Eyeing 4th Wave Up For European Indices

The FTSE 100 Index (FTSE) remained weak on Wednesday, so far still holding above the low made at the beginning of the week, but unable to muster much of a bounce so far as the possible 4th wave.

The potential for more of a bounce as a 4th wave remains possible, just not a reliable setup for it based on the micro price action so far.

If price does break directly lower from here, we are either dealing with further extension in wave 3 or a very short-lived and shallow 4th which is not very reliable.

The Euro STOXX 50 (STOXX) also curled back down again Wednesday, still holding above Monday's low but otherwise struggling to gain much upside traction in the suggested 4th wave bounce.

If price breaks directly lower from here, it is possible that was all we get for a 4th wave, although difficult to rely on.

Otherwise, as long as Monday's low holds, there remains an opportunity for price to attempt to fill out a more proper sized 4th.

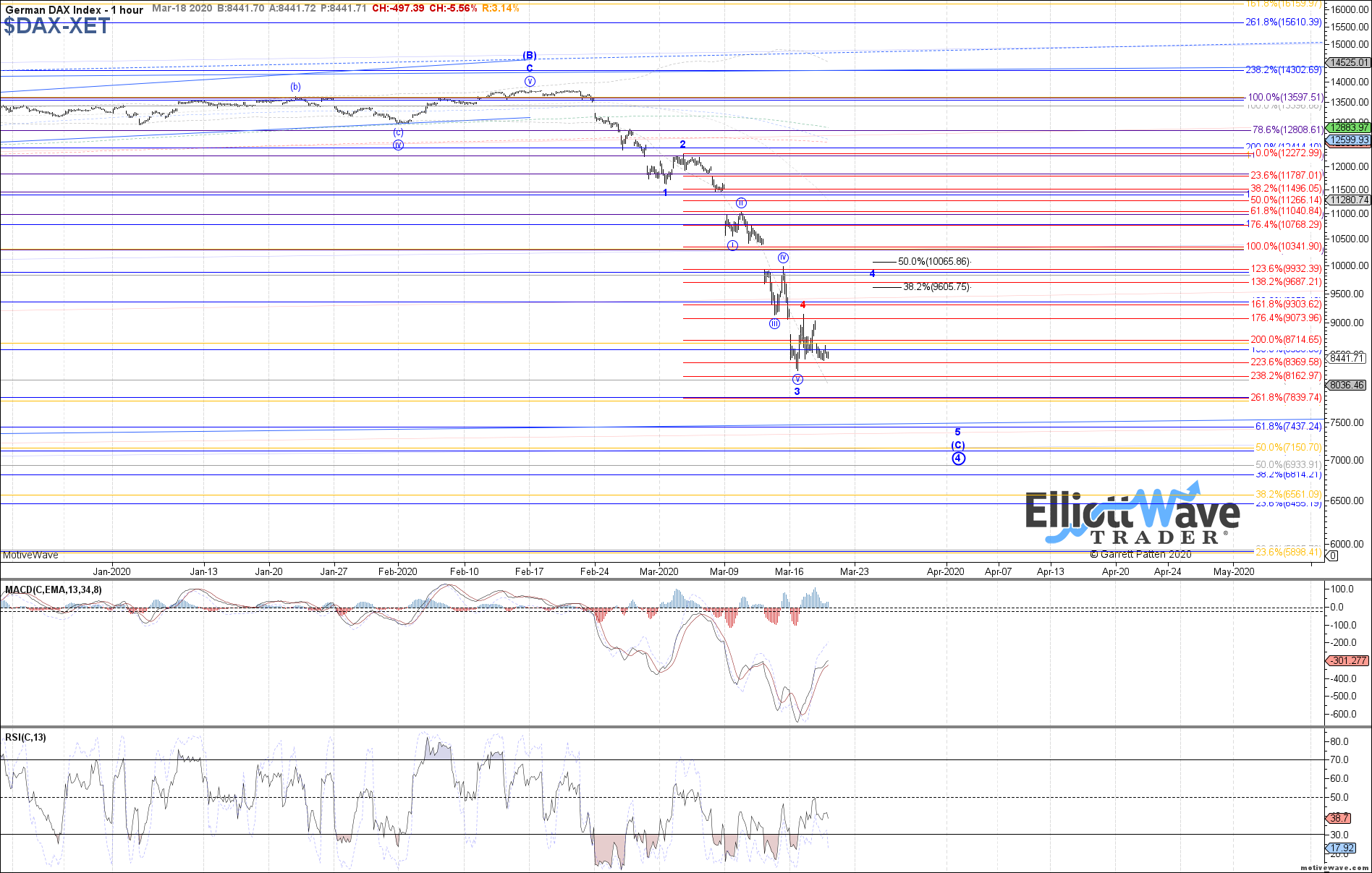

The DAX Performance Index (DAX) looks similar to the STOXX chart, still above Monday's low, but struggling to get much of a 4th wave bounce so far. If price breaks directly lower from here, it is possible that was all we get for a 4th wave, although difficult to rely on. 7500 would be the next likely target for a 5th if so.

Otherwise, as long as Monday's low holds, there remains an opportunity for price to attempt to fill out a more proper sized 4th.