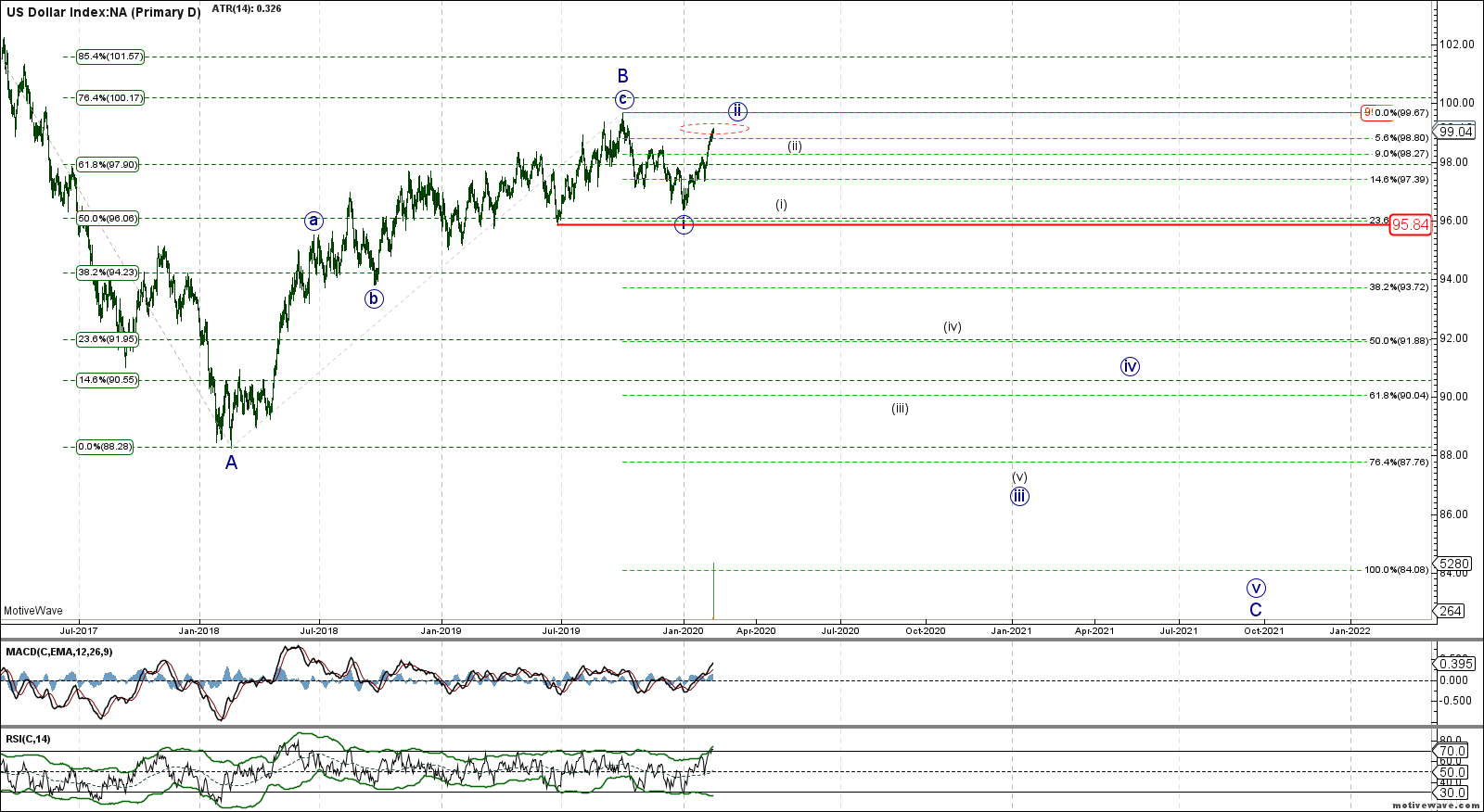

Eyeing Top in DXY

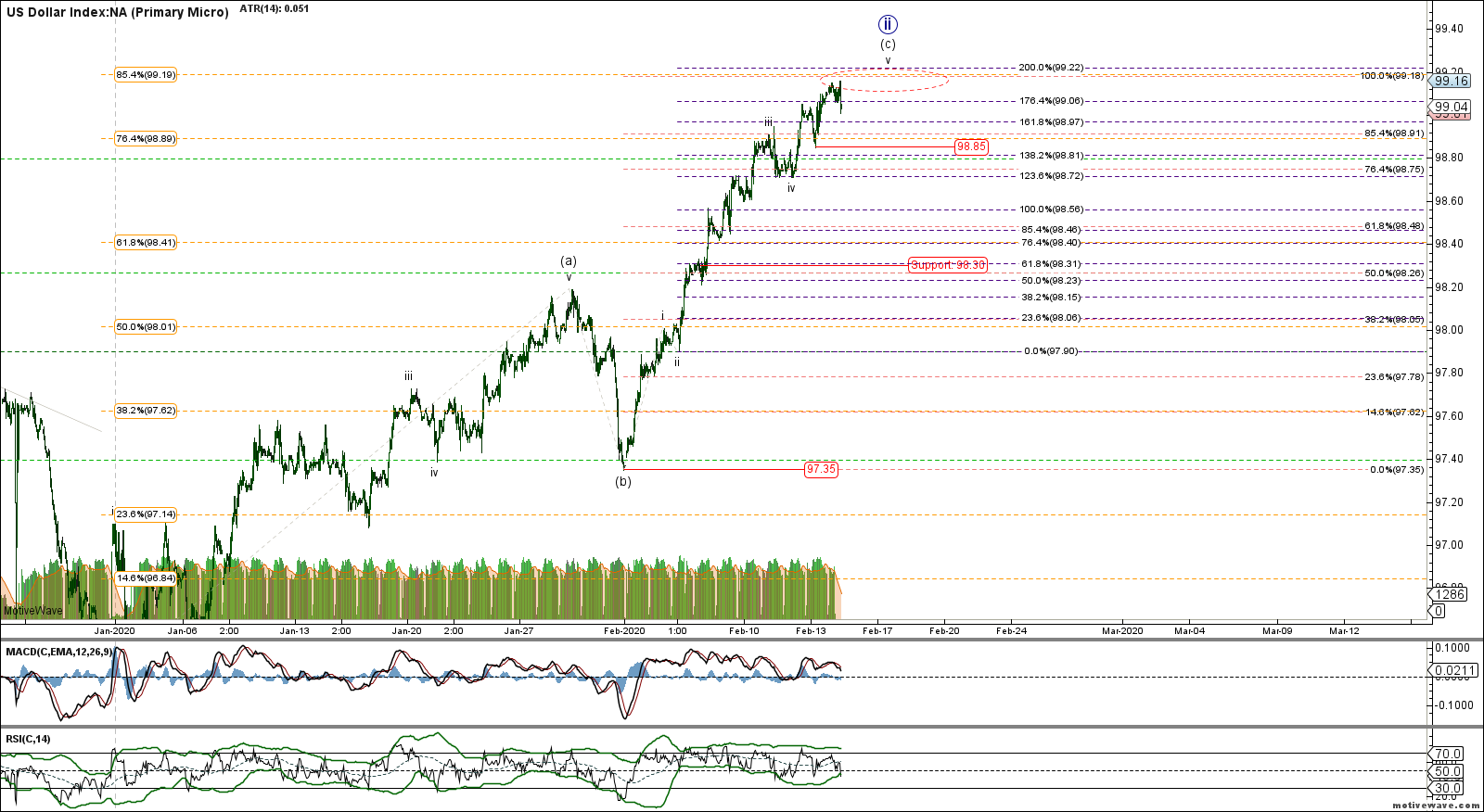

Below 98.85 in the U.S. Dollar Index (DXY) would be a strong signal maintaining the top is in place. However, a confirming signal would be given by a break below the 98.30 region.

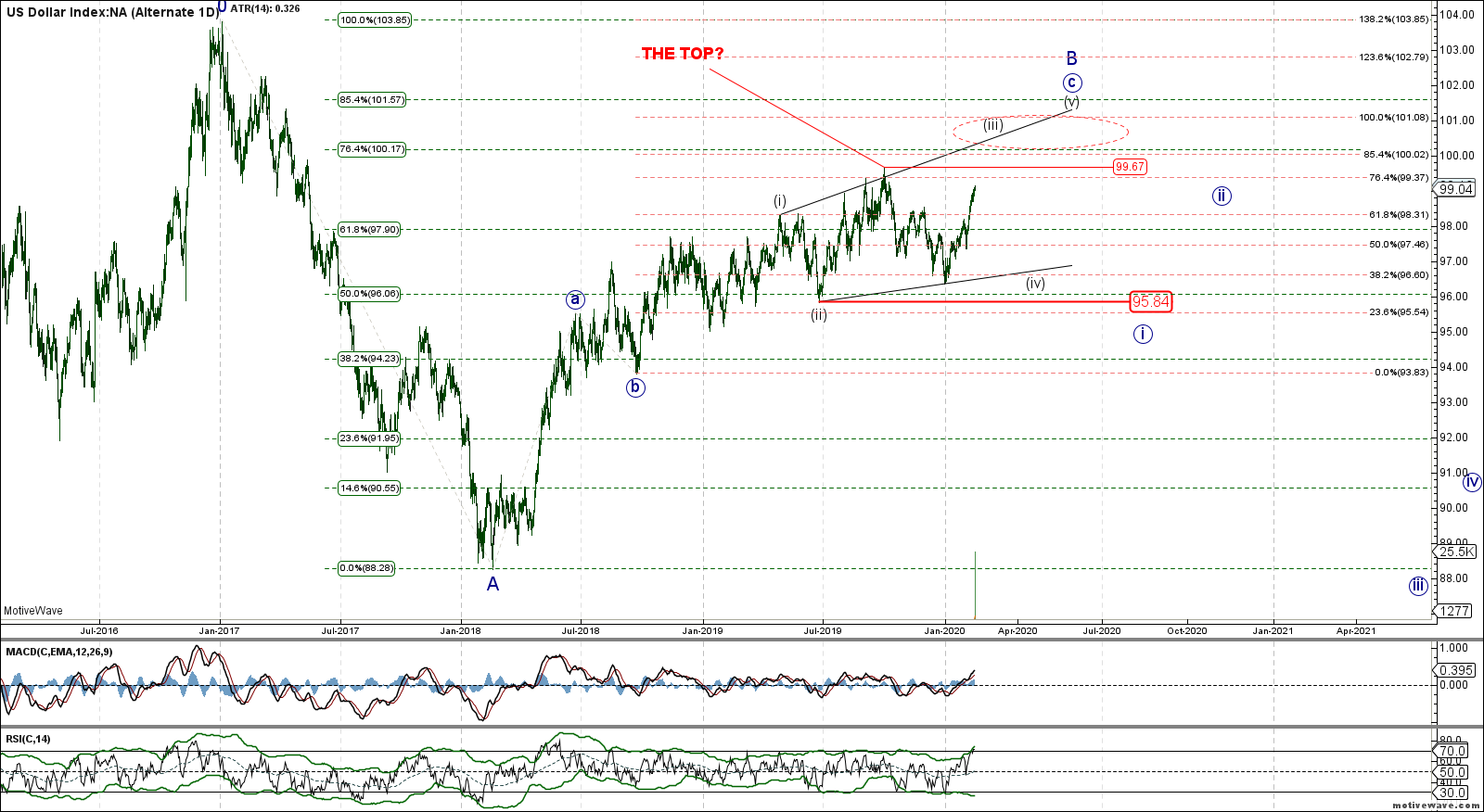

Over 98.30 and there's still a chance for an extension towards the 100-101 area suggested by the Alternate 1 D count on the chart.

An impulsive drop towards 98.30, though, would make the topping count (Primary D) much more likely than the Alternate 1D.

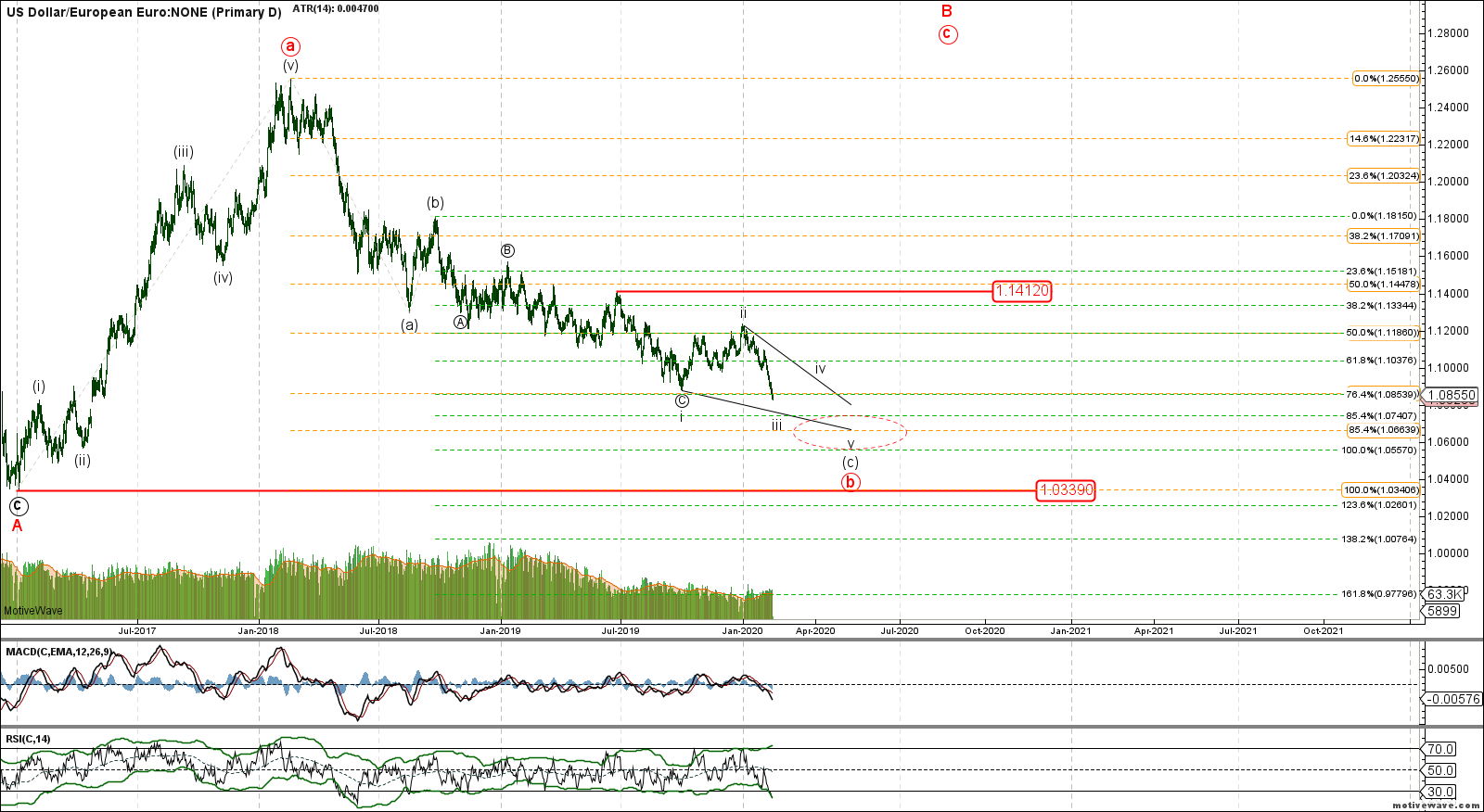

As for the EURUSD, I reiterate the recent update: EURUSD hit the upper region of possible target zone for the wave iii. In other words, we may bounce anytime, though an extension to 1.0752 is still a doable scenario.

Below 1.1239, a further extension matching with wave v is a reasonable expectation, while over this level would be a strong indication of the bottom in place.