European Indices Trade Mixed

The German DAX traded strongly higher today, finally breaking out above the prior June and July highs and cooperating with expectations that wave 3 of iii is underway. There remains room for more near-term upside to reach the ideal fib target at 16090 before wave 3 of iii completes and price begins the next consolidation phase as wave 4 of iii. A break below 15800 would now be the first warning sign of morphing into something more immediately bearish.

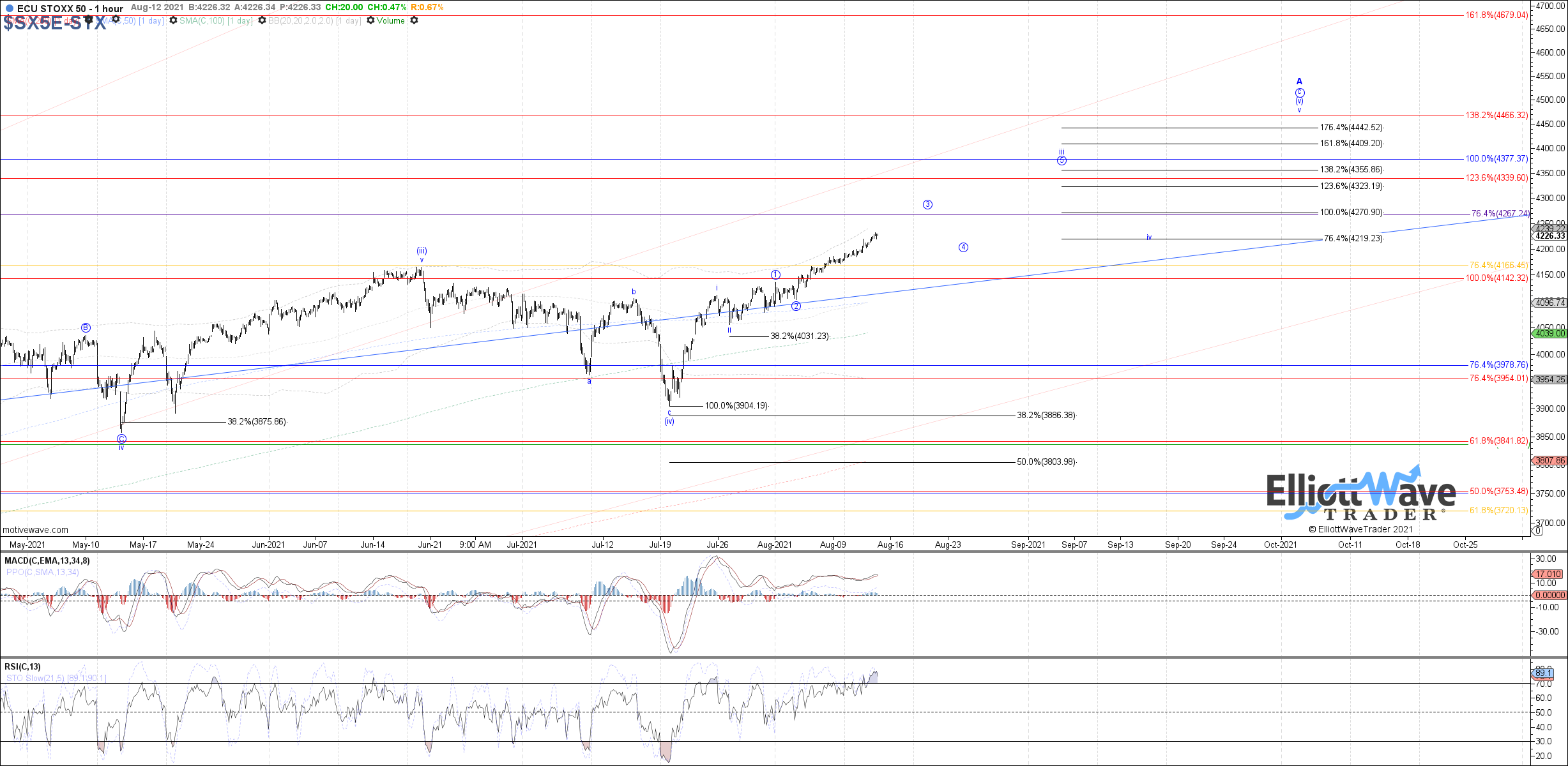

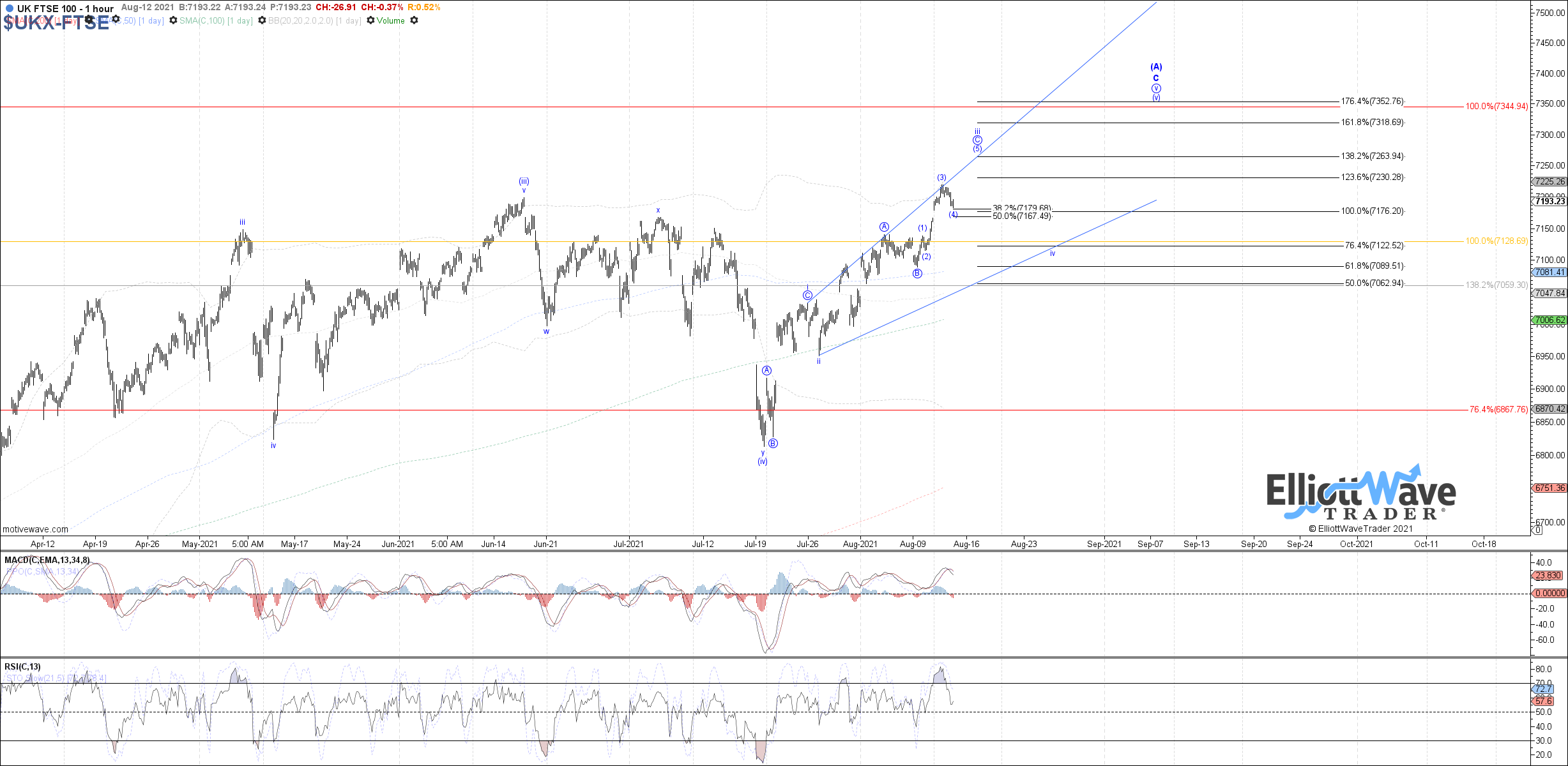

The Euro STOXX 50 continued to climb higher today, still cooperating with expectations that wave 3 of iii is filling out. There remains room for more near-term upside to reach the ideal target fib at 4270, before the next corrective consolidation as wave 4 of iii is seen. Therefore, as long as price is above 4185, further upside is expected.The UK's FTSE 100 curled down slightly today, but potentially as just a micro 4th wave in wave C of iii. If so, then 7180 - 7165 is micro support that should hold in order to turn price back up in wave (5) of C to reach the 7265 fib target above. Otherwise, below 7165 opens the door to the higher degree wave iv already underway and 7120 as the next support level to watch.