New Monthly Lows for European Indices

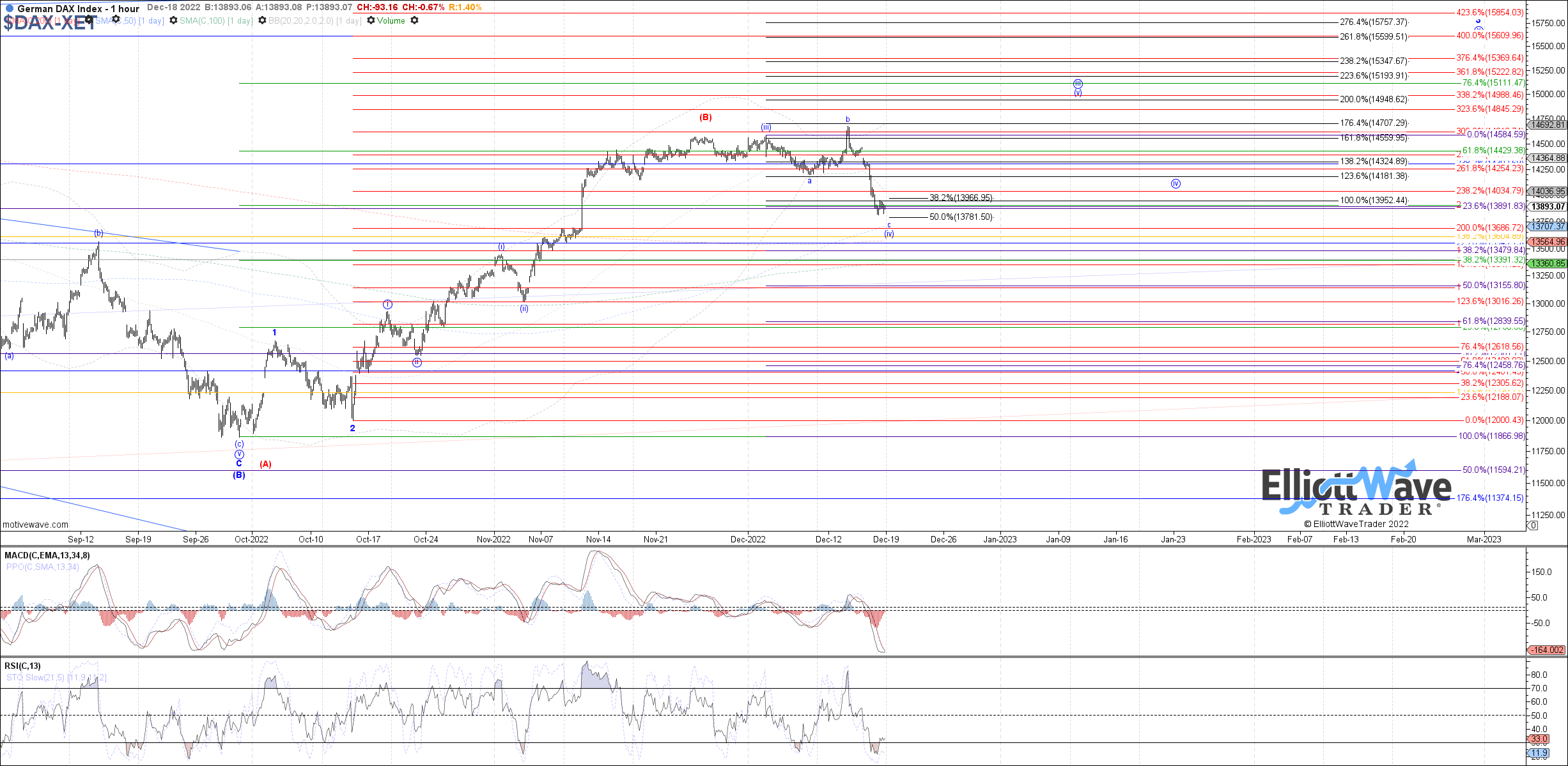

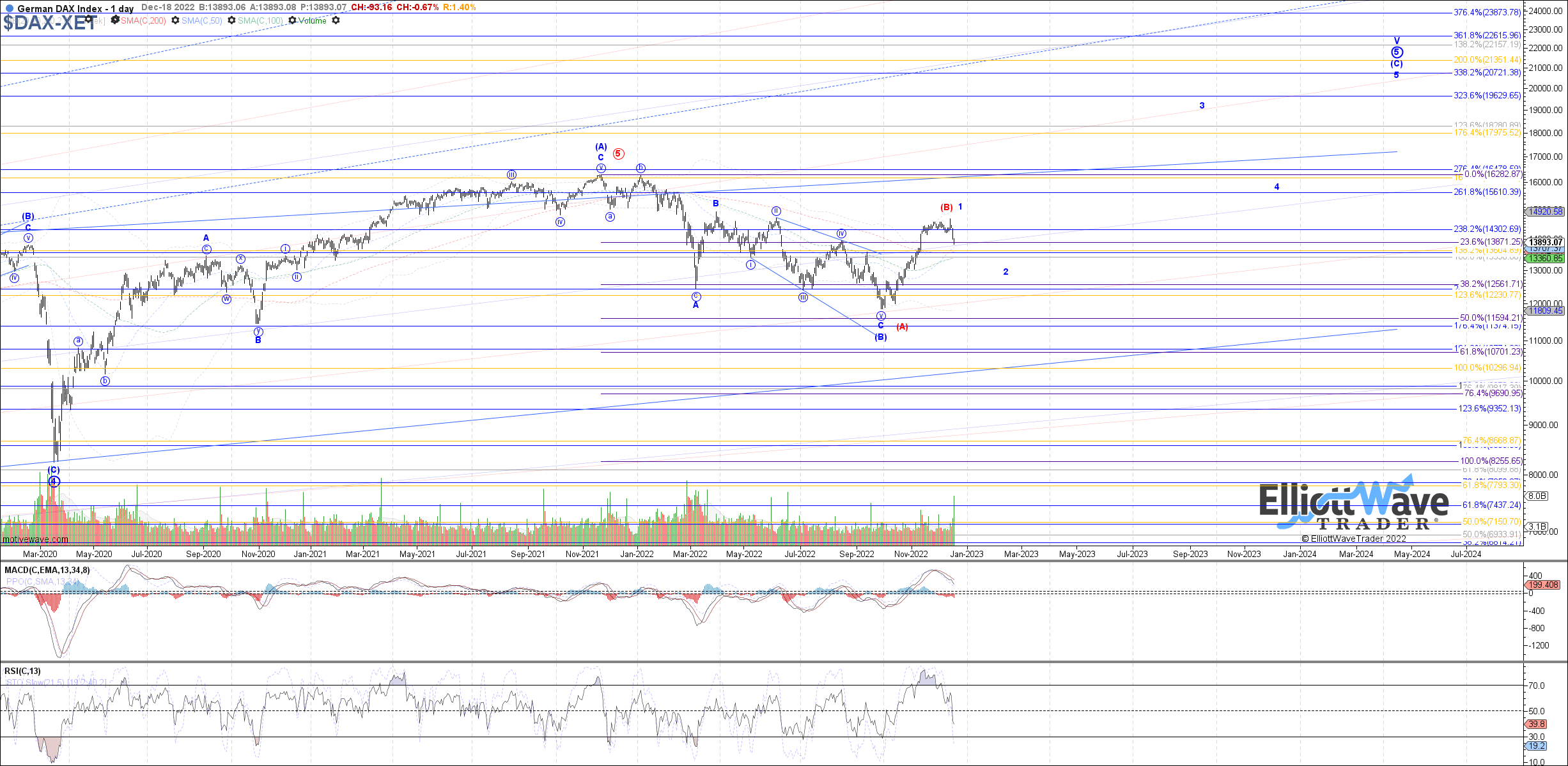

The DAX Performance Index started off initially higher last week, briefly making a new high on the month before quickly rolling back over from there to make a new low on the month. Therefore, last week’s high looks like it completed wave b of an expanded flat, with price now filling out the c-wave.

Under the expectation that the expanded flat is a wave (iv), then 13780 is fib support that should hold as wave iv in order to turn price back up next as wave v of 3. Otherwise, below there opens the door to a larger 1-2 off the September low as the next bullish option, with 13500 as potential support for wave 2.

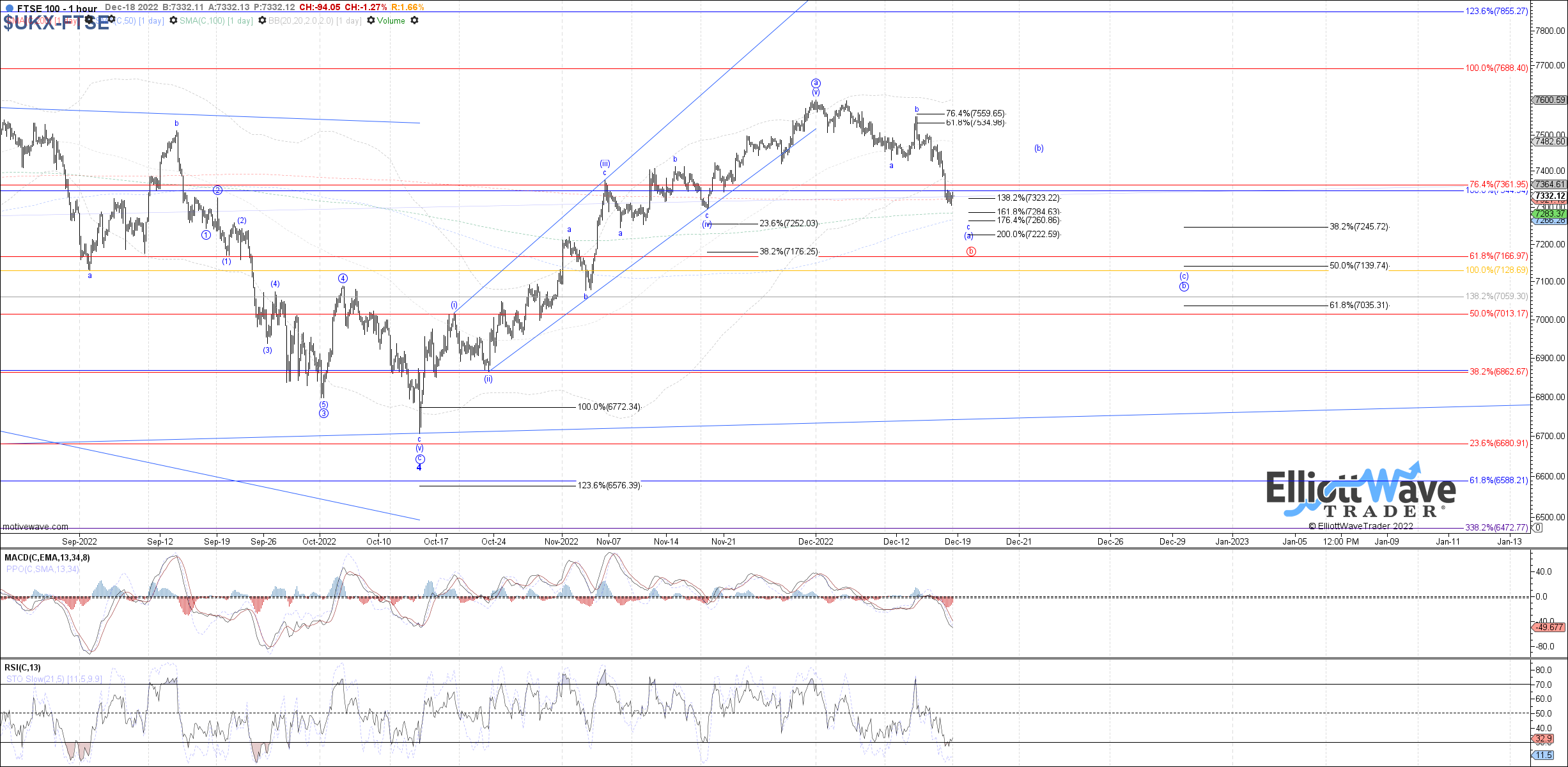

The FTSE 100 also started off initially higher last week, but in this case held a lower high compared to the prior high on the month before rolling back over to make a new low on the month by the end of the week. Therefore, price continues to cooperate with the expectation that wave b of 5 is filling out, with price working on either wave c of (a) or potentially the higher degree (c)-wave to complete all of wave b at the next low.

Either way, 7245 remains the minimum expected fib target to reach before wave b of 5 completes.

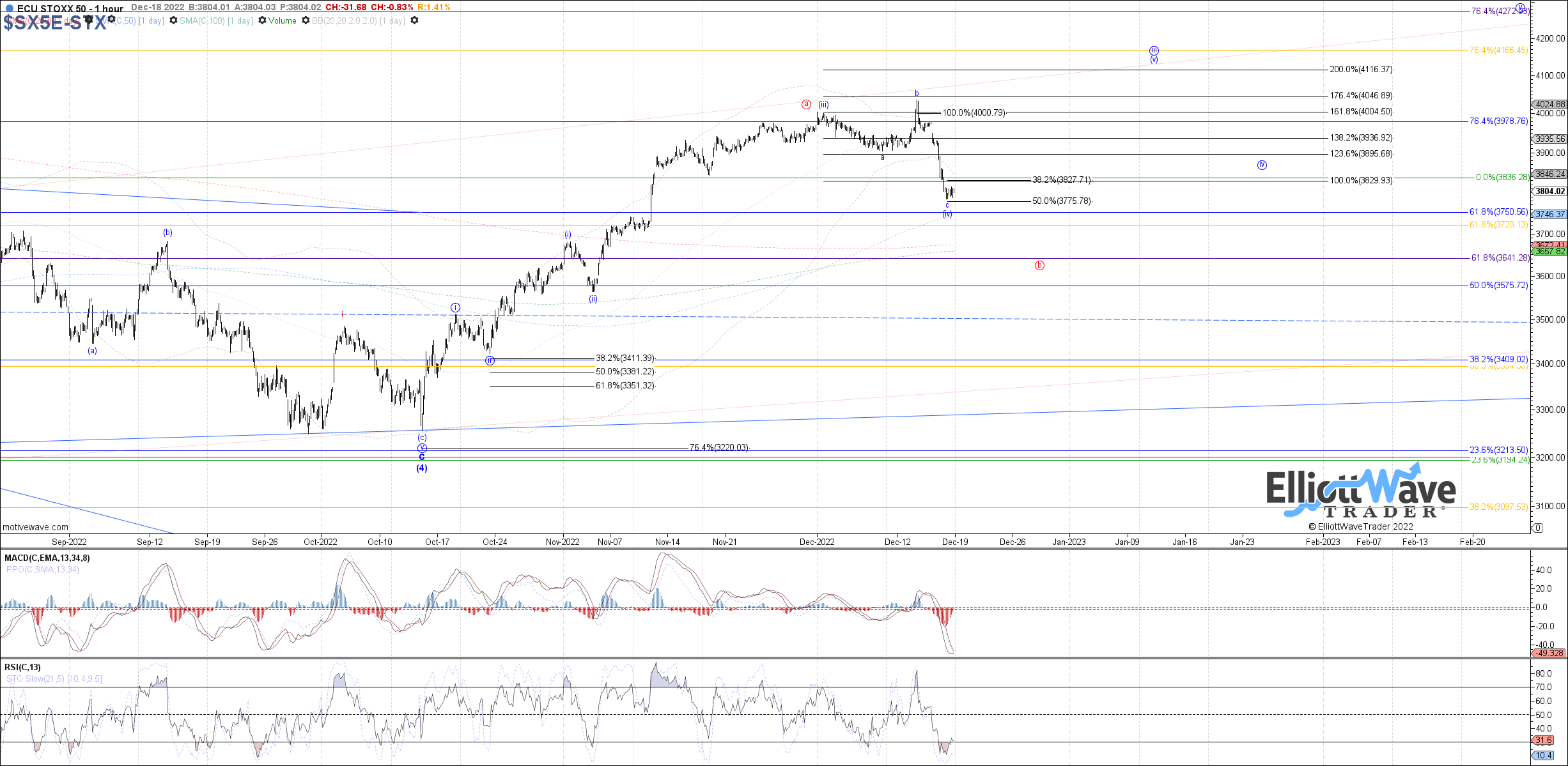

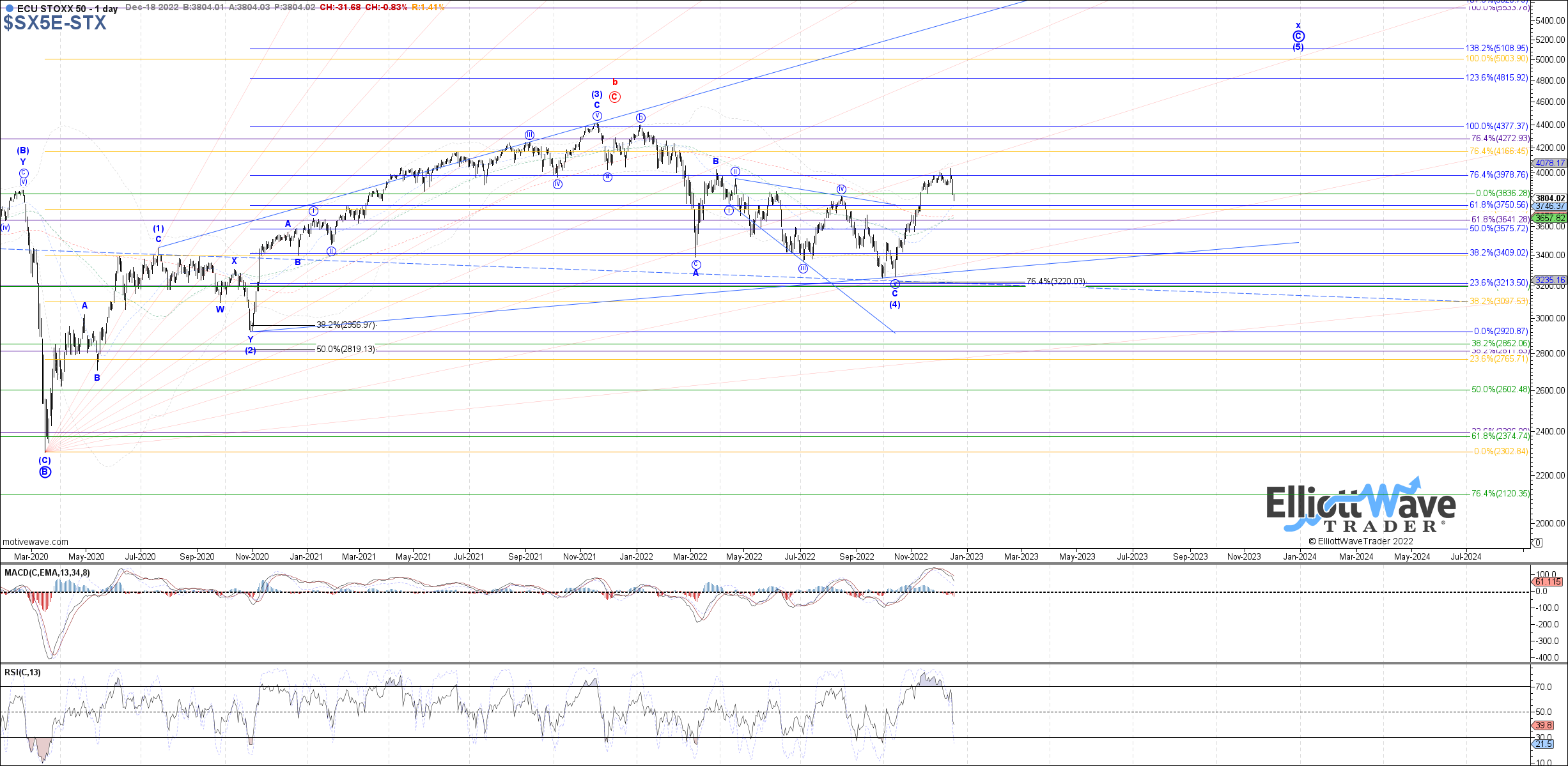

The Euro STOXX 50 started off initially higher last week as well, making a brief new high on the month before quickly rolling back over to a new low on the month and continuing lower into Friday’s close. Therefore, like the DAX, last week’s high looks like wave b of an expanded flat. If an expanded flat as wave (iv) of iii, then 3775 is ideal support to hold as wave (iv).

Below there would over the door to a larger a-b off the October low as the alternative.