European Indices Close Lower

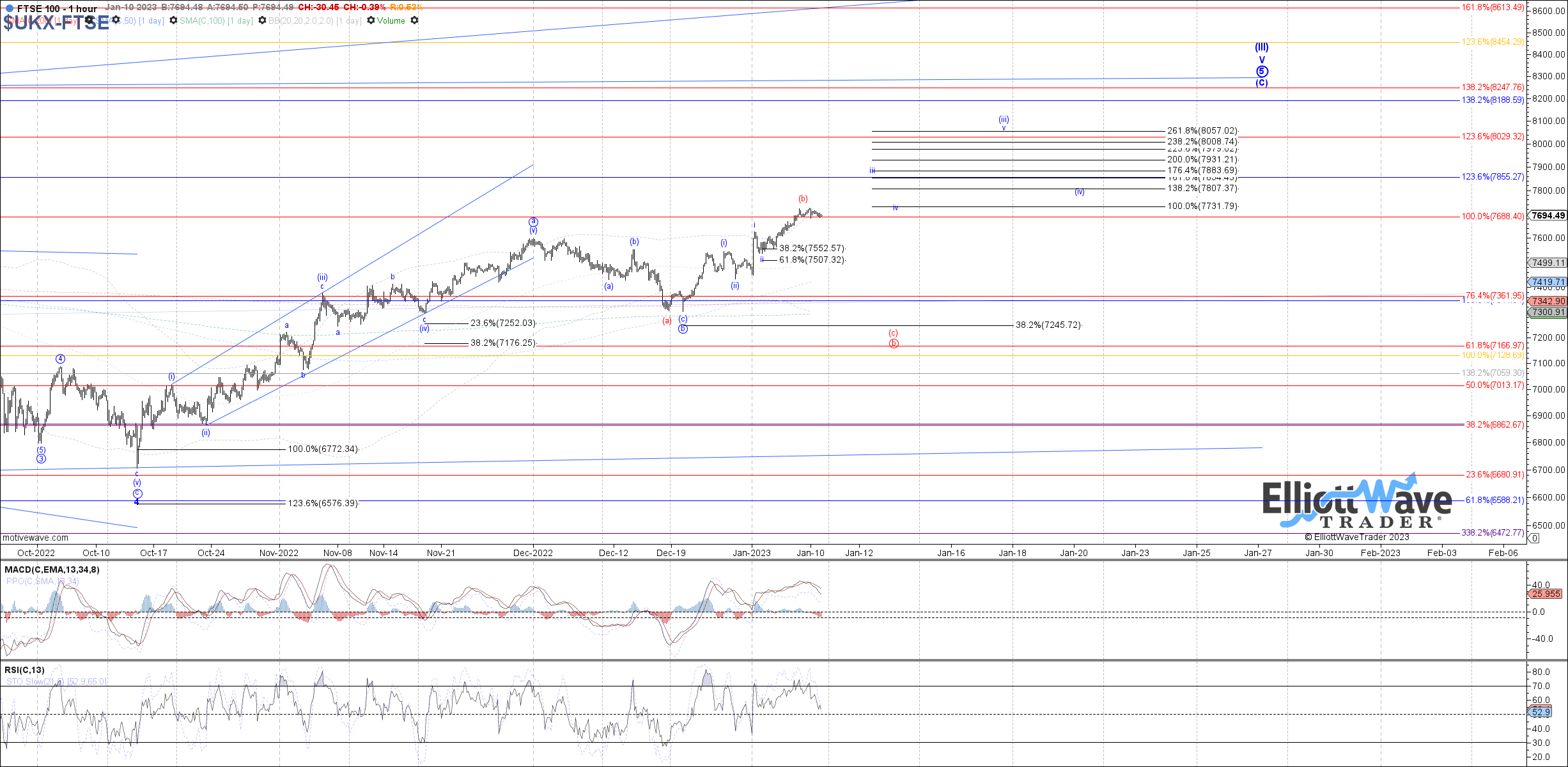

The FTSE 100 Index closed mildly lower today, but otherwise not enough evidence of a local top or the blue count being derailed. The higher price stretches, the less likely the red (b)-wave becomes, and a break back below 7535 is needed to derail the blue count. Until then, 7810 - 7855 is the next fib target range for blue wave iii of (iii).

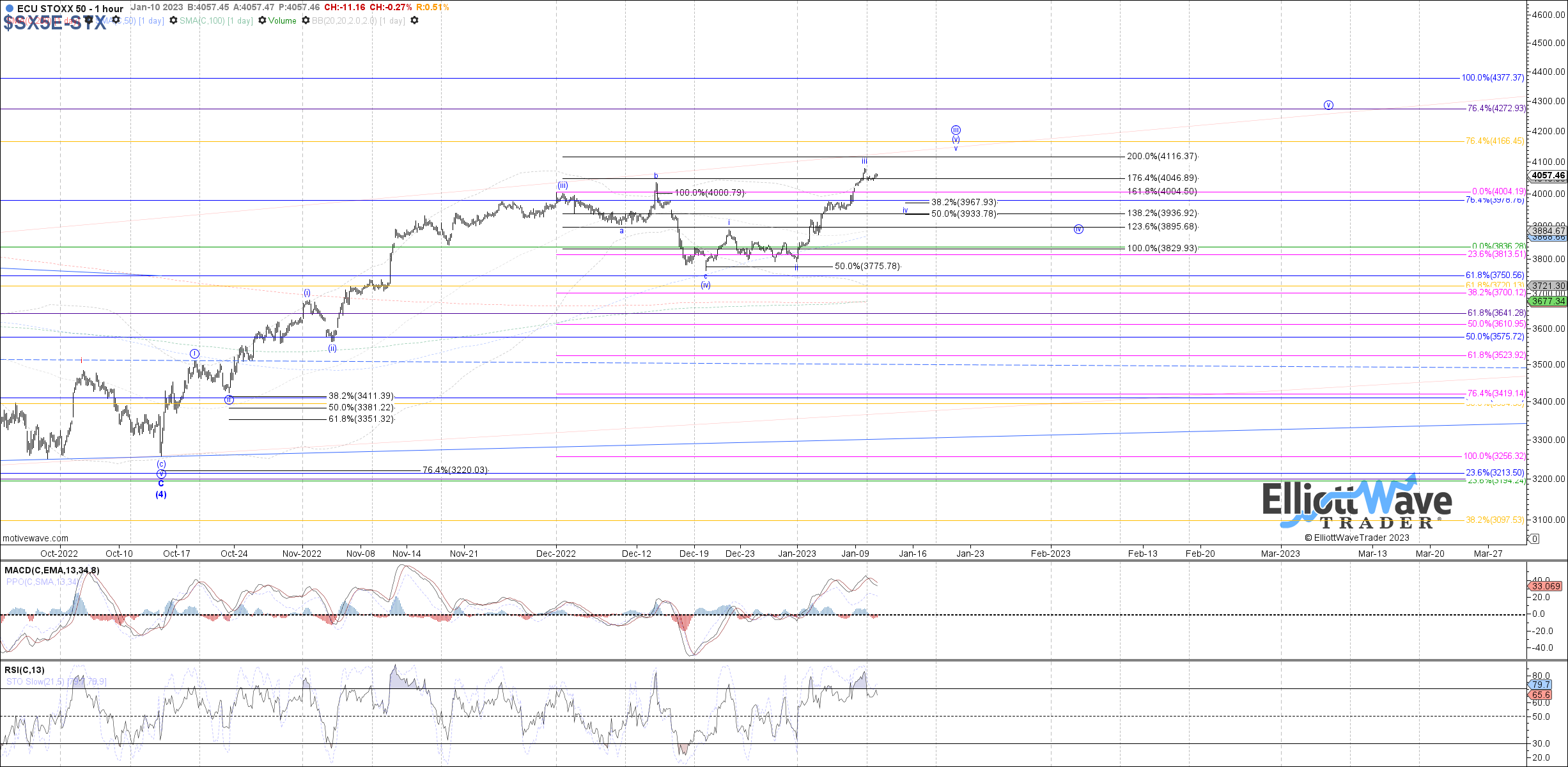

The Euro STOXX 50 also closed modestly lower today, potentially turning down in the start to a wave iv consolidation, but without much off the high so far. If price has started a wave iv consolidation within wave (v), then 3970 - 3930 is retrace support expected to hold in order to turn price back up in wave v of (iii). Any further immediate upside can otherwise be a slight extension of wave iii.

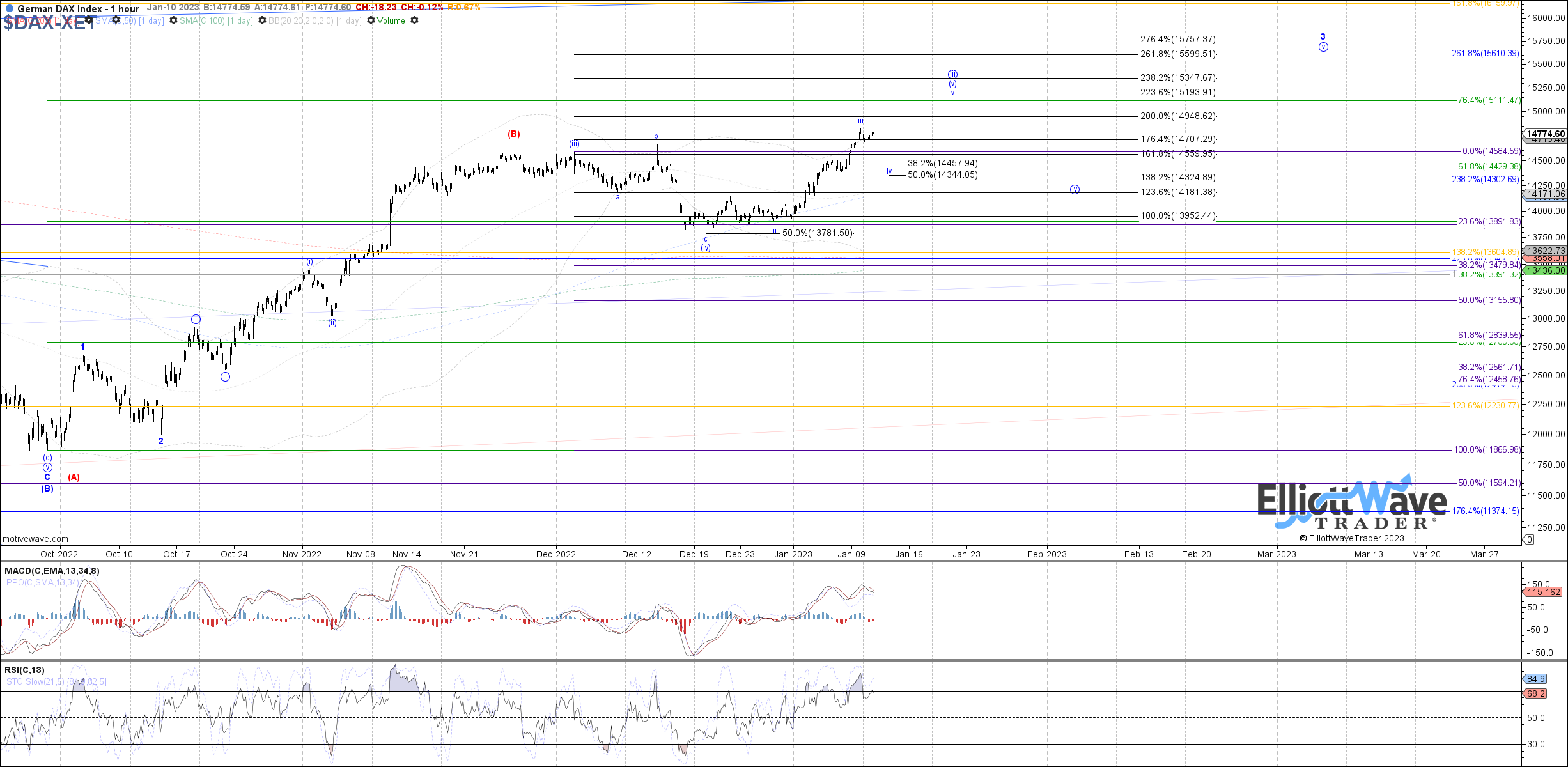

The DAX Performance Index closed marginally lower, and like the STOXX it is possible that price is attempting to start a wave iv consolidation within wave (v) of iii. If it does continue to turn down from here, 14460 - 14345 is target support excepted to hold in this case in order to turn price back up again as wave v of (v). Otherwise, any immediate new high on the week would likely be just a slight extension of wave iii.