European Indexes Approach Downside Targets

The DAX continued lower today, making a new low below last week's low as suggested and satisfying the expected downside for wave iii of (iii). Therefore, another near-term bounce as wave iv of (iii) can be attempted next, with 15510 - 15570 as the overhead target range if price does end up holding today's low and turning up from here.

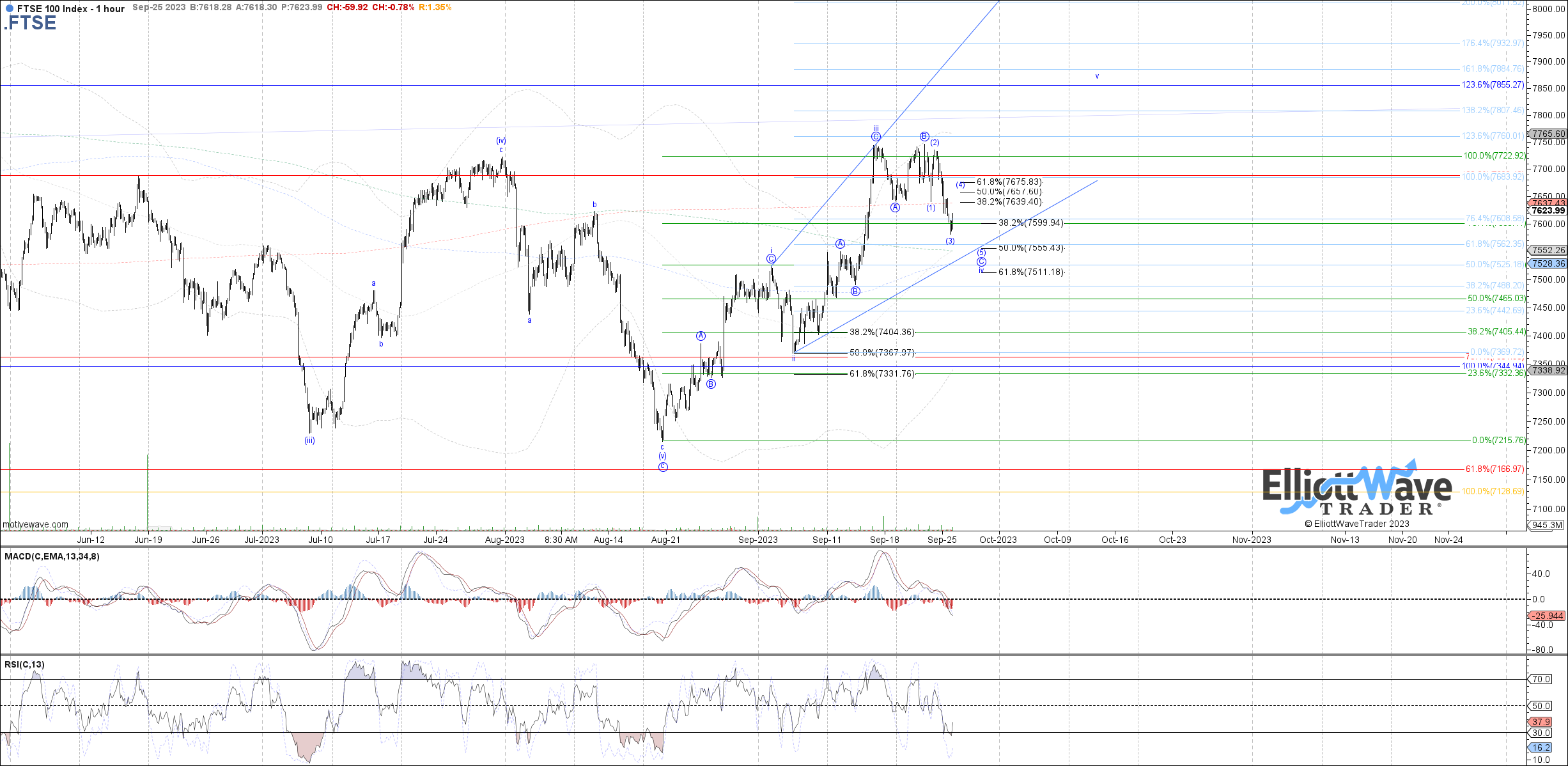

The FTSE traded lower today as well, following expectations for a wider flat wave iv still in progress within the potential leading diagonal off the August low. Although price has now reached the top end of the target range cited between 7600 - 7510, the subwave structure for wave C of iv looks like it is missing another (4)-(5) before completing. Therefore, unless 7675 is taken out, another (4)-(5) lower can be seen.

The STOXX also dropped lower today, like the DAX making a new low below last week's low and satisfying the expected downside for wave 3 of iii. Therefore, another near-term bounce as wave 4 of iii is possible, with 4200 - 4215 as the overhead target range if price does turn up from here. Otherwise, 4130 is still the next fib support if a little bit more near-term downside in wave 3 of iii is seen first.