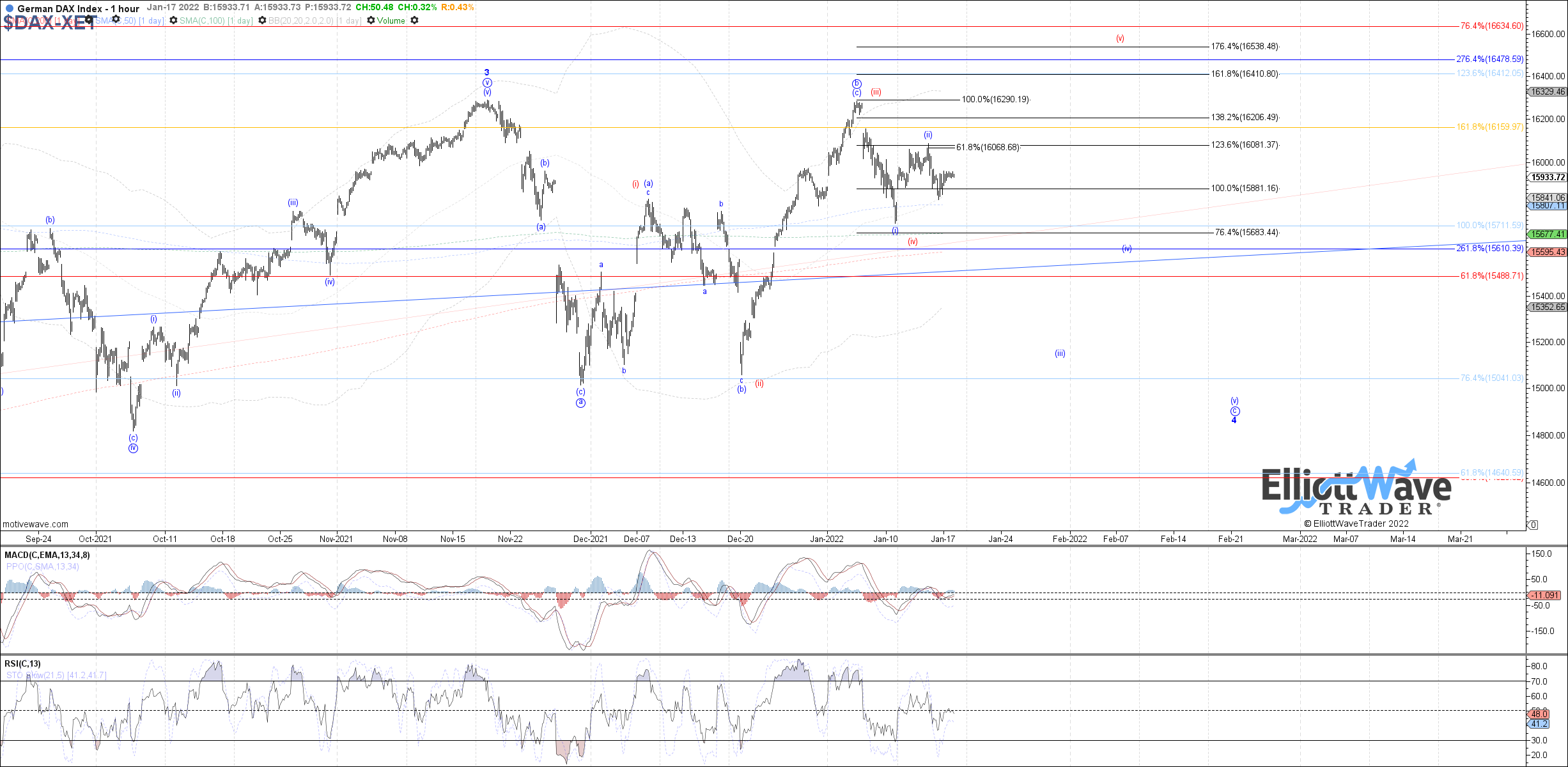

European Indices Close Higher

The German DAX Performance Index closed modestly higher, but so far remains below last week's high. Therefore, the potential (i)-(ii) start to blue wave c to the downside remains valid, but a sustained break below last week's low is needed to trigger wave (iii) of c underway. Otherwise, price needs to exceed last week’s high in order to invalidate the immediate downside setup and open the door to the bullish potential of heading to a new high as red wave (v).

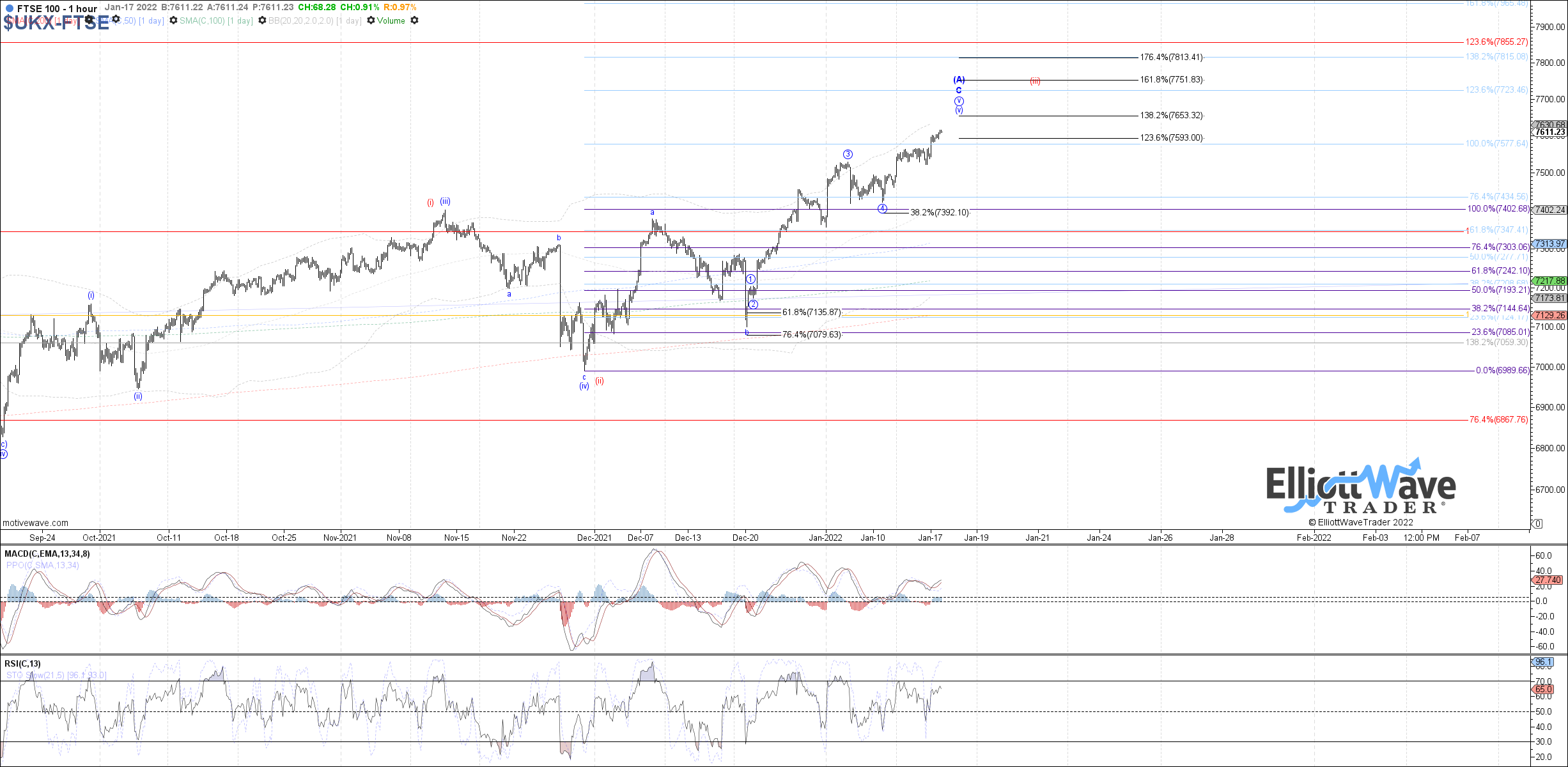

The UK's FTSE 100 closed higher today as well, also making another higher high on the month and still showing no indication of a local top in place yet as either blue wave 5 of (v) or red wave (iii). 7655 and 7725 are now the next fib targets above to watch if further upside is seen, otherwise a break below 7520 is needed at a minimum to consider a local top being attempted.

The Euro STOXX 50 Index also closed higher today, but so far remains below last week's high. Therefore, the potential (i)-(ii) start to blue wave c to the downside remains valid, but a sustained break below last week's low is needed to trigger wave (iii) of c underway. Otherwise, price needs to exceed last week’s high in order to invalidate the immediate downside setup and open the door to the bullish potential of heading to a new high as red wave (v).