More Upside Ahead for TLT in Multi-Month Rally Off May Low

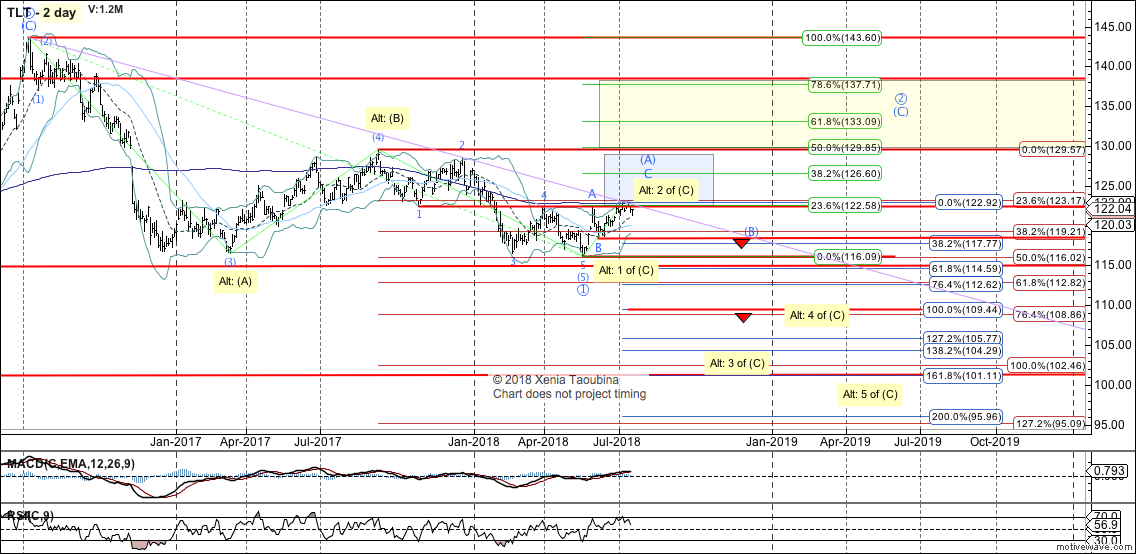

The iShares 20+ Year Treasury Bond ETF (TLT) is looking poised for a multi-month rally to the 129-133 region as part of a corrective bounce after having potentially formed a multi-year top. My base case remains that wave (5) of the impulse down off 2016 high completed at the May low (116.09). This preference for a rally remains for as long as TLT can now hold 118.42 at all times.

While breaching this support does not invalidate the potential for a higher corrective bounce, it would open up the door to a new bearish alternative ("Alt") count. To shift the odds in favor of the Alt count, TLT needs to break below 114.30, and to confirm it, it needs to get below the blue 1.0 extension on the 2-day chart.

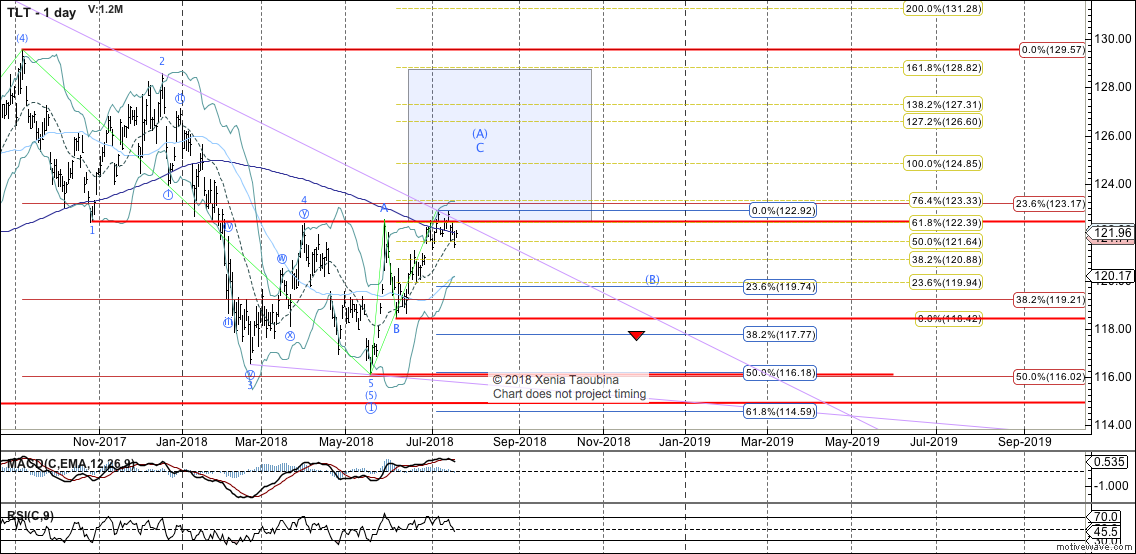

Zooming in on the 1-day chart, through the month of June, my expectation was that the pullback off the May high would hold over the May low and that TLT would stage a move back to its May high in wave C. That expectation has now been met. For as long as TLT can now hold 118.42, the potential for the rally to subdivide exists. IF TLT is able to break below its June low (118.42), it will open up potential for further lows with support at 114.30.

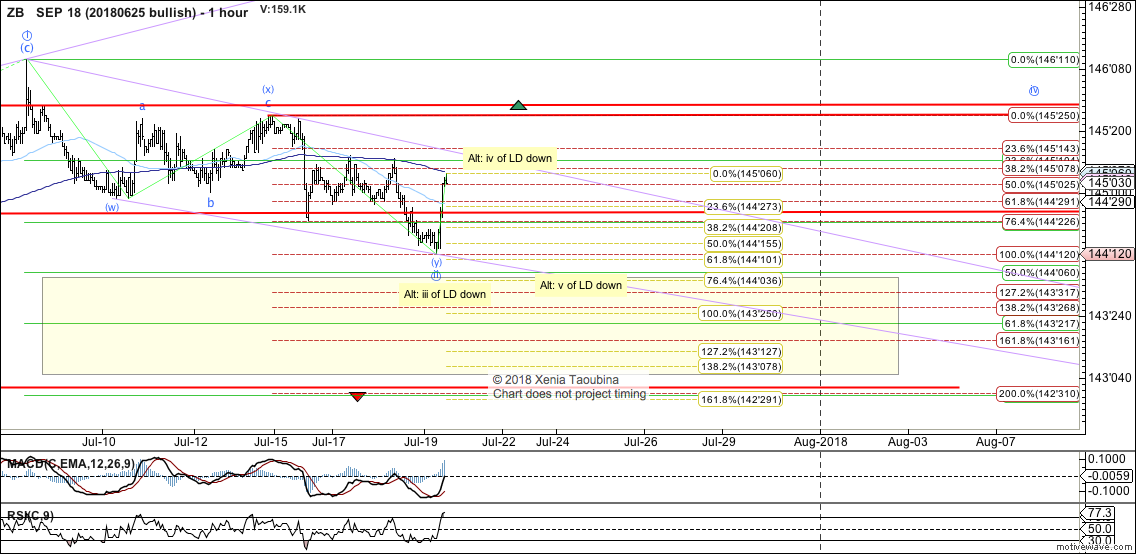

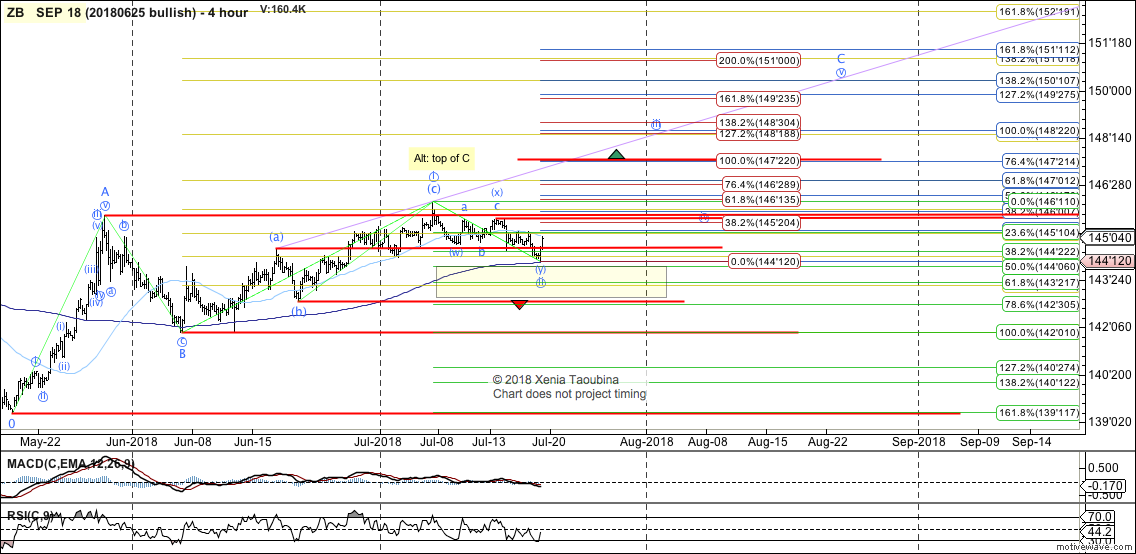

In the 30-Year T-Bond Futures (ZB), ZB continued to follow through down to the 1.0 extension of the initial decline; however, it didn't breach the necessary line in the sand for downside acceleration, and reversed back up. At this time, the rally off today's low is best viewed as an impulse, so I favor a corrective decline to have completed, with confirmation of such completion over 145'25.

Once over 145'25, a break over 146'11 will be favored, with the potential for acceleration higher. As long as it's below 145'25, the potential to go lower remains. IF today's 144'12 is broken, I will expect such break to be minor and to hold the yellow 1.0 extension; however, it will then open up potential to a larger degree top, as it will form an leading diagonal down (Alt count).