European Indices Close Flat After Higher Open

The DAX started off the session initially higher, reaching the 15700 fib target cited for wave (iv) of c before turning back down into the close to end the session relatively flat. Therefore, easily possible that today's high completed wave (iv) of c and price is now attempting to fill out wave (v) of c. If that is the case, then the 200 day SMA at 15380 is the minimum expected target to reach before wave (v) of c completes. Otherwise, above the .618 retrace at 15760 starts to look like more than a 4th and opens the door to at least a larger degree corrective bounce that can target 15865 - 16115.

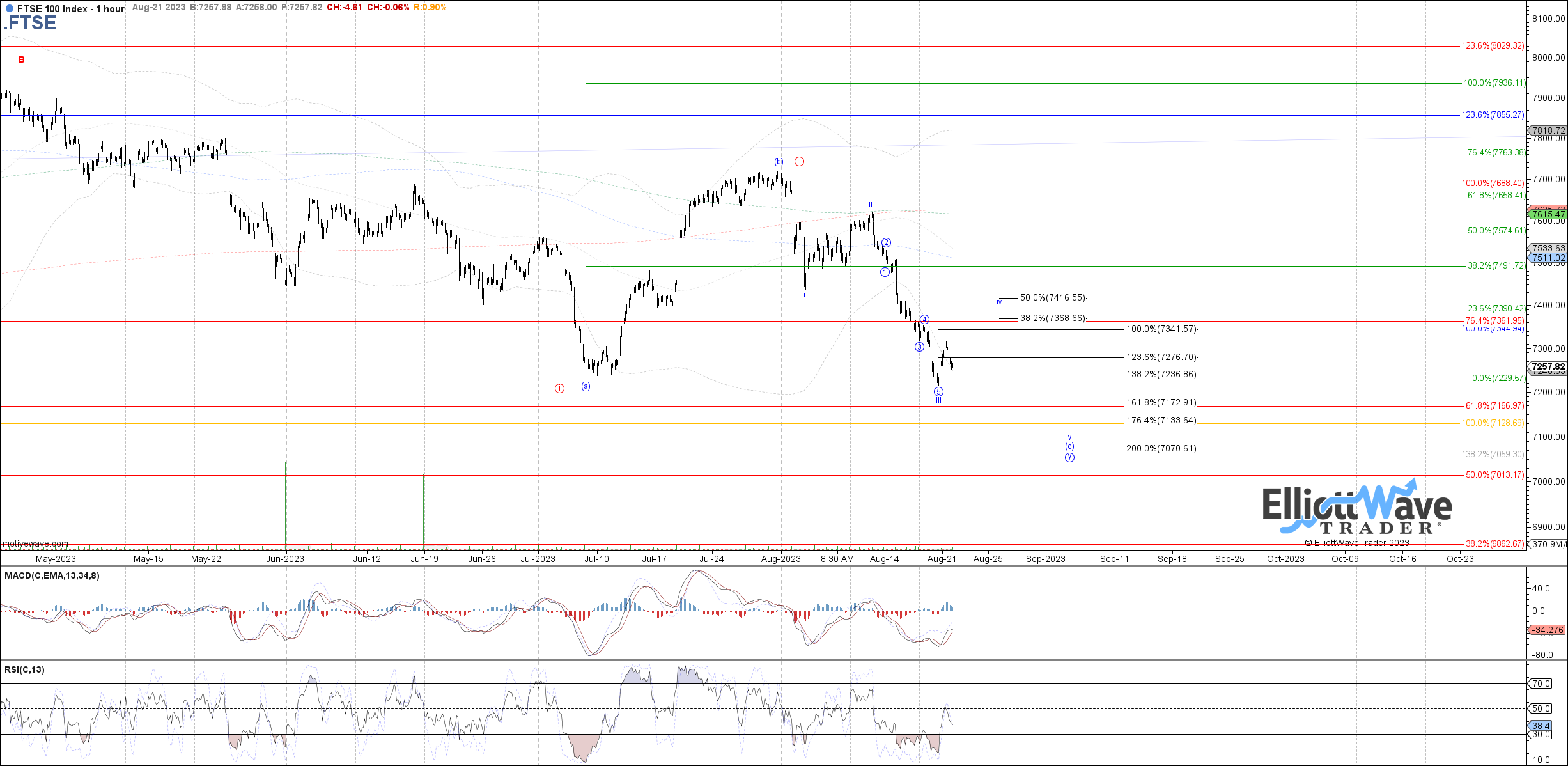

The FTSE also started off initially higher at the open before curling back down into the close to end the session relatively flat. Price is well shy of reaching the 7370 - 7415 target range cited for wave iv of (c), so difficult to assume a shallow and short-lived wave iv already completed. If price does make a direct lower low from here it can easily be another extension of wave iii instead with 7170 as the next fib target.

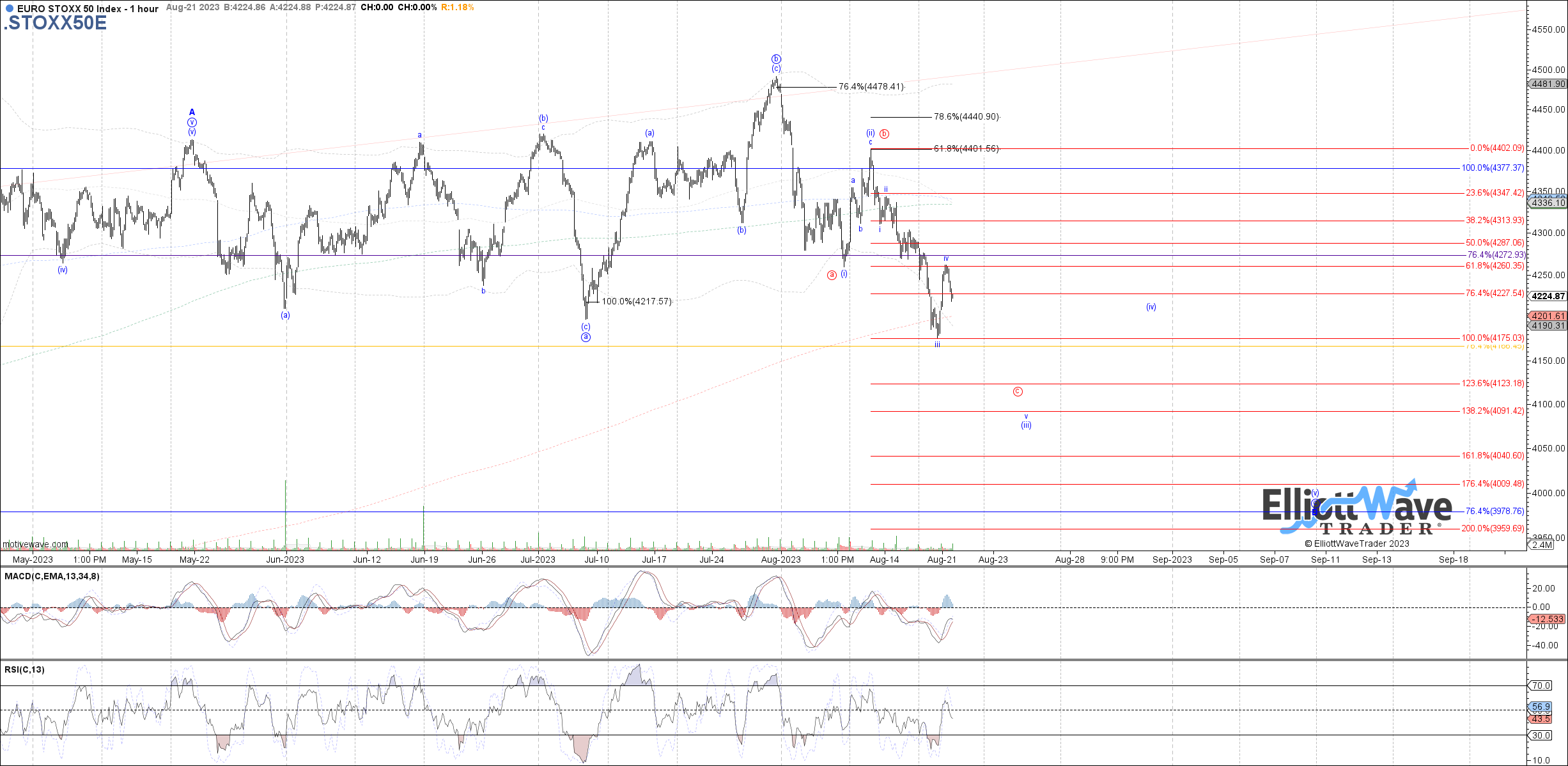

The STOXX started off the session initially higher as well, reaching the .618 fib cited at 4260 before rolling over into the close. Therefore, in order to maintain the impulsive count down from the July high, today's high needs to hold as wave iv of (iii), with 4090 still the ideal target for wave v of (iii). I've also added an abc in red similar to the potential on the DAX, but also ideal to hold below today's high for that count.