European Markets Review: DAX, FTSE, STOXX

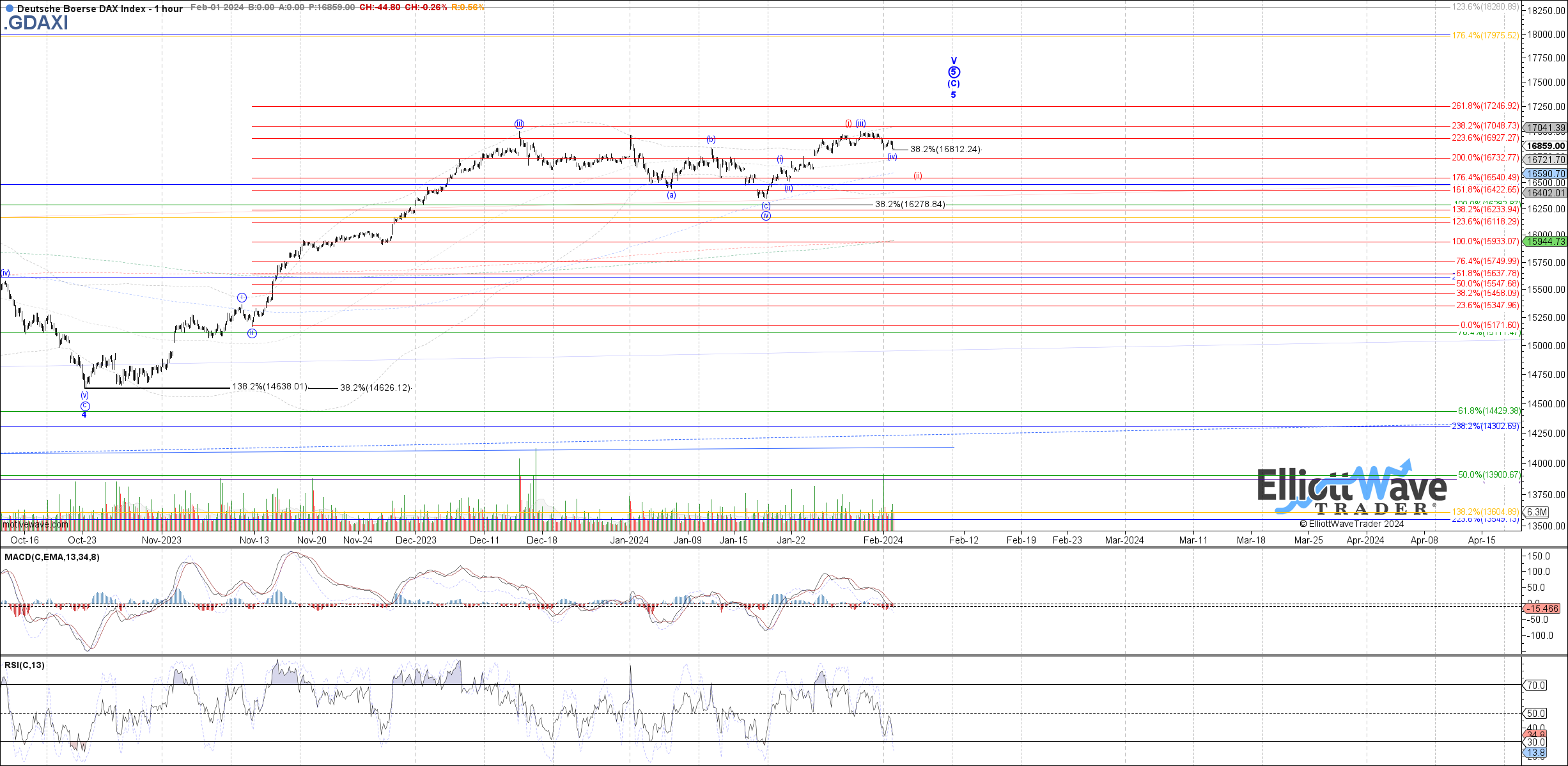

The DAX Performance Index closed modestly lower today, testing the retrace support cited at 16815 as ideal to hold as wave (iv) of v. If price does turn back up from here as wave (v) of v, then 17250 is still the potential target to reach before wave 5 of (C) completes. Otherwise, more near-term downside would open the door to a larger ending diagonal wave v as an alternative option.

The FTSE 100 closed lower today, curling down a bit further from the .786 retrace that was tested at the high of the week. As noted, the next step toward signaling a local top in place is breaking below 7595. Otherwise, as noted the further price exceeds the .786 retrace, the more likely it is to reach a new high above the prior high on the month as at least wave B still in progress shown in red.

The STOXX closed modestly lower today as well, but unlike the DAX has not yet reached standard fib support for wave (iv) of v. In this case there is still room down to 4590 - 4565 as standard retrace support, otherwise if price turns directly back toward a new high from here it may just be further extension in wave (iii) instead.