Deep Dive: Roku and Etsy Analysis

This is part two of my deep dive report, focusing on growth stocks. The previous part focused on macro updates.

While I’m generally in favor of value stocks more than growth stocks with a multi-year view, there are some interesting opportunities opening up in the growth stock space after the sizable correction that many of them had this year.

I do, after all, have a growth stock section in my newsletter portfolio, and that section has outperformed most other things in the portfolio over the past couple years. Roku (ROKU) and Etsy (ETSY) are ones I’ve been watching among several others recently.

Despite sizable corrections, their stock prices are still higher than a year ago, which should give conservative investors a pause. However, their fast-growing businesses are much larger as well, so the valuation ratios have actually improved to varying extents, as discussed below. It’s hard to have super high conviction here until I see more of a confirmed bottom or a deeper capitulation related to higher Treasury yields, but the risk-adjusted returns are starting to look interesting enough to begin a gradual accumulation process.

Roku Analysis

Roku was founded in 2002. After a breakup with Netflix (NFLX), they released their first Roku box in 2008. Roku boxes give “smart” functionality to TVs, providing them with access to all sorts of streaming content including HBO Max, Netflix, Amazon Prime, and countless others. My household has one and it’s great.

Starting around 2014, Roku also began partnering with various smart TV manufacturers to use Roku’s operating system to serve as the TV’s smart functionality. With a Roku-enabled TV (recently branded as a “Roku TV”), you don’t need the separate Roku box, and Roku TVs now account for over a third of TVs sold in the US. In that sense, Roku has started to position itself as the “Windows” of TVs.

The company went public in 2017.

So, the company has been around for a while, but a lot of this was just laying the foundation. The real money is in the platform. The platform is Roku’s business where they collect ad revenue and streaming revenue from users for free and premium content respectively. Roku’s number of users keeps growing, and their revenue per user keeps growing (now about 3x as much per user as in 2016, from $9 to $32 per quarter). Only in the past few years has Roku become a powerhouse reaching critical mass, and as a public company.

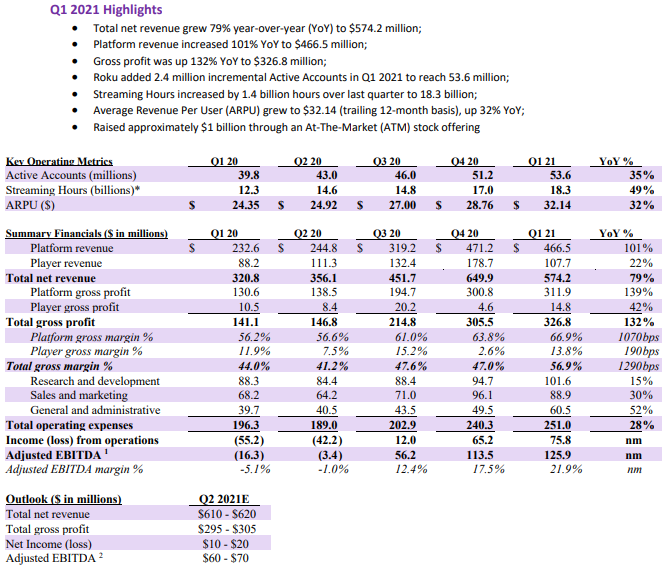

Back in 2016, about three quarters of Roku’s revenue came from selling their hardware, and the remaining quarter was from the platform. Both have grown since then, but the platform portion has really taken off. Now, three quarters of Roku’s revenue is from the platform, and the remaining quarter is from the hardware. This is good for gross margins. Here’s the past year:

Source: Roku Q1 2021 Results

Roku is challenging to analyze because like Amazon (AMZN) used to do, Roku reinvests basically everything into growth. So, any price-to-earnings or price-to-free-cash-flow multiple is a joke, with extremely high numbers. An investment in Roku depends on a rough assessment of their growth potential during the next decade, rather than relying on current earnings. That’s the challenge.

Here is Roku’s quarterly revenue and price/sales ratio:

You can see the regular Q4 holiday revenue spike on the purple revenue line. For the orange line, Roku’s market cap hit a bubble high of 33x revenue earlier this year when a bunch of other growth/ARKK stocks hit a peak, but now is down to “only” 22x. It’s still on the higher-end of average in terms of its historical valuation, but then again, it’s also a higher-margin business than it used to be, with a more persistent track record.

The balance sheet is very strong, with over $2 billion in cash-equivalents and less than $100 billion in long-term debt.

My ideal case would be to see one more deeper capitulation in price. I’d love to see 10-year Treasury rates spike, and a variety of growth stocks including Roku to drop sharply. That would be a great buying opportunity. I’m not sure if we’ll get it or not, but Roku at maybe 15x sales would be absolutely lovely.

When I’m looking at the 5+ year view, however, I’m less inclined to quibble about 30% price fluctuations that may or may not come, and willing to employ risk-mitigation strategies while buying into the stock. Roku’s revenue should be dramatically higher 5 years from now, and as they increasingly shift towards platform growth, their improving margins should propel them towards greater profitability.

So, while I’m not willing to go “conviction long” on Roku at this level, I think it has reached the point of being a good stock for dollar-cost averaging into at current prices (i.e. inclusion into the newsletter portfolio), or selling cash-secured puts against to get paid to wait to potentially purchase at a lower cost basis if a dip happens (i.e. inclusion into my other holdings). There is minor evidence of a rounded bottom forming in the stock price, so I’m not sure if we’ll get a lower entry point or not, even if I hope that we do.

Roku’s market cap is currently under $50 billion. I expect them to have a $150 billion market cap or more by the end of the decade. It will be a bumpy ride in the interim even if that is correct, but as part of a diversified portfolio I’m willing to absorb that volatility, with risk mitigation methods in place like dollar-cost averaging or careful cash-secured put-selling.

Currently, the stock price is $347. You can sell cash-secured put options at a strike price of $300 for September 17, 2021, and earn nearly $15 in premiums. In other words, if Roku remains above $300, you earn about 5% in premiums during a 3-month period (which is over 20% annualized). If Roku dips below $300, you buy at basically a $285 cost basis considering the strike price and premium combined, which I think is a pretty attractive long-term entry point for this company and is a 17% discount to current prices.

Etsy Analysis

Etsy was founded in 2005 and is a huge online market place for craft and vintage items. It has a market capitalization less than half of eBay’s (EBAY), but I expect it to eventually equal the size of that company in market capitalization as my base case.

Etsy acquired Reverb in 2019, which is a marketplace for instruments. High-end instruments last for decades and have huge re-sell value.

The company announced plans to acquire depop in 2021. This is a marketplace app for Gen Z clothing, and while it doesn’t appeal to me at all (frankly every picture I looked at looks bad), it apparently works well among that younger demographic. I’m not depop’s target audience, so who am I to judge?

Overall, Etsy’s main demographic is Millennial and Gen X women, Reverb’s main demographic is Millennial and Gen X men, and depop’s main demographic is a mix of male and female young Gen Z folks. Even on Etsy though, there are a lot of items for men. Women on the platform tend to buy those items for men in their lives, but there is also an approximately 20% of the userbase that consists of men directly. And of course the Reverb platform caters to anyone interested in instruments, and just happens to lean male.

Source: ETSY Investor Presentation

While Roku has had a more explosive growth pattern, Etsy had a more gradual growth pattern (averaging 20%+ revenue per year) until COVID-19 put Etsy briefly into high-gear. Many people turned to buying and selling crafts during lockdowns, and in particular, there was a lot of commerce for making and buying custom masks on Etsy. This is starting to wear off now.

However, my base case is that the prior trend of 20%+ annual revenue growth will continue. This was a one-time stepwise increase in users and that rate of acceleration won’t continue, but a percentage of them will be sticky and the prior growth trend should resume. In a world of cheap products and corporatized retail, many people find value in hand-made crafts and vintage items, enabled by a marketplace with sizable network effects.

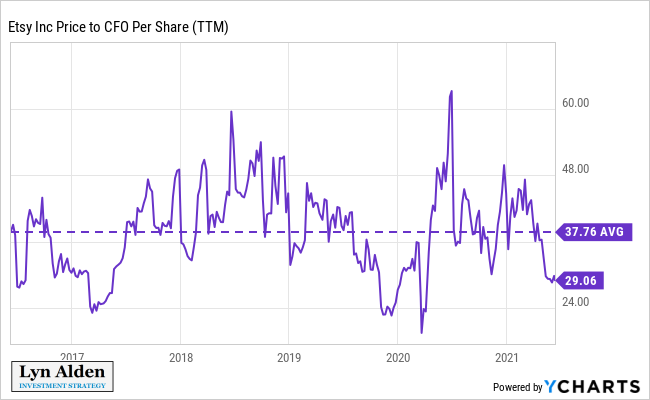

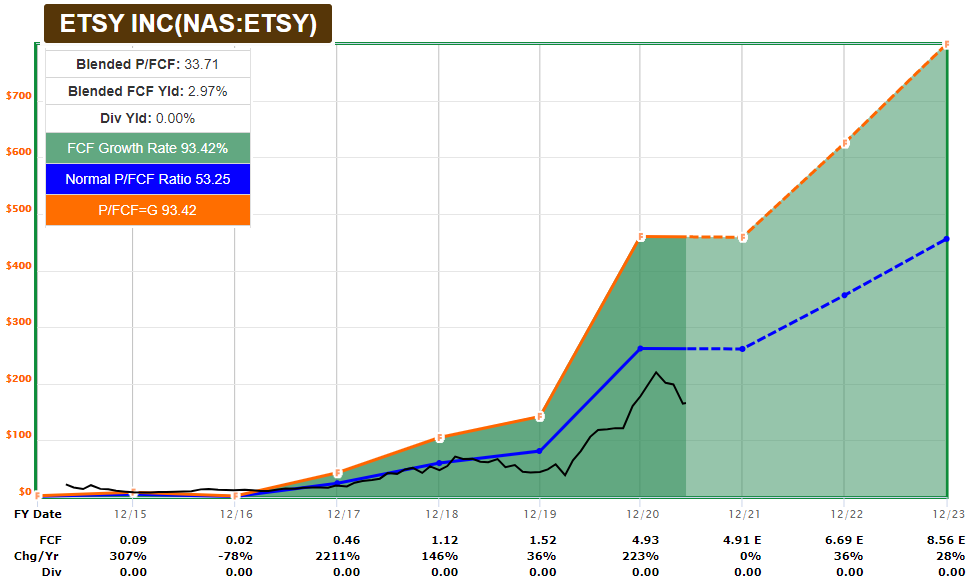

Etsy is actually trading near the low end of its historic price to cash flow ratio. Some of this is due to the market (correctly, in my view) expecting a relaxation of recent cash flow growth. But the point is, there isn’t exactly euphoria here. The market is exercising appropriate caution. I think the 5-year potential here is great, even if I don’t know how it’ll fare over the next 6 months.

Unlike Roku with its massive growth rate and Amazon-like reinvestment approach, Etsy has historically grown at a more moderate pace, and with positive free cash flow. The stock is currently trading at 33x analyst-consensus 2021 free cash flow and 25x analyst-consensus 2022 free cash flow, which isn’t too high considering their average growth rate.

Chart Source: F.A.S.T. Graphs

Etsy also has more cash than long-term debt. The balance sheet is in great shape.

Overall, I’d be happy to buy Etsy and hold for 5 years as part of a diversified portfolio. However, I would prefer to see a bigger capitulation, and I just don’t know if we’ll get that or not. I’m willing to start dollar-cost averaging into it, or sell cash-secured puts against it.

Growth Stock Risks

Both Roku and Etsy have individual company or industry risks related to competition, execution, and other details. Roku has competition from Amazon Fire (AMZN) and Apple TV (AAPL), for example. I’m also concerned that since Roku is starting to produce some original content, that it could be a big cash flow sink like Netflix (NFLX) deals with. Meanwhile, Etsy is taking a mild risk with its depop acquisition, and faces general risk from Facebook (FB) and eBay (EBAY).

However, their larger risks from an investment standpoint are related to valuation. The underlying businesses are strong and hard to disrupt at this point with sufficient network effects, but the valuation multiples are on the high end (more-so for Roku than Etsy), so the main question is whether we’ll see deeper price corrections ahead.

One of my concerns in recent months was that I was expecting an inflationary spring/summer (which we’ve gotten so far), and wasn’t sure if Treasury yields would rise or not considering the TGA drawdown and other variables (so far, not so much). If Treasury yields rise in the second half of 2021, it can put pressure on highly-valued growth stocks again, since the discount rate goes up quite a bit.

We’ve seen growth stocks cooling off quite a bit, allowing for more attractive entry points, but I don’t know if this rise in Treasury yields is completely done for this cycle. If we get, say, an energy price spike in late 2021 or in 2022 along with the TGA no longer in drawdown mode, it could very well lead the Treasury market to wake up and bring yields higher.

So, my way of hedging that risk is simply to own plenty of energy stocks and other inflation hedges. My overall portfolios remain tilted towards value and inflation, but there are select growth stocks I’m willing to buy when they’re less hot, like Roku and Etsy here, as part of a balanced portfolio.

Final Thoughts: Move Forward, But With Caution

One of my favorite investors, Howard Marks, has the quote, “move forward, but with caution”. In other words, don’t be paralyzed with fear, but have a sober analysis of risks.

Over the past year, I’ve gotten tons of emails from folks who are interested in the market but who are always concerned about the possibility of a crash. Meanwhile, the S&P 500 was under 3,100 this time last year, and now it’s over 4,200, and cash failed to keep pace with official measures of price inflation.

I think the fear is understandable, because many people just view stock indices as a price that goes up and down on a chart, rather than deeply understanding the investments they own. And that’s to be expected; most people have day jobs and don’t work full-time in finance.

When you own individual companies, or analyze an index carefully and look through the top companies and get a feel for their valuations, you can be more comfortable with the types of investments you hold. Some stocks are very heated in terms of valuation, while other ones are actually at below-average valuations. And there isn’t just one market. There are various international markets to select stocks or other assets from as well.

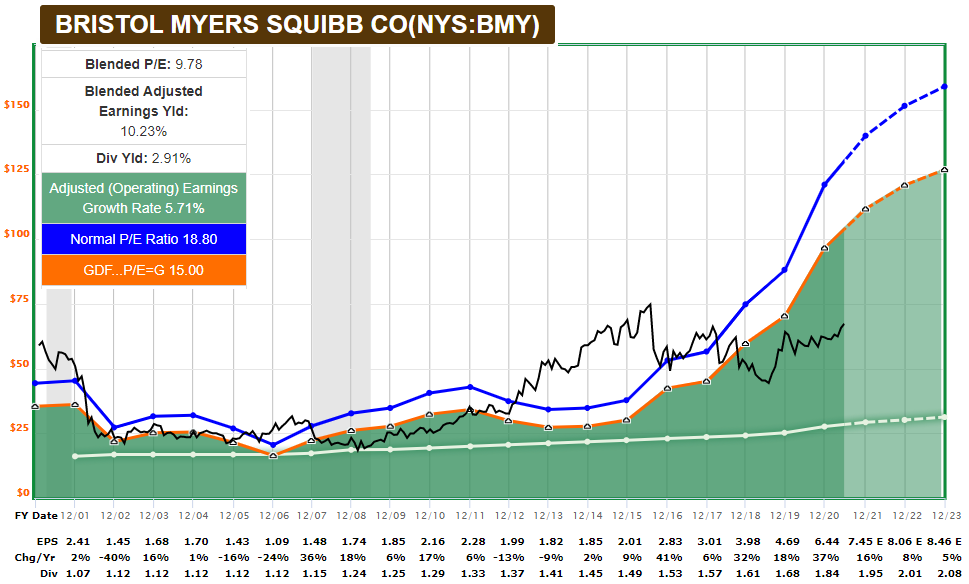

Bristol Myers Squibb (BMY) for example is still at a single-digit forward P/E ratio:

Chart Source: F.A.S.T. Graphs

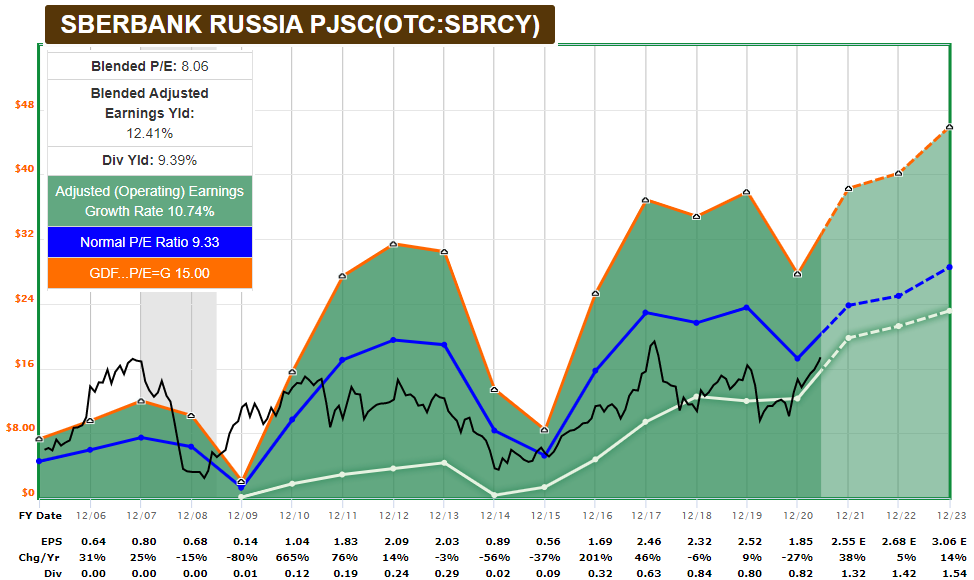

Sberbank of Russia (SBRCY) is even cheaper:

Chart Source: F.A.S.T. Graphs

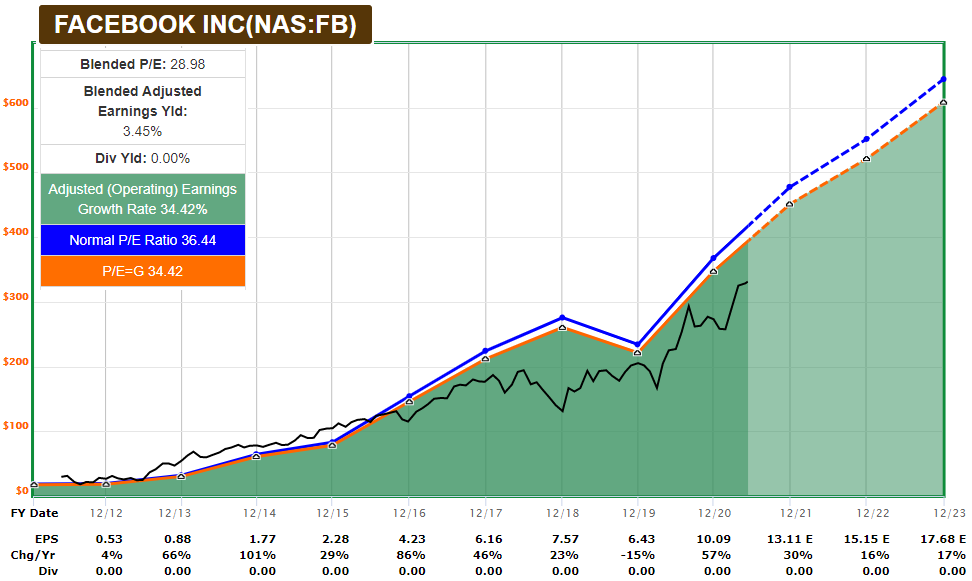

If we head out of the realm of value and look into growth stocks, we see something like Facebook (FB) that is not exactly cheap, but that is completely in-line with its historical norm:

Chart Source: F.A.S.T. Graphs

All of those stocks have risks, but overvaluation isn’t particularly one of them. I continue to like a large number of dividend-paying stocks, as well as some growth stocks and inflation hedges on either side of that mix.

There were multiple times over the past year where I was concerned about the levels of market euphoria, and raised a bit of cash, or focused a bit more on defensive stocks. But overall, the approach was to keep seeking value wherever it is, and that process is what I’ll keep doing.

Despite the negative real yields, I do hold some short-term bonds as dry powder (although I’m underweight them), along with gold for some defensive insurance. Investors could also buy into long volatility funds or use other means to hedge downside risk. But the point is, there are attractive investment opportunities out there, and while they may have volatility, maintaining a diverse collection of good stocks spreads out the risk and allows their compounding effects to work their magic for a portfolio over time.

In terms of risk awareness, some of the big things I’ll be watching in the months ahead are 1) how the economy performs with stimulus support fading away, 2) whether the Senate can pass an infrastructure bill or not, 3) how tight the energy market gets later this summer if at all, and 4) the TGA drawdown and Q3 net Treasury issuance.