Deep Dive: Macro Update and Cigna Analysis

The macro section of this report provides an update on the virus, credit markets, inflation, gold, and emerging markets. It then provides a market update on bitcoin and smart contract platforms, and then dives into an update on Cigna, a healthcare stock that I’ve been following for some time.

Macro View

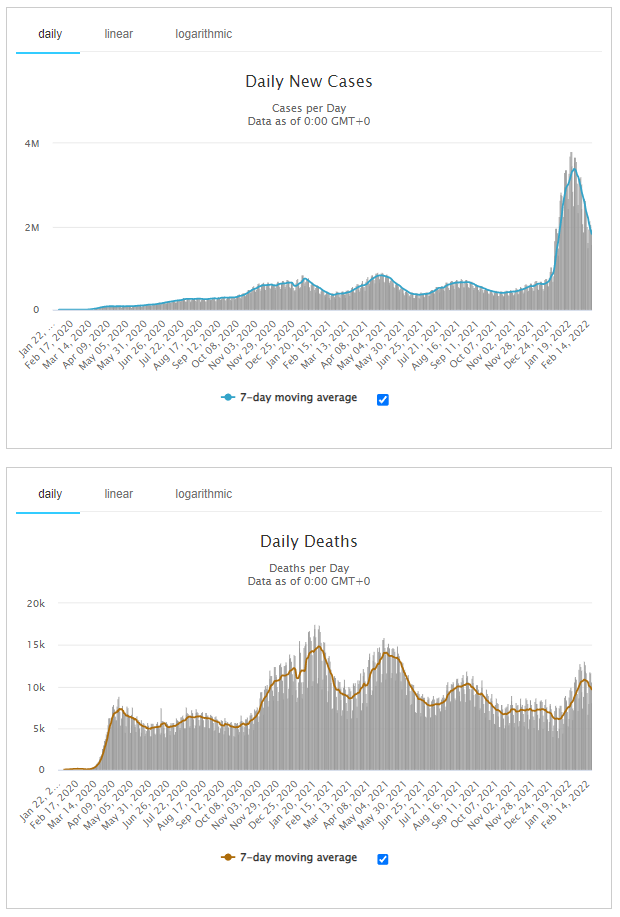

The Omicron wave continues to trend down, and more countries remove various restrictions that they have in place for it:

Chart Source: Worldometer

At this point the political consensus seems to have shifted to viewing this as an endemic disease rather than a pandemic and I’m optimistic that it will continue to be perceived that way, but that view may be tested to some extent if/when there is another wave in the future.

Worsening Credit Conditions

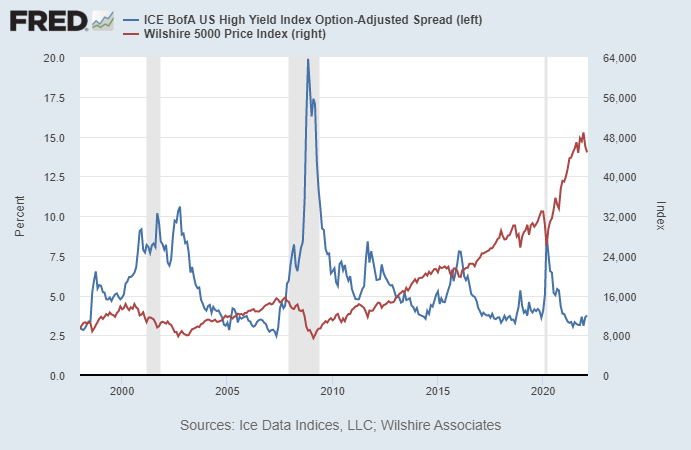

The interest rate spread between high yield bonds and Treasuries broke out of a year-long basing formation recently. It’s still at a low level but now has an upward trend. This is a sign of slowing economic growth and deteriorating assessment of credit quality for junk-rated companies compared to nominally risk-free assets.

Chart Source: St. Louis Fed

Usually when this happens, stocks also run into some turbulence. Credit spreads are in blue and US stocks are in red:

Chart Source: St. Louis Fed

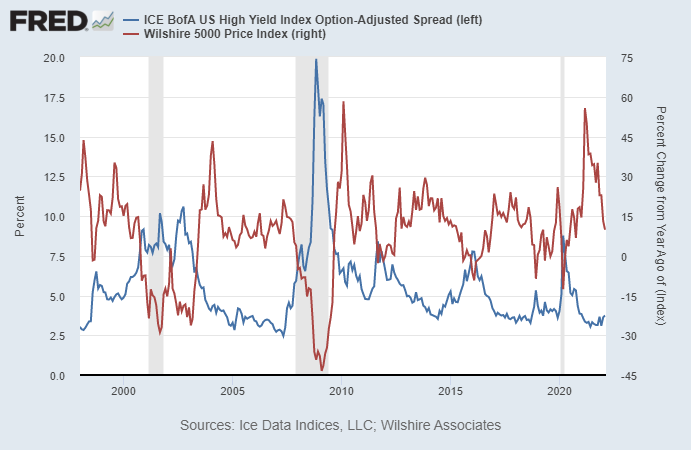

Here’s a similar view that shows stocks in year-over-year percentage change terms, to visualize it differently:

Chart Source: St. Louis Fed

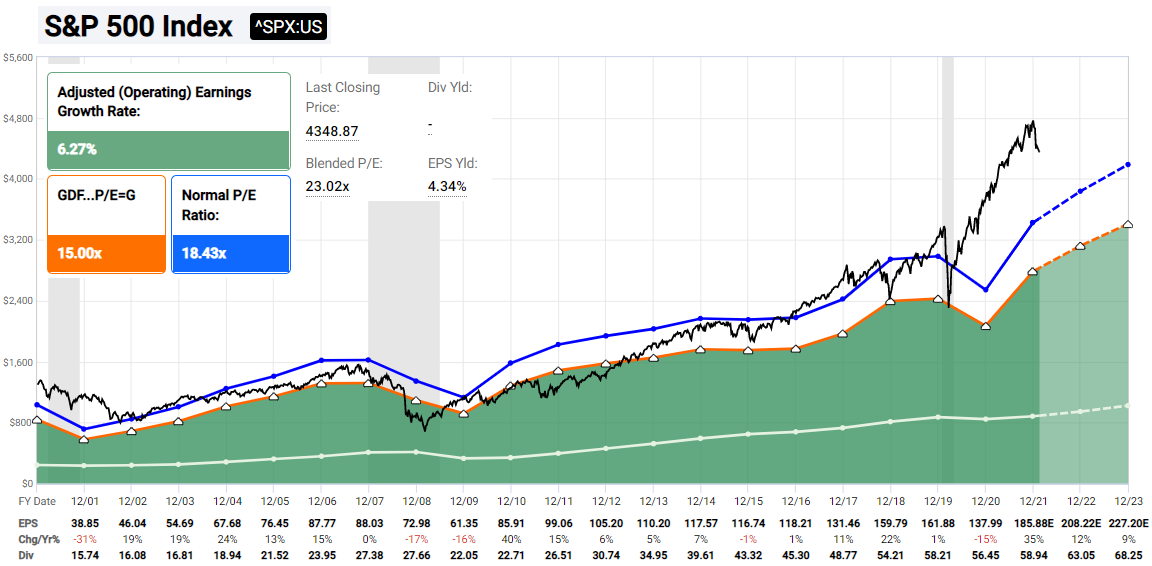

In recent cycles when the Fed tightened monetary policy, they did so in an environment of improving credit spreads. This time, they’re planning to raise interest rates into what currently consists of decelerating economic growth and worsening credit spreads. Meanwhile, large cap US stocks in general remain expensive relative to history, in part due to how low interest rates are.

Chart Source: F.A.S.T. Graphs

Overall, I continue to view these conditions as “risk off” for many types of US assets. I prefer high-quality value stocks and gold as my defensive positions, along with some cash-equivalents despite the persistent inflation and negative real yields. Meanwhile, I’m relatively bullish on emerging market equities, because they are in a different phase of the economic cycle; so some of them are currently experiencing acceleration of economic growth after a tough 2021.

I’m also keeping an eye on the gold chart, which has been holding up rather well recently.

Gold is back above its 200-day moving average, and that moving average has an upward tilt to it. I don’t really track moving averages much but the observation is simply that momentum is back in the bulls’ favor for now. I wouldn’t be surprised to see gold roll up to new all-time highs in the next couple years.

From another perspective, the S&P 500 as priced in gold is starting to roll over into negative momentum for the first time since late 2018:

Inflation Update

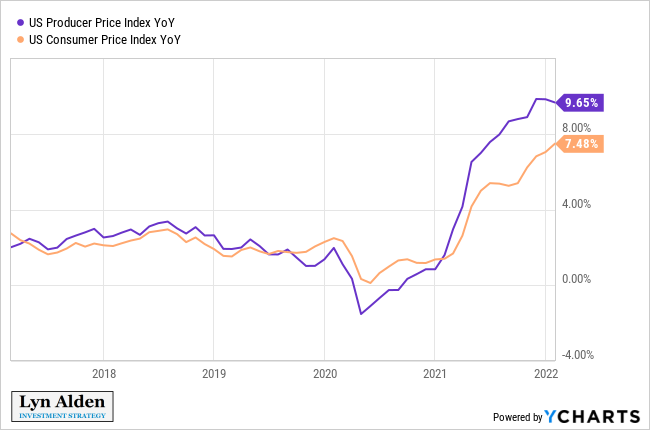

The producer price index is showing signs of having reached a local top in year-over-year terms. I think we’ll probably see the same for headline CPI by late Q1 or early Q2.

The reason has to do with base effects. Monthly inflation has been rather steady for about a year now, so now high inflation prints are about to start lapping year-ago similarly-high inflation prints, and thus the year-over-year figures are likely to stop going up. Monthly inflation would need to break out to a higher level in order to get yearly inflation up at this point.

However, if inflation remains relatively high (4-8%), even if it stops going higher on a year-over-year basis, that’s still a significant problem.

Investor views about what inflation is going to do next tend to be very polarized. There is one camp that argues that all of this inflation is transitory, just caused by supply chain disruptions, and that it’ll go back to normal soon. There is another camp that thinks this is all just starting and that we’re entering a period of secular inflation.

My view falls near the middle but towards the secular inflation view. For the past couple years I’ve been in the “inflation camp” overall, which has been correct so far. Basically, I think there is a good chance that year-over-year inflation will reach a local top in a couple months, and that we’ll have a period of flat or lower year-over-year inflation prints for a period of time, while still being above-target. And I think this is within the context of an overall inflationary decade; the 2020s decade will likely have higher average inflation than the 2010s decade due to tighter commodity supply and tighter labor markets. In other words, I think inflation will be a persistent problem, but not necessarily in a straight line that just keeps going up.

The right-tail risk to that view is that if oil prices spike higher this summer due to lack of supply and solid emerging market demand, it can result in inflation (or more precisely, stagflation) that is even higher than my base case. There is a reasonable probability of that happening, and I’ve written a number of times about energy shortages, which is part of why I remain in the inflationary camp overall. I do think we’ll probably have oil price spikes to new highs this decade; I just don’t know if they will spike this summer or not. I continue to have a structurally bullish view on oil and gas equities in general, and am willing to hold them through periods of volatility.

Emerging Markets Update

I continue to be somewhat bullish on Chinese and Brazilian equities relative to US equities for 2022. These two countries had a lot of pain for their equity markets in 2021 and have been showing signs of having bottomed. I’m pretty bullish broadly on Southeast Asian countries as well.

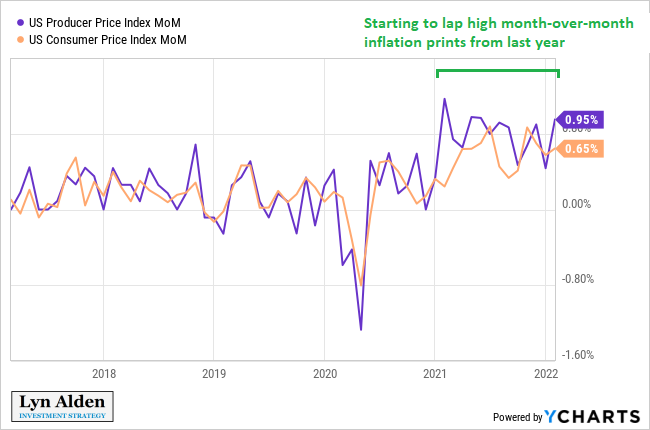

The Chinese credit impulse for example is looking good:

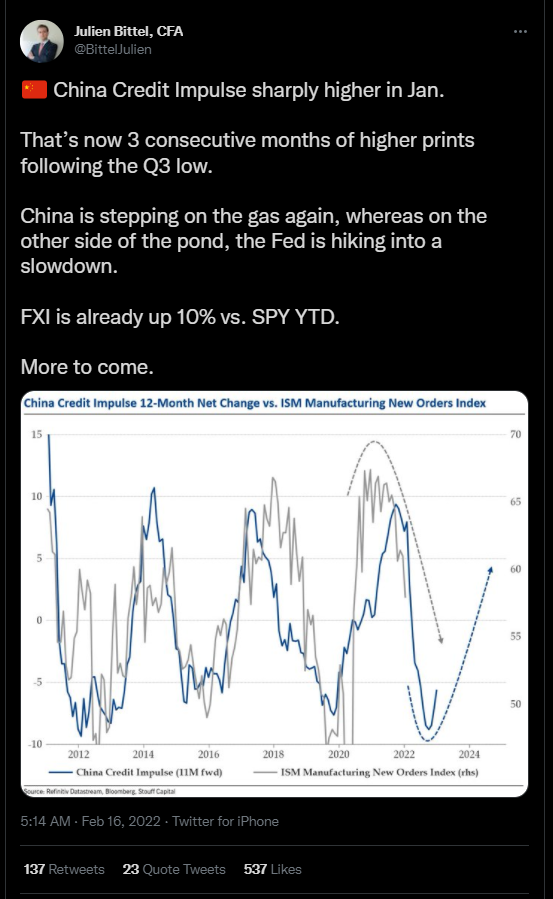

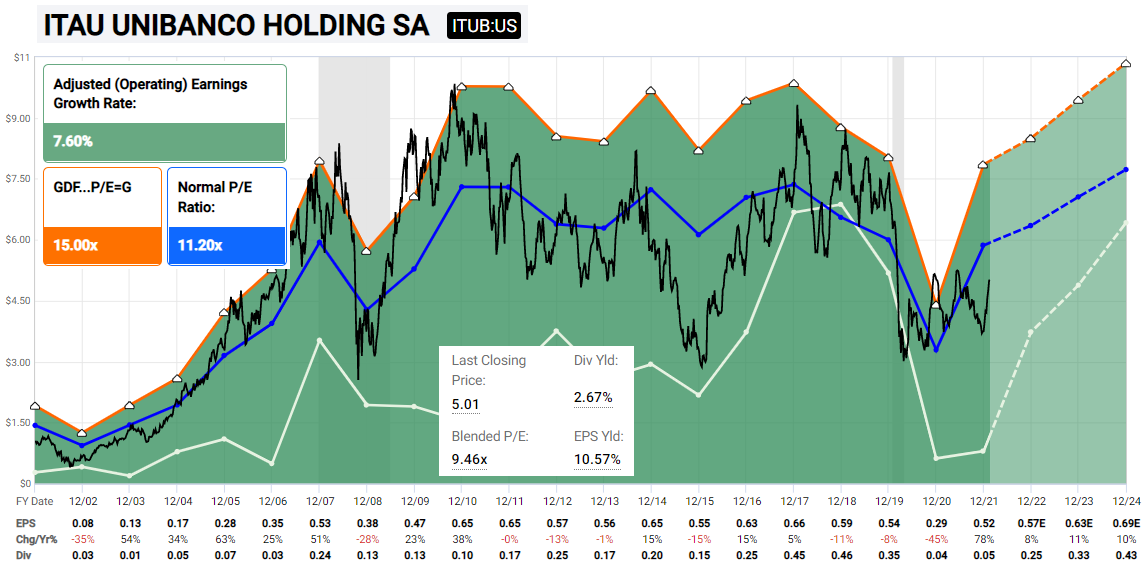

And I’m liking what I’m seeing out of Brazil. Here’s their biggest bank stock in dollar ADR terms, for example:

Chart Source: F.A.S.T. Graphs

This bullish emerging markets view is supported by the observation that the US dollar is losing its upward momentum. There was a strong period of capital flows into US equities but this seems to be behind us.

The dollar index on the weekly chart for example reached overbought levels and is now seemingly rolling over into negative momentum:

The big-picture monthly chart for the dollar doesn’t have a firm sell signal yet but gives a lot of context for where the dollar currently is in relation to its history. I do expect another significant down-leg at some point in the future, although I don’t have a high conviction view over the next 3-6 months. There’s so much capital stuffed into US equity markets, the world is historically underweight emerging markets, and the capital flows seem to be showing early signs of reversal. It’s a situation I’ll continue to monitor.

Bitcoin Note

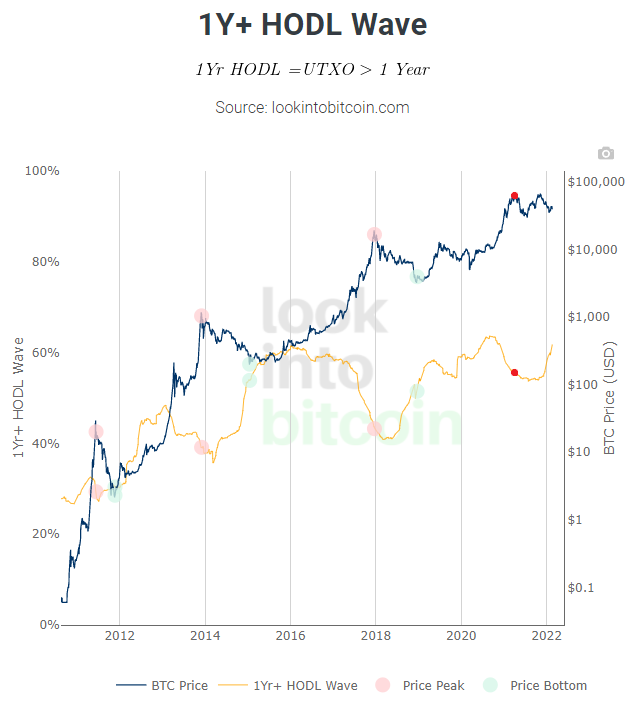

Bitcoin’s price chart continues to be very choppy, with no strong pattern in place. It has been unable to hold the $40k support level.

The supply side continues to look long-term bullish (a low propensity to sell by the existing holder base, coins having migrated from weak liquid hands to strong illiquid hands), and a lot of the fundamental ratios currently place the asset in a historical “value” zone, but the demand side continues to be weak. Until there is an influx of new demand in a more risk-on type of environment, price action is likely to be choppy. It’s a good zone for long-term accumulation in my view, but there’s no clear intermediate-term trade setup.

Canadian Bank Account Freezes

Bitcoin got some unintended advertising recently related to the large Canadian protests.

For those that have not been following it, a large Canadian protest has occupied Canada’s capital city and disrupted transportation, and they received donations from a lot of people to support them. Donation platforms began blocking millions in Canadian dollar donations to the protestors, and in response some of the donors began shifting over to peer-to-peer bitcoin donations instead.

As protests continued, the Canadian government then moved to invoke their 1988 Emergencies Act for the first time in its history, to give itself emergency powers to freeze banking system accounts without a court order, which was opposed by the Canada Civil Liberties Association and a subset of Canadian politicians but that overall has majority support among Canadians according to polls so far. People involved with protests, and people that supported the protestors, are being targeted for financial account freezes.

As Bloomberg reports:

The new rules make demands of a broad list of entities — including banks, investment firms, credit unions, loan companies, securities dealers, fundraising platforms, insurance companies and fraternal benefit societies. They must determine whether they’re in “possession or control of property” of a person who’s attending an illegal protest or providing supplies to demonstrators, according to orders published by the government late Tuesday night.

If they find such a person in their customer list, they must freeze their accounts and report it to the Royal Canadian Mounted Police or Canada’s intelligence service, the regulations say. Any suspicious transactions must also be reported to the country’s anti-money-laundering agency, known as Fintrac.

As part of this invocation of emergency powers, the Canadian government is also currently making crypto exchanges blacklist any bitcoin/crypto deposits they receive from protest-associated bitcoin addresses. The government can’t stop peer-to-peer bitcoin payments in the same way that they can freeze bank accounts, but they can add frictions around getting specific bitcoins converted back into fiat currencies on major exchanges for near-term financing needs, by tracking them on the blockchain. There are ways around those blockages, to sell the bitcoins peer-to-peer or to anonymize the blocked addresses, but these sorts of methods require extra work and knowledge by the user.

The Canadian government also went after some self-custodial bitcoin services with orders to freeze and report customer assets, but the response from those services was that they are just software companies and they literally don’t hold the funds so they can’t freeze them, and they purposely don’t know who the users of the software are and thus can’t share that information either.

I think a recurring theme during this 2020s decade will involve governments trying to find out, legally and technically, to what extent they can apply analog-era bank regulations to modern peer-to-peer distributed open source software systems. They may write new laws as needed to try to re-assert control over peer-to-peer transactions. This won’t be a one-off issue.

I described my observation of this issue on social media, not specifically as it applies to Canada but rather in the broadest international sense (especially for developing countries where rule of law is generally weaker and where the majority of people in the world live) regarding the difference between custodial and non-custodial monies and their interaction with governments:

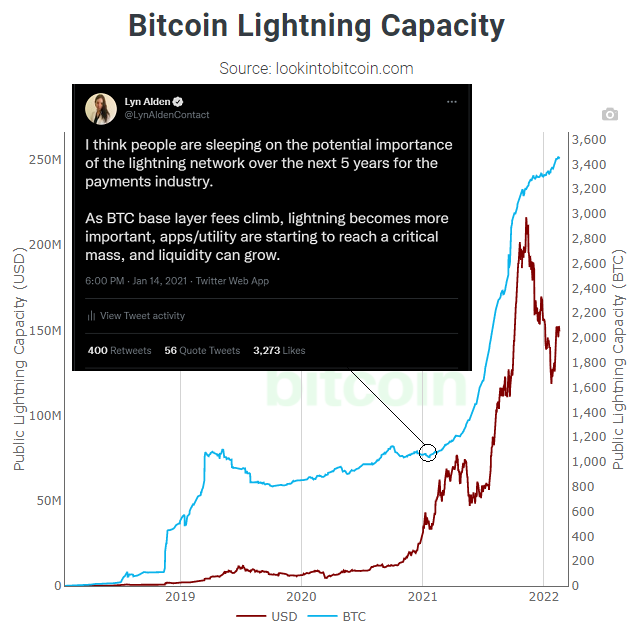

Lightning Network Update

The Lightning network is an open source second layer on top of the bitcoin base layer that consists of smart contracts, and allows for instant and nearly-free payments, as well as a significant degree of anonymity for the sender. It consists of multiple implementations (there is no “owner” of Lightning), but in practice Lightning Labs has the most widely-used implementation, followed by Blockstream. A number of participants add liquidity, development, and other services to the network.

Since I initiated coverage of it, the Lightning network has really taken off:

Chart Source: LookIntoBitcoin.com

After a flattish period in late 2021 and early 2022, the size of the Lightning network seems to be expanding again. This may be due to the fact that Cash App recently integrated itself into the Lightning network. That theoretically brings 70 million users to the Lightning network, although in practice only a small number will use it at first.

An example of Lightning in action, for those that have not used it, is to see Alex Gladstein, the Chief Strategy Officer of the Human Rights Foundation, demonstrate buying coffee using a non-custodial Lightning mobile wallet in El Zonte, back in autumn 2021. He posted a video of his experience, and also posted a link in that thread that allowed people online to tip the barista. She ended up receiving over $150 USD equivalent in bitcoin tips from dozens of countries.

I continue to research and analyze this network, including speaking with developers of the network.

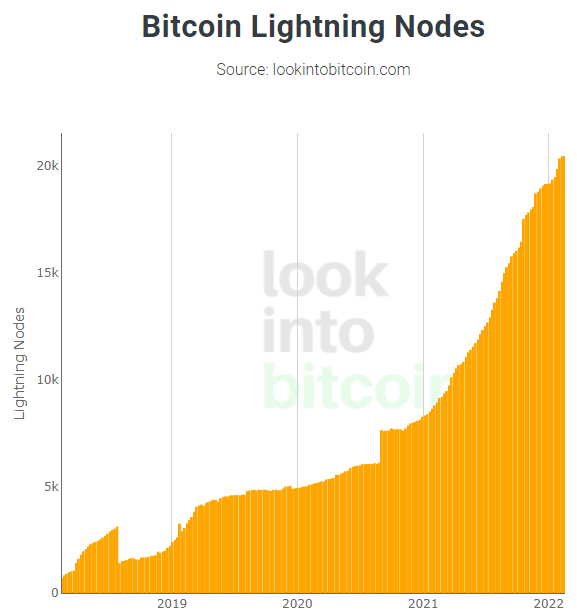

Meanwhile, the number of Lightning nodes continues to grow substantially. There is a growing community of individual smaller node operators that communicate together on Telegram and elsewhere to open Lightning channels with each other:

Chart Source: LookIntoBitcoin.com

In terms of total locked value, the Lightning network remains small, which I think is why it is still so under-the-radar. This is because Lightning is quite utilitarian, rather than offering any sort of speculation opportunities. There is no “Lightning token” to trade, and the network is not for altcoin trading/gambling. Instead, it’s for payments and payment routing, where the optimization goal is to have only a small amount of bitcoin on the network (and the rest in cold storage on the base layer), while having as much liquidity and usability as possible. DeFi, on the other hand, is mainly for speculation and arbitrage, and by its nature incentivizes adding more and more locked value. And yet people often try to compare the two numbers, Lightning vs DeFi total locked value, as though they are measuring the same thing. Funds held on Lightning are best thought of as being the digital equivalent to physical cash in your wallet; something that is useful but that you purposely don’t want to have a ton of at any given time, for security purposes.

The Taproot soft fork update to the Bitcoin network in autumn 2021 was quietly a big upgrade for Lightning, because it improves privacy and enables more features. Basically, in addition to routing bitcoin-based payments, the Lightning network will be able to route stablecoins nearly for free as well. This could be in the form of custodial (dollar-collateralized) stablecoins, or could be in the form of Lightning channel algorithmic (bitcoin-collateralized) stablecoins.

There is still a lot of development to do for ongoing scalability and privacy on the network, but it already works, and is an open monetary protocol that more and more entities are connecting to. It can be used custodially or non-custodially, depending on the balance of convenience, privacy, cost, and security that the user wants.

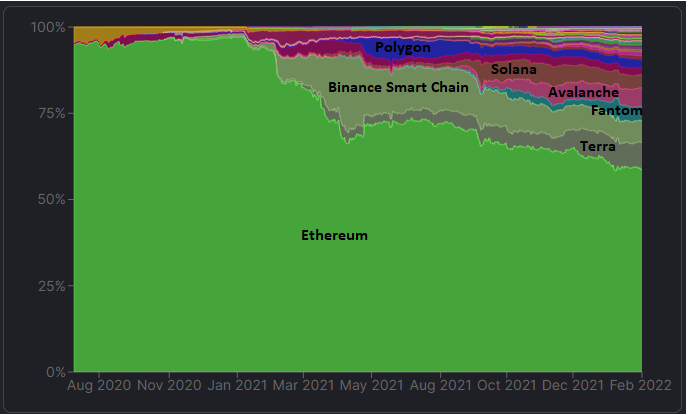

Smart Contract Blockchain Updates

I’m keeping an eye on the price action and market share of major smart contract platforms as well, which I generally classify as digital equities for the purpose of analysis (as opposed to digital commodities like bitcoin or litecoin and so forth). I think there are better than 50/50 odds that Terra and/or Avalanche end up flipping Cardano, Solano, and Binance Chain in market capitalization at some point.

I previously called for Solana to potentially flip Cardano, and it did two months later. However, Solana keeps going offline due to technical issues related to spam attacks, which brings into question its technical capability. Seeing it happen a couple times was understandable since it is new technology but the number of instances is getting pretty high now. At the moment, Solana is back underneath Cardano in market cap. However, it does have a lot of VC support and critical mass, so it’s still in the game.

Terra recently reached a deal with the Washington Nationals whereby Terra will sponsor them for $40 million, and the Nationals may begin accepting Terra’s UST stablecoin as payment for purchases. What makes Terra rather unique is that the protocol is centered around algorithmic synthetic stablecoins, which differ from the more traditional custodial stablecoins.

Avalanche has been gaining market share with its very complex consensus system, high throughput, and short time to finality, and Fantom has been gaining share as well although it’s more centralized. Fantom hasn’t been listed on Coinbase yet.

The total value of tokens locked in DeFi went from $18 billion USD at the start of 2021 to $194 billion USD today. However, the market share keeps getting diluted as the various smart contract blockchains compete with each other. Ethereum had 97% of the total value locked on DeFi platforms at the start of 2021, which is now down to under 59%. Scalability limitations on Ethereum, resulting in high fees and throughput limitations, are leading many traders to spill out onto cheaper and higher-throughput competitors.

Chart Source: Defi Llama

For folks that trade these types of smart contract coins, they tend to look at the tech innovations, look at what is gaining market share, look at the ratio of market capitalization to total locked value, and buy coins they think are undervalued based on those metrics. So for example by those types of metrics, they would buy Avalanche, Terra, and Fantom rather than Binance Chain, Solana, and Ethereum.

But as the chart shows, market share is fickle in this industry, and it’s all very new. All of these ecosystems are primarily about circular speculation. A trade can be good for a few months but then can lose most of its value in the longer run, which is why I don’t cover trading strategies for these types of altcoin assets. There are niche speculators out there that can make a lot of money trading these coins, but most people don’t do well.

If we shift our focus to the NFT industry for a moment, Ethereum still has about 90% market share. NFTs have less velocity than DeFi assets, and so NFTs are less impacted by high fees and throughput limitations, and have been able to stay mostly on Ethereum for now.

Ethereum is aiming to do “the Merge” within 2022 which means the existing proof-of-work chain will connect with the beacon chain, and the system will become a proof-of-stake system. However, staked ETH still won’t be able to be unlocked at first, and that fix will come in a later update, according to current documentation. The developers have delayed the proof-of-stake conversion multiple times over a few years because it’s a very hard problem to solve. Solana, for example, still has manual stake-slashing; it’s not even automated. Thus, I don’t really know if Ethereum’s Merge will happen in 2022 or not, but it’s something I keep an eye out for in terms of news.

Crypto Regulation Risks Continue

There were a lot of high-profile crypto company ads at the Super Bowl this year, including Coinbase, FTX, and Crypto.com. Some of these companies have been sponsoring major sports organizations, teams, or stadiums over the past year. These exchanges have large marketing budgets, and many of the protocols themselves have marketing budgets as well (Solana, Ethereum, Terra, Avalanche, etc) either in the form of a DAO or a traditional company that serves as a development and marketing hub for the protocol.

This is in contrast to the more commodity-like bitcoin, which has no central organization or official marketing budget. Any marketing for it is grassroots word-of-mouth, independent analysis, or done by some of the exchanges and other companies in the industry.

One of the biggest risks for this smart contract blockchain industry, aside from intense market share competition and the possibility of speculative exhaustion, is regulation by the SEC.

Many cryptocurrencies, including most smart contract blockchains, seem to pass the Howey Test, which indicates that they are securities. In other words, they raised capital from investors like a startup company, with the intent to use that capital to improve the protocol and make the tokens more valuable over time. For this reason, most of the companies behind the protocols raised capital from outside of the US, to avoid being charged with selling unregistered securities in the US.

However, what this means by extension is that regulated exchanges in the US are likely selling unregistered securities to the American public on the secondary market, and SEC Chairman Gary Gensler has basically said as much. Regulation could eventually lead major exchanges to delist certain tokens that meet the requirements of being securities but that don’t have proper disclosures in place that securities are supposed to have, or force developers of those tokens to publish disclosures that are up to the standards of other securities.

From Bloomberg last month:

“I’ve asked staff to look at every way to get these platforms inside the investor protection remit,” Gensler told reporters in a virtual press conference. “If the trading platforms don’t come into the regulated space, it’d be another year of the public being vulnerable.”

Gensler rattled the crypto industry last year, including when he argued that most tokens were akin to securities that should be covered by the SEC’s tough rules.

This securities regulation risk doesn’t apply to coins like bitcoin or litecoin, because they raised no capital and instead just put open source software out there for users to build the blockchain themselves. Those types of assets don’t pass the Howey Test, and so they are and will probably continue to be regulated more like digital commodities.

Portfolio Updates

The portfolios are available in my Google Drive.

Newsletter Portfolio

-Sell the 5% CNR position in the growth stock pie. Add 2% to HDB (up to 10% of the growth stock pie) and 3% to TWLO (up to 8% of the growth stock pie).

CNR received a buyout offer at a premium, and the price jumped substantially as a result. I would have liked to have held this one for longer but I’m not going to complain about the stock going up 50% in two weeks. It is what it is.

Fortress Income

-No current changes.

ETF-Only Portfolio

-No current changes.

No Limits Portfolio

-Sell CNR due to the buyout offer.

Top 12 List

-Remove CNR due to the buyout offer and replace it with ITUB.

Other Holdings

-Sell CNR due to the buyout offer.

-Sell SOL and buy AVAX and LUNA for research and testing. These cryptos are tiny positions relative to my net worth for research purposes. They’re not recommendations to buy, but instead are merely disclosures for what I own small amounts in for full transparency. The only digital asset that I have a sizable net worth position in as an investment is bitcoin.

Cigna Update

Defensive healthcare stocks continue to be of interest to me in this risk-off market environment, so I am re-iterating my bullish view of Cigna (CI) here.

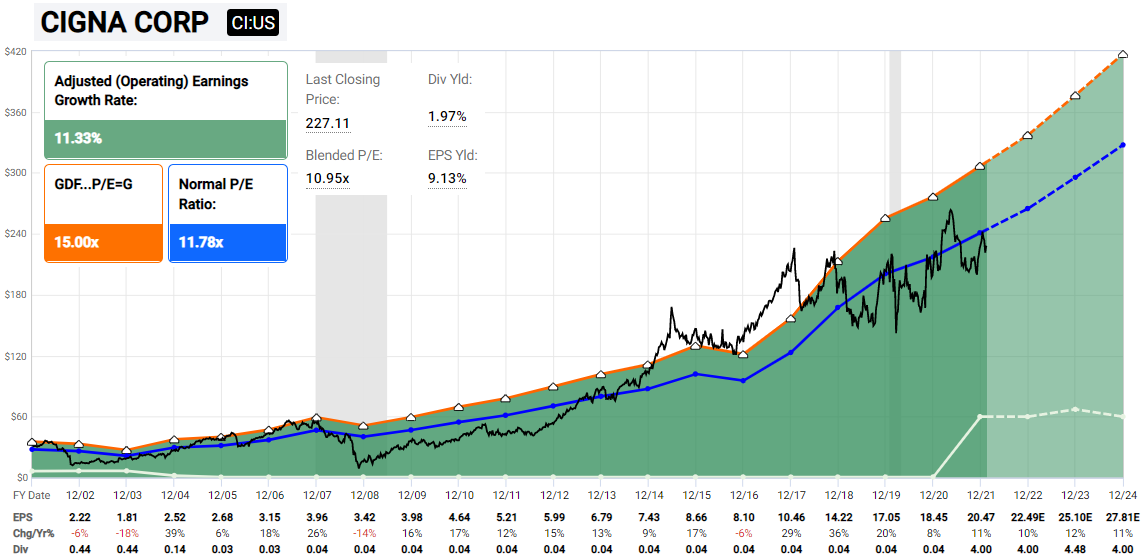

Cigna is a health insurance and pharmacy benefits company that I analyzed before. Their goal is to increase revenue by 6-8% per year, and then add 4-5% per year on top of that to the per-share bottom line from share buybacks and targeted acquisitions, resulting in 10-13% earnings per share growth. And then on top of that they pay a nearly 2% dividend yield.

With a divided US Senate, there doesn’t seem to be any major healthcare reform on the horizon that would disrupt Cigna’s profitability.

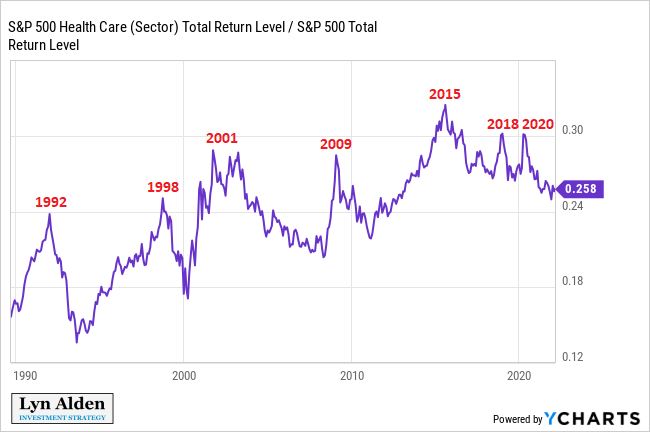

Healthcare stocks tend to do better than the broad S&P 500 in risk-off environments. This chart shows the ratio of healthcare stocks to the broad S&P 500, and you can see that the spikes are generally associated with recessions and risk-off periods. These include the Savings and Loan crisis (early 1990s), the Asian Financial Crisis (1997-1998), the aftermath of the dotcom bubble (early 2000s), the aftermath of the subprime bubble (2009), the end-of-QE global economic slowdown (2015/2016), the liquidity issues that resulted in the Powell Pivot (late 2018), and the the COVID-19 crash (early 2020). I wouldn’t be surprised to see another leg up in the coming years.

Recent Earnings

Cigna reported earnings about two weeks ago, and they came in mildly above consensus analyst expectations for both the top line and the bottom line. However, their guidance for 2022 performance came in a bit light compared to consensus analyst expectations. So, the stock dropped that day. It did rebound in subsequent days though, and generally has been in a choppy sideways pattern.

They also announced a 12% dividend increase, which is good to see. They’re growing the customer base, aggressively reducing the share count, and focusing on sustainable dividend growth. For a non-cyclical stock with an 11x price/earnings ratio, there’s not much more I could ask for. Over the long run, I’d certainly prefer to hold a diversified basket of these sorts of value stocks than to hold 10-year Treasuries yielding less than 2%, for example.

Valuation Assessment

As previously mentioned, Cigna trades for around 11x earnings, despite the fact that it has solid growth:

Chart Source: F.A.S.T. Graphs

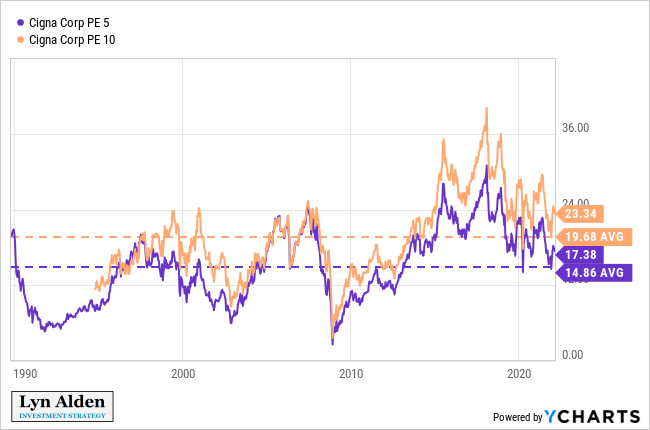

From a Shiller PE perspective, which compares stock price to a 5-year or 10-year inflation-adjusted average earnings figure, Cigna is reasonably valued:

The company is more diversified than it used to be, which in my view warrants its current valuation.

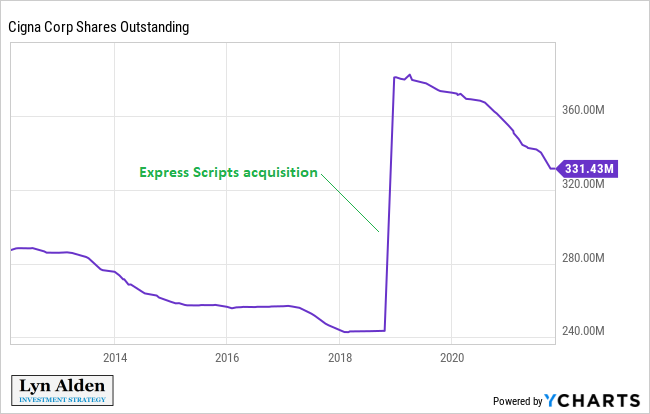

In terms of capital allocation, they have been aggressively buying back shares as of late, which is quite effective for this type of value-oriented company (which doesn’t need a lot of R&D for example):

The company initiated a dividend in early 2021 at $1 per quarter, and a year later here in early 2022 they raised it to $1.12 per quarter.

The balance sheet is solid with an A- credit rating from S&P.

Overall, there’s a lot to like here, and a pretty low hurdle for success. I wouldn’t go too heavily into any one stock, but to the extent that I can find a diverse mix of value stocks like this, I think they can make for an effective portfolio in this environment.

Final Thoughts

This continues to be a challenging macro environment. My approach continues to be to try to find attractive assets for a 5-year time horizon, that have recently become out-of-favor or are otherwise attractively valued, while maintaining a defensive outlook.

The bulk of my liquid net worth consists of profitable high-quality value stocks, with great free cash flows, decent dividends, and low valuations. I also have a significant bitcoin position, and a precious metals position, and cash-equivalent position, as part of my liquid net worth. During inflationary decades, value stocks and commodities indeed tend to be the best performing assets.

After overweighting those exposures, I round out a portfolio with smaller positions in growth stocks.

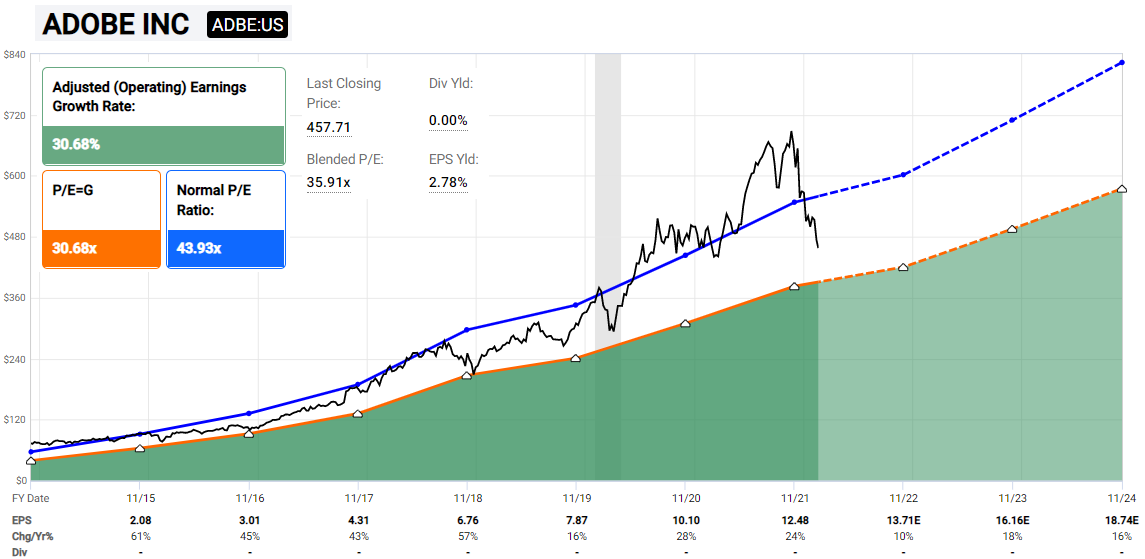

I’m starting to see some growth-at-a-reasonable-price stocks open up as decent investments again. Adobe (ADBE) is an example. I first bought it for the newsletter portfolio in January 2019 at around $230/share. I then sold it in September 2020 at around $430/share. I then re-recommended it for about the same price in March 2021 after it trended sideways for a while, and then it soared as high as $670 and then came back down to $440/share. The price/earnings/growth ratio is reasonable here.

Here’s a F.A.S.T. Graph, emphasizing their current era as a “software as a service” business. They’re not exactly undervalued but they are back in a “value range” by historical standards:

Chart Source: F.A.S.T. Graphs

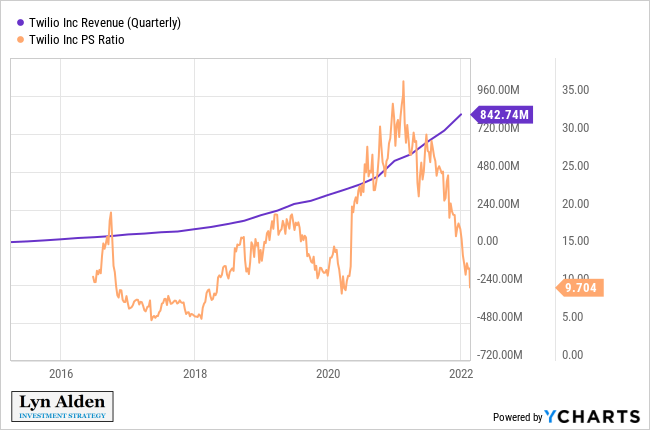

I’ve also been picking up a few of the ARK-style stocks with network effects that are 45-75% off their highs. They offer decent risk/reward opportunities as well in my view (such as Twilio, Roku, and similar names), at least for small portfolio positions. Many of them are at historically low valuations relative to their growth rates. Nobody wants to buy something like this at the moment. And yet it’s at March 2020 valuation lows:

As someone who is primarily a value investor, I find myself sympathetic to a small subset of growth stocks. A subset of their profitable and unprofitable growth stocks are probably attractive at these levels, if one is willing to sort through their network effects and hold for the next five years. For stocks like ROKU, TWLO, ADBE, and FISV, I’ll take them as modest positions and let them play out, or fail to do so, with position sizes such that no stock can majorly impact my portfolio returns.

However, the bulk of my equity assets will remain in profitable value-oriented companies. Energy pipelines, healthcare stocks, bank stocks, consumer stables, and industrials, continue to be among the more attractive sectors for allocations in my view.