European Indices Rebound - Market Analysis for Jul 26th, 2021

EUROPE/AMERICAS

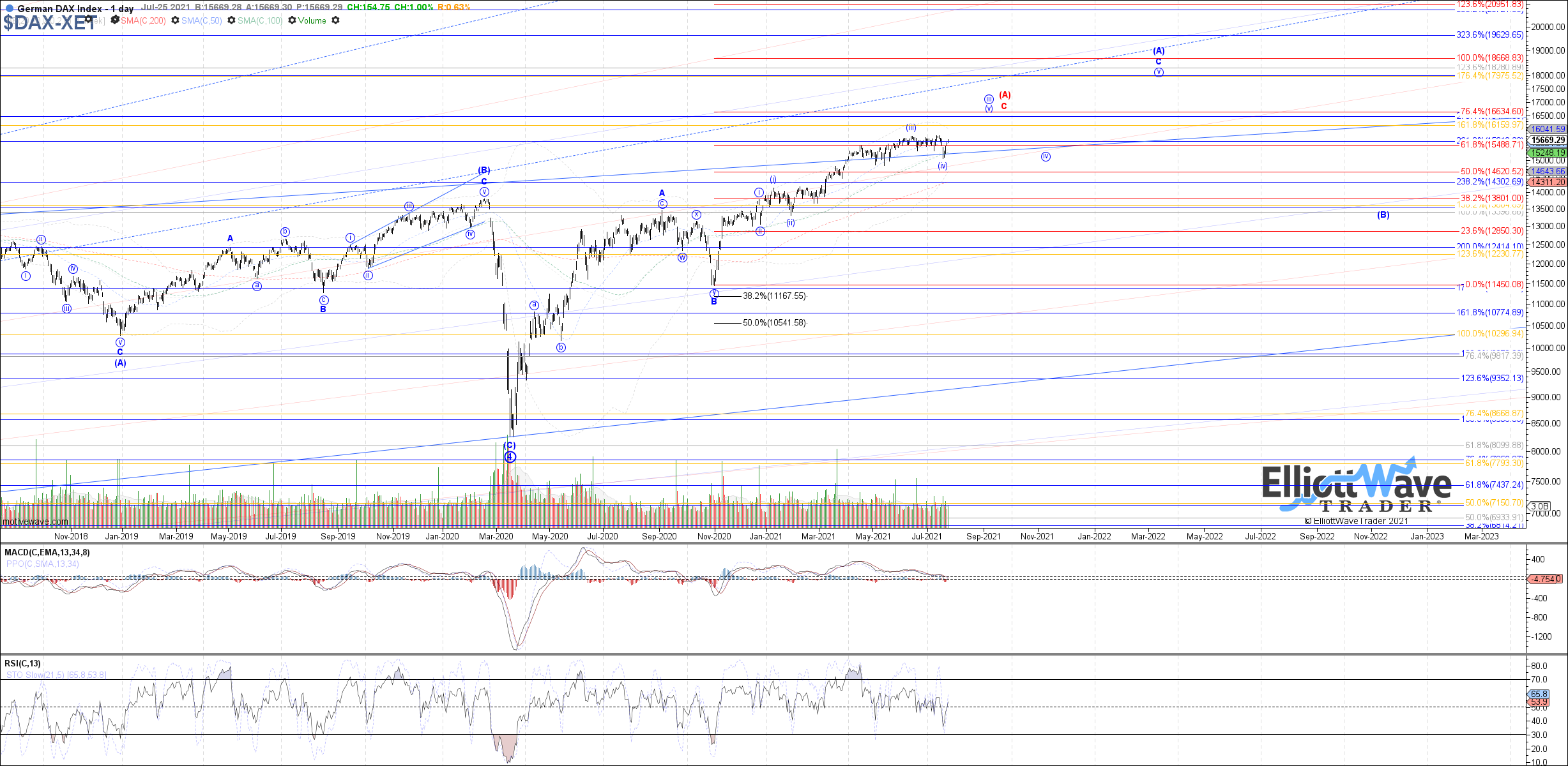

DAX: The DAX started off sharply lower last week, slicing below the prior low on the month and confirming that all of wave v of (iii) was complete. Price has since rebounded just as strongly though, erasing all of last week’s initial loss and opening the door to wave (v) of iii already attempting to fill out. If that is the case, then price is likely nearing a local top as wave i of (v), that can setup a near-term pullback next as wave ii of (v). It is too early to assume that wave i of (v) is already complete, but if that does happen to be the case then 15435 – 15290 is current support for wave ii of (v). The bearish alternative is that last week’s low only completed an (a)-wave down shown in red, and the subsequent bounce since is a (b)-wave, but price would need to at least take out the .618 retrace to begin favoring that.

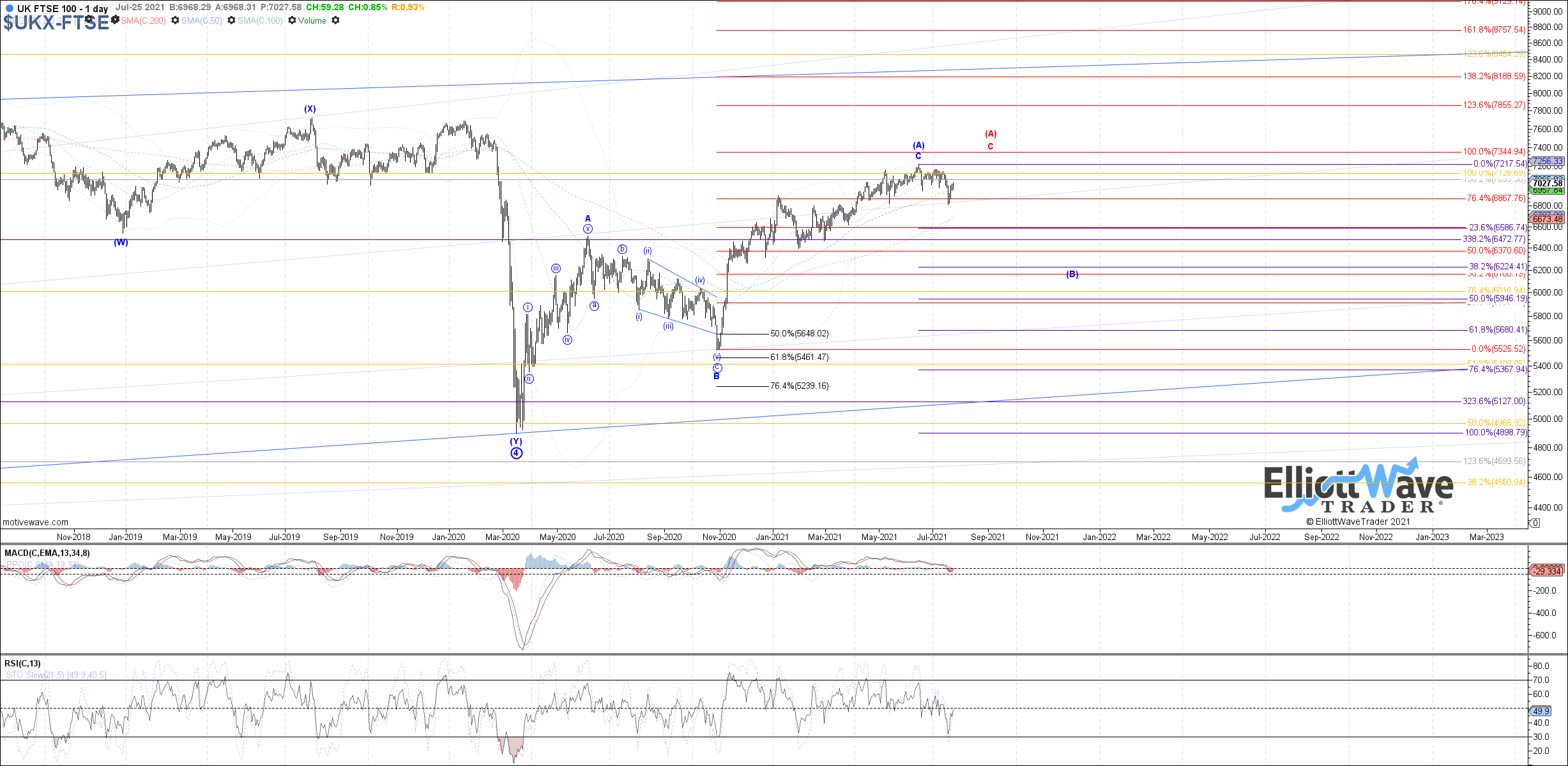

FTSE: The FTSE also dropped sharply lower at the beginning of last week, not finding support until after a retest of the prior May low. Price has since seen a decent rebound back up from there though, and even can be considered 5 waves up from last week’s low. Therefore, I have to give the benefit of the doubt to at least an (a)-wave up even if this bounce overall is corrective, and even possible to consider this as wave i of another extension higher. In either case, if 5 up is nearing completion off last week’s low, then a corrective pullback as blue wave (b) or red wave ii should follow next.

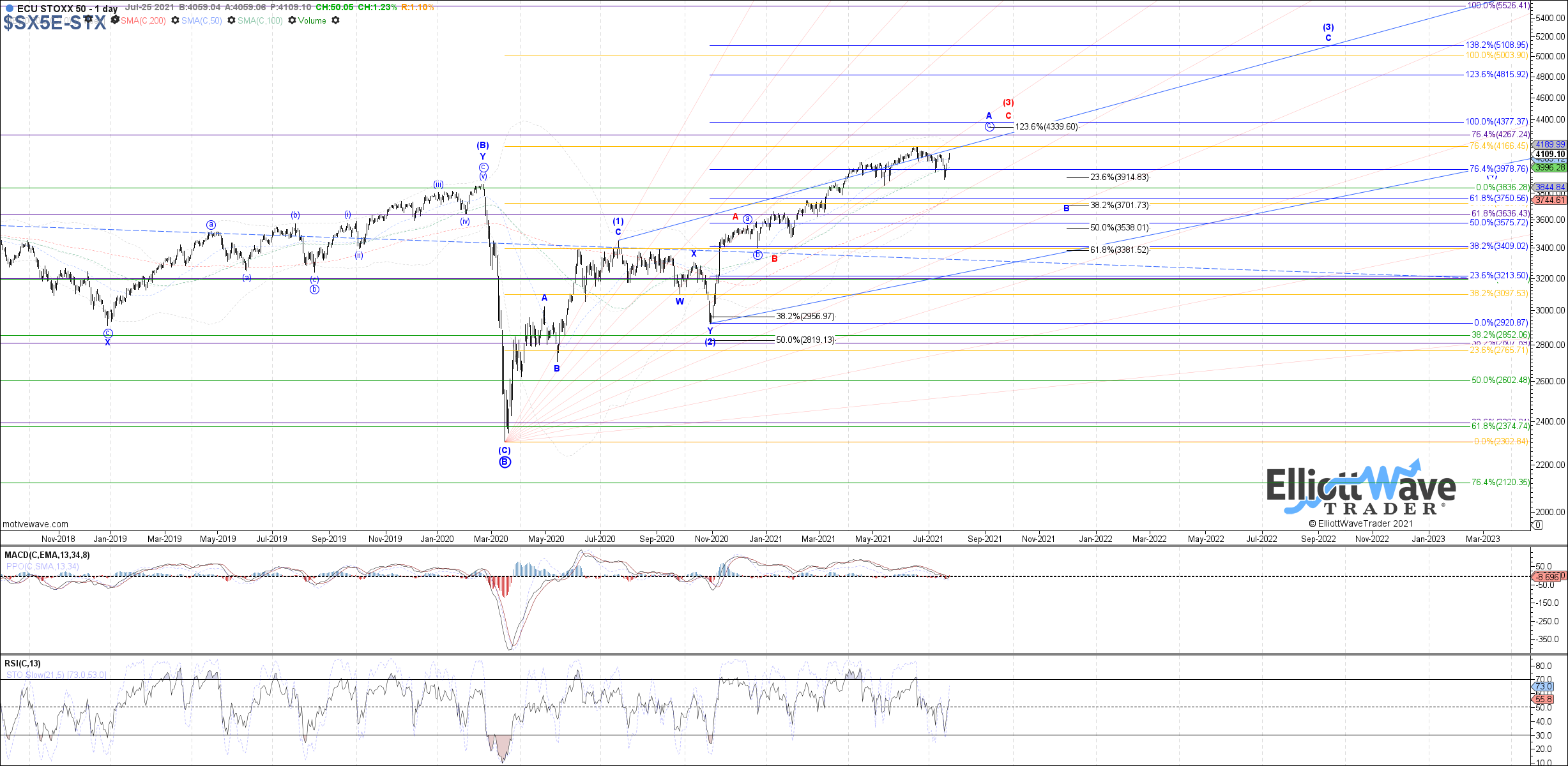

STOXX: The STOXX saw the same sharp drop lower at the beginning of last week, making a new low on the month before rebounding just as strongly. Similar to the DAX and FTSE, this bounce off last week’s low certainly looks impulsive enough to be considered the wave i start to wave (v) of C, with the bearish alternative being a b-wave bounce. In either case, price should be setting up at least a near-term consolidation as blue wave ii next, which is expected to take price back to a .382 - .618 retrace of wave i.

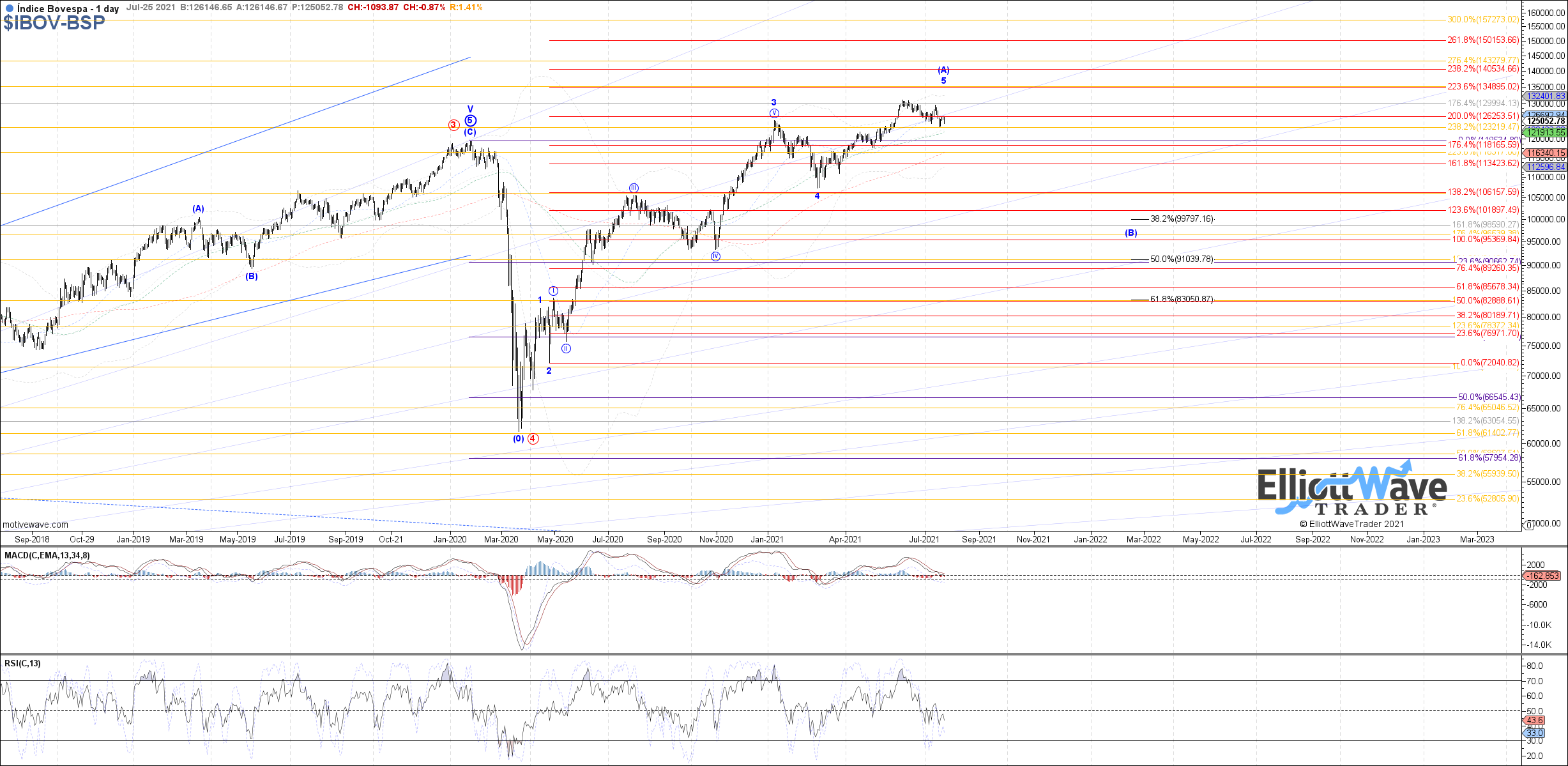

IBOV: The Bovespa saw initial weakness at the beginning of last week as well, making a new low on the month and finally testing the original 123225 target support for wave iv of 5. Price has so far held that support, but ultimately a breakout back above the current high on the month is needed to confirm wave v of 5 underway with ~135000 still as a potential target above. Otherwise, if price turns back down below last week’s low then 120880 is the next fib support below for a deeper wave iv, with the alternative that all of wave 5 already completed at the Jun high.

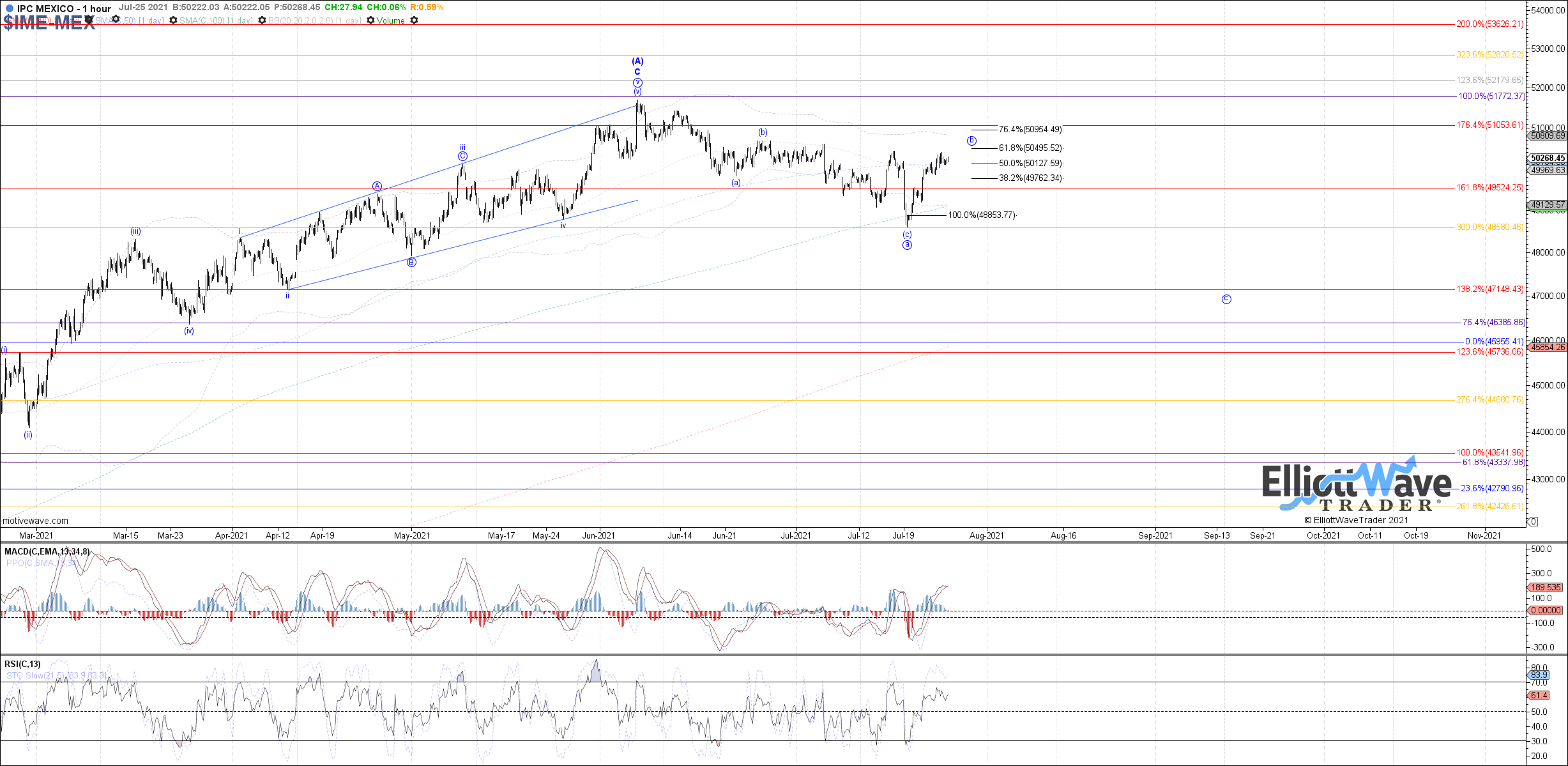

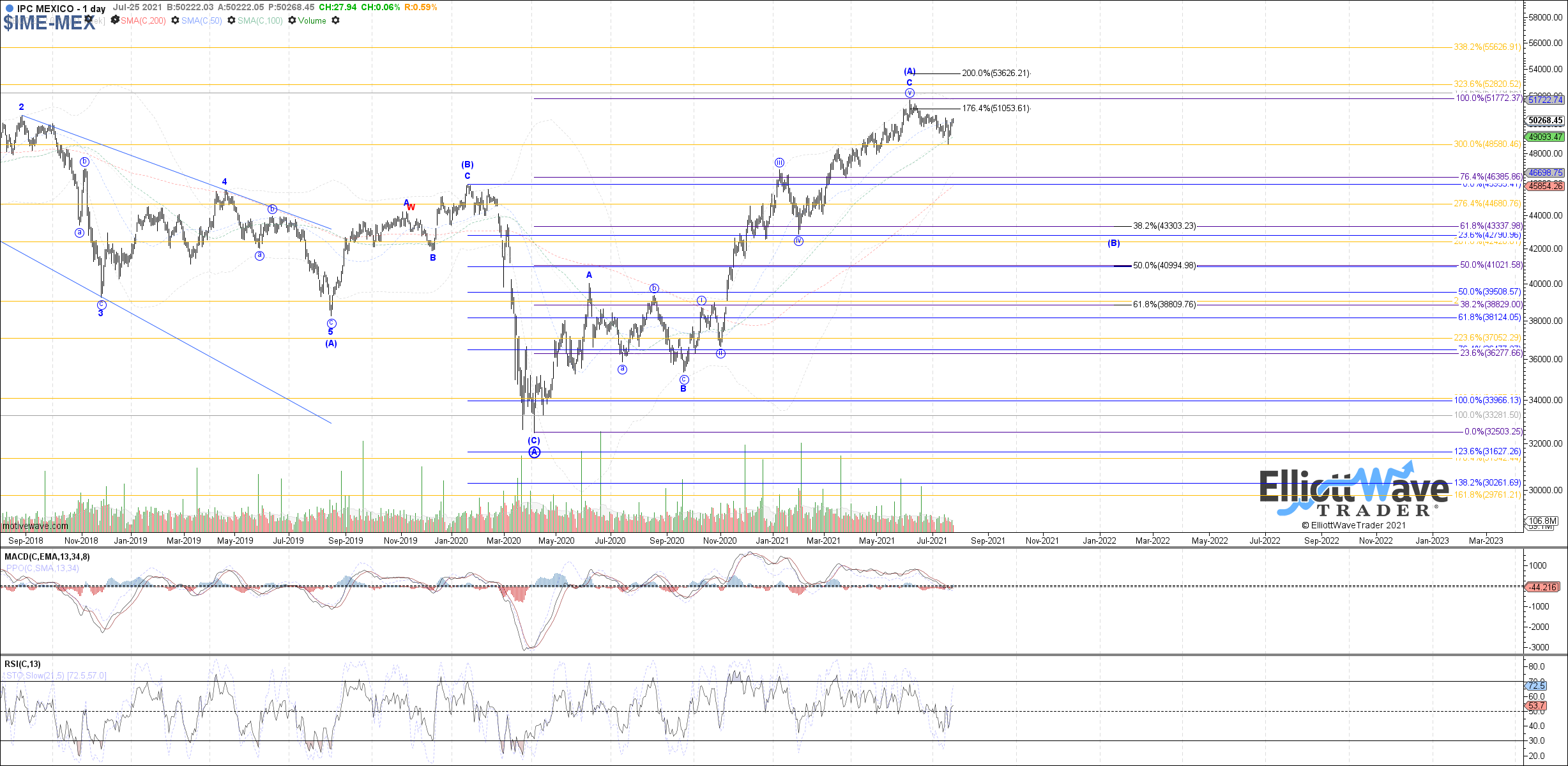

IPC: The IPC also made a new low on the month at the beginning of last week, but has since bounce back up near the current highs on the month. Therefore, the assumption is that last week’s low completed an initial a-wave to the downside, and price is now working on a b-wave bounce. Under that assumption, 50495 is the ideal resistance level to hold as wave b as the .618 retrace, but if not then 50955 is the next fib level to watch as the .764 retrace. Beyond there and the door opens to another extension in wave C of (A), but that is not currently what I am expecting.