European Rally Fades Into Close

The FTSE 100 Index started off initially higher today, making another new high on the month and reaching closer to the measured move fib at 7570 before rolling over into the close to end the session slightly negative. A break below 7440 is now the minimum indication of a local top as blue wave (a) or red wave B potentially in place, otherwise until then price can still try to reach the measured move fib at 7570.

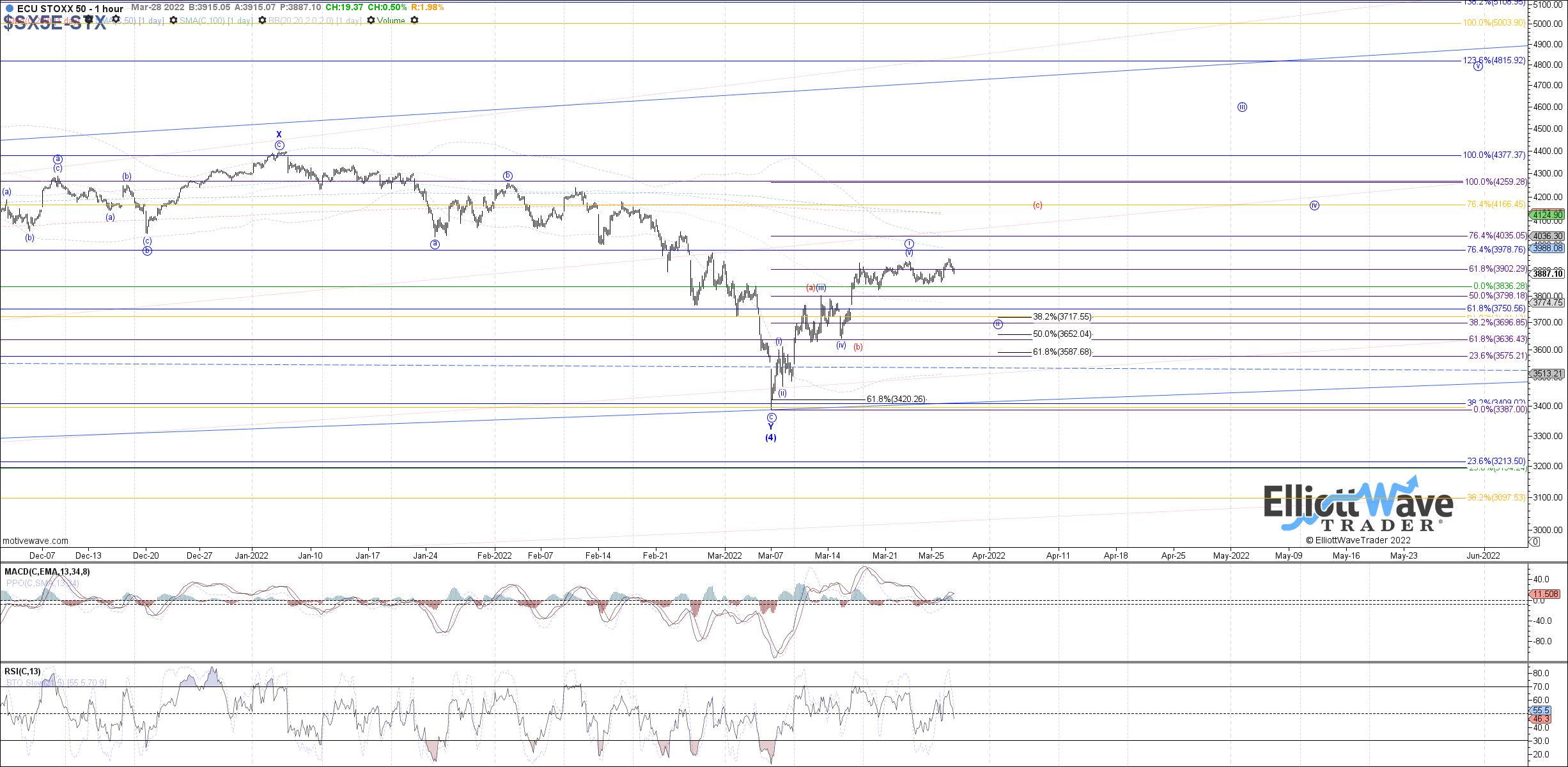

The Euro STOXX 50 started off initially higher this morning as well, briefly exceeding last week's high before rolling over into the close but still ending the session positive. Price continues to maintain above the 3820 signal support that needs to break in order to confirm blue wave ii filling out. Until then, more near-term extension higher cannot be ruled out.

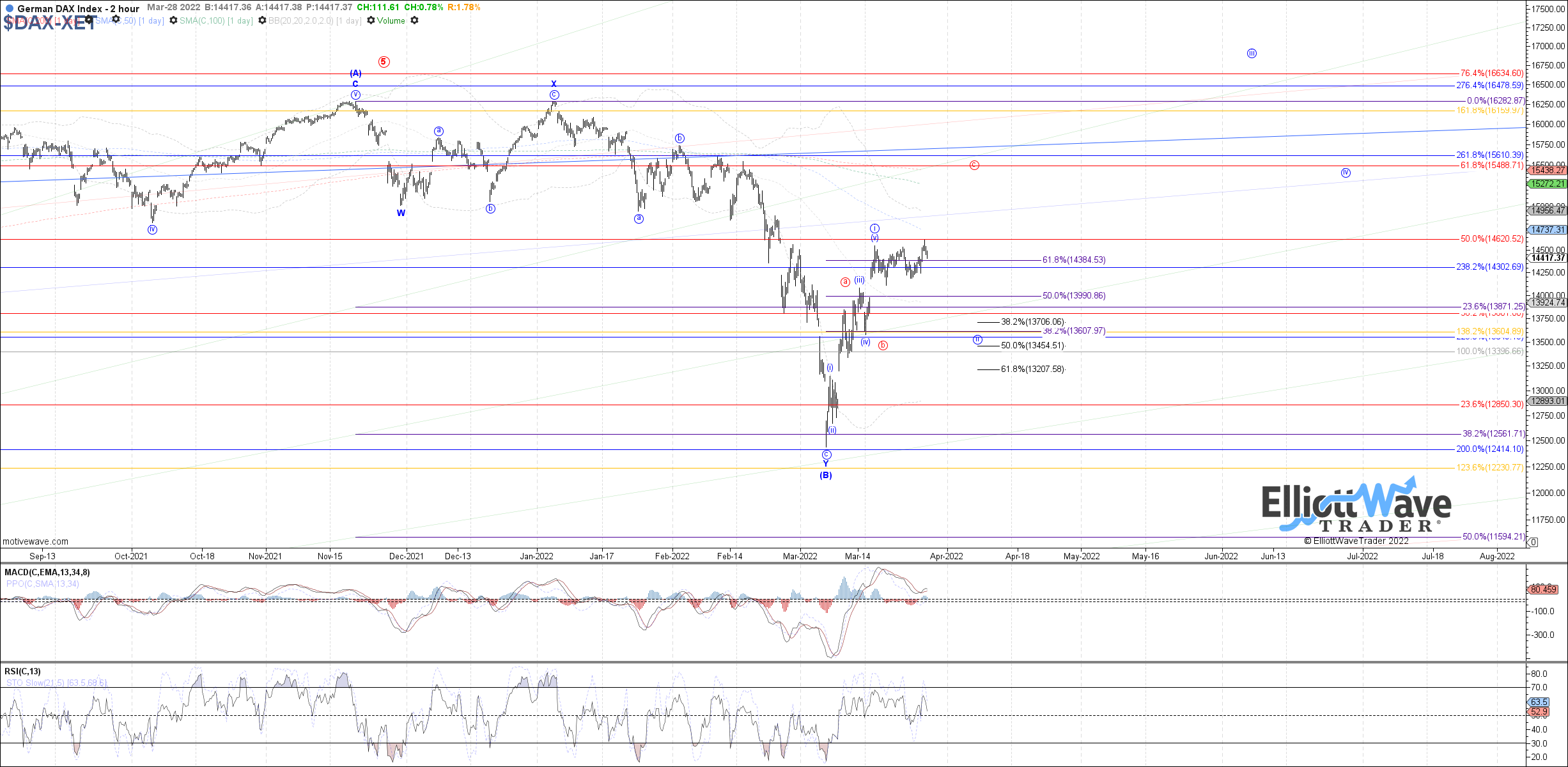

The DAX Performance Index started off initially higher today as well, briefly making a new high on the month before curling back down into the close but still ending the session positive. I still view the blue count as reasonably probable, but we continue to need a break below the 14120 signal support to confirm wave ii filling out. Until then, further near-term extension high cannot be ruled out.