January 2021 Liquidity Update

Here’s a brief liquidity update to start the year.

Many market participants continue to be surprised by the resiliency of the stock market, even in the face of rising bond yields and the recent scene at the capitol.

However, liquidity conditions continue to support equities, at least for value stocks.

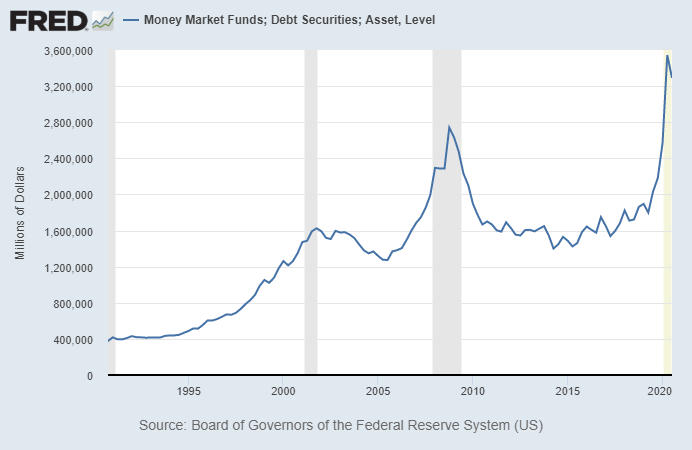

As I mentioned in a previous liquidity update, money market balances (a decent proxy for the infamous “cash on the sidelines” that pundits like to mention) seem to have peaked in Q3 2020 and are turning down, which all else equal is decent for risk assets:

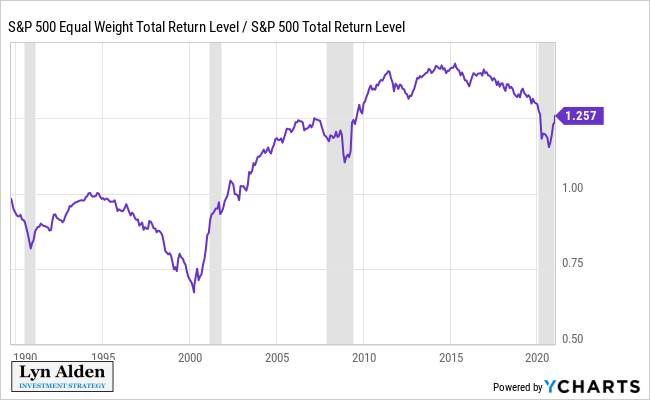

Indeed, the equal-weight S&P 500 has done well in recent weeks vs the market-weight S&P 500:

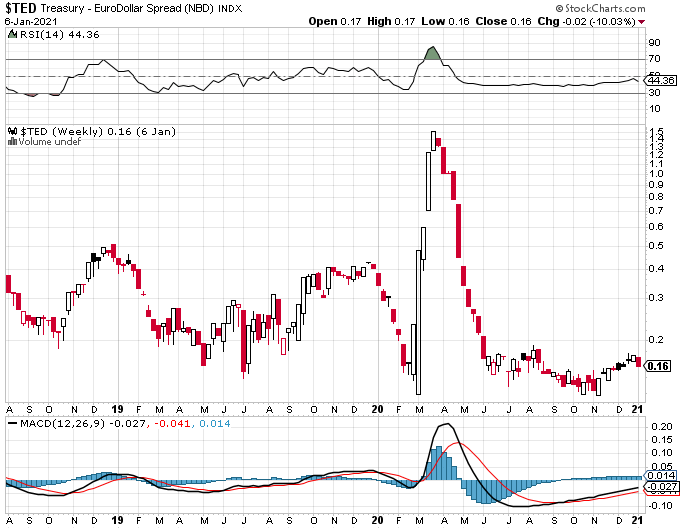

Meanwhile, the Treasury/Eurodollar spread remains low, indicating minimal offshore USD tightness:

While some individual growth stocks do appear to be driven by excessive speculation (I’m looking at you, Tesla), many of the more cyclical stocks, particularly bank stocks, are in an ideal environment. Banks tend to prefer steeper yield curves, and that’s exactly what the market has been giving them.

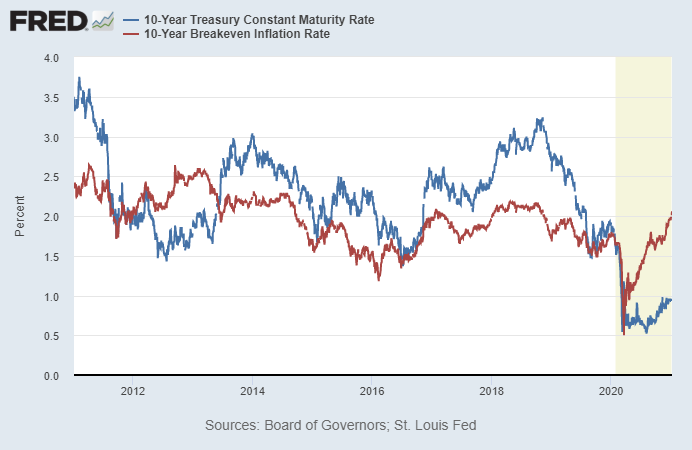

Recently, 10-year Treasury yields broke well over 1% for the first time since the pandemic/recession began, and inflation expectations have reached over 2%.

This is the second longest stretch since the inception of the TIPS market where 10-year yields remained below the inflation rate, as priced by the TIPS market.

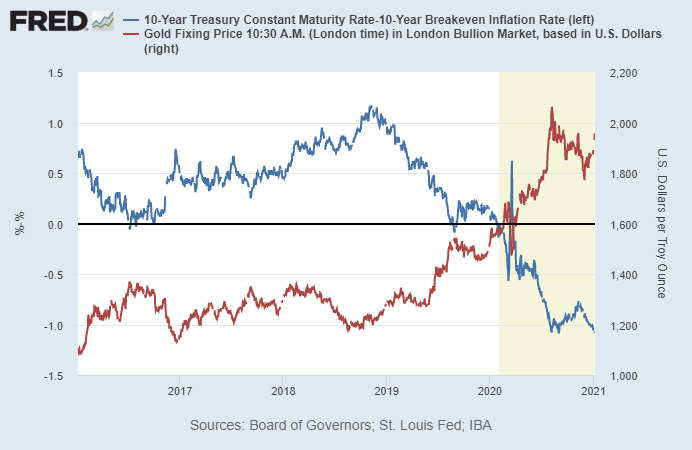

Real yields, as measured by the 10-year yield minus the 10-year inflation breakeven rate that the TIPS market is pricing, has been retesting the lows set in late August, at below -1%. Gold continues to move inversely correlated with real yields:

The dollar has shown some resiliency, as rising nominal yields have offset rising inflation expectations. The strong deficit-financed growth of broad money supply, as well as the current round of stimulus checks, should continue to support inflation expectations. An apparent narrow Senate control by Democrats, including the VP as the tiebreaker, somewhat increases the odds of further stimulus in Q1 and Q2 of 2021.

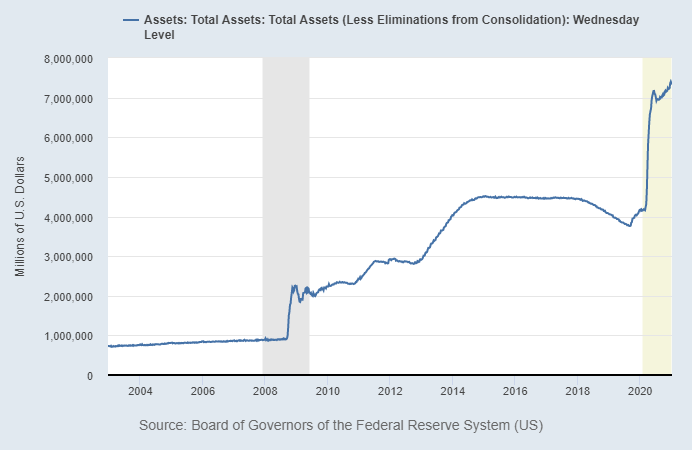

The Fed’s overall positioning seems to be to let long-duration yields rise until it reaches a pain point for the market, similar to what occurred in Q4 2018. They’re pegging the short end of the yield curve near zero, well below the prevailing inflation rate, and taking excess Treasury supply off the market to the tune of $80B/month, but otherwise letting the private market price some of those remaining long-duration bonds.

They indicated as such with their latest FOMC minutes release:

“Regarding the decisions on the pace and composition of the Committee's asset purchases, all participants judged that it would be appropriate to continue those purchases at least at the current pace, and nearly all favored maintaining the current composition of purchases, although a couple of participants indicated that they were open to weighting purchases of Treasury securities toward longer maturities. Participants generally judged that the asset purchase program as structured was providing very significant policy accommodation. Some participants noted that the Committee could consider future adjustments to its asset purchases—such as increasing the pace of securities purchases or weighting purchases of Treasury securities toward those that had longer remaining maturities—if such adjustments were deemed appropriate to support the attainment of the Committee's objectives. A few participants underlined the importance of continuing to evaluate the balance of costs and risks associated with asset purchases against the benefits arising from purchases”

-Dec 15-16 2020 Meeting Minutes, Released January 6, 2021

Here's today's snapshot of the Fed's balance sheet:

The combination of rising nominal yields and rising inflation expectations, along with broadly rising M2, remains favorable for commodity producers and financial stocks, and somewhat of a mixed bag for precious metals.

My base case endgame scenario for this inflation cycle would involve the Fed moving to cap long-duration yields, resulting in a period of deeply negative real yields, but we’re not at that point yet.