Market Outlook: Why The Jobs Report Is Always "Wrong"

Summary

- Friday's jobs report included larger-than-average revisions.

- Allegations have been made that the revisions prove incompetence or manipulation.

- We explore why the revisions were so large, and why revisions are common.

- It is crucial to the economy that the BLS provides quality statistical data, especially when it's data politicians don't like.

= = = =

Good Morning HDI!

This is going to be a hard article for me to write. I know a lot of people are going to get mad, and I know I'm going to be accused of being "political". But there are facts, and my obligation is to inform my readers of the facts. Nothing I say is meant to be construed as support for or against any political candidate or for or against any policy. Our job here is to understand what is actually happening in the economy, so that we can make investment decisions that will make us money.

I'd love to sit here and just talk about the numbers in the jobs report. Unfortunately, the accuracy of the numbers themselves has been questioned and has become politicized by the assertion that they were manipulated for political reasons. That's an incredibly serious allegation and, at this point, seems to have no evidence beyond a belief that revisions prove the numbers were "wrong".

Jobs Reports Are Estimates

On Friday, the Current Employment Statistics Report saw a larger-than-average negative revision of both May and June's employment numbers. The result was that jobs added were 258,000 lower than previously reported. Within hours, the Commissioner of the Bureau of Labor Statistics, Erika McEntarfer, was fired with the President openly accusing her of publishing "faked" job numbers, going on to imply that the numbers were intentionally manipulated in an effort to manipulate the election.

"This is the same Bureau of Labor Statistics that overstated the Jobs Growth in March 2024 by approximately 818,000 and, then again, right before the 2024 Presidential Election, in August and September, by 112,000. These were Records — No one can be that wrong?"

Yes, they can be "that wrong" and it is actually very routine to be "that wrong". As someone who has spent decades reading these reports, the initial assessment is almost always wrong. This is to be expected because they are estimates. The headline reports a set number, but the actual report produces a range.

As I wrote last month:

"A "90% confidence interval" is a statistical measure that we can be confident the real number falls within the shaded area 90% of the time. This means that 10% of the time, the real number is outside of those bounds.

This BLS is telling us that there is a 90% probability that total non-farm jobs changed in a range from +11,200 to +282,800 in June. The news report "147,000 jobs created!" and people laugh at the "experts" who were so far off with their estimate of 117,500 jobs. If the headline were being precise, it would read:

US Non-farm Jobs Increased between 11,200 and 282,800 in June, We'll Find Out Exactly How Many in about 5 Years."

The downward revision for June was to +14,000. That is at the low end of that 90% confidence interval, but within the range. And keep in mind that it is a 90% confidence interval, not a 100% confidence interval.

On average, in the initial month, the BLS only receives about 60% of the responses. For the other 40%, they are guessing. They know they are guessing, and while it is an educated guess, taking a ton of data and using statistical techniques, nobody who works in the industry pretends that it is anything other than an estimate.

I've also explained several times in my Market Outlooks how the jobs report is not counting the number of jobs added; they are estimating all the jobs in the country and deriving the jobs added by subtracting the prior month from the current month. So while being off by 258,000 jobs sounds like a lot, what the June report really estimated was that there were 159.7 million jobs in June, and the July report said there were actually 159.4 million jobs in June. So the estimate was off by 0.2%. The way the news media reports it and the headline that BLS provides makes it sound like the revisions are huge, but in reality, estimating within 0.2% when you only have 60% of the data is a high degree of accuracy.

What Was Wrong

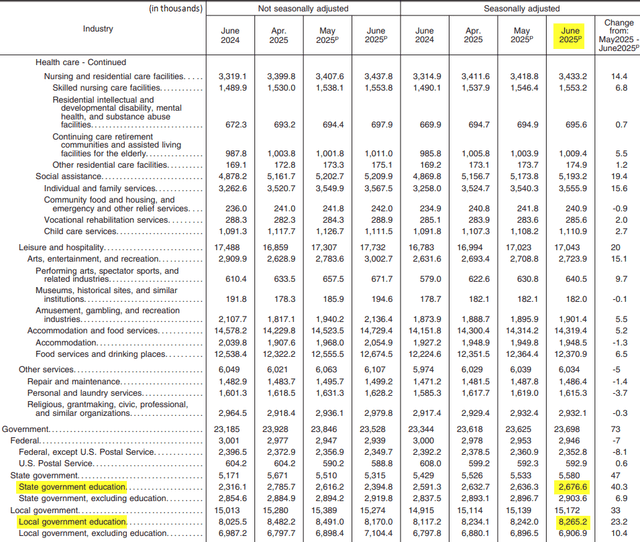

Let's dive into why the BLS was wrong about May and June by looking at exactly what they were wrong about. While many of the numbers were adjusted, the bulk of the change came from two line items. Here is page 31 of the June 2025 CES report published July 3rd:

BLS June 2025 CES report

You can follow along here.

You'll note that "State government education" was estimated at 2,676.6 thousand jobs. "Local government education" was estimated at 8,265.2 thousand jobs.

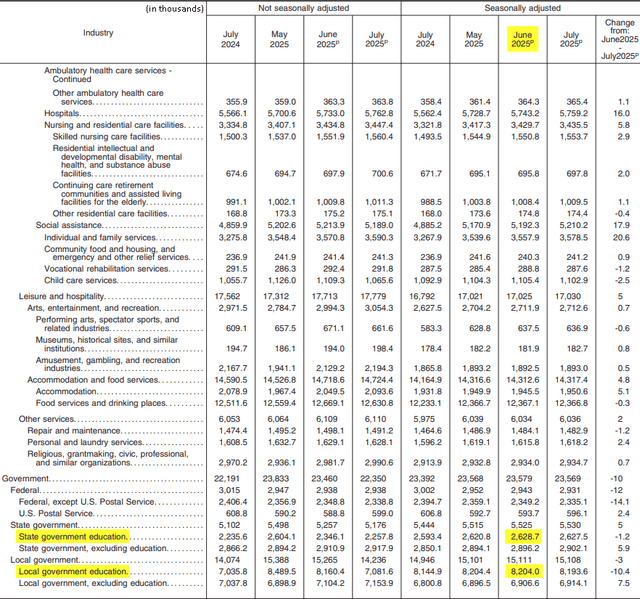

If we look at the June 2025 numbers for that same line, which is also available on page 31 of the July 2025 CES report published on Friday:

BLS July 2025 CES report

You'll note that "State government education" was estimated at 2,628.7 thousand jobs. "Local government education" was estimated at 8,204.0 thousand jobs.

So we have 2,676.6 - 2,628.7 = 47.9k jobs, and 8,265.2 - 8,204.0 = 61.2k jobs. That is 109.1k jobs of the 258k revision. Excluding those two segments, the revision was ho-hum par for the course.

A quick Google search can reveal that funds frozen by the Department of Education caused numerous schools to decide to cut back or outright suspend their summer programs. These were jobs where a substantial portion of the funding came from the Federal Government, the Federal Government cut spending, and so localities had to choose to pick up the tab or lay off the workers who staffed these programs.

The BLS is guilty of not projecting the result of the policy of freezing grants from the Department of Education. But it isn't the BLS's job to predict based on a subjective outlook of what a policy might or might not do to employment in a sector. Their job is to use objective statistical processes to estimate current data based on past data.

For the overall economy, that such a large portion of the revision was from government education is good news. When I first saw the headlines of the jobs report, my first reaction was "here's the collapse". But when you can tie the bulk of the revision to a specific government policy, then the rest of the report falls into that same category of "not great, but not terrible" that jobs reports have generally been in for the past two years.

Those who want to argue that current economic policies are bad for U.S. jobs can point to softness throughout the jobs report in sectors like mining or manufacturing. But those on the other side of the fence can point out that there has been a slow decline for three years, which is also true. I've been talking about it and pointing it out for three years.

As I've said before, I believe that politicians have much less control over the economy than they take credit for or get blamed for. The economy is huge, and it has a momentum of its own. Political policies tend to nudge the economy; they very rarely make a major change in its course. The power of any particular policy is usually amplified in the political debate to appear much more impactful than it really is, either to take credit for the good or to place blame for the bad.

The reality is that we can't really tie the revision to tariff policy or the Big Beautiful Bill or any of the other things that the political sphere is inevitably going to try to use it as proof for. As I've said before, it's going to take many months before we really know the impacts of tariff policies. It will probably be well into 2026 before the data reflects the full impact of current economic policies, and even then, there will probably be plenty of debate over how much blame/credit goes to policy and how much is just the economy's natural gyrations.

What we can state with certainty is that if the Federal Government provides fewer grants to local governments for education, then local governments will hire fewer education staff. That's the only conclusion the data provides with certainty, and whether the government should or shouldn't be providing grants for various education institutions is well outside my purview.

My Concern

My concern is that a government bureaucrat reported a result that the President didn't like and was summarily fired. It doesn't take a leap of logic that the next person in line might be tempted to avoid reporting a result the President doesn't like. After all, people are naturally biased toward wanting to keep their jobs. It threatens the integrity of the numbers if the Commissioner of the BLS fears that their job is at risk if those numbers are unfavorable to the current administration, or that a revision might be too large, so maybe it should be swept under the rug.

The fact is that while the revision in July was larger than average, it was hardly unprecedented. March 2021 numbers were revised down 131k, December of 2020 numbers were revised down 166k. March and April of 2020 were revised down 672k and 250k, respectively, for -922k in downward revisions over just two months. In September and October 2008, the jobs numbers were revised down 244k and 183k, respectively, for -432k in two months. You can go all the way back to 1979, from November to December, jobs were revised down 406k over three months.

These revisions aren't new. They tend to happen more frequently when something is changing in the economy, because the BLS relies on what was reported in the past several months to estimate what the numbers will be for the entities that haven't replied yet. When the economy is changing rapidly and the employers are making changes to their staffing levels, that is going to be picked up in the revisions, not in the initial report.

I've seen many terrible jobs reports over the years, some that came from left-field that nobody expected would be bad. I've seen Presidents fit the numbers into a narrative to make themselves look better or the opposition to look bad. I've never seen a President claim the numbers are fraudulent. And looking at the numbers, there is absolutely no reason to believe they are fraudulent. The revisions were large, but they were within the margin of error, primarily within two line-items, and we can find a specific policy that caused those line-items to be lower than typical. If the government fires people, it can't then be surprised when there are fewer people working.

From an investor perspective, we can be confident that the headline number isn't saying as much about the private sector that we invest in as much as it first appears. The trend continues to be overall negative, as it has been for several years, and I expect that it is going to continue. That's why we've focused on positioning our portfolio with a large allocation to fixed-income and in sectors we believe won't be hit too hard by a recession.

Conclusion

Hopefully, cooler heads will prevail in Washington, DC, and the administration will appoint someone to the role who continues to do their job based on statistical methodology. Because if the litmus test for a BLS Commissioner is that they have to provide numbers the President agrees with, that would be extraordinarily bad for the prospect of investing in the United States at all. We don't want to have an economy where the government is producing numbers that make politicians happy.

Would it be nice if the government could somehow collect immediate and precise data? Absolutely. But in a free country, businesses are free to put the survey on their desk and respond to it whenever they feel like it, and in many cases, not respond at all. That means the jobs report is going to be an estimate, and estimates will be off and subject to revisions in the future. This is true of all government statistics (and indeed all statistics), for example, I previously covered how the extent of the recession during the Great Financial Crisis wasn't fully quantified until 2018! 10 years after it happened. And even that number is still using some educated guesses.

For now, we can put the July jobs report in the bucket of "not horrible, but not great" that has been quite common recently. The economy is slowing, but we aren't seeing the screeching crash we've seen in other cycles. Rather, it's been a long, slow decline that has gone on for several years. The July report looked like a crash for a moment, but when you look at the details, it isn't as bad. Businesses are clearly being cautious. They are neither pushing hard to expand nor are they aggressively cutting back. They are floating in that zone of maintaining the status quo and waiting. That's what the data is telling us.

I'm joining them. I'm buying dividend-paying stocks and interest-paying bonds, collecting my income while I watch.