European Indices Trade Lower

The FTSE dropped sharply lower today, undercutting last week's low and therefore invalidating a bottom in place as red wave iv. As noted though, there is room for red wave iv up to 7700, after which odds start to favor the bearish count in blue and a b-wave top in place. A break back above yesterday's high is the first step toward assuming red wave v is reattempting to fill out.

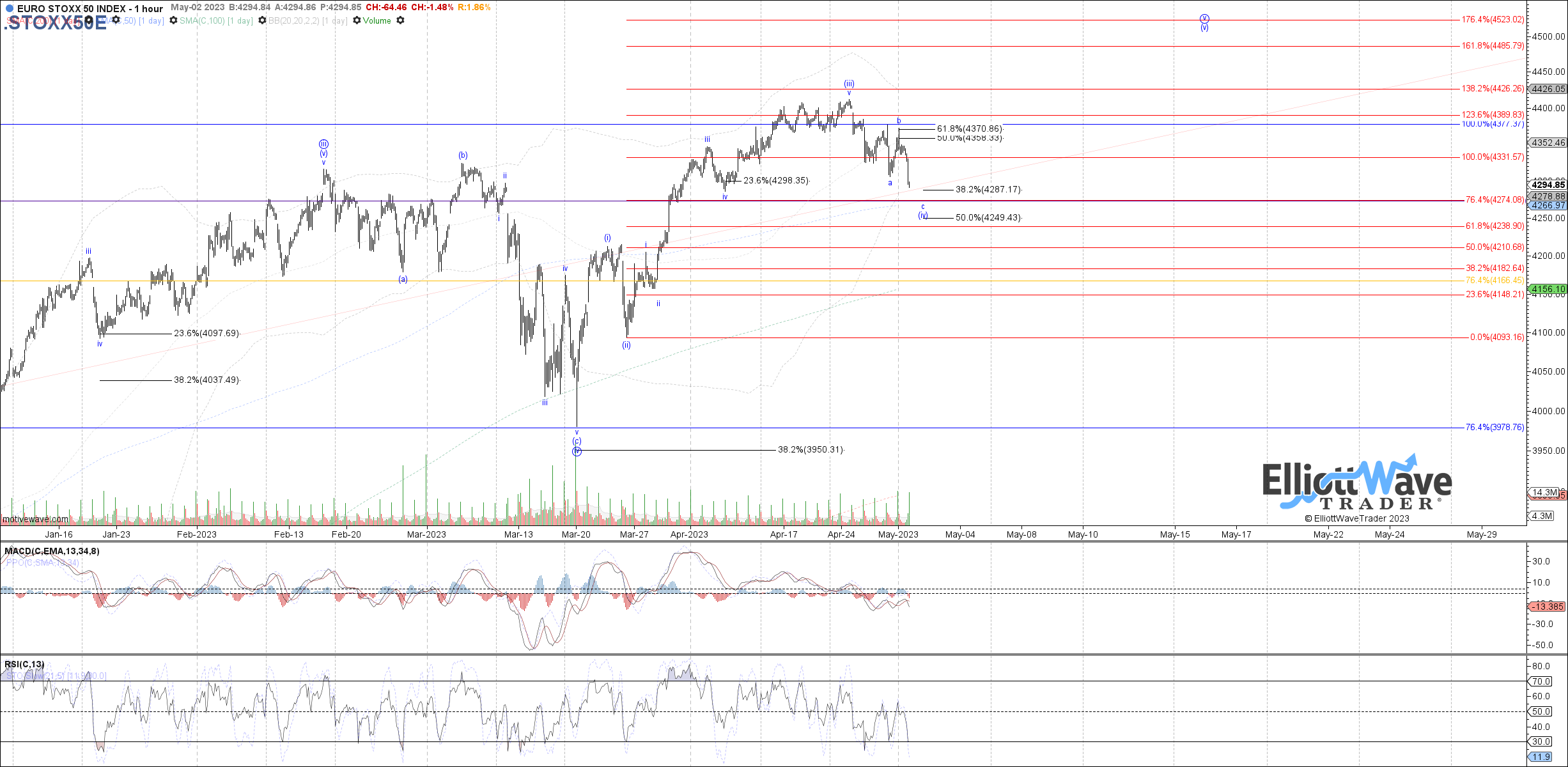

The STOXX traded lower today as well, undercutting last week's low like the FTSE and therefore confirming at least wave (iv) still in progress. Price is now approaching the 4285 fib target cited, but has room down to 4250 if needed. Anything past that makes the expectation for another high needed as wave (v) of v much more questionable.

The DAX spiked initially higher at the open to tag the 16010 fib target cited before reversing into the close, following the suggestion of an expanded flat for wave (iv). 15650 - 15485 is now ideal fib support to hold as wave c of (iv), and as long as it does the expectation for another high to follow as wave (v) of v remains.