Eye On Asian Markets

ASIA/PACIFIC

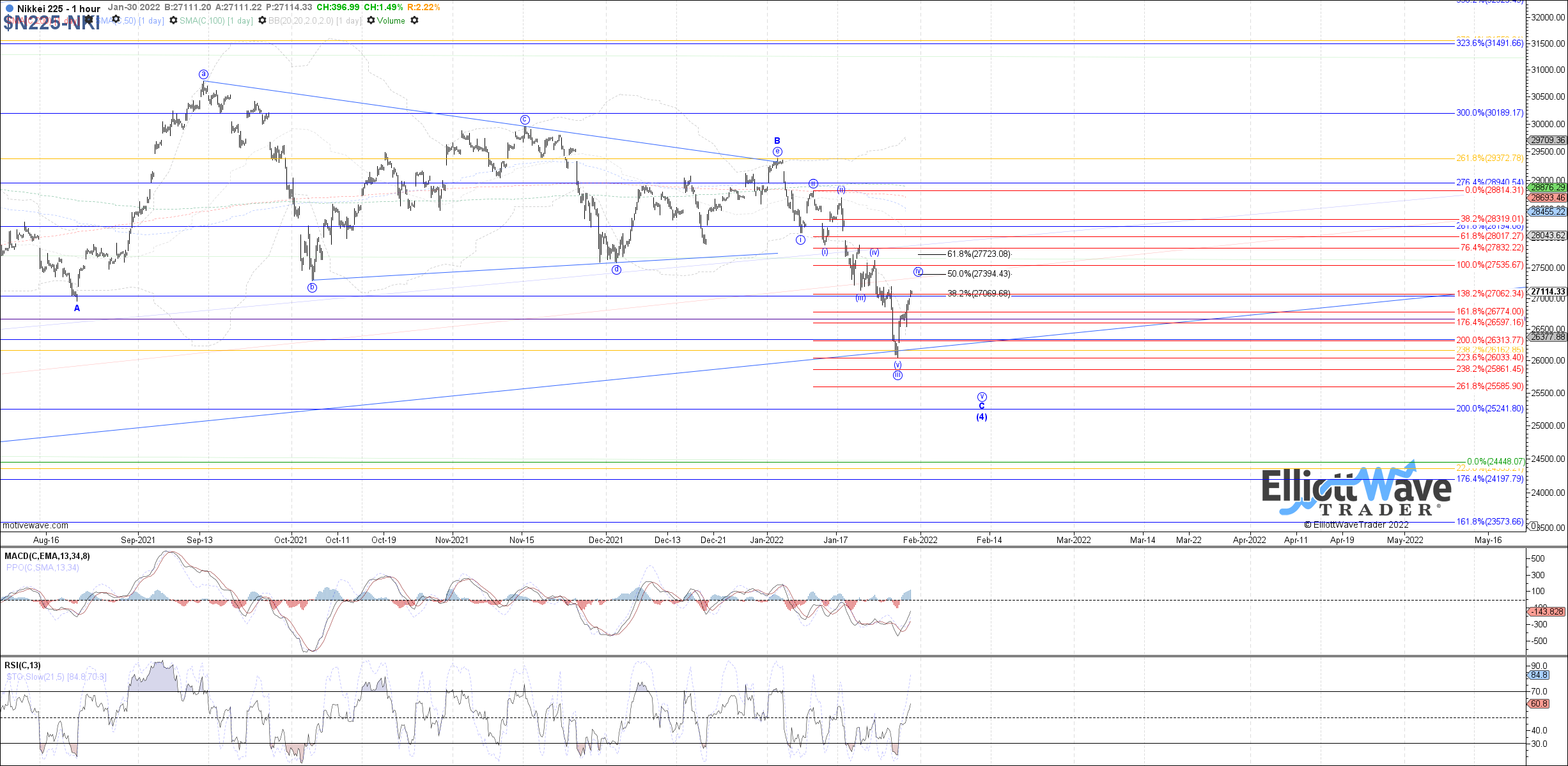

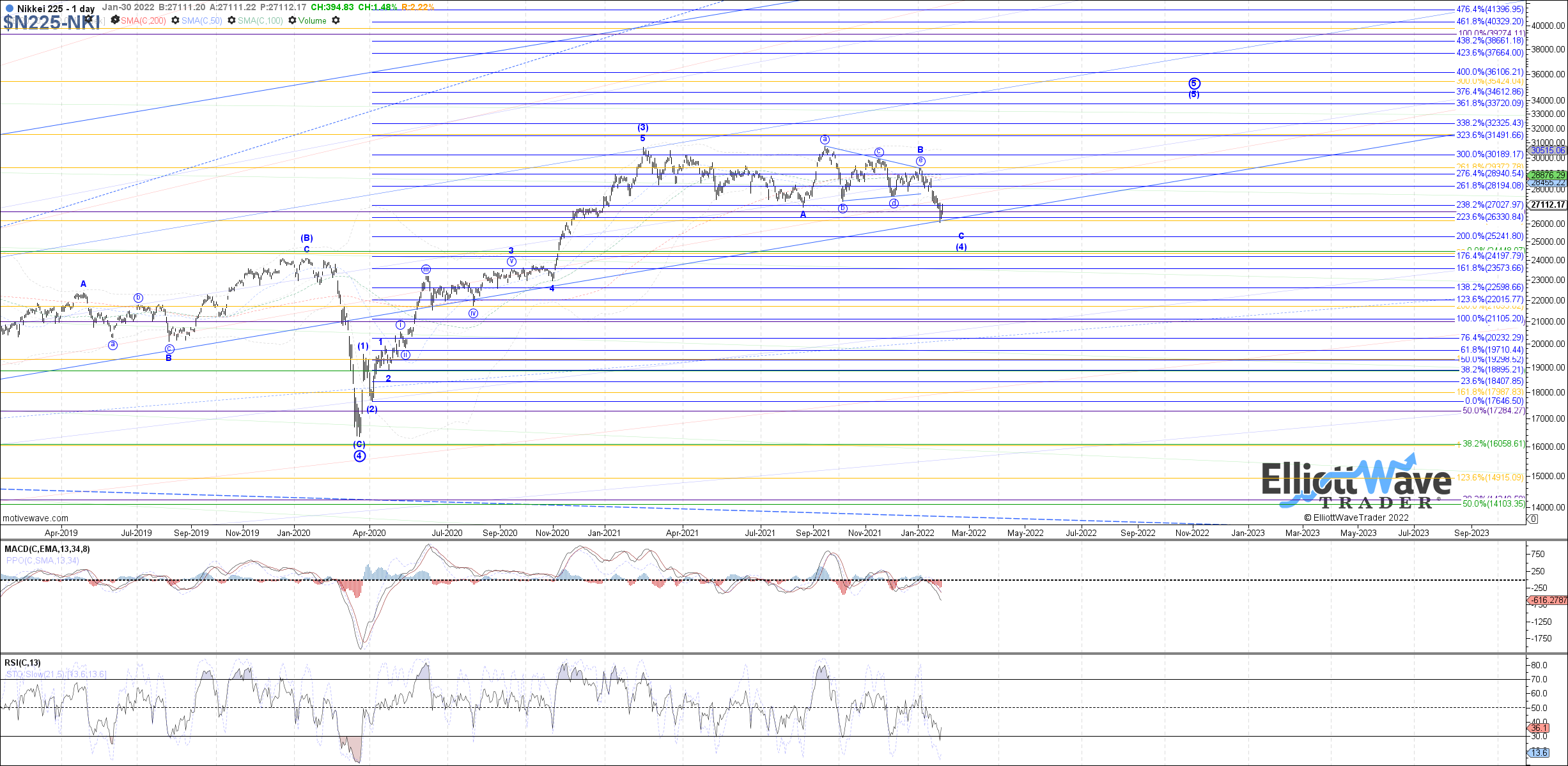

N225: The Nikkei continued initially lower last week, satisfying and even exceeding the expected target for wave (v) of iii. Price has since been filling out a decent sized bounce, which is now entering the fib target region between 27070 – 27395 cited as resistance for wave iv of C. Assuming that resistance region holds, one more final low as wave v of C is expected to complete the more complex, wider flat wave (4). Otherwise, a break above 27725 is needed to open the door to all of wave C of (4) already complete.

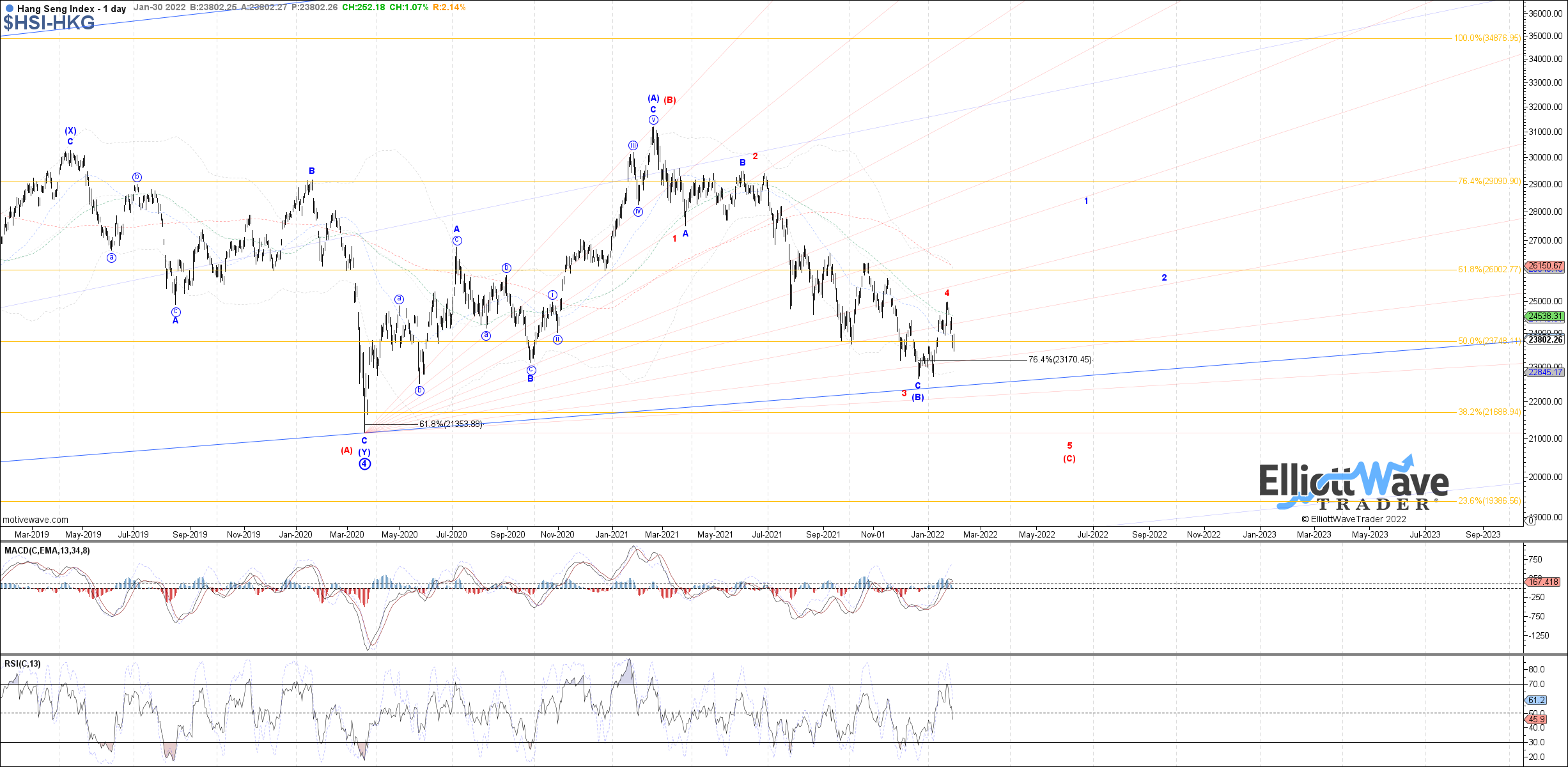

HSI: The Hang Seng rolled over last week, following expectations for a corrective pullback following the 5 waves up from the December low as an impulse. So far price has tested and is attempting to hold the .618 retrace at 23525 cited as ideal fib support for wave ii. If price can now produce another micro 5 up targeting between 24360 – 24925, it should confirm the start to wave iii with the 5 up being wave (i) of iii. Otherwise, 23140 is the next fib support below if further near-term downside is attempted instead.

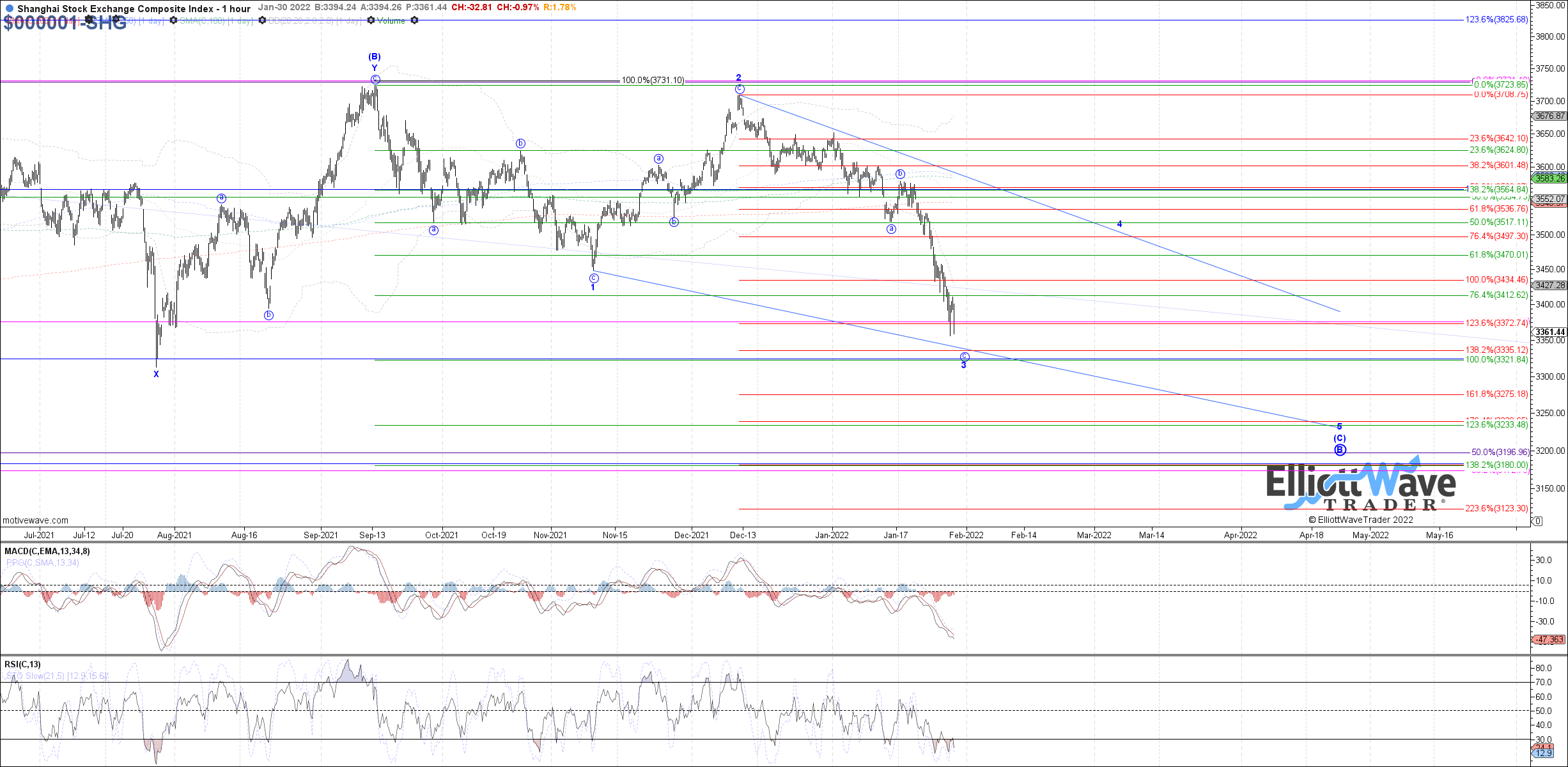

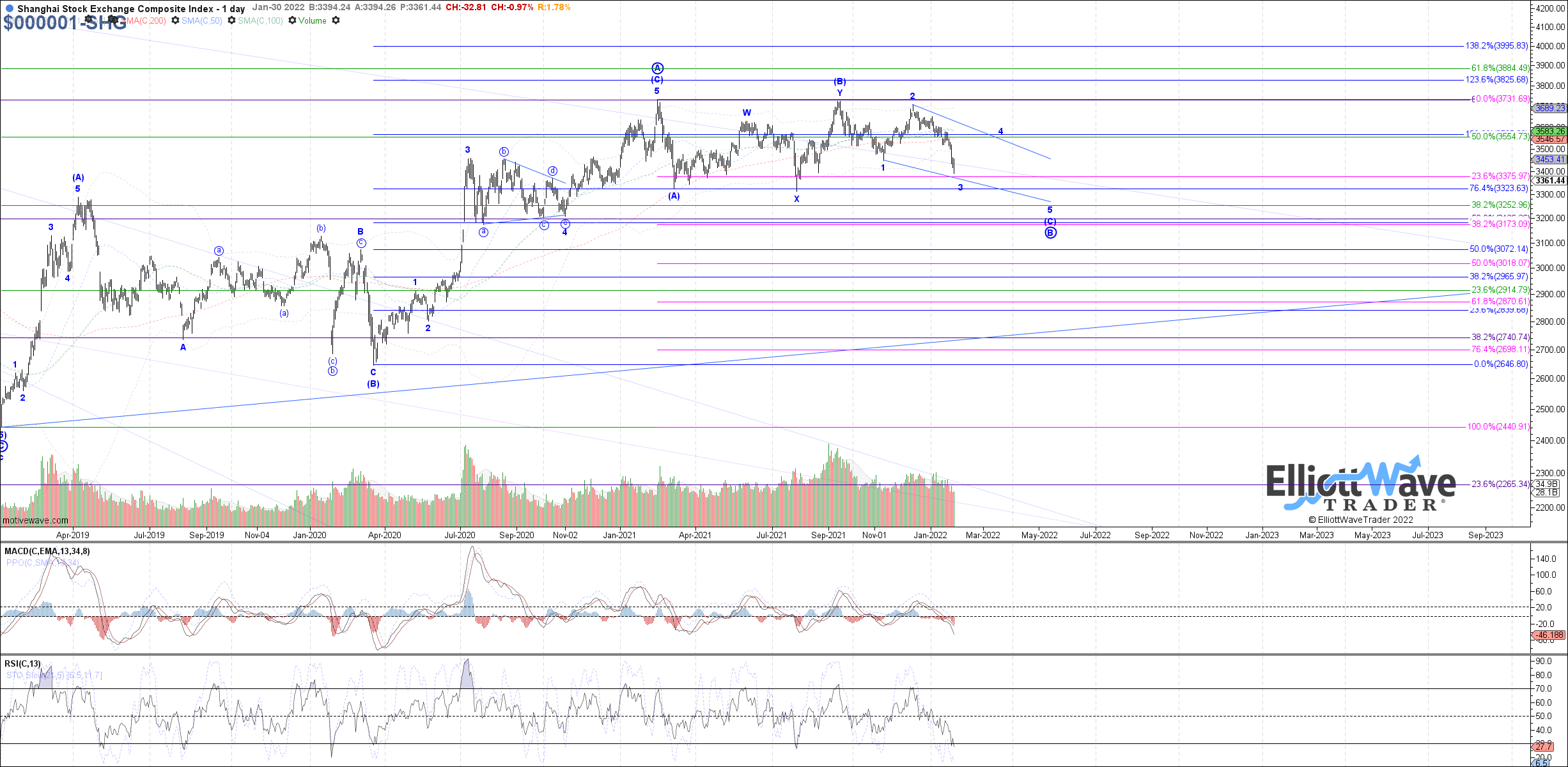

SSEC: The Shanghai Composite continued sharply lower last week, confirming that price was further along in blue wave 3 of (C) and now satisfying the minimum expected fib target at 3375. Price has not shown any clear indication of a local bottom yet though, so the next fib target at 3335 may end up getting tested before a wave 4 of (C) bounce begins. Otherwise, a break back above 3420 is needed as the minimum indication of a local bottom already in place.

NIFTY: The Nifty continued initially lower last week as well, opening the door more confidently to the impulsive C-wave down from the January high shown in blue. However, price has since bounced into what should be the fib limit for a wave (iv) of iii within the blue wave C, which means price needs to turn back down from here in order to keep that path as operative. A sustained break above 17370 would otherwise open the door to the red 1-2 as the bullish alternative, or perhaps a wave (4) triangle as another option to consider.

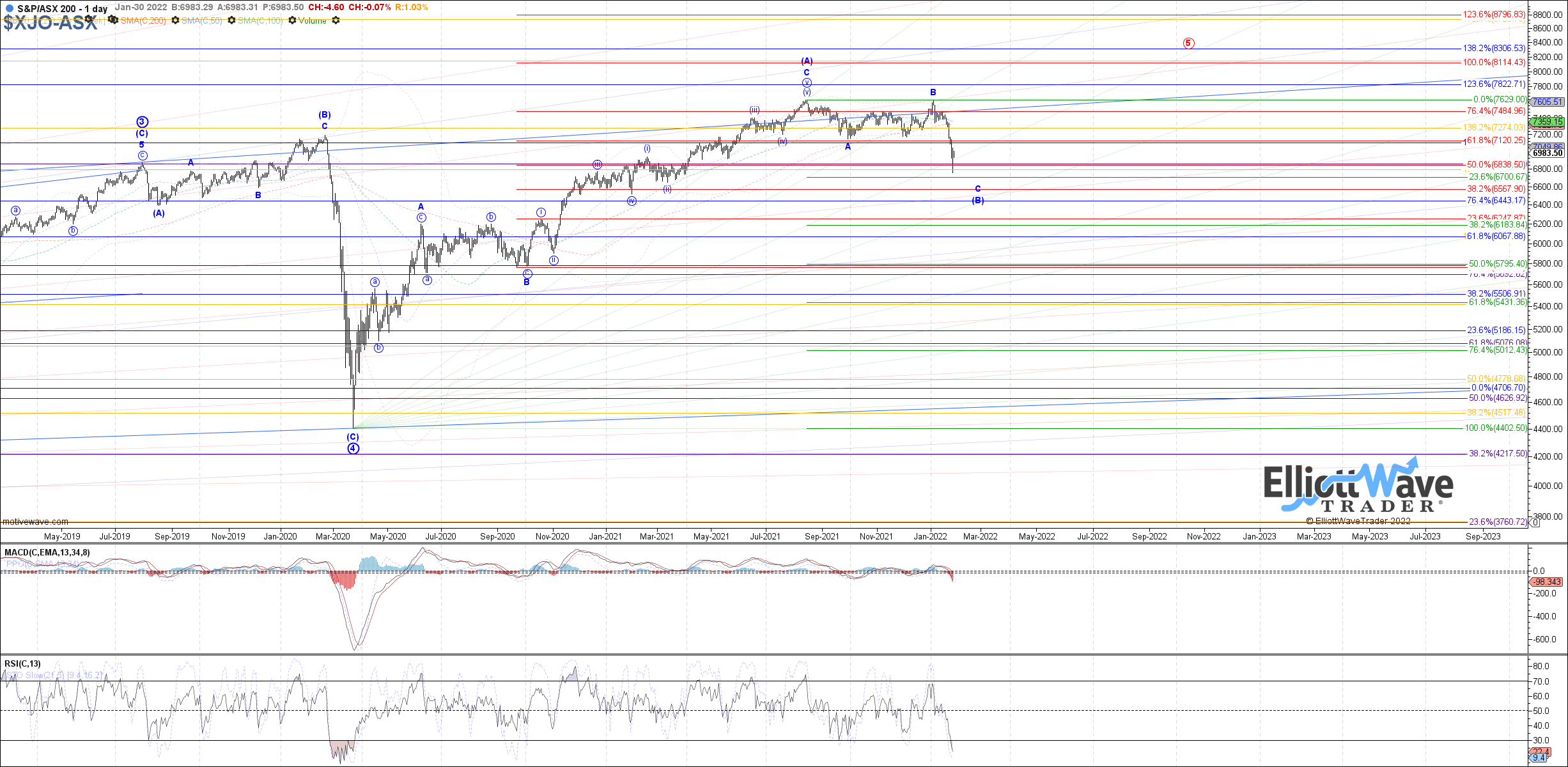

XJO: The ASX also continued sharply lower to begin last week, extending further in blue wave iii of C and now bouncing in what should be wave iv of C. Under that assumption, 7025 – 7115 is ideal fib resistance to hold as wave iv of C in order to turn price back down for one more final low as wave v of C. Otherwise, a break above 7200 opens the door to being more immediately bullish with a more significant bottom already in place at last week’s low.