Exxon-Mobil (XOM) - Still Running With Big Energy?

Written by Mark Malinowski with charts and commentary by Zac Mannes and Garrett Patten

Black gold, Texas Tea, Big Oil, and the Valdez. When the average American thinks about things that are quintessential energy history, let’s be honest, they think about Exxon-Mobil. They have brands like Esso, Mobil, and Exxon, which are household names that we see all the time across 46 of the United States and Canada.

Exxon Mobil occupies position number 15 as of early 2026 in terms of Market Capitalization on the S&P 500. So there are only 14 companies that have a larger market cap in the US. However, Exxon-Mobil is only about ⅓ the value of Saudi Aramaco, the world’s largest energy producer.

Exxon-Mobil has roots reaching back to Texas over 140 years ago. Clearly, it has to be doing something right to keep up with changing demands and needs of their customers.

Exxon-Mobil has continued to grow by acquisition and diversification since Exxon and Mobil combined in 1999:

XTO Energy (a natural gas focused company) in 2009

BOPCO (a Permian Basin focused shale oil company) in Jan 2009

Celtic Exploration (Canadian natural shale oil and gas producer) in 2013

InterOil (LNG focused company in Feb 2017

Jurong Aromatics (Singapore chemical (benzene, toluene, xylene) producer) - Aug 2017

Denbury (a carbon capture developer) in 2023

Pioneer Natural Resources (Major Midland Basin oil producer) in Q2 2024

Lithium production for electric batteries (Arkansas extraction of lithium from deep well brine using a resin based separation technology) - First production 2027

Expansion of the Beaumont Refinery with the BLADE unit (250 kbpd capacity) - startup 2023

Investment and growth going forward:

Upstream Oil & Gas Development: High-return projects in deepwater Guyana and Brazil, LNG projects in Papua New Guinea. Capital expenditures planned to be between $28-33 billion annually from 2026-2030 to boost oil and gas output.

Low Carbon Solutions (LCS): Pursuing up to $30 billion in lower-emission investment opportunities between 2025-2030, including:

Expanding Carbon Capture and Sequestration (CCS) capacity at the LaBarge facility in Wyoming

Plans to produce renewable diesel at Strathcona refinery in Edmonton, Canada.

Final investment decision late 2026 for integrated LCS-enabled low-carbon data center projects

So Exxon-Mobil has done a good job of diversifying away from just being an oil and gas company into one of the most vertically integrated producers of energy on the planet. What about the slow and steady decline in the price of energy over the last few years? What do their earnings look like?

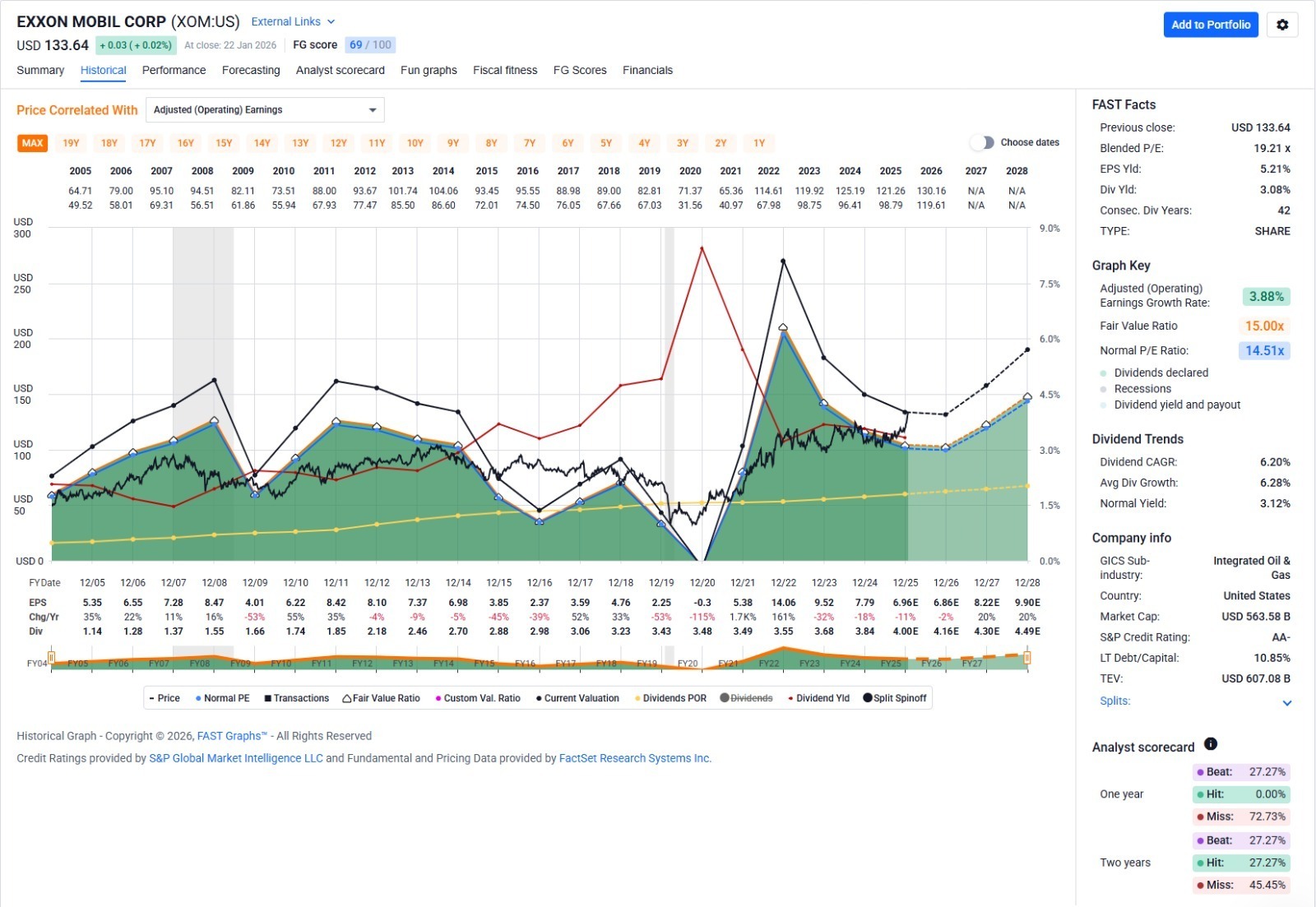

Based on the performance of their balance sheet and their dividend payments stock holders seem to have been rewarded over the last several years. However, looking forward over the next couple of years projections point to a slower growth rate.

Clearly Exxon-Mobil will face headwinds in the near term with prices for crude and natural gas being more than 50% and 60 % down off the 2022 highs, respectively. However, we do see upside potential for natural gas, but that is a discussion for different charts and different day.

Weekly chart for Crude Oil futures(right scale) and Natural gas (left scale - blue) futures

Some mixed signals in terms of underlying prices for energy. With that in mind, how does Exxon-Mobil look from a technical/ Elliott Wave perspective headed into earnings?

Technical Analysis:

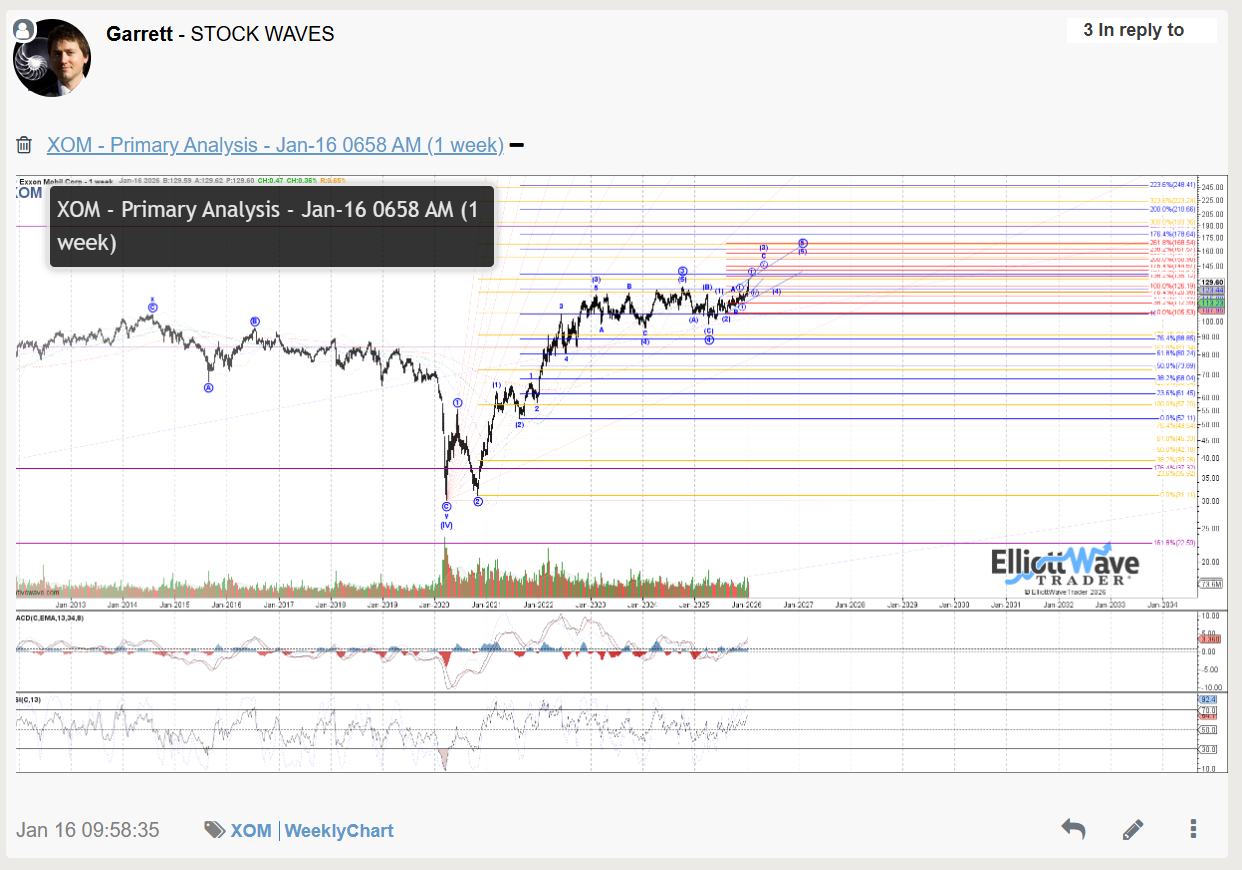

Stock Waves at Elliott Wave Trader has covered Exxon-Mobil (XOM) since it started back in 2012, but the current pattern has been tracked since the 2020 lows and more recently tracking the April 2025 low for the final leg up from the 2020 low.

Back in May 2025, Garrett reviewed the Exxon-Mobil chart ahead of Earnings for the next day showing the potential for a bottom to be in place, but the risk of one more low.

Price has held that low, however the pattern has continued to get more complex even though bullish. In September, Garrett, highlighted XOM to subscribers multiple times highlighting support and resistance levels.

At the end of December XOM had continued to climb a wall of “worry.” Structure at the end of major moves is often very overlapping and choppy, shaking out many shareholders who were trying to trade this actively vs those who are simply holding for the dividend payments. Diagonal structures likes these are a key area of strength for the analysts at Stock Waves and being the end of the energy cycle, many charts are trading in patterns like Exxon-Mobil.

In the middle of January, Garrett zoomed out to the big picture count for Exxon-Mobil (XOM) showing that the 2020 low was a Super Cycle degree bottom for wave (IV) and that the chart continues to show a bullish stance in the long term, but also that the vast majority of the move off the 2020 low is nearing completion.

That brings us to yesterday, where Garrett Patten wrote to subscribers:

For 2026, we continue to look higher in increasingly larger wave 4s and 5s targeting 160 to 170 price range, but what path price ends up taking depends on price holding support levels on expected pullbacks.

We are bullish on several other energy names in the vertically integrated, natural gas and energy services sectors, but individual targets and support and which names show the largest potential are readily available for our members to search and make requests about. If you are interested in the energy sector and what the current cycle looks like on various names, come and see what math, pattern recognition and technical indicators could add to your tool box at www.elliottwavetrader.net.