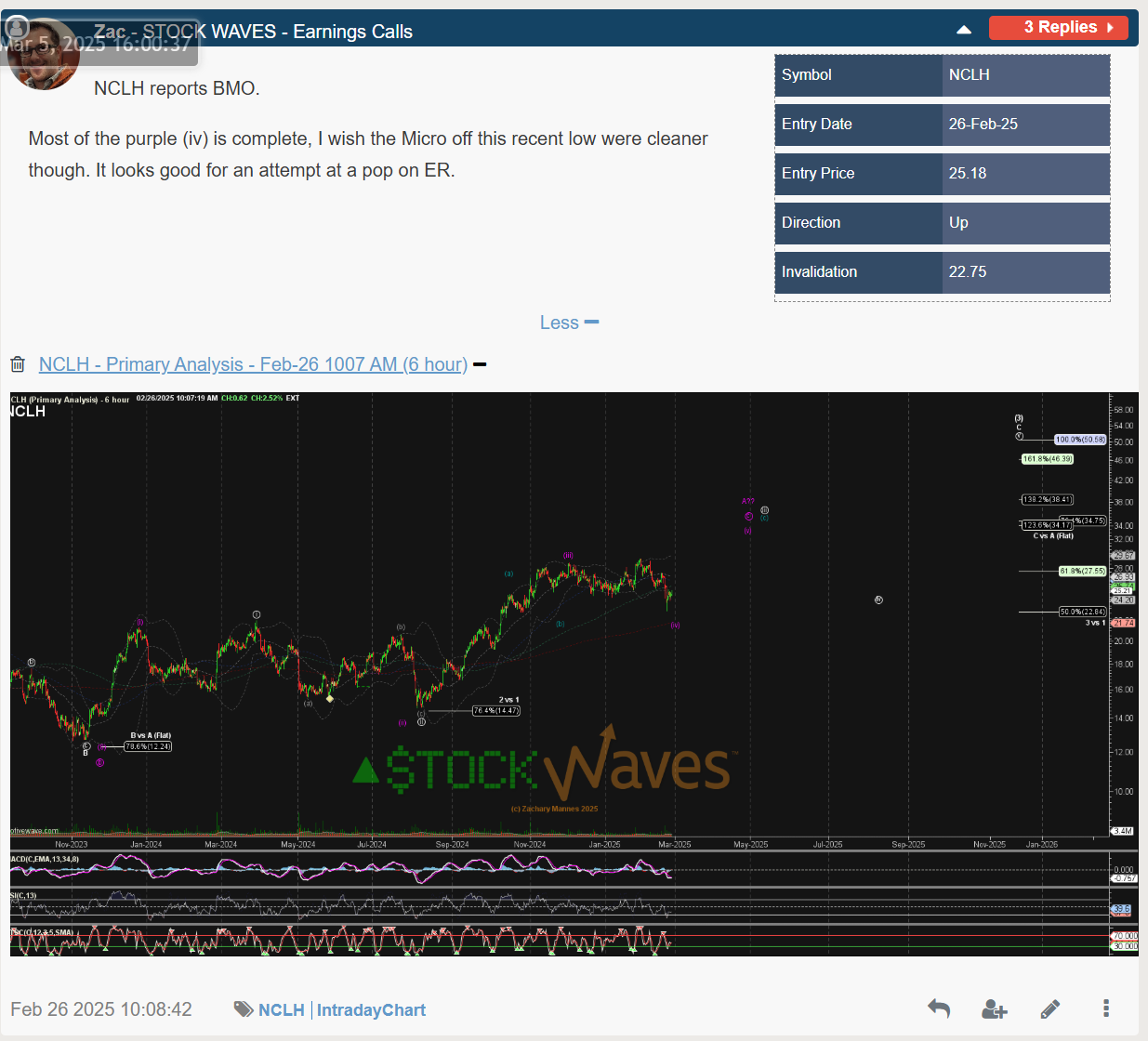

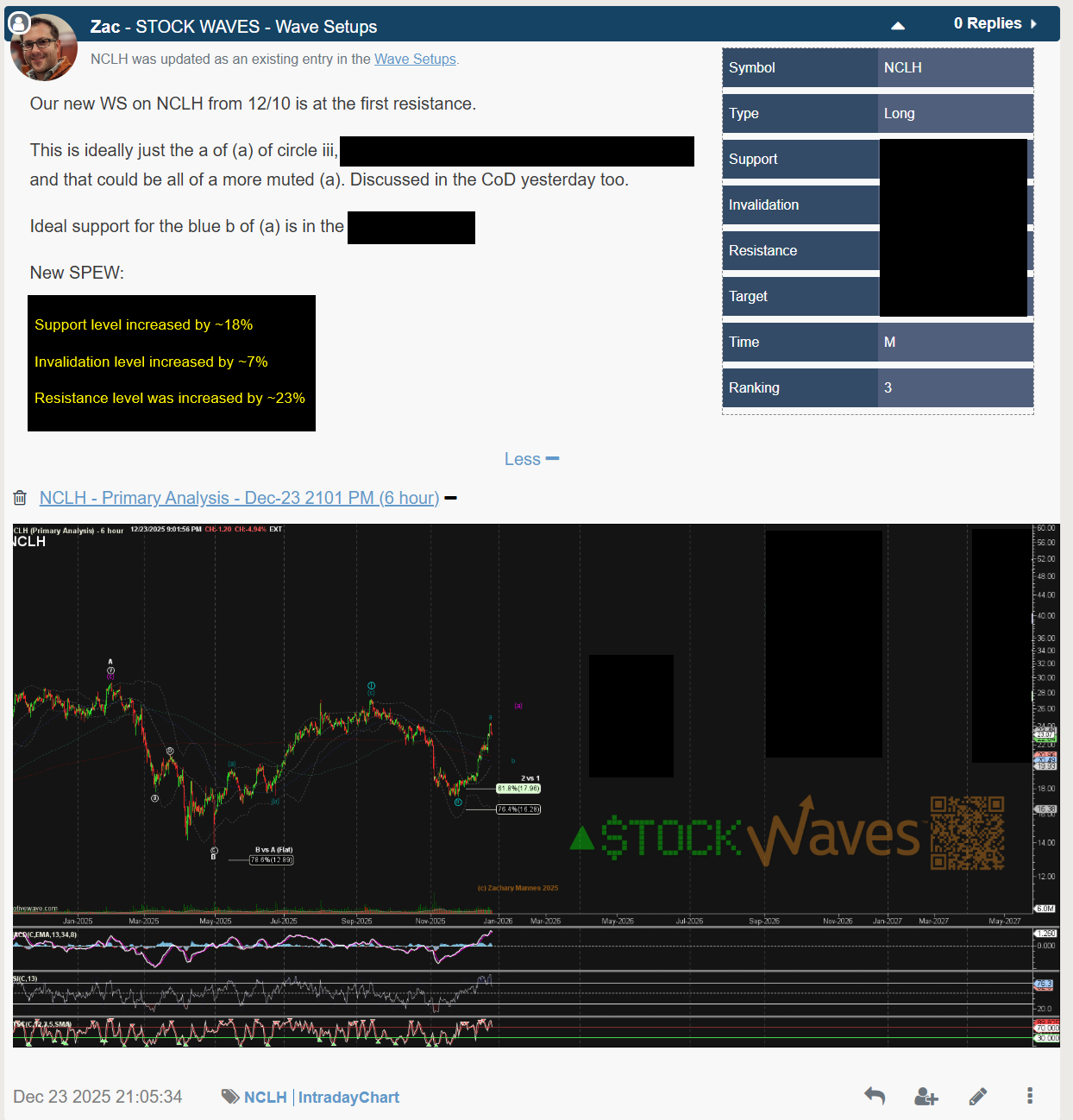

Zac Mannes has been actively tracking the travel sector macro trends via Elliott Wave analysis for a long time, and he had been tracking several bullish potentials heading into earnings in February 2025. Price initially popped higher following earnings, allowing for a winning exit, however price did not continue that bullish trend for long and headed lower into the 13s in April of 2025 when many stocks found their footing.

By June of 2025, Zac noted new bullish potential, but also identified some other charts he liked the structure of better and that he would be waiting for a clear structure and 3 waves corrective retrace to improve probabilities of a bullish setup and the risk reward from a risk perspective.

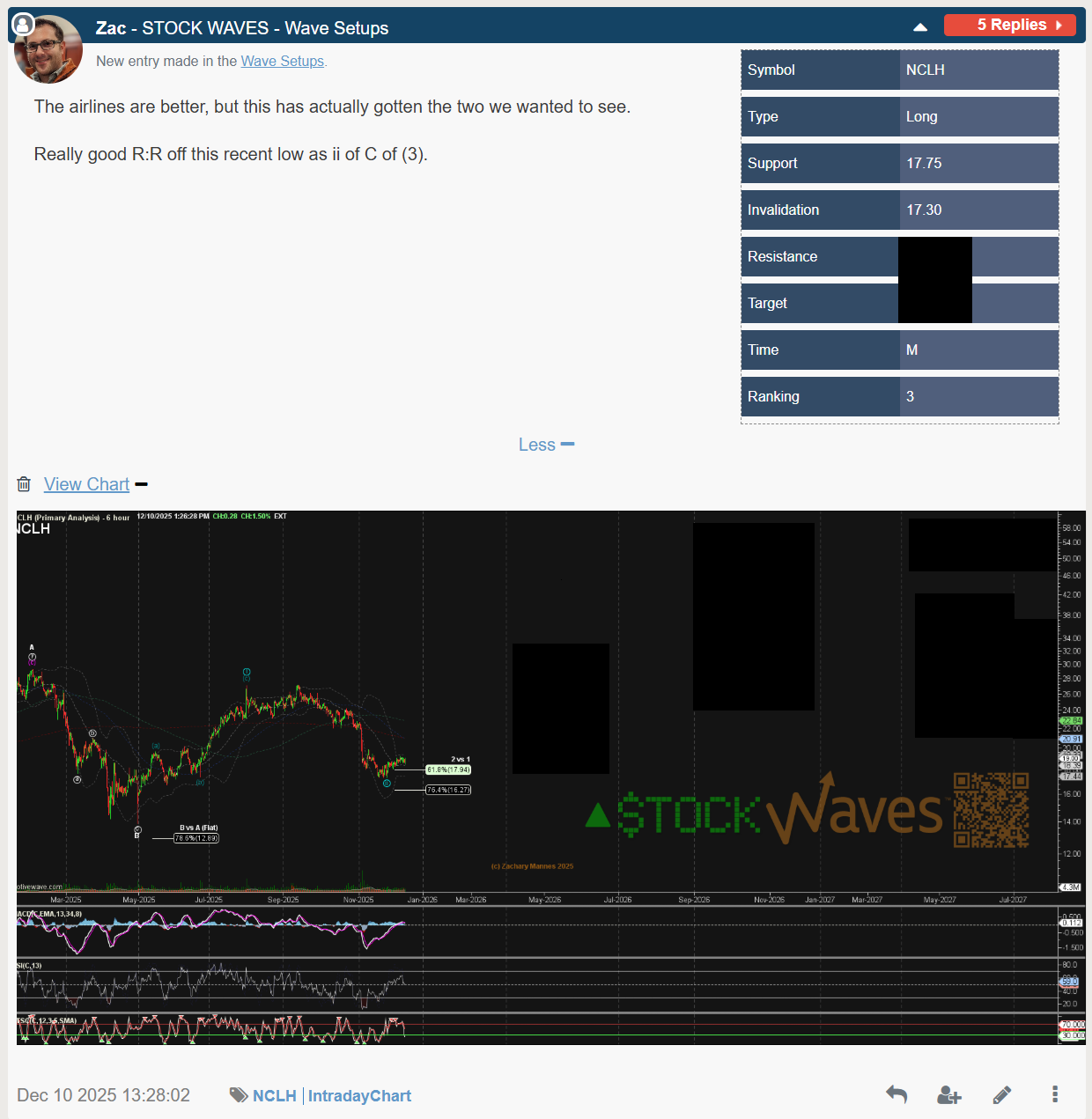

This setup took patience and the structure took all the way to December of 2025 to fully develop into something worthy of a Wave Setup:

Unfortunately, this active setup has to be redacted as we have subscribers that pay for this analysis.

Zac even covered this setup in the Charts of Day video where he clarified possible subwave paths for wave (a) and why price was so important.

Price moved rather rapidly off that low and hit the initial resistance point that Zac identified allowing him to move support and resistance levels higher, consistent with the structure of the move so far, but also that the structure allowed for a move higher.

This update allowed members who took the trade to move up stops and manage risk above the identified entry point from December 10th.

The next two weeks were a little slow but the alt structure that Zac identified increased in potential and Zac covered for members in a Charts of the Day video on January 7th.

Diagonals:

The challenge with diagonals is that they allow the price structure to move and morph more than a strict 5 wave impulsive move. This certainly adds more variability and is usually associated with the start or finish of larger degree moves. This type of structure often has people shying away from charts like this, that do in fact present good risk reward and tradeable structure. However, Stock Waves leans into this diagonal variability as a core strength. This potential structure and moves are covered regularly on Wave Setups, allowing members who wish to trade around a core to do so know when and where a count may break or find support, especially on a chart that is identified as an active Wave Setup.

We continue to remain bullish on NCLH off the April 2025 low, and see it potentially doubling into 2027 (providing that support holds). However, given the diagonal structure, it is clear that the road ahead will be filled with more twists and turns.

So if step by step analysis and clear risk reward opportunities identified and presented is something that fits your style, come and check out what we do at www.elliottwavetrader.net.