New Highs For The Month For European Indices

EUROPE/AMERICAS

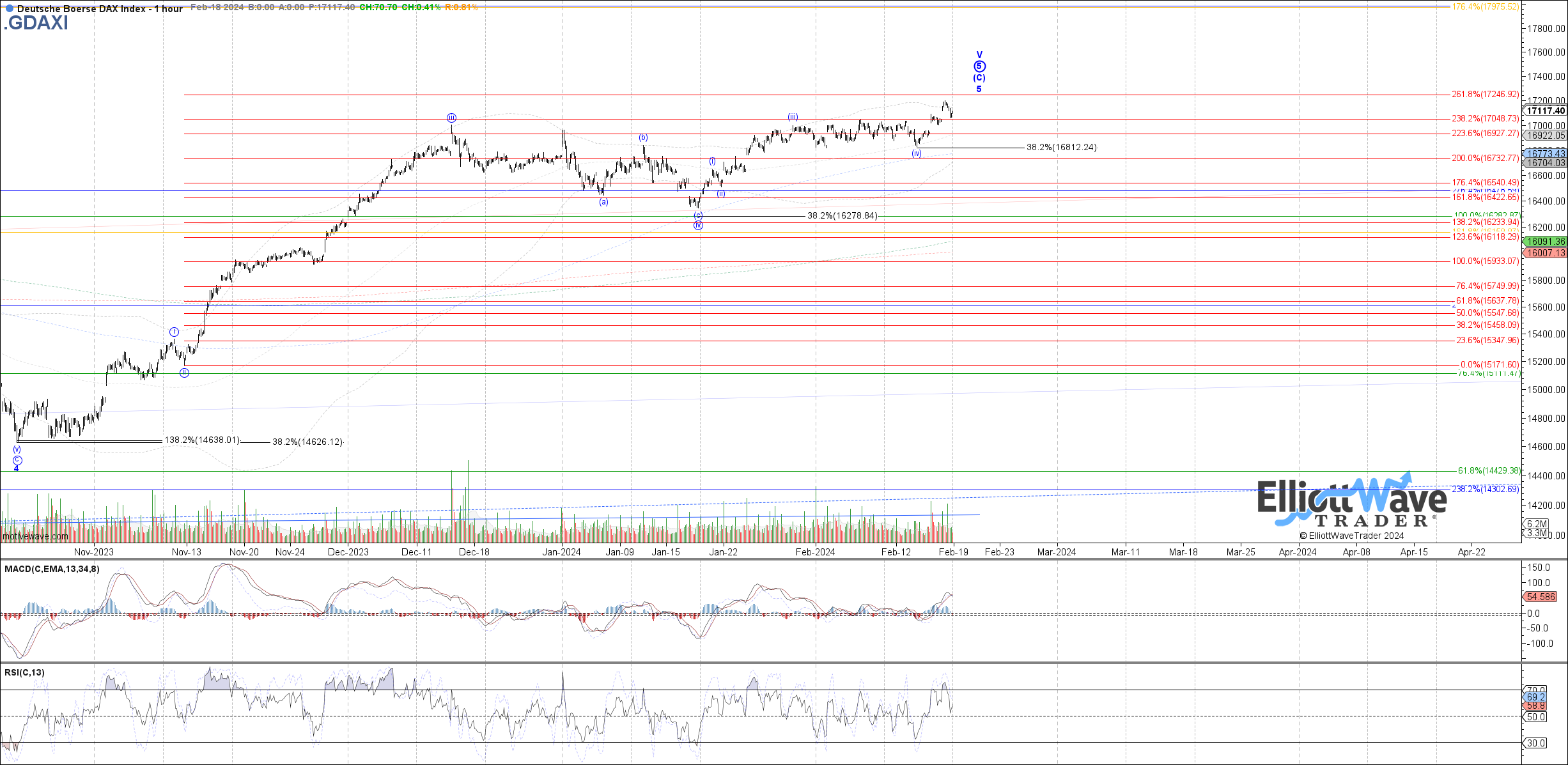

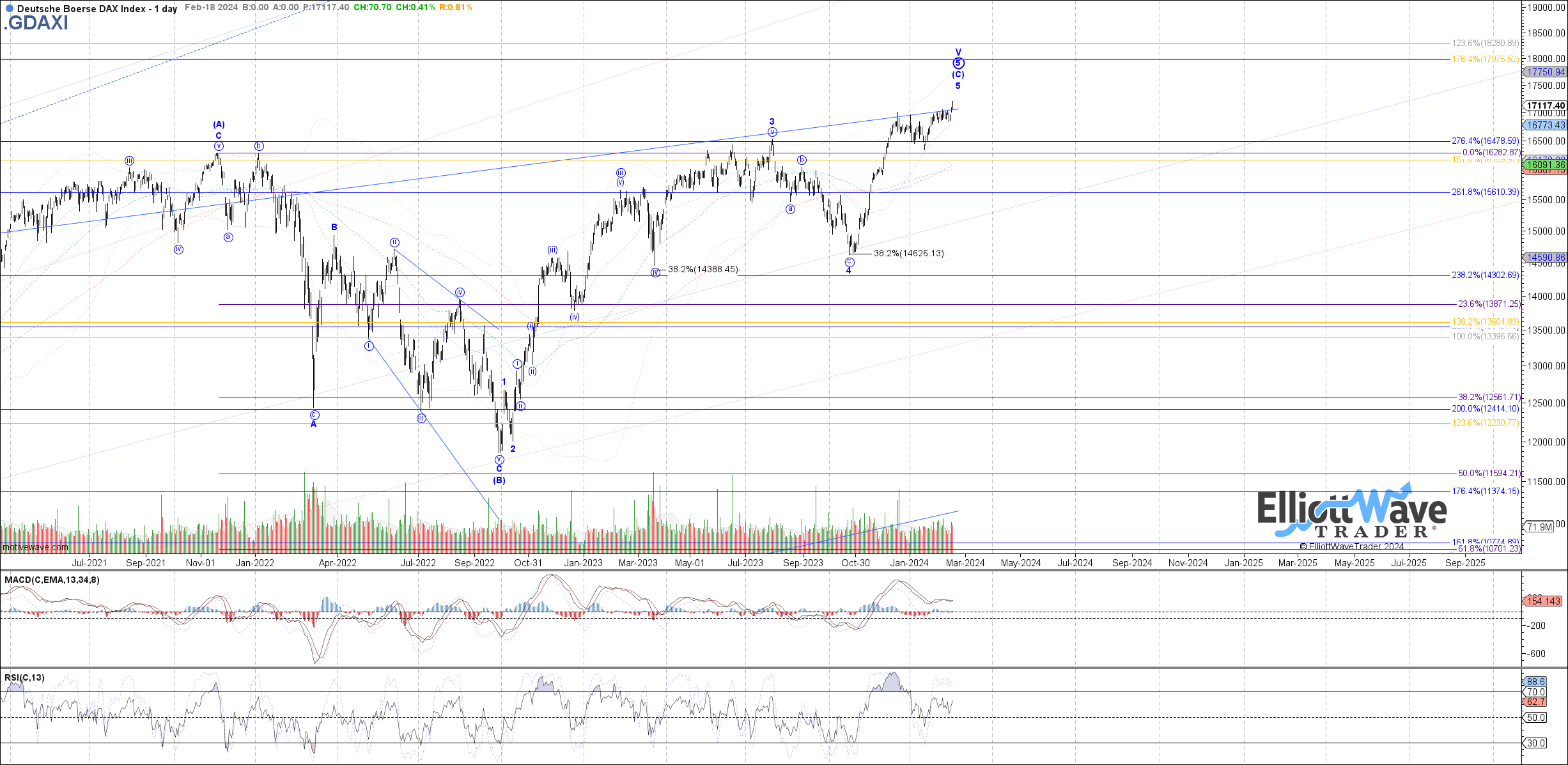

DAX: The DAX started off the week initially lower, retesting the 16815 support cited for a wider flat wave (iv) of v before turning back up into the end of the week and making another new high on the month. Therefore, price should now be filling out wave (v) of v, with 17245 still as a potential fib target above to reach. Otherwise, any break back below last week’s low will now open the door to a top in place.

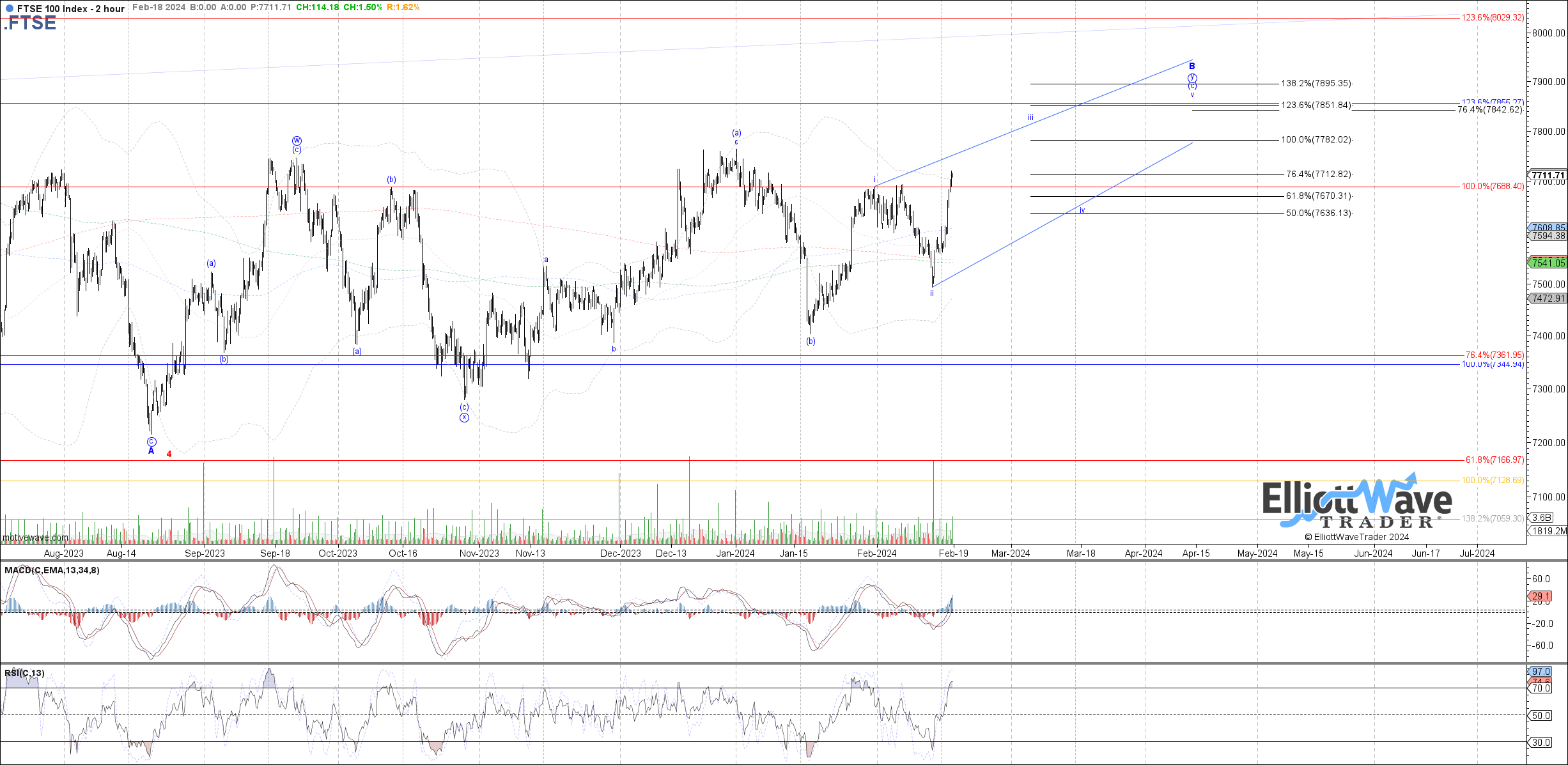

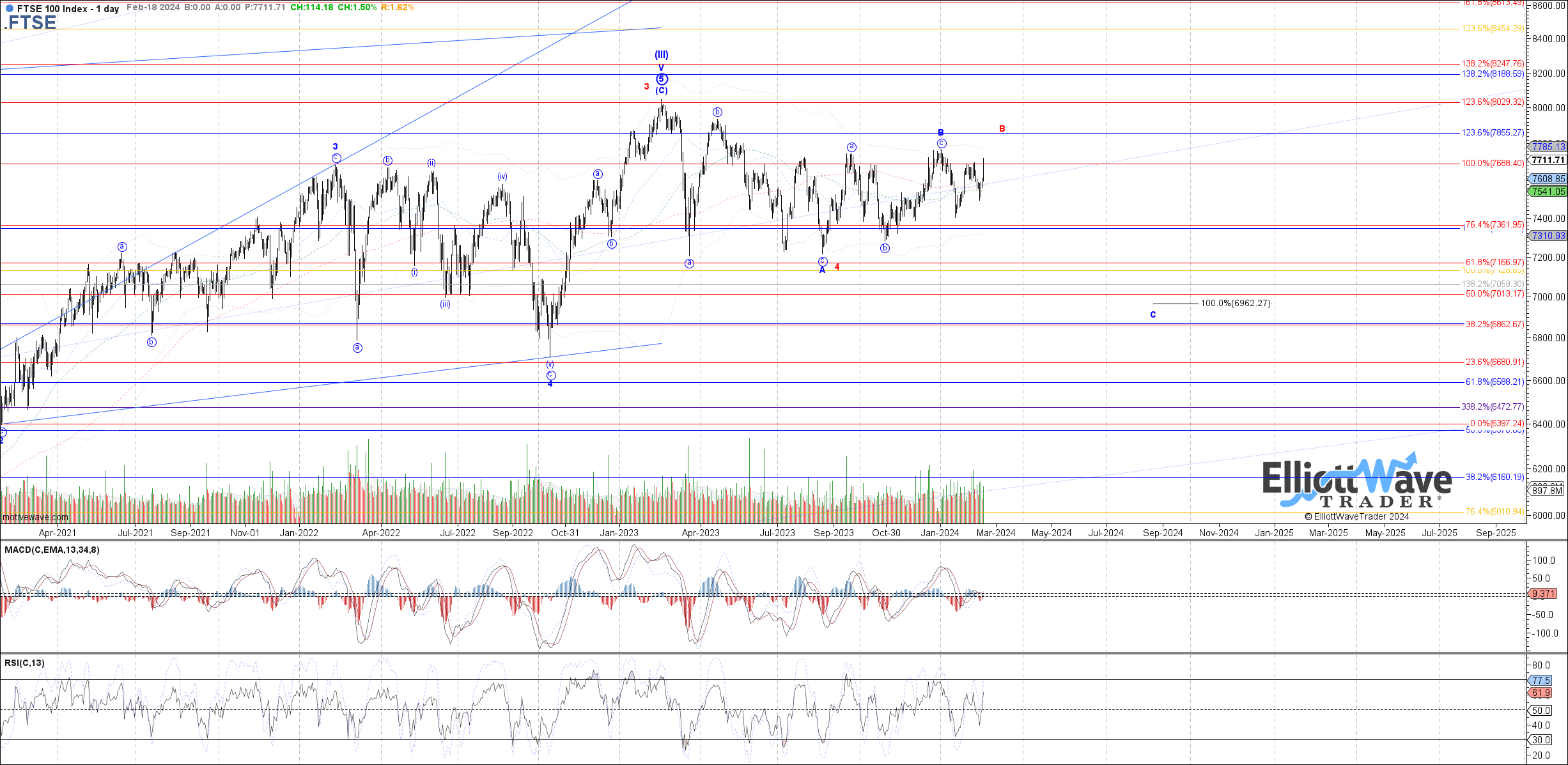

FTSE: The FTSE also started off the week initially lower, briefly breaking signal support but unable to sustain that break. Instead, price turned strongly back up into the end of the week, closing at another new high on the month. Therefore, unless price turns immediately back down in order to hold a lower high compared to the January high and then breaks back below last week’s low, it looks like the larger B-wave previously in red is taking over. That would suggest price working on wave iii of (c) with 7780 – 7850 as the potential target.

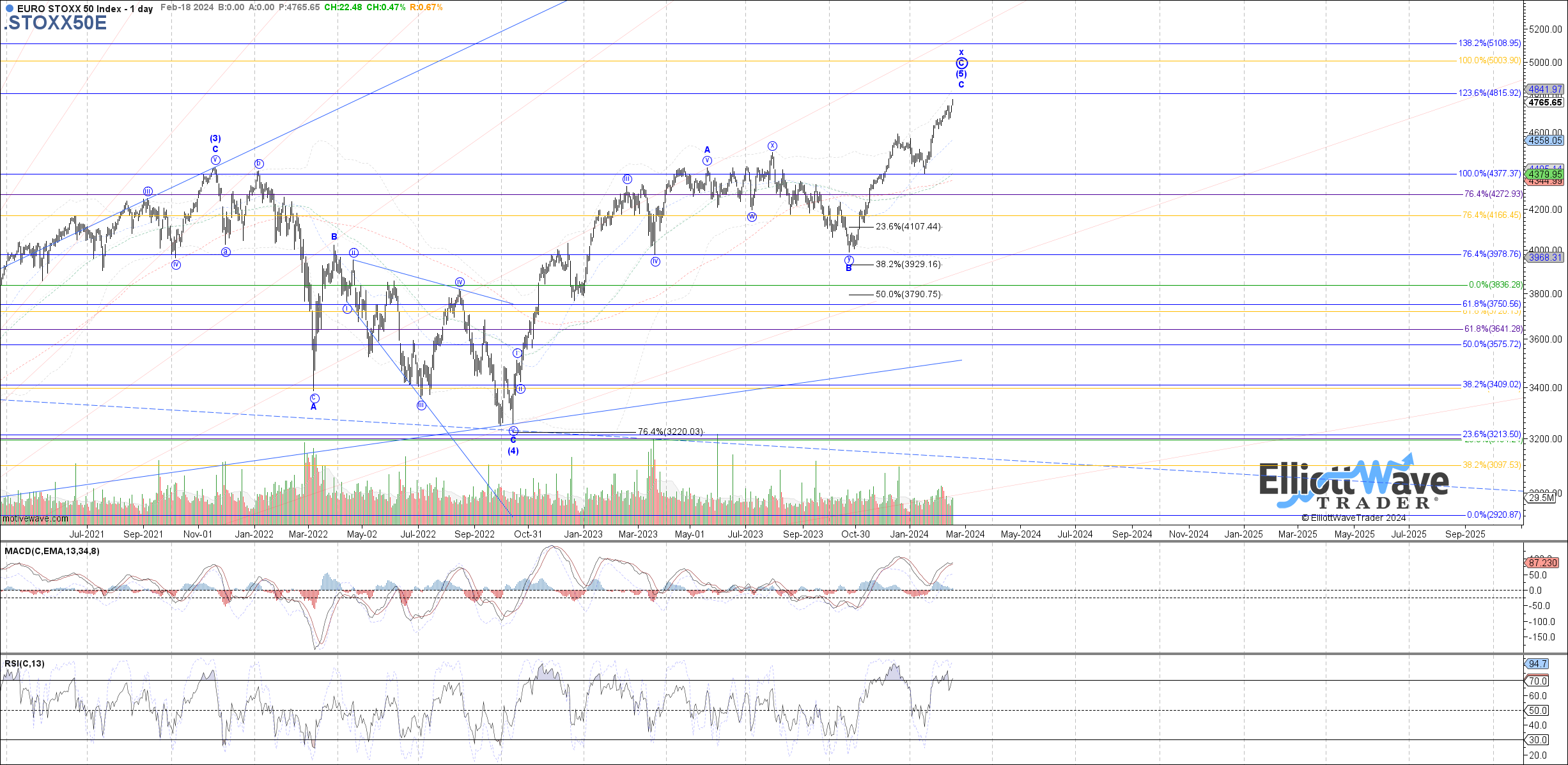

STOXX: The STOXX started off initially lower last week as well, but soon turned back up to a new high on the month by the end of the week. Therefore, it looks like price is still working on wave (v) of v, with 4800 now as the next fib target above. It will now require a break back below last week’s low in order to open the door to wave (v) of v complete and a larger degree top in place.

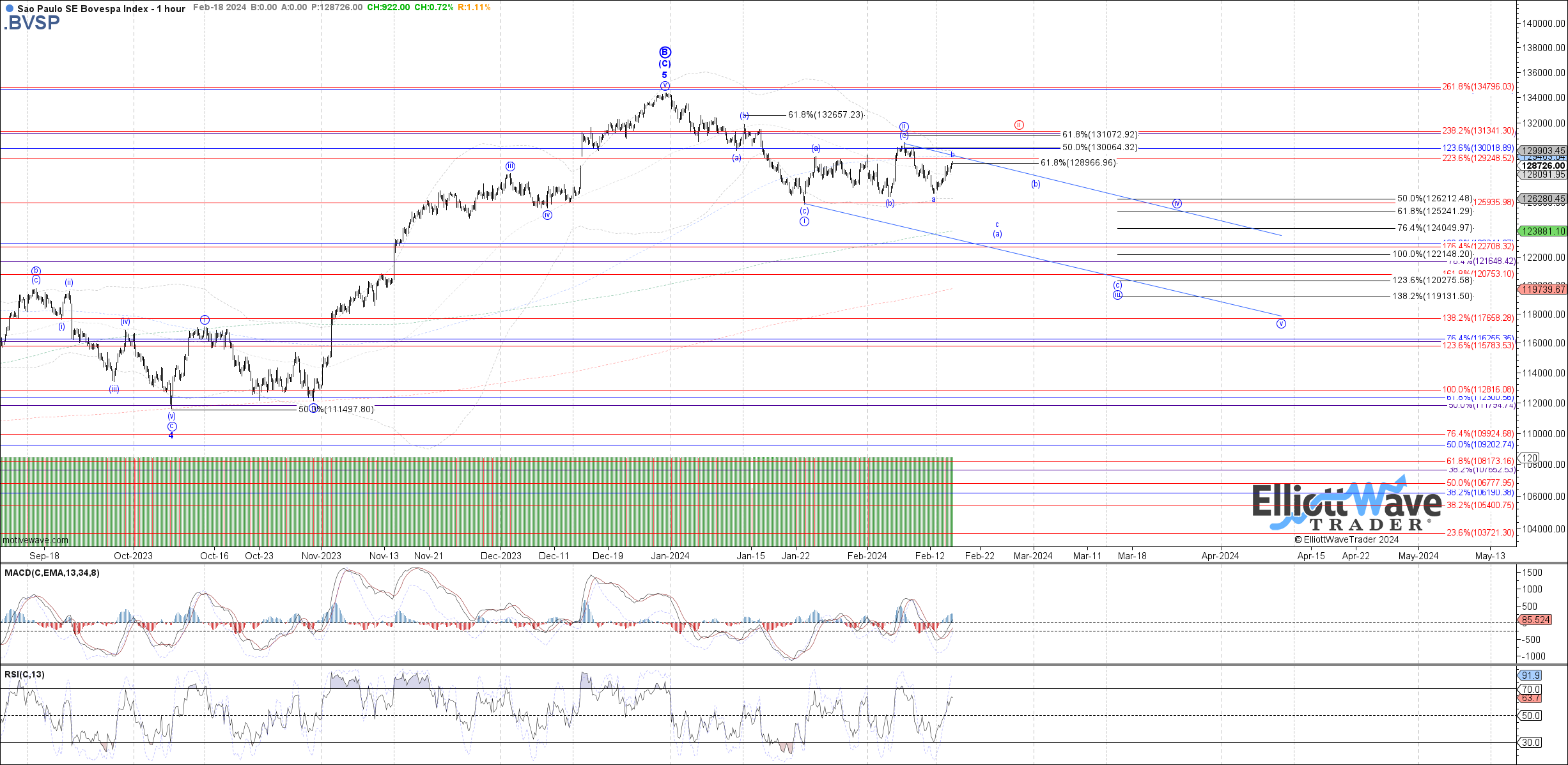

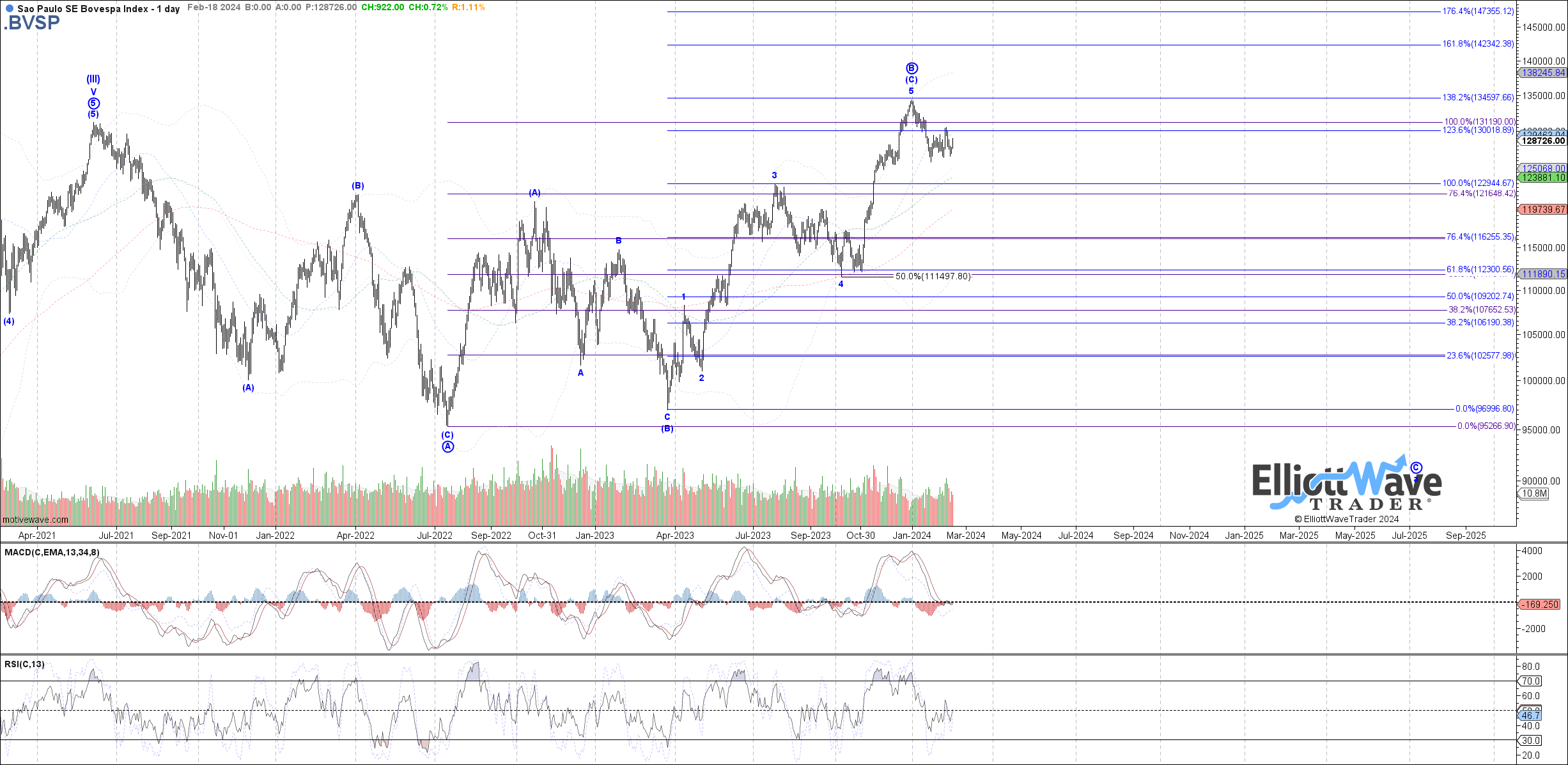

IBOV: The Bovespa started the week initially lower, but failed to break down below the prior February and January lows, instead bouncing into the end of the week. In the most immediately bearish interpretation, this bounce would be wave b of (a), still within the start to blue wave iii. Otherwise, back above the prior high on the month would force at least a wider flat wave ii shown in red.

IPC: The IPC continued to roll over last week, increasing odds that a top has already been struck as wave v of C of (B). As noted though, the next step toward confirming that is breaking below retrace support between 57195 – 56090, followed by a break below the January low for complete confirmation.