European Indexes Drop Sharply

The FTSE 100 Index dropped sharply lower today, undercutting last week's low and coming very close to a retest of the prior June lows. Until a new low below there is made, a stick-save as the i-ii is still possible, but not very likely at this point. Instead, the wider flat wave 4 discussed as the alternative is looking more probable, with 6865 - 6770 as a potential target region to reach before wave (v) of c in the wider flat completes.

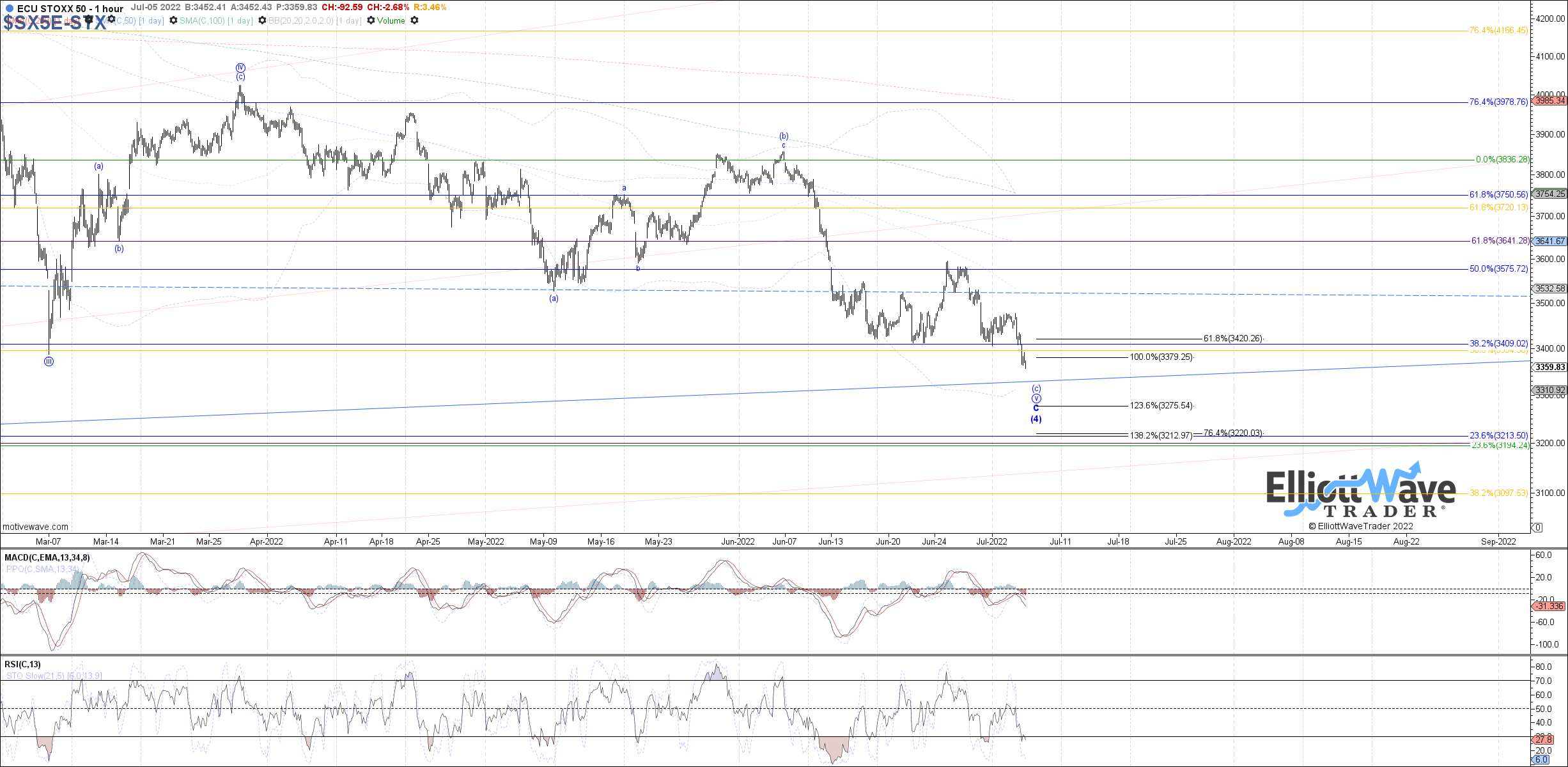

The Euro STOXX 50 continued to stretch lower today, now undercutting the prior March low. Therefore, still zero evidence of a new local bottom being attempted yet, and further extension remains possible with 3275 and 3220 now as the next main fib levels to watch. Otherwise, price now needs a break back above 3480 to consider a bottom being reattempted with confirmation above last week's high.

The DAX Performance Index continued to stretch lower today as well, also undercutting the prior March low like the STOXX. Therefore, price has officially invalidated the 1-2 off the March low, with the next bullish option being a deeper (B)-wave. 12325 and 12100 as now the next fib support levels to watch, and price will otherwise need to break back above 12920 as the minimum indication of a bottom being reattempted with confirmation above last week's high.