I Am Loading Up Big Dividends For My Golden Years

I Am Loading Up Big Dividends For My Golden Years

“Until the music stops” is a popular phrase on Wall Street. It reflects the mindset that as long as markets continue to rise and liquidity is flowing, investors will continue to take risks, dancing along without worrying about when conditions will change.

But the music does stop, and when it does, it often brings painful consequences for innocent investors who get caught dancing too long.

Yet while the music stops, the bills don’t.

For retirees, this reality is even more delicate than for those still in the workforce. This is not the time to be stressed about market volatility or forced to sell shares at the wrong time just to cover living expenses.

Instead, it’s time to build a durable, rising income stream that pays you regardless of market noise. That’s why I am loading up on high-quality, big-dividend payers trading at attractive prices, ensuring that my golden years remain truly golden, even when the music stops.

Pick #1: KRP - Yield 12%*

Kimbell Royalty Partners (KRP) is one of the largest owners of pure mineral and royalty interests across the leading shale basins in the United States with over 17 million gross acres in 28 states and in every major onshore basin in the country. The company’s 90 operating rigs within its acreage represent 15.7% of the entire U.S. Lower 48 active drilling fleet.

In early May, the company redeemed 50% of these securities using its credit facility, simplifying its capital structure and reducing the cost of capital. The company ended Q1 with net debt to TTM consolidated adj. EBITDA of ~1.5x.

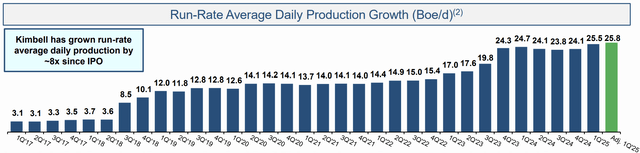

KRP's production mix is primarily dominated by natural gas (48%) and NGLs (19%), with crude oil accounting for only 33%. KRP pays variable distributions based on the volumes produced and the associated commodity prices. Despite volatile commodity prices, KRP has delivered an 8x increase to its run-rate average daily production growth since its IPO in 2017.

Investor Presentation

A $10,000 investment in KRP during its IPO would have delivered $7,065 in tax-advantaged distributions to date, with plenty more to go from this cash cow. The company continues to make aggressive acquisitions to expand its footprint. Earlier this year, the company made a $230 million acquisition to fortify its footprint in the Midland Basin.

Note: KRP converted to a C-Corp for federal income tax purposes in September 2018. Investors will receive a 1099-DIV and not a Schedule K-1.

The company reported a record Q1 2025 run-rate oil, natural gas, and NGL revenues of $88.6 million, and raised its distribution by 17% sequentially to $0.47/share. Its TTM distribution calculates a 12% yield. Readers must note that ~70% of the recent distribution that was paid on May 28, 2025, is estimated to constitute non-taxable reductions to the tax basis and does not constitute dividends for U.S. federal income tax purposes.

With a significant 9% insider ownership by management and the board, KRP is a well-managed and leading hydrocarbon royalty firm in a highly fragmented industry with a highly lucrative business model. We enjoy great tax-deferred distributions from this partnership as it continues to trade at bargain prices.

Pick #2: O – Yield 5.6%

With 55 years of consecutive monthly dividends and 30 years of annual payout raises, Realty Income Corp. (O) is trademarked as "The Monthly Dividend Company". Even during the subprime mortgage crisis, which was driven by issues in the real estate sector, O saw a drawdown of -34.7% compared to the S&P 500's -50.8%. The Dot-com bubble barely caused O to flinch, and the current market is much more similar to that event.

O buys real estate and leases it using long-term triple-net leases. The REIT’s ended the first quarter with a weighted average lease term of 9.1 years, providing steady returns.

O's management has noted that they are capable of underwriting over $20 billion/year in investment opportunities but have passed on a significant chunk due to capital limitations. The REIT could grow faster if it had access to more capital, which has been challenging due to weak sector valuations and higher interest rates. The company is attempting to solve this problem by exploring private capital sources, including pensions, sovereign wealth funds, insurers, and non-profits.

Realty Income’s future could be even better than its past. Historically, O has been excellent to shareholders, and today's low valuations present an attractive opportunity to ride its growth-focused future as the REIT taps into the private capital market.

Conclusion

Markets will cycle, headlines will change, and interest rates will eventually fall, but steady, growing dividends are timeless. By focusing on well-managed, high-yielding companies with proven resilience and shareholder-aligned management, I am building an income engine that pays me to wait, regardless of the economy's performance.

This is the power of income investing for your golden years: earning a steady income while you sleep, travel, and enjoy life on your terms.