Deep Dive: Macro Update and Brazil Equity Analysis

The macro section of this report covers the global virus, inflation, gold, and some geopolitical risks.

The report then provides an update on Ark-style stocks and bitcoin, and takes a look into Brazilian equities.

Macro View

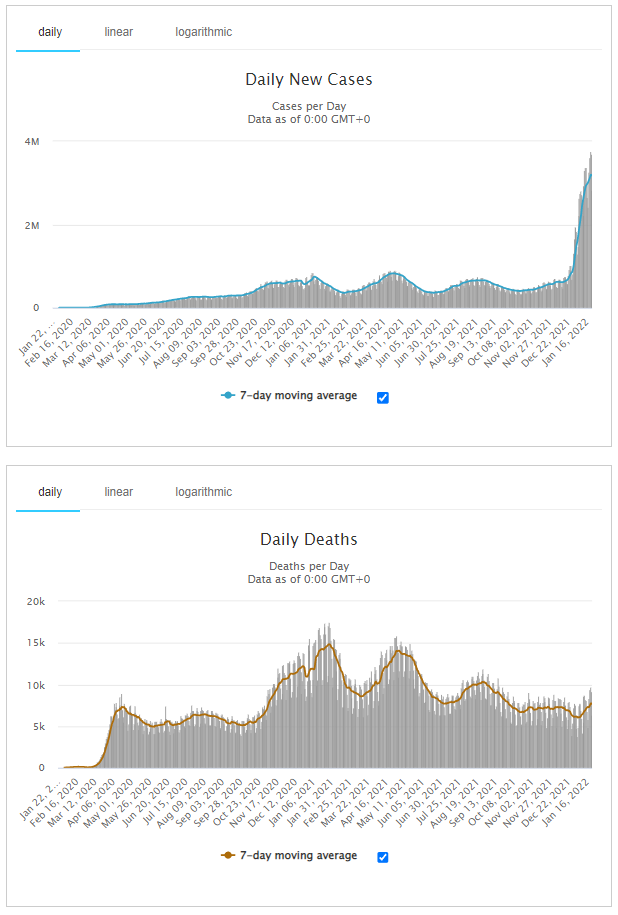

The Omicron variant continues to be a gamechanger as far as COVID-19 is concerned, with a massively high infection rate and a low per-capita fatality rate compared to prior waves, even when accounting for the lag between cases and deaths:

Chart Source: Worldometer

Despite these massive case numbers, I assume that Omicron case counts probably have an under-reporting effect because the symptoms tend to be more mild than previous waves and test providers have reached limits in many areas for how many testing appointments they can do. As a quantifiable example, Massachusetts’s official daily case count statistics showed that Omicron reached a little over 3x the daily case count as the previously-largest wave, while Massachusetts wastewater testing found about 8x as much RNA per mL compared to the previously-largest wave. I don’t really know; I’m not a medical expert.

As the Omicron wave subsides, that should be good news for the global economy in 2022 and beyond. If future waves are similar to or more mild than Omicron, then the virus would likely be treated as endemic by the majority of people and institutions, meaning it is something we unfortunately have to deal with and try to mitigate, but not something we structure our society around. If the official death counts are reasonably accurate, then about 7,500 people per day die from COVID-19 worldwide out of 164,000 average total deaths per day, representing about 4% or 5% of total deaths. Hopefully the combination of improving prevention and treatment options, along with weaker virus mutations, will press this number down lower over time.

However, even though this is good news for the global economy, it might not be good for US markets because stimulus is pulling back as well, and the major US indices are rather heavily weighted into expensive growth equities. As I described in my January public newsletter, there is so much global capital stuffed into US large cap equities that is vulnerable to re-allocation to other parts of the global market.

Market Turbulence

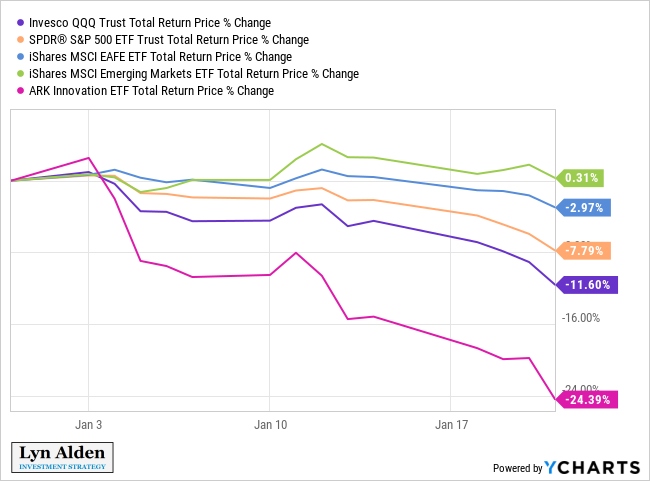

January so far has been a rough month for US markets:

Since December, I’ve been cautioning of weaker stock market performance going forward.

With fiscal stimulus winding down, and the Fed now tightening, the base case would be for a volatile market again as we enter another probable “green box” in 2022. Equities have been very reliant on these ongoing stimulus efforts. Plus, equity valuations are much higher now, and 2021 already had record inflows into equity at a scale that exceeded the prior twenty years combined. Everyone piled into equities. It could be different this time, but that’s not the assumption I would go with. The caveat is that fiscal stimulus from a Build Back Better bill might serve as another purple circle, but that remains to be seen, and much of that money is not very fast-acting like stimulus checks or corporate tax cuts are.

So, I am looking for a defensive posture around the margins.

-December 12th, 2021 report

It started to play out somewhat faster than I would have expected.

Friday was an ugly end to an ugly week, with the S&P 500 down 1.89% for the day, the Nasdaq down 2.72%, Netflix down over 20%, and cryptos crashing across the board.

I saw some research that showed that over the past three decades, whenever Friday has an S&P 500 drop bigger than 1.5%, the following Monday is down over 95% of the time as well. Whether this upcoming Monday will be one of the exceptions or not, I have no idea.

Hyper-growth stocks like what Ark holds have been falling for nearly a year now and so shorts are quite late to that game at this point, but mega-cap US growth stocks that make up the S&P 500 and Nasdaq remain rather elevated. I’m not bullish on stocks like Apple (AAPL) and Tesla (TSLA) at current levels when looking out the full year, even as they may get a bounce in the days or weeks ahead.

Inflation and Policy Update

It increasingly looks like headline consumer price inflation will peak in year-over-year terms sometime within or around late Q1 2022.

Rent and owner’s equivalent rent are still pushing up their portions of the CPI basket, since they operate on a lag compared to home prices and actual rents. However, several other areas are cooling off a bit.

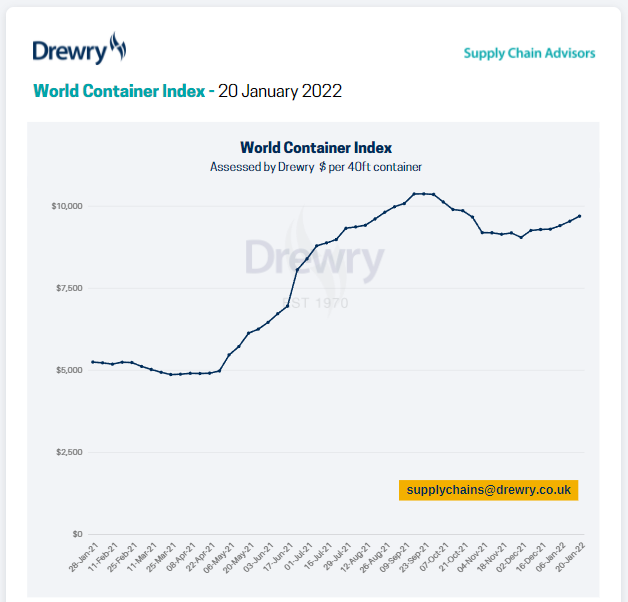

The world shipping container price index remains very elevated, but at the moment is off of its 2021 highs:

Chart Source: Drewry

The dry bulk index has approximately returned to the pre-pandemic trend:

Chart Source: Trading Economics

However, that doesn’t mean that elevated inflation won’t be sticky for a while. The Atlanta Fed Wage Growth Tracker is at 4.5% for median wage growth (20-year highs), and energy prices remain elevated as the supply side remains rather tight. OPEC+ hasn’t met their total production quota lately, and many North American energy companies are focusing on disciplined capex. Broad monetary inflation is currently about 12% year-over-year, which remains quite elevated.

The market rapidly priced in upcoming Federal Reserve policy tightening, and is now expecting about seven rate hikes over the next two years. That would be rather fast tightening, but we have to keep in mind that it is within the context of year-over-year headline price inflation currently being over 7%.

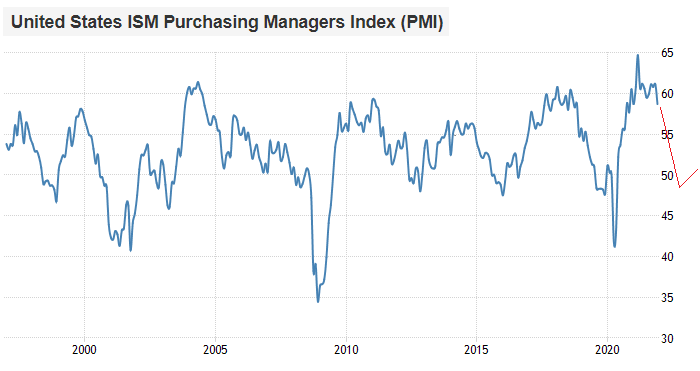

The US purchasing manager’s index is rolling over, and leading indicators suggest that it’ll probably have a downtrend throughout much of 2022. I suspect we’ll be getting another cycle that looks something like this:

Chart Source: Trading Economics

For the bulk of 2022, US markets are potentially looking at the combination of no fiscal stimulus and the Fed tightening monetary policy into an economy that is already decelerating in terms of growth. However, US banks are lending again, and while the underlying economy is slowing, there are no signs of outright recession on the horizon as of this writing.

I’m not going to try to guess how many rate hikes the Fed will get to in this cycle, but I’ll take the “under” vs the market on the Fed’s ability to tighten policy. When the Fed hiked rates throughout 2017 and the first half of 2018, they did so within the context of rising PMIs. Now, they are just starting it when PMIs are already rolling over.

Geopolitical/Russia Update

Russian stocks were very strong going into October 2021, including Sberbank in particular that hit all-time highs in US dollar terms. Since then, Russian stocks have been sharp underperformers as news continued to escalate regarding Russian military forces amassing near Ukraine’s border.

Some western nations including the United Kingdom and the United States have sent weapons to Ukraine in response. The UK in particular said that it sent anti-tank weapons.

A key backdrop for this is that the Russian government does not like the idea of Ukraine joining NATO, since it would expand NATO’s reach into a country that shares a big border with Russia. Russia would feel boxed in, since NATO would be increasingly able to deploy heavy arms there. It’s similar to why the US would not want Russia deploying arms in Cuba, so close to US shores.

Additionally, much like Crimea, parts of southeastern Ukraine have a significant percentage of the population that speaks Russian and has a pro-Russian outlook.

Russia’s amassing of forces compels western countries to negotiate, and it remains to be seen if Russia will indeed launch on offensive to take more land in Ukraine. If they do, they face considerable sanction risk. Recently, the US has been threatening Russia with the ultimate sanction- cutting Russia off from the SWIFT system if they invade Ukraine. However, Russia is a very large market, and has fortified its finances against that risk for years. It was then reported in media that the US and Europe have stepped back from that level of sanction, and instead would do more targeted sanctions. All options are technically on the table but it is very hard to cut off one of the biggest energy exporters and military powers from the SWIFT system. That would be one of the biggest macro events of the decade.

I trimmed the Sberbank and Lukoil positions in the No Limits portfolio back on December 13th (as described in the December 12th report) to reduce tail risk from an extreme outcome. Both companies remain attractive on a company-specific level, but the macro factors could not be ignored as it related to position sizing. I continue to hold the remaining smaller positions for now.

I don’t have very significant concerns about the risks to the Russian companies themselves. In my view, the biggest risk would be if US investors are forced by sanctions to divest from Russian equities. This would mainly be a risk for the investors themselves (selling at low prices), not the underlying companies in the long run.

If I were a non-US investor, and instead a Brazilian or Malaysian or Japanese investor for example, I would view this as a strong buying opportunity for Russian equities. As an American investor, I take a somewhat more cautious outlook, and simply hold for now as a small part of a diversified portfolio.

In addition to putting a lot of lives at risk (the worst part of all of it), this situation represents another tail risk for global energy markets that are already rather tight on supply.

Gold Update

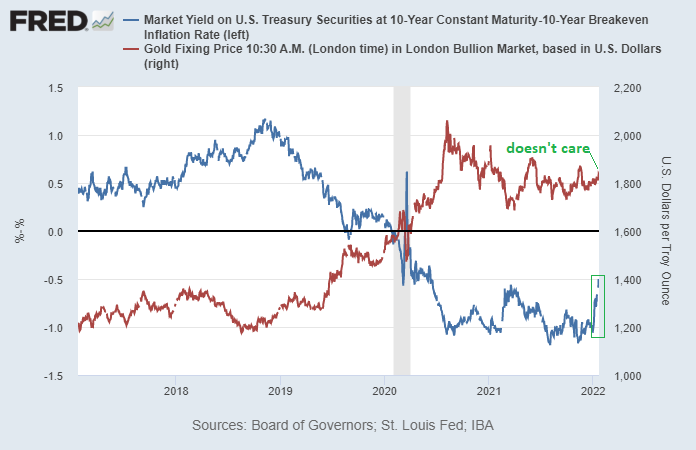

The gold price has held up reasonably well recently, in the face of sharp increases in nominal and real Treasury yields. More often than not, this sharp jump in real rates (nominal yields minus TIPS yields) over a compressed time period would lead to a drop in gold:

Chart Source: St. Louis Fed

When an asset shrugs a bearish catalyst and stays solid, or shrugs off a bullish catalyst and stays weak, it’s worth taking notice. That sort of behavior can signify a market regime shift. Gold has built a very strong base around $1,700.

Interest rates remain well below trailing inflation levels and market expectations of forward inflation levels. The gold market seems to be thinking that the jump in real rates is overdone and is shrugging it off, or is factoring in a lot of other variables (weakening dollar index, economic growth deceleration, choppy equity performance, rising geopolitical conflict). Basically, I think the gold market is taking the “under” on the Fed’s ability to tighten policy.

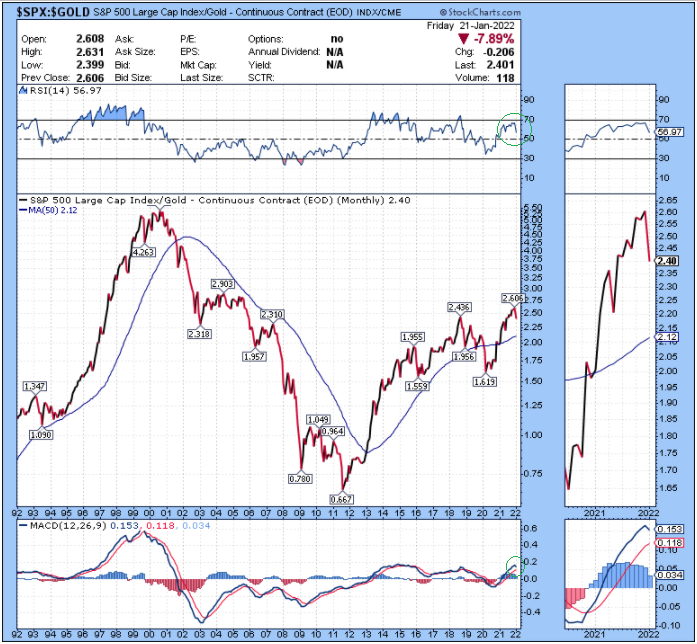

The S&P 500 as priced in gold is losing momentum on the monthly chart. Gold is setting up for a likely period of outperformance for 2022 after a weak 2020 and 2021:

The same is true for the S&P 500 vs gold miners. The S&P 500 is rolling over in favor of gold miners at the moment, and I think there is a decent shot that this trend shift has legs to it:

Obviously I don’t know for sure what will happen. Gold is gold. But as the US purchasing manager’s index probably continues to roll over throughout 2022, it is likely to benefit gold’s price relative to risk assets including broad equity indices. That is my base expectation going forward unless I start seeing evidence to the contrary.

Dollar Update

The dollar has been showing some early signs of weakness. After becoming overbought on the weekly chart, it rolled over into negative momentum.

During Friday’s major risk-off day across markets, the the S&P 500 closed below its 200-day moving average for the first time since the first half of 2020. Cryptos crashed, triggering leverage liquidations. Often on these sorts of days, the dollar tends to rally, but it was flat-to-down instead.

Meanwhile, since the start of the year, emerging markets have outperformed the S&P 500 by over 700 basis points. Emerging markets have basically held flat while US stocks have had a sharp sell-off. People often assume that if US stocks go down, emerging markets have to go down more, but that’s not always the case, especially during macro regime shifts.

My base case is to have a dollar bearish outlook, although there are a lot of moving parts here.

On one hand, the Fed planning on tightening its monetary policy is bullish for the dollar, since it contributes to positive rate differentials vs other currencies. That’s the obvious bullish narrative and it can’t be ignored. In addition, any significant military engagement around Ukraine could result in a temporary flight to dollars, since it’s geographically and militarily out of reach of that problem.

On the other hand, global investors are incredibly overweight large-cap US growth stocks, and American investors are incredibly underweight foreign stocks. Everyone is basically on one side of the ship, and it’s heavy to that side. To the extent that they want to reduce those positions and shift more to value, it generally means a more international focus. As the Fed tightens monetary policy and puts pressure on expensive mega-cap growth stocks, it can drive capital out of them, and thus result in capital outflows from the dollar. Rather than being a liquidity crisis that sends the dollar up, this looks like more of a grind and rotation into different assets.

A weak fiscal environment, tightening monetary policy, overvalued equities, a wide trade deficit, with PMIs rolling over, doesn’t exactly make a good case for overweighting US assets at the moment. And in particular if investors don’t overweight US equities (the crown jewel of global asset markets over the past decade), that can be a bigger bearish effect on the dollar than the Fed’s tightening is bullish for the dollar. It’s something I’ll continue to monitor.

Ark Innovation and Bitcoin Note

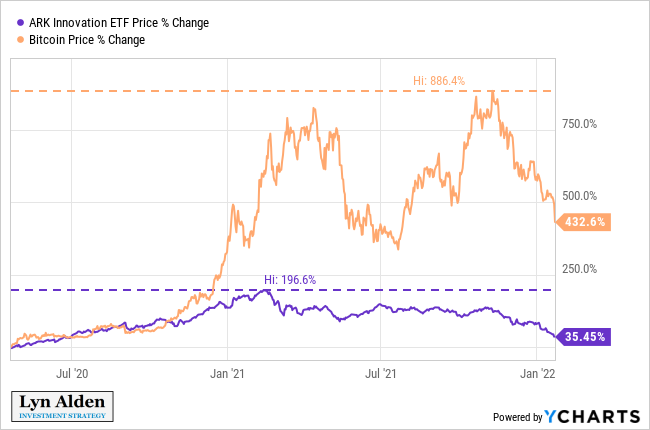

Back in February 2021, the Ark Innovation ETF (ARKK) peaked after a tremendous run. During a 13-month stretch from January 2020 into February 2021, ARKK went up by over 200%.

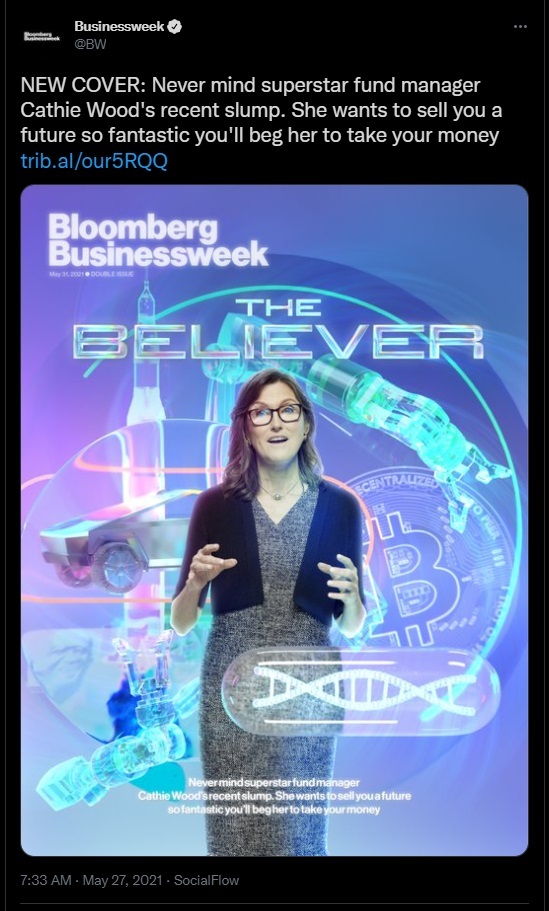

Ark, due to its fame, became the popular proxy for mostly-unprofitable hyper-growth stocks. Cathie Wood, the founder and leader of Ark Invest, has been a high-conviction bull on innovative growth stocks since she began the ARKK ETF in 2014. She has argued that technology would grow so exponentially that it would be a strong deflationary force, including pushing down oil prices.

Throughout early 2021, after the tremendous bull run, Wood appeared on many magazine covers and was featured in a number of biographic articles. For example, the Financial Times ran a March 2021 piece about her called, “Cathie Wood: a tech investor doing God’s work“. Businessweek ran this cover in May 2021:

However, the Ark Innovation ETF peaked in February 2021, and is down 54% since then while broad market indices continued to grind higher. As of this writing, Ark has now underperformed the Nasdaq 100 since the start of 2020.

To Wood’s credit, starting a fund focused on hyper-growth stocks in 2014 was a genius move. It’s just that it all became overdone in 2020/2021, and that’s when most investors piled onboard. If Wood made a mistake in my view, it was that she continued to pound the table on growth-vs-value in all of her interviews, even at the height of such massive outperformance when most of the basket was trading at 20x or 30x revenues, pulling more and more investors in at the top.

But that’s the challenge with running a company around a singular theme, whether it’s growth stocks, value, gold, or anything else. Managers of these strategies rarely if ever say their theme is overdone. Would a growth manager say, “This isn’t the right time for growth stocks; they’re too expensive now, stop giving us money.” Would a value manager say, “You know what, as much as I like value, I think the most expensive stocks are probably going to outperform for the next five years during a disinflationary cycle.” Would a gold fund manager say, “Look, after a good run for gold in a crisis, gold will probably underperform a lot going forward as the economy normalizes for a period of time.” Almost never.

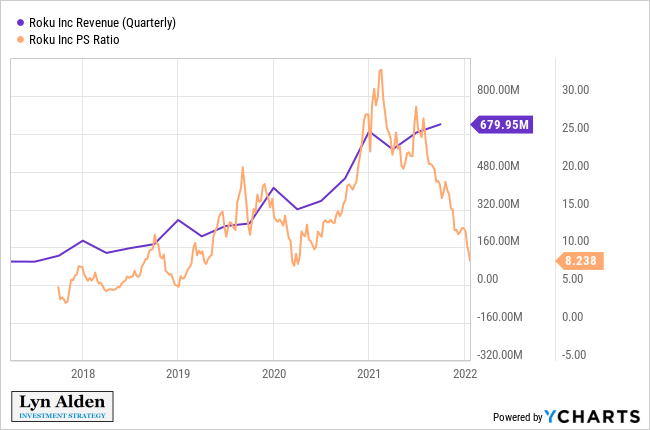

I’ve not disagreed with the top-line growth of the underlying companies found throughout the Ark portfolio, but have mostly avoided them due to extremely high valuations. A good company can be a bad investment if you buy it at the wrong price. As people piled into ARKK, Wood had to keep using that incoming capital to buy growth stocks. And now that people are pulling funds from ARKK, she is forced to sell the stocks at any price.

I’ve also been on the other side of her oil view; it’s been one of my bullish areas and continues to be with a 5+ year view. The world’s demand for energy, including various types of energy, does not change as rapidly as software does. Solar and wind collectively represent just 3% of the world’s total energy production, and are made using fossil fuels. Their share will continue growing, but from a small base. Meanwhile, there isn’t enough capex going into the oil and gas industry, leading to shortages.

However, I make tons of investment mistakes myself as does everyone, and I’ve always enjoyed listening to Wood’s arguments on topics because it’s important to hear views from multiple angles.

I did buy a few hyper-growth stocks after they sold off significantly from their February 2021 highs, but that proved to be much too early of an entry. I put about 2% of the newsletter portfolio into a few Ark stocks like Roku (ROKU), Zoom (ZM), and a couple other high-volatility growth stocks, and they had a nice bounce from there, but then deeply rolled over. That’s why I kept those positions small to begin with; at those valuations, even after the pullback where I entered them, they were quite risky.

If the ARK Innovation ETF and its various companies continue to crash or stagnate, I’ll get more interested in them for a second tranche of purchases. When Wood is on magazine covers and everyone is talking about “the Exponential Age” is when I want to avoid or at least significantly underweight those investments, since they are crowded. When it all crashes and burns and everyone claims that Ark was a folly, is when I want to pick through the rubble and find some oversold stocks that do have good long-term potential.

Roku (ROKU), for example, has given up the entirety of its valuation premium recently:

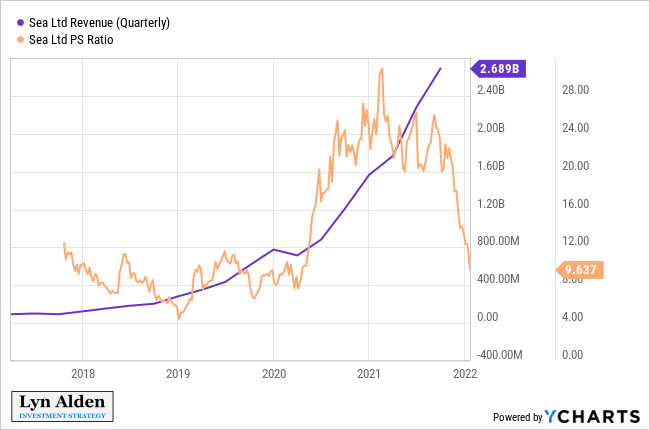

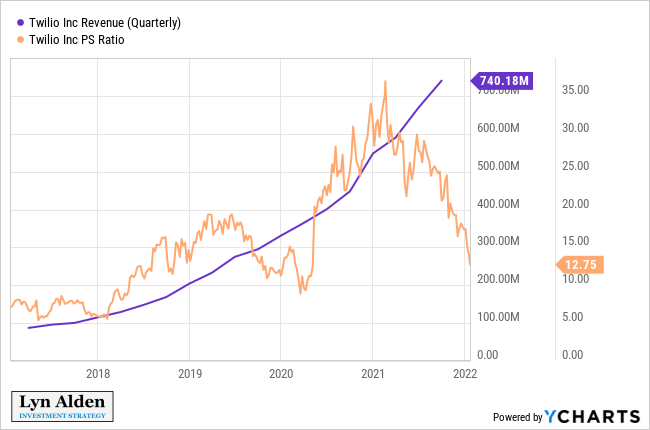

And so has Sea Ltd (SE), for which I do not have a position but am watching:

Twilio (TWLO) has my attention here as well, and I also don’t have any position in that one yet:

As much as I like value over growth for the next 5+ years, the ARKK-style names are firmly on my watch list for capitulations throughout 2022, after such a bloody year of losses. Most of them are names I have never had a position in, while a few of them are ones that I have small positions in, and I might be adding a bit at some point.

Ark developed an innovative model of open source research, where they try to be as transparent as possible about their research rather than keeping it proprietary. People can review their research and then either agree or disagree with it in specific areas. They also arranged the sectors that their analysts are grouped under differently than traditional firms, to reflect changing technological trends. I think there is a lot of good that has come out of Ark, and it’s mainly the high valuations in 2020/2021 that became a problem after years of investment success.

Bitcoin Update

Bitcoin and blockchain technologies in general have been one of the bullish themes that Ark has, and that I’ve agreed with. I think Ark’s blockchain analyst Yassine Elmandjra puts out great work.

I originally recommended Bitcoin in April 2020 and since then it has outperformed most hyper-growth stocks. The risk/reward looked a lot better to me than the broad set of hyper-growth companies in general and so far that ended up being the case:

However, there has been generally positive correlation between the two, even as Bitcoin held up better. Bitcoin has been in a volatile sideways choppy price pattern ever since spring 2021, around the time when Ark and Ark-style stocks started to roll over. Bitcoin didn’t fall and keep pushing down to lower lows like Ark stocks did, but it did basically consolidate sideways throughout most of 2021 after a strong year in 2020.

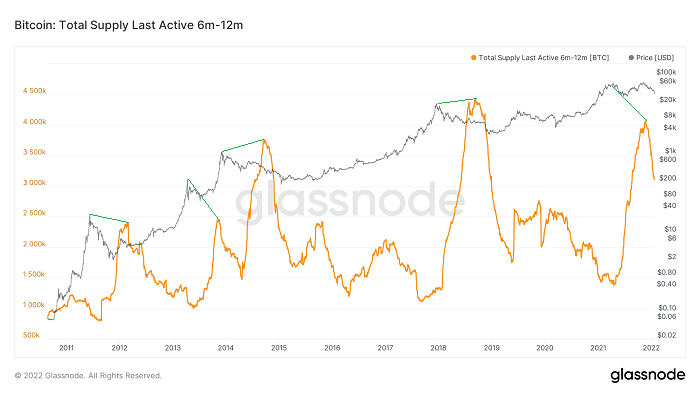

Demand for bitcoin peaked along with Ark stocks back in Q1 2021. Since then, bitcoin has been in a bear market in terms of demand. However, the supply side has been so tight (low new coin issuance, miners holding a big share of their own production, coins migrating to addresses with a low propensity to sell, a cultural trend of dollar-cost averaging, etc) that the price has remained somewhat elevated despite that weak demand, and even managed to briefly touch new all-time highs during that period.

This chart shows the price of bitcoin in black along with the percentage of the on-chain supply that moved within the 6-12 month ago period in orange (which shows up with a 6-12 month lag). We can see that a lot of coins changed hands during the Q1 2021 period, just like other major spikes in the price:

Chart Source: Glassnode

Basically, despite a lot of weakness recently, bitcoin has thus far held up somewhat better than other assets that it is correlated with. The tight supply side of bitcoin is currently like dry kindling, with no demand spark. Whenever that demand spark comes, I expect a big leg up in price. But right now, the market is in a risk-off period with PMIs rolling over, equities losing momentum to gold, and so forth. It’s not the best market for bitcoin to do well, so I am intermediate-term neutral. I expect a lot of choppy price action for a while.

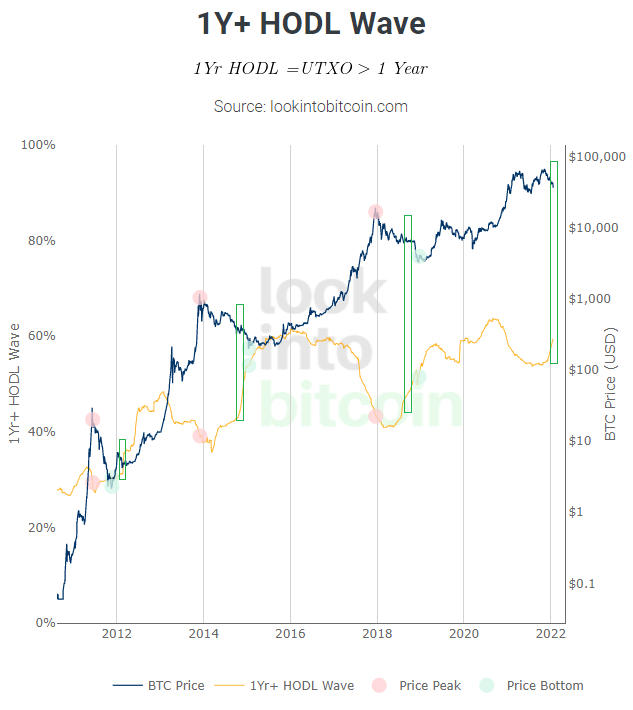

If we look at the percentage of on-chain bitcoin owned by addresses that have held it for more than one year, it is rising significantly, which is common in bear markets. A lot of recent buyers who bought around the top have already sold out at a loss. Meanwhile, a lot of people who were waiting for a dip to buy bitcoin, will turn around and say that it’s too risky to buy now.

Whether the price starts to level out in the $30k+ range, or liquidates to a lower-low from here, will depend in part on the conviction of long-term holders. Back in 2018, for example, bitcoin started to find a price bottom of around $6k, but then as stocks sold off late that year, even a big chunk of long-term bitcoin holders capitulated and sold their coins, contributing to a sharp drop from about $6k to about $3k, which was the ultimate bottom for the cycle. I put some green boxes around the regions in Bitcoin’s history that were about 11 months after a price+demand peak with a rising HODL wave:

Chart Source: Look Into Bitcoin

The four prior major bull runs for bitcoin (2010/2011, 2013, 2016/2017, and 2020/2021) all occurred during years of rising PMIs in the US, meaning economic growth was accelerating. That macro setup isn’t in place for 2022. A weaker dollar could benefit bitcoin, and I think we’ll get some major bounces in price, but overall it’s looking like 2022 will probably be a year for bitcoin consolidation and choppy trading activity to build a base for the next bull move, rather than likely being a bullish year in its own right.

I continue to view dollar-cost averaging as the best way to get exposure to bitcoin for most people that want some.

And as a note, the financial media seems to have forgotten about the November 2021 Taproot upgrade already, which was a soft fork that the Bitcoin network went through, and the first major upgrade since Segwit in 2017. In particular, Taproot gives a lot of potential new functionality to the Lightning Network over time including more integration between stablecoins and Lightning. For Lightning developers, there is basically a firehose of potential things to work on and it’s a matter of prioritizing what to focus on.

A lot of private bitcoin-based companies raised large rounds of venture capital in 2021, and so they are very well-funded to continue development through this cycle.

Portfolio Updates

The portfolios are available in my Google Drive.

Newsletter Portfolio

-Sell the 4% stake in CCJ from the commodities pie. Increase GUNR from 12% to 16%.

-Reduce VWO from 28% to 24% of the international pie. Increase ILF from 10% to 14%.

Fortress Income

-Reduce VIGI and IEMG from 25% to 21% of the ETF/CEF pie. Add an 8% position in ILF.

This spreads out the international exposure a bit more towards Latin America. An 8% position in the 30% ETF/CEF section of the portfolio represents just 2.4% of the total portfolio.

ETF-Only Portfolio

-Reduce RSP from 18% to 16%, and VWO from 15% to 14%.

-Add a 3% position to EWZ.

No Limits Portfolio

-Sell 50 shares of VWO, sell 20 shares of ITOCY. Buy 150 shares of EWZ.

I continue to like the broad emerging markets ETF (VWO). Itochu (ITOCY) has done its job as a relatively low-volatility Japanese value holding. However, I’m trimming both a bit to allocate to EWZ, a deeper-value play that focuses on Latin American emerging market equities.

Broad emerging markets ETFs have a lot of Taiwan/tech exposure, and some of them (but not VWO) have a lot of South Korean (more tech) exposure. I want a bit more Brazilian exposure.

Top 12 List

-No current changes.

Other Holdings

-Buy more EWZ.

Brazilian Equities Analysis

Brazilian equities had a rough time during the second half of 2021. However, they are showing some initial signs of having bottomed in dollar terms. Here’s the iShares MSCI Brazil ETF (EWZ):

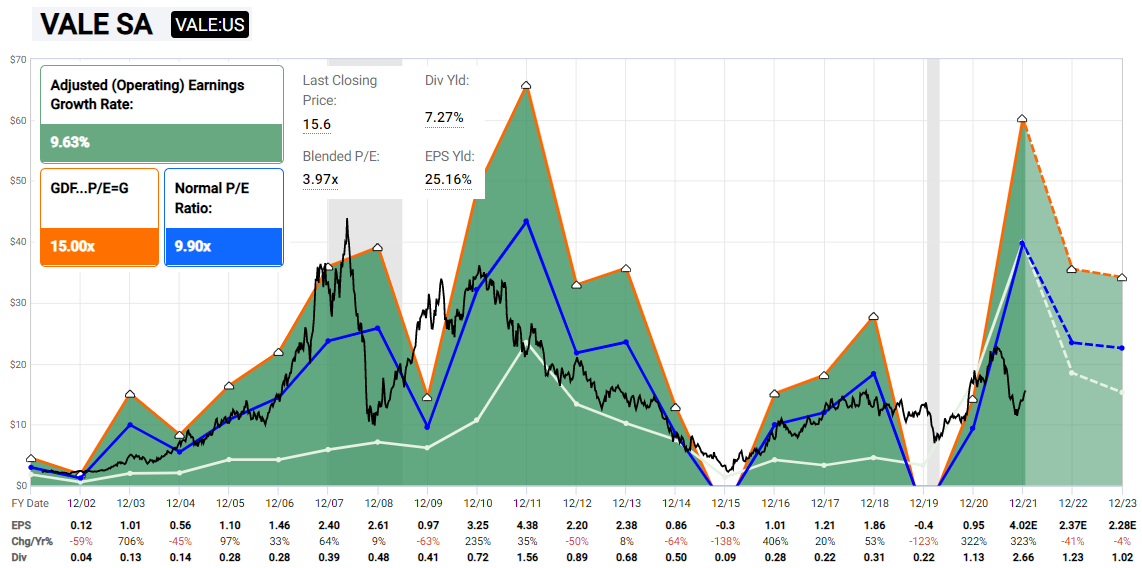

The top stock in the ETF is Vale (VALE) trading at a price/earnings ratio of about 4x. However, as a highly cyclical company, the price/earnings ratio can be a bit misleading. Looking at 2023 earnings that are expected to be lower (after a tremendous spike in iron prices wears off), VALE has a forward price/earnings ratio of about 7x.

Chart Source: F.A.S.T. Graphs

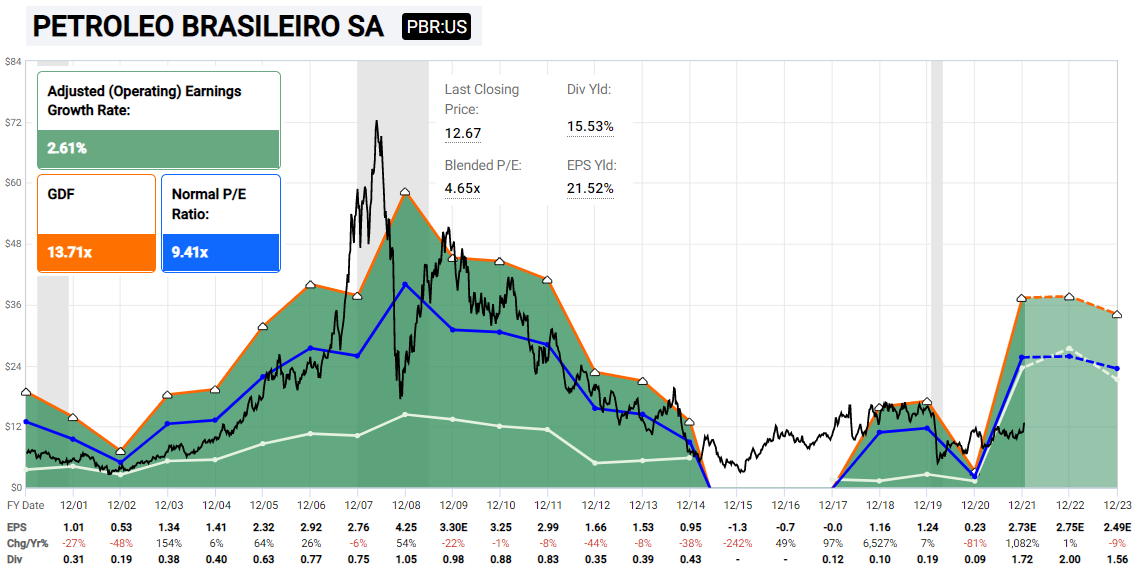

And then there is Petrobras (PBR), trading at under 5x earnings, and consensus analyst expectations are for earnings to be relatively flat over the coming years.

Chart Source: F.A.S.T. Graphs

Both of those companies pay out high dividends.

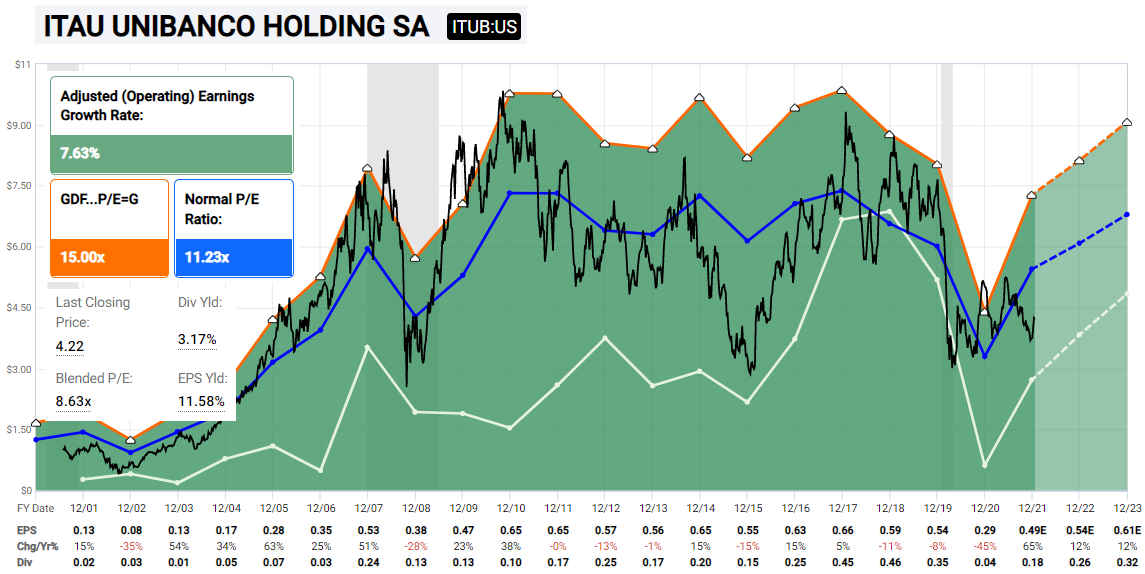

And then there is Itau Unibanco (ITUB), trading at under 9x earnings, and under 7x estimated forward earnings as analysts expect a rebound.

Chart Source: F.A.S.T. Graphs

All of these companies have risks. Vale is barely investment grade, and the other two are non-investment grade. And the government could come in and change the rules on them, to deal with fiscal problems.

However, Brazil can be thought of as a deep value play. Since it is heavily tilted towards materials, energy, financials, industrials, and consumer staples, its index is very weighted towards value sectors. And Brazilian equities would likely be one of the biggest beneficiaries of a weaker dollar in the years ahead, if that were to occur.

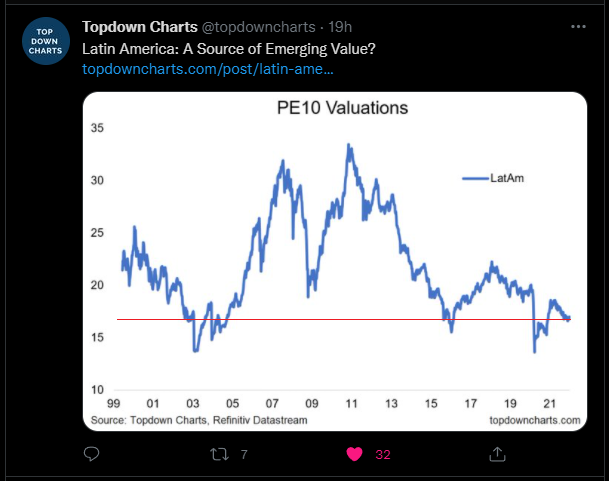

If we look at Latin American equities (ticker: ILF) more broadly (of which 60% are Brazilian and 25% are Mexican, with the remaining 15% being everything else), they are trading near their all-time low multiples of cyclically-adjusted earnings:

Chart Source: Topdown Charts (red line annotation by Lyn Alden)

It’ll be volatile. It’ll be uncertain. I wouldn’t over-allocate to it. But I’m cautiously bullish on Brazilian equities here including both ILF and EWZ as ETF ways to play it.

Brazil’s Dollar and Oil Correlation

Brazil is a commodity-oriented country, and like many emerging markets, has rather high dollar-denominated debts. As the world economy keeps going through these big boom/bust commodity cycles (tied partly to growth/demand cycles and partly from capex/supply cycles), as well as dollar strength cycles, Brazil’s economy and stock market is similarly subject to huge boom and bust periods.

When the dollar strengthens sharply, it increases the value of Brazil’s dollar-denominated debts relative to their local currency, which is a crushing blow. Simultaneously, a strong dollar shoves down commodity prices. The Brazilian equity index, consisting in large part of commodity producers and banks, gets slaughtered.

The opposite can happen if the dollar weakens and commodities enter a structurally bullish period.

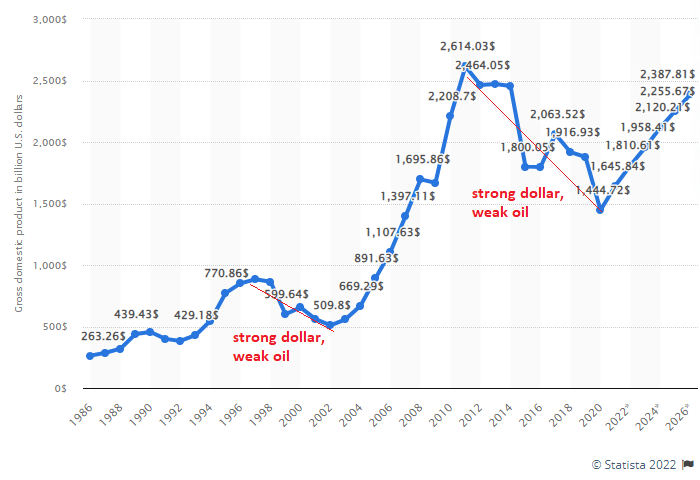

Here’s Brazil’s GDP in dollar terms. There are some IMF forward estimates on there, which we can mostly ignore. Mainly I’m showing this for the past:

My long-term base case is for higher oil prices and a weaker dollar in the 5+ years ahead, so apart from country-specific risks, Brazil looks reasonably attractive after a long stretch of underperformance. It only takes a tiny percentage of capital to flow out of US large cap equities and into emerging markets for Brazilian equities to do well over a multi-year stretch.

Inflation and Policy Tightening

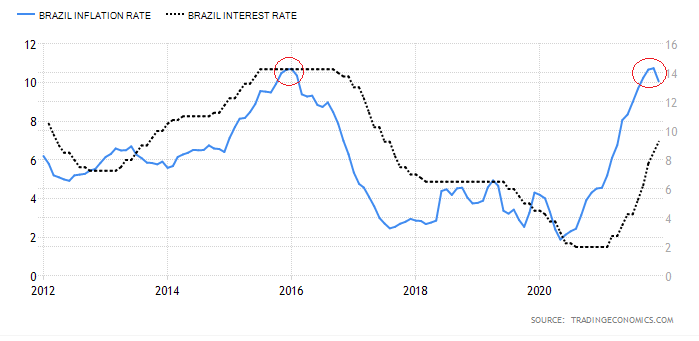

Brazil had high inflation last year, like most countries. And like many emerging markets had to do, Brazil’s central bank tightened their policy rate. In fact, they increased it from 2% to over 9% last year, which put a lot of pressure on equity valuations and financial conditions.

However, inflation in Brazil is showing signs of stabilizing. That’s an interesting bullish catalyst:

Chart Source: Trading Economics

The last time that inflation in Brazil reached this level and rolled over, which allowed their central bank to stop increasing rates, was in early 2016. That also happened to be the ultimate price bottom for EWZ within the past 15 years:

As developed market domestic stimulus fades during 2022 and thereafter, it relieves some inflation pressures for the moment. Brazil already front-ran the US Federal Reserve in terms of monetary tightening, and a lot of bad outcomes are already priced in for Brazilian equities.

Brazilian Elections

Brazil has a presidential election in October 2022. The incumbent Bolsonaro is currently behind in the polls compared to his opponent Lula, who was previously president from 2003-2010 and then was convicted of money laundering in a controversial trial for which he spent time in prison during 2018 and 2019.

Lula is on the political left, representing the Worker’s Party. Bolsonaro is on the political right, and is formerly of the military.

Naturally, this gives quite a bit of uncertainty regarding market performance. Global investors tend to prefer somewhere in the ballpark of center-right outcomes during election season in various countries because they perceive them as more protective of capital markets.

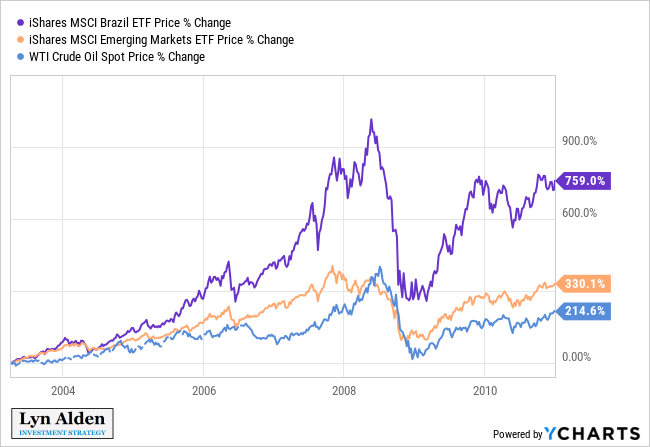

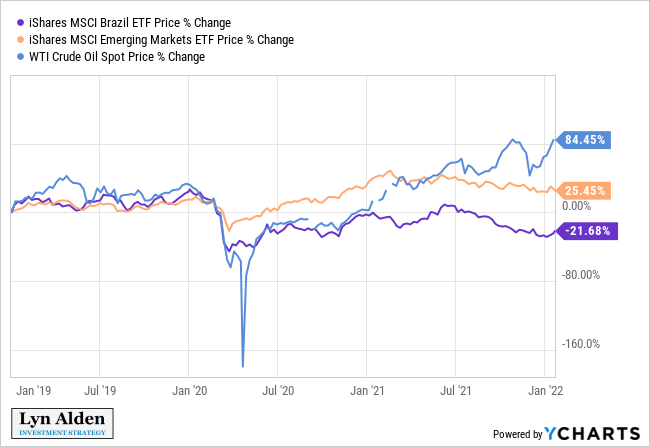

However, markets have a tendency to surprise people. During Lula’s previous two-term presidency from 2003 through 2010, Brazilian equities outperformed broader emerging markets in dollar terms and outperformed the price of oil:

And during Bolsonaro’s presidency so far, Brazilian equities underperformed broader emerging markets in dollar terms and underperformed the price of oil. Rather than benefiting from the resurgence of a strong commodity market in 2021, Brazilian assets continued to stagnate:

There are a lot of factors at play, with the natural resource cycle being one of the biggest factors over the long run. Do elections provide risk and uncertainty? Absolutely. However, they are not the only variable, and given how low investor sentiment is along with these other factors, I’m pretty bullish from the current point when looking out over the long run.

There are situations that could change that outlook, but until then, I like the risk/reward for the bull case as a small part of a diversified portfolio.

Brazilian equities already had a decent move to the upside to start the year, so from a short-term traders’ perspective, I’d expect a pullback or consolidation. However, I’m looking out potentially years for this position, not weeks or months.

Summary Thoughts

Starting in December of last year, I began laying out a defensive outlook for major US stock indices in 2022, as the Fed pulls back monetary stimulus and Congress pulls back on fiscal stimulus.

Since then, we’ve had more confirmation on that with PMIs rolling over as well. The next phase is to see headline price inflation peak by the end of this quarter most likely (although since it’s reported with a lag, we may not see it until the second quarter). The S&P 500 closed below its 200-day moving average here in January, for the first time since mid-2020.

There are many assets out there that I think remain expensive and are looking heavy at their current prices, such as Apple (AAPL) and Tesla (TSLA).

Some of the Ark-style stocks that already fell 50-80%, however, are looking interesting at these levels, although I’m not inclined to buy into a falling knife price pattern. We’ll probably see some big bounces from such oversold levels, but only the highest-quality ones with network effects interest me. I’ll be monitoring some of these stocks for signs of capitulation.

Bitcoin is an asset that I like for the long-term, but considering that its four prior major rallies occurred during US PMI expansions (2010/2011, 2013, 2016/2017, and 2020/2021), the year 2022 is shaping up to be a challenging year for the asset as it probably chops around with violent price rallies and sharp drops. A weaker dollar could benefit it, but a weak US stock market would probably continue to pressure it. It’s a traders’ market for bitcoin, and suitable for dollar-cost averaging.

On the other hand, emerging markets equities, such as in Brazil and China, appear to have reasonably bullish setups, after they got a lot of pain out of the way in 2021. Gold is starting to look attractive again, and defensive dividend-paying US value stocks in general (healthcare, energy pipelines, tobacco stocks, etc) continue to look like decent places for capital allocation.