European Markets Review - Market Analysis for Dec 28th, 2021

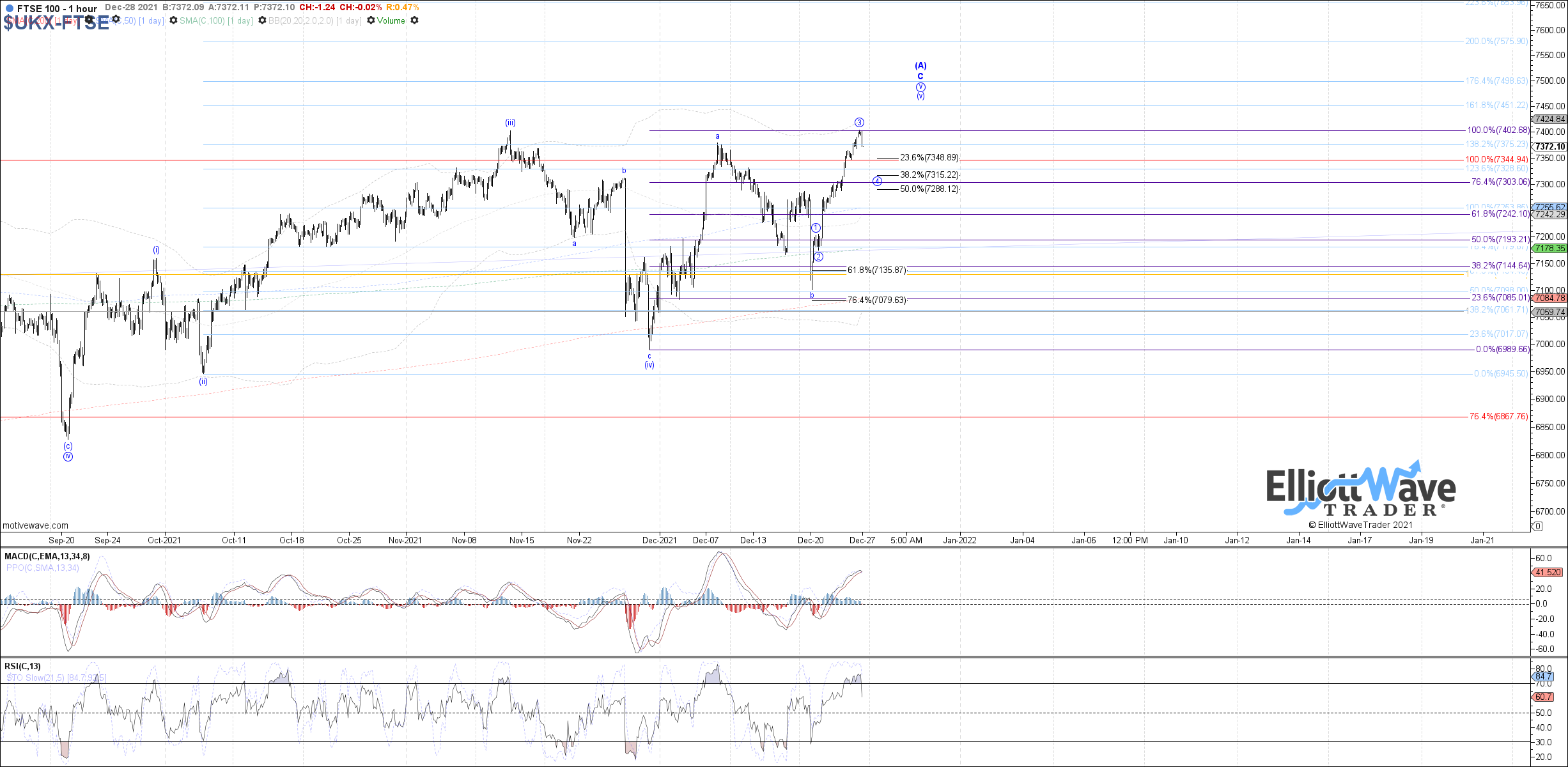

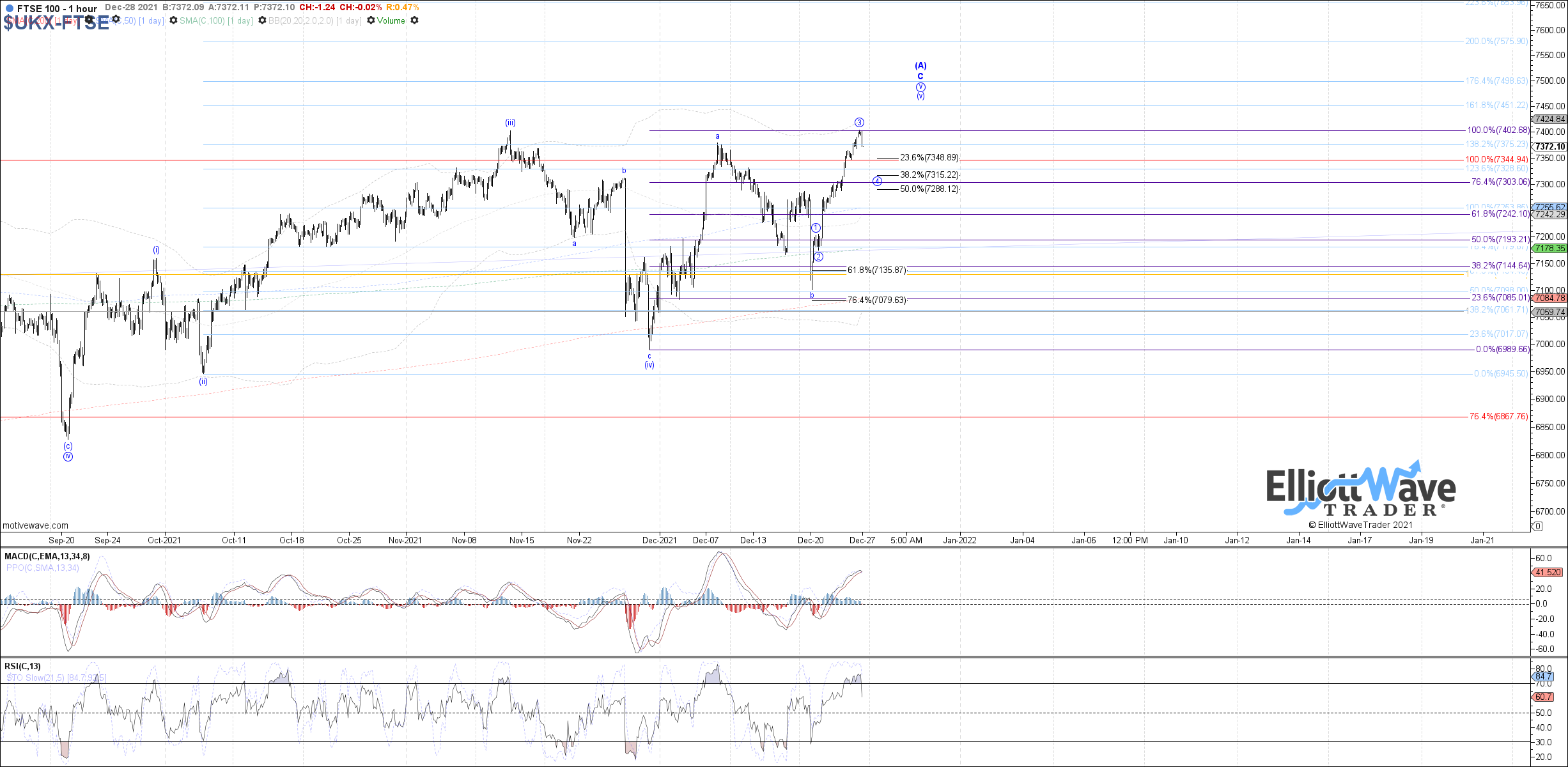

The FTSE remained closed today, so the same notes still apply. Price continues to follow expectations according to the ending diagonal path as wave v of C filling out, which allows for another 4-5 before wave c of (v) completes. 7315 is ideal support to hold as wave 4 of c, otherwise a break below 7285 opens the door to being more immediately bearish.

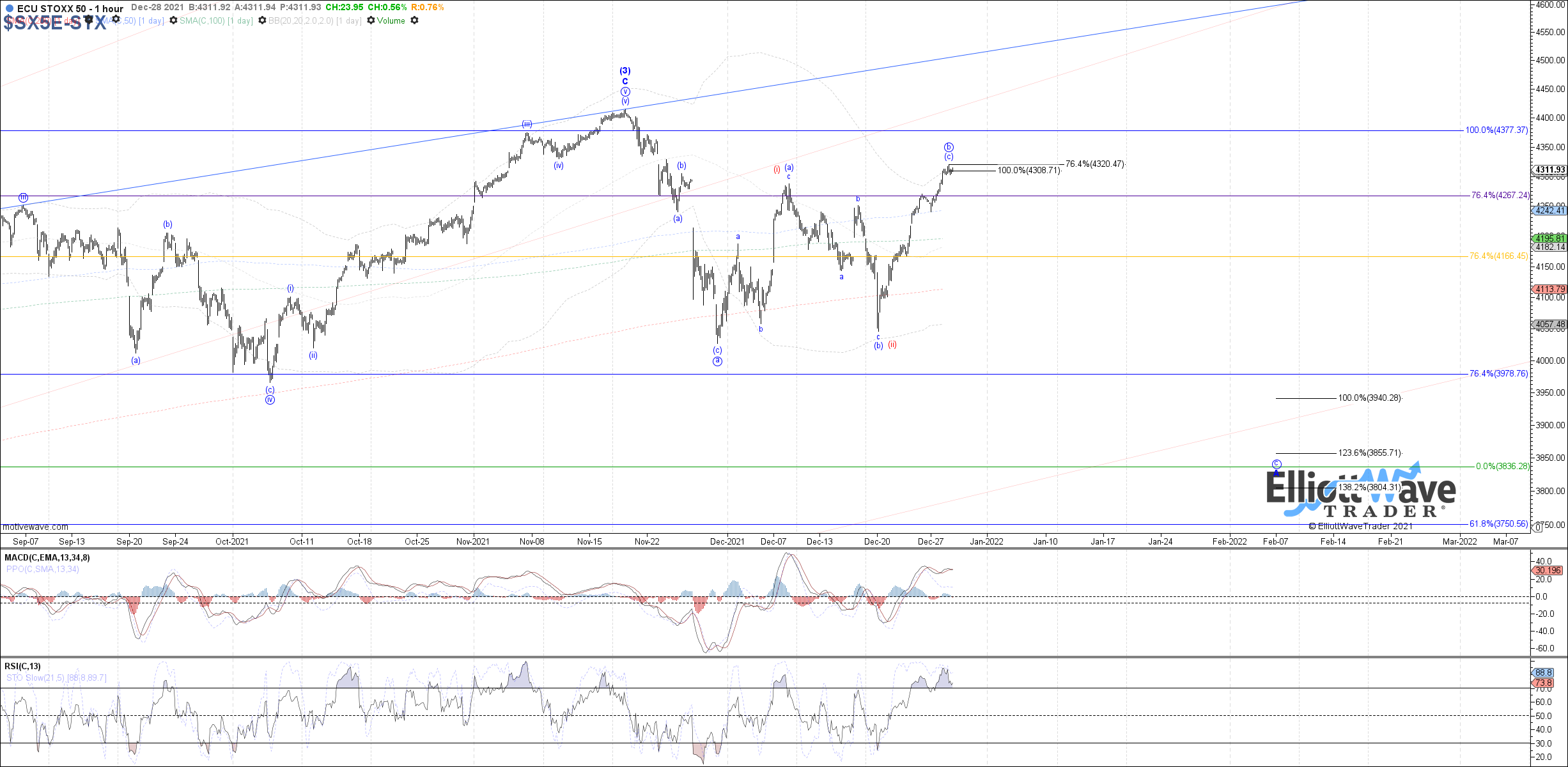

The STOXX closed higher today, now reaching the fib targets between 4310 - 4320 as the ideal spot for price to attempt a local top as wave (c) of b assuming a wider corrective flat off the November low. Exceeding this resistance would not invalidate that potential, but the closer price stretches toward the November high the more likely a diagonal off the November low becomes as the alternative.

The DAX closed higher as well, reaching the .764 retrace as the ideal spot for a local top to be attempted as wave (c) of b like the STOXX, assuming a wider corrective flat off the November low. Exceeding this resistance would not invalidate that potential, but the closer price stretches toward the November high the more likely a diagonal off the November low becomes as the alternative.