Introducing the GDXHL and USOHL systems

Introducing the GDXHL and USOHL systems

Similar to the NYHL1M system, I have put together systems for both GDX and USO in order to have trades entries similar to the great run we have been having with trading SPX using the NYHL1M system.

It uses the same principle as that of NYHL as in internals/ highs and lows/ to determine mechanical buy and sell points in GDX and USO. I am not going to go into the nuts and bolts of these systems - lets just say the logic is similar to that of NYHL1M except that it is tweaked a little here and there for the particular instrument it is working on.

The most important characteristic of the High - Low systems is that it captures trends beautifully. This is one reason it has been working so far this year and last in SPX - beautiful trending markets provided you are ok to SIT while making money… instead of trying to counter trend trade…

Now, this is where we have some issues with GDX and USO. They have had some nice trending periods… but for the last 5 years or so, a major portion has been trendless chop - and this has meant that the systems have not done as well as SPX. But I believe that that too is going to come to an end and we may again begin trending in the miners… and maybe to a lesser extent in crude oil.... and even though not as well... both USO and GDX has returned more than 100% over the last 5 years all the while the instruments themselves have been abysmal... detailed returns below...

Since this is new, I have begun tracking them on a trial basis in the Smart money room.. and depending on how things look after 2-3 months, will make it official and part of the officially covered indicators and trades.. and also add to the trade tables. For now, I am tracking them manually.... even though we are trading them in the room...

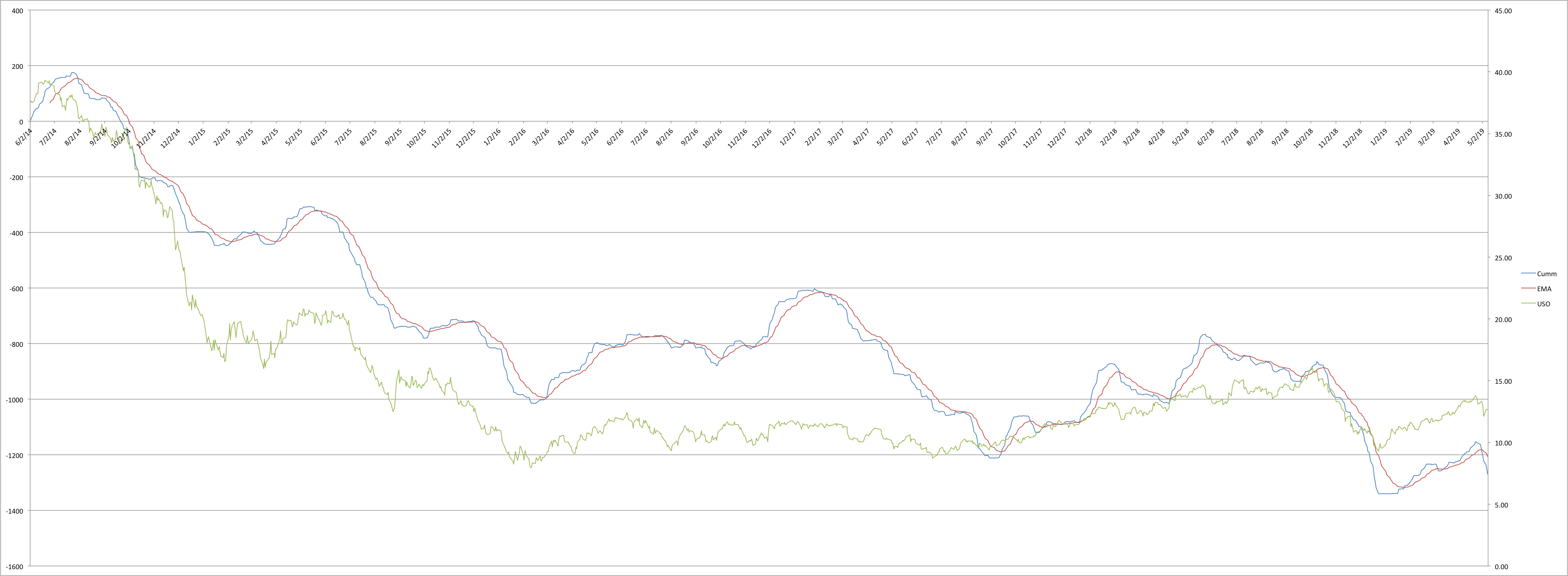

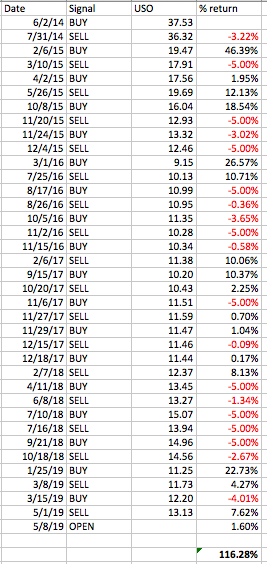

So first Crude oil or USO... the idea is the same as what we have for NYHL on SPX... as in internals..

USO, last went to a sell on May 1st.. at 13.2$… we entered a small short trade , short USO 13.13$ stop 13.74.

Wider stop than what I usually do on SSO or QLD.. reason is that USO, GDX etc are commodity related so you have to widen stops and reduce size...

The last point is critical... size on USO should be something 1/10th of what you trade on SSO, QLD etc...

5% stop... so a full size position should only take a 2% hit to your account... and this is just a 1/4 size position.. so even if we get stopped out, it should only be a 0.5% hit to your account

Last trade before the current short one was long USO on 3/15 to May 1st... so 1.5 months... from 12.2$ to 13.2$.. 8.2%

Do not ask me more on the nuts and bolts of the system.. I am going to keep the exact math behind it secret... there was a lot of work and sleepless nights on it behind the scenes... It is basically similar to NYHL1M... thats all you need to know...

USOHL chart setup... same as NYHL... blue going below red is a sell...blue going back above red is a buy signal... right now on sell...

Backtest for the last 5 years...

116% return on USO.. all the trades over last 5 years...

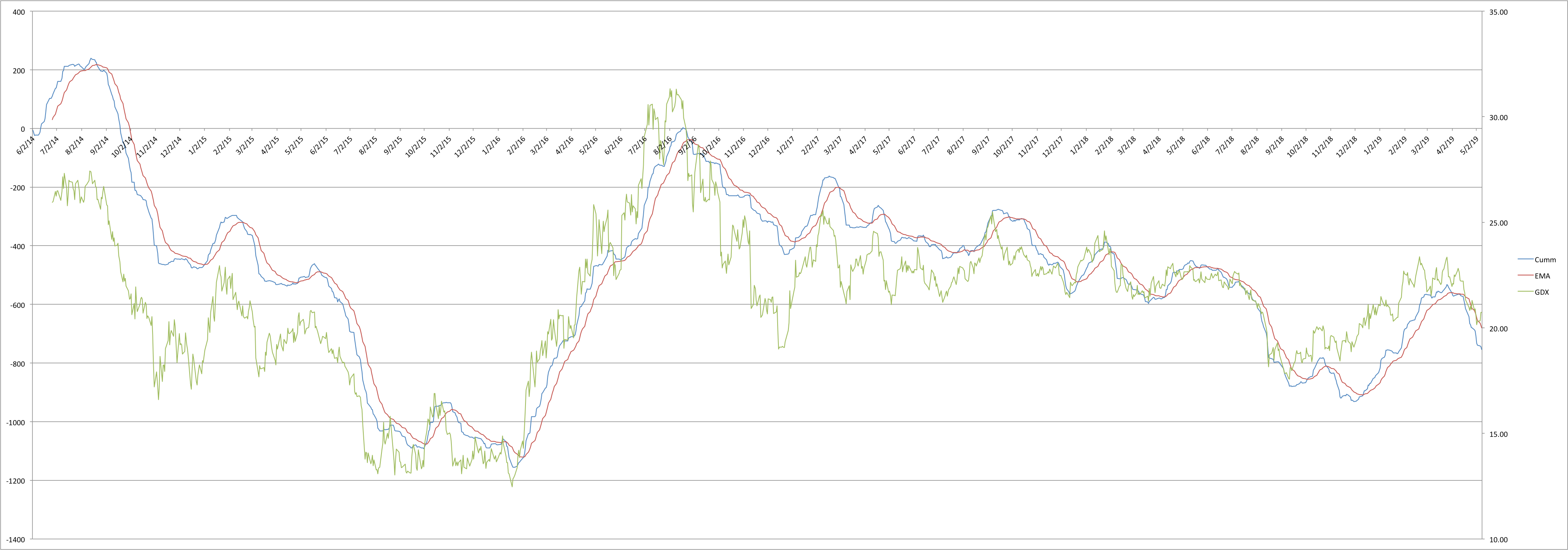

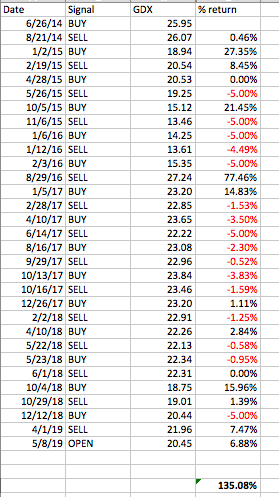

Then GDX…

Again, same idea as what we have for NYHL on SPX... as in internals.. This system is solidly on a sell and is going to be a while before a buy... that is the way is stands right now..

We went to a sell on 4/1 at around 22$ on GDX… and we are still on that same sell...

At the core, this is a trend following system... so will work best in trends... in ranges it does not…as I wrote above... for the last 5 years, this system has returned around 130% on GDX all the while GDX has gone from 26$ to 21$...

Same GDXHL chart setup...

Backtest for the last 5 years...

135% return on GDX.. all the trades over last 5 years...

Questions welcome... I will try to respond to them a little later in the day...