European & Asian Indices Remain Below Last Week's High For Possible Leg Lower

The FTSE 100 Index (FTSE) curled back up slightly today, but so far remains well below last week's high. As long as last week's high holds, then a potential i-ii start to wave 5 may be filling out. If so, then 5635 is ideal micro resistance to hold as wave ii, with a break below 5350 signaling the start to wave iii of 5. A break above last week's high instead opens the door to the possibility of a more significant bottom already in place.

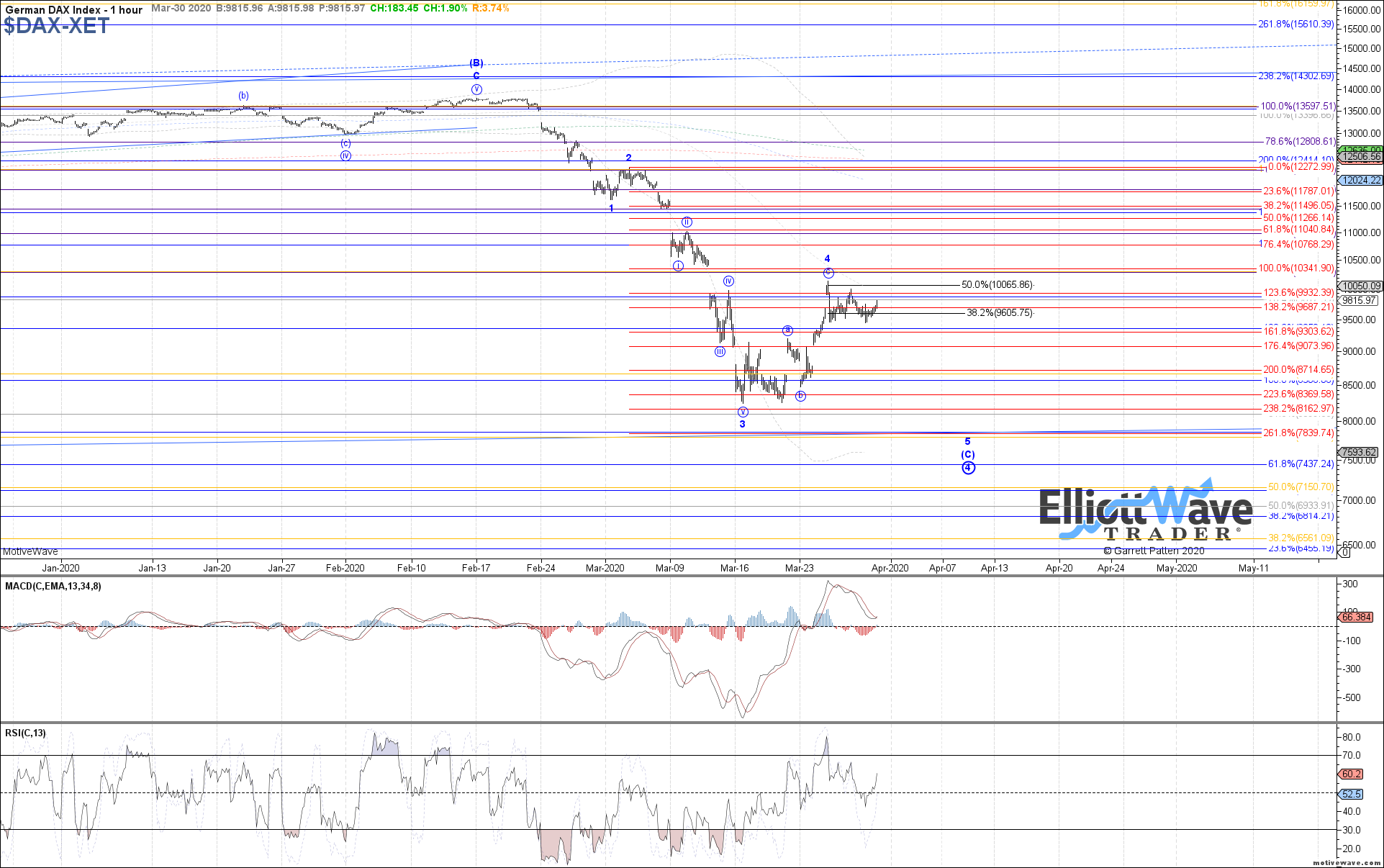

The DAX Performance Index (DAX) curled up also today, but like the STOXX and FTSE remains below last week's high for now. My stance here is the same, if price is still going to attempt one more leg lower as wave 5 of (C), then it really should be from here rather than needing any further near-term upside first. A retest of last week's high or marginally higher high before reversing is fine, but any significant break above there and I will consider a possible bottom to wave (C) of 4 already struck.

The Euro STOXX 50 (STOXX) curled back up today as well, but like the FTSE remains below last week's high so far. As discussed, if price is still going to attempt one more leg lower as wave 5 of (C), then it really should be from here rather than needing any further near-term upside first. Therefore, if price fails to follow through lower from here, and instead does exceed last week's high, then I will consider a possible bottom to wave (C) of B already struck.

The Shanghai Composite has also curled back up, but so far remaining below last week's high as well. As long as price remains below last week's high, this may be a (i)-(ii) start to red wave v of C filling out. Otherwise, above last week's high opens the door to 2850 - 2905 potentially being reached next as resistance for the possible wave ii in blue as discussed.

The Hang Seng Index has curled back up as well, but like the Nikkei so far remains below last week's high. It is possible that price wants to test the 24000 target resistance cited a bit more exactly before reattempting a local top as either blue wave a of 4 or all of a 4th in red. If last week's high holds, then 22740 - 22115 remains initial support for a corrective pullback as blue wave b of 4. If price makes a marginally higher high from here instead, that support will be raised accordingly.

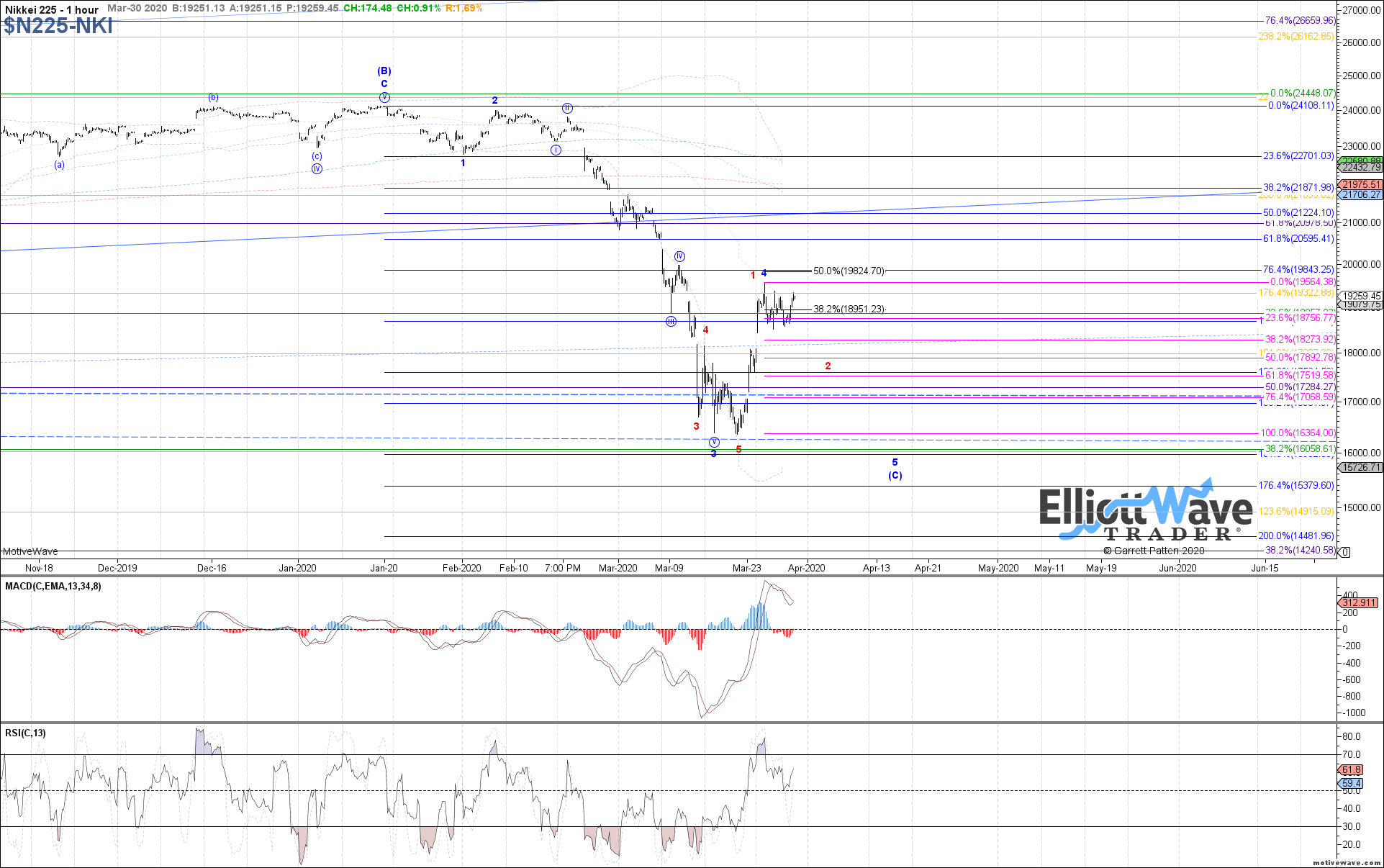

The Nikkei 225 has curled back up again, but so far remains below the high made last week. Therefore, expectations remains the same, ideally looking for more near-term downside as either red wave 2 or blue wave 5 to retest the March low. If last week's high holds, then 18275 - 17520 remains initial support for a corrective pullback as red wave 2, below which increases odds of filling out blue wave 5.