Deep Dive: Macro Update, SBF Post-Mortem, Brazilian Equities

The macro section of this report covers the latest inflation data, moves in the dollar index and gold, business cycle updates, and other topics.

The digital asset section covers the ongoing industry fall-out from the FTX/Alameda implosion.

The equity section provides one more update on Brazilian equities, now that election results are in.

Macro View

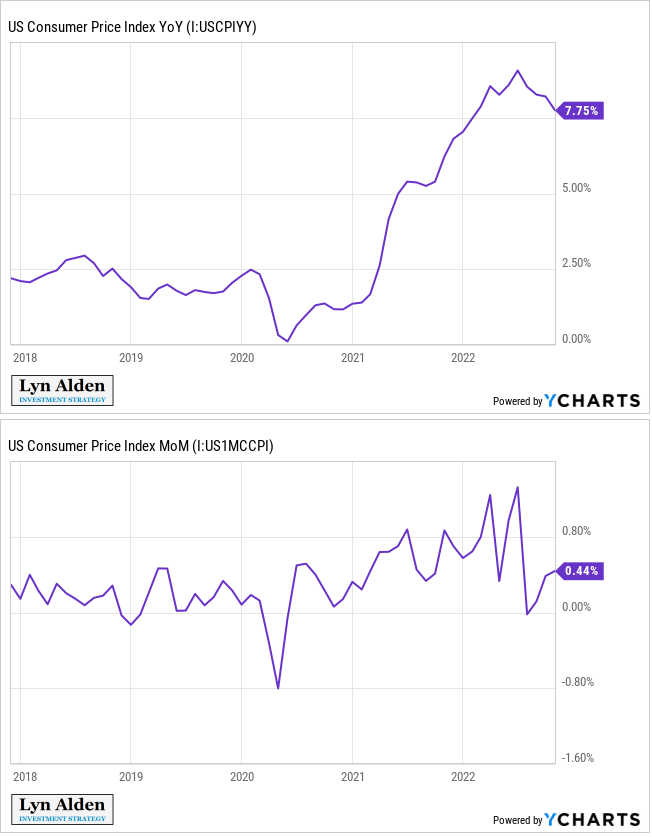

Last week, the monthly inflation print for the US came in below expectations, which was one of the few times it has done that over the past 18 months.

Here’s the year-over-year and month-over-month CPI:

Chart Source: YCharts

For a while, I have been writing about a likely disinflationary cycle, within a broader inflationary trend. We’re firmly in that disinflationary cycle now.

The challenge, of course, is that this is largely due to demand slowdown rather than supply improvements.

And not all types of inflation are the same. Going forward, I remain concerned about energy inflation especially. If China opens back up, and if the US stops drawing down its Strategic Petroleum Reserve, then there could be a severe oil shortage during the next growth cycle due to a lack of production improvements.

This chart shows the severity of China’s recent economic stagnation due to recurring lockdowns and real estate deleveraging:

Source: Patrick Zweifel, Pictet Asset Management

The charts for Chinese construction activity look similar. Less consumption and less construction activity reduces China’s oil consumption around the margins.

In addition to tight energy supply, US labor price inflation is likely to continue to be sticky for many blue-collar categories. From the 1990s until 2020, we have been in a period of globalization, where countries with capital met with countries with labor and formed deals. In recent years, that has been in structural stagnation, and possibly reversal. The Fed seems intent on trying to slow this down but some of it is outside of just a monetary phenomenon.

On the other hand, I am less concerned about specific supply chain bottlenecks associated with COVID-19 lockdowns and rapidly shifting consumer behavior. That period is mostly behind us now. This could be revisited, however, if something more abruptly disrupts the massive amount of trade that occurs between the US and China. As these categories decline in price, many financial media pundits will claim disinflationary victories, and they will be partially right.

But the real issue, in my view, is energy. Energy shortages, along with deficit monetization and a weaker dollar, is the combination that I am most concerned about regarding the next inflationary wave after the current disinflationary cycle of monetary tightening and demand destruction.

Dollar and Gold

The dollar index has been in a downtrend recently, breaking its 2022 upward momentum on the weekly chart:

The recent inflation print strongly contributed to this. If inflation begins falling, the Fed is more likely to slow down its interest rate hikes, and so the market begins expecting a slightly less hawkish Fed, and thus a weaker dollar.

A number of assets rallied on recent CPI weakness and dollar weakness. The Nasdaq had one of its best days this year, and gold rallied sharply. Here’s the gold chart:

That’s a notable momentum shift for gold, and something to be aware of to see if it sustains that trend-change or not. My base case for the moment is that the gold bottom is in.

The way I would describe this is that we are likely reaching peak Fed hawkishness in rate-of-change terms, even though high absolute hawkishness (higher interest rates and ongoing balance sheet reduction) is still going to occur. In other words, the Fed might have one more 75 basis point hike and then shift to smaller hikes, or it might step down to a 50 basis point increase in the next meeting.

Mixed Messages

Monetary tightening takes a while for its effects to trickle through the economy. Mortgage-industry layoffs began a while ago. Tech-industry layoffs and hiring freezes continue to occur, and these workers tend to have high incomes. Other parts of the labor force are more mixed, but in general, it’s white collar labor that is facing the brunt of the layoffs. As this grinds on, more and more households and businesses will need to refinance low-yielding debt into high-yielding debt, which redirects their cash flows towards debt servicing.

The yield curve continues to be inverted, which suggests that recession is likely to occur in 2023.

All of that is bearish for the economy.

However, the Atlanta Fed is projecting a strong Q4 2022 of real GDP growth. It’s higher than my prior expectations were for this quarter, but that’s what the data currently say.

The copper/gold ratio agrees with the Atlanta Fed. Generally when copper is rising relative to gold, it represents increased economic activity. And indeed, copper has been in a mini-uptrend relative to gold lately:

I put the ISM purchasing manger’s index chart there as well, because usually those PMI cycles correlate heavily with the copper/gold ratio, however at the current time the copper/gold ratio is pointing up while the ISM PMI remains in a downtrend.

Overall, until more data come in, I would say that the data suggest a decent economic finish here for 2022, but with likely weakness ahead for 2023.

Treasury Borrowing Estimates

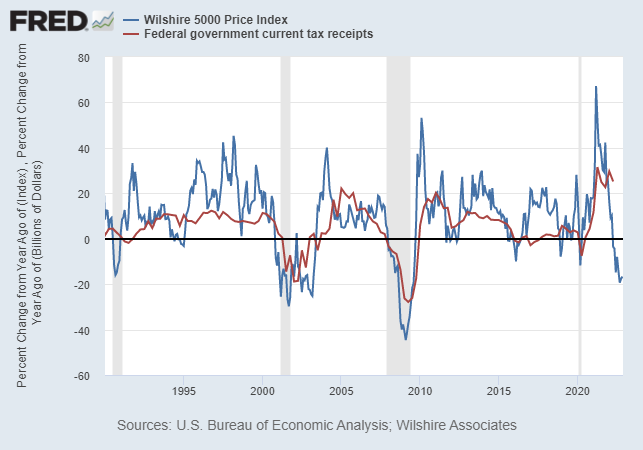

US tax receipts tend to correlate with US asset prices on a lag. Asset prices performed very well in 2021, and so did tax revenue. As asset prices fell sharply in 2022, tax revenue growth stagnated but has not yet fallen sharply, as of Q2 (the latest quarter of full tax data). Signs are pointing towards a weakness in tax revenue in the current and future quarters.

This chart shows the Wilshire US stock index vs US federal tax receipts, in year-over-year percent change terms:

The US Treasury announced on October 31st that they expect an additional $150 billion borrowing in this quarter (Q4) compared to what they previously estimated for this quarter. Overall, the US Treasury expects to have $1.128 trillion in net borrowing just for Q4 2022 and Q1 2021 combined, which is rather high for a two-quarter period.

The FT published a good piece the other day about US Treasury market illiquidity, the high amounts of projected forward supply, and the dearth of buyers.

Whiteley says a trader used to be able to get hold of $400mn of US Treasury bonds — not an outsize quantity in this $24tn market — as a routine matter. But now that typically involves breaking up the order into smaller chunks; perhaps doing $100mn of the trade electronically, he explains, and then picking up the phone to see if they can prise the rest of the debt from the hands of Wall Street’s trading desks over the course of a day.

-The Cracks in the US Treasury Bond Market

Source: Jesse Felder, sharing a key FT chart

Treasury market liquidity remains one of the potential constraints for how much the Fed can reduce its balance sheet, and high interest rates result in larger deficits due to a big expansion in the amount of interest owed on the debt as old maturities get refinanced at higher rates.

Digital Assets Note

The digital asset industry just experienced its biggest-ever implosion, with the bankruptcy of the FTX/Alameda crypto empire, and with apparently quite a lot of outright fraud involved throughout the run-up to it.

If this summer’s Luna/Celsius/3AC collapse was the crypto “Bear Sterns moment” (referring back to the 2008 financial crisis), this FTX/Alameda collapse was the equivalent of Lehman going down, with apparently quite a dash of Madoff/Enron involved as well. The full contagion through the crypto industry is still unclear as of this writing.

This digital asset section is longer than normal, due to the sheer scale of the events that happened over the past couple weeks.

The FTX/Alameda Collapse Timeline

In 2017, Sam Bankman-Fried (commonly called “SBF”) founded a crypto trading firm and market maker called Alameda Research, after he left his prior role at Jane Street.

In late 2018 and early 2019, they attempted to raise some capital. Documents for this fundraising attempt that were previously only shown to prospective investors were made public recently, and those documents had promised high returns and no risk, which is a red flag.

In 2019, SBF founded a crypto exchange called FTX, while continuing to own Alameda. Moving FTX offshore, or “shopping for jurisdictions” made it harder to regulate than an onshore exchange, although they had an onshore US segment as well. FTX created its own FTX token with a 2019 initial coin offering, with the ticker “FTT”. This token could be used for trading fee discounts and such, and some exchange profits would go towards burning the supply (kind of like share buybacks), and so it lets users speculate on the success of the exchange.

Over the next few years, FTX raised around $2 billion in traditional equity as well, including from blue chip investors like Sequoia and Temasek. FTX quickly became one of the largest crypto exchanges by volume, and had a private equity valuation of $32 billion. One of the early investors was Binance, by far the largest crypto exchange in the world.

FTX eventually changed jurisdictions from Hong Kong to the Bahamas. Despite large investments from prominent investors, there was little oversight, including no board seats from these outside investor groups which is highly unusual for a company of this size.

SBF became a media darling, cultivating an image of altruism. He also became one of the largest political donors in the US, and had close relationships with regulators. FTX paid to gets its name on stadiums (one of two main crypto exchanges to do so), and got Tom Brady as a major spokesman. Binance eventually cashed out its stake in FTX, in the form of stablecoins and FTX tokens.

In April 2022, FTX hosted a conference called Crypto Bahamas (to which I was invited but declined to attend), with Bill Clinton and Tony Blair as speakers among many others. SBF’s empire was riding high, with stadium naming rights, leading athlete and celebrity endorsements, former world leaders speaking at their events, the ears of regulators, and positive media attention.

SBF generally critiqued bitcoin, focusing on all sorts of other cryptocurrencies instead, especially Solana. As part of this, he often made arguments in favor of proof-of-stake consensus rather than proof-of-work, and this tends to go over well with the media. He was less interested in decentralization than he was in speed.

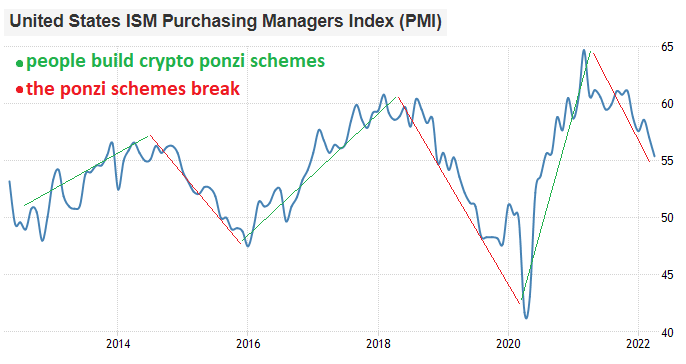

In May 2022, the Terra/Luna crypto ponzi blew up, which brought down Three Arrows Capital, and a number of lenders that had exposure to Three Arrows Capital. I had warned a number of times about Luna ahead of time in my reports, and then wrote a post-mortem public article about it called Digital Alchemy.

The main chart from that piece emphasized that crypto ponzis tend to blow up when economic activity is weakening and liquidity conditions are tightening:

Chart Source: Trading Economics, annotated by Lyn Alden

This blow-up across the crypto lending industry in the spring of 2022, triggered by the collapse of Luna, was the crypto industry equivalent of the Panic of 1907, where a bunch of leveraged speculators went bankrupt, bringing the whole banking system to its knees, at a time when there was no central bank to print money.

During the Panic of 1907 liquidations eventually ended when John Piermont Morgan used his capital along with the organization of other bankers to backstop the system as a pseudo-central bank. SBF publicly positioned FTX/Alameda in this JP Morgan role in summer 2022, providing liquidity to failing crypto lenders, which helped restore confidence in the industry.

However, not all was as it seemed. FTX/Alameda was hurt by the Luna collapse as well, at least in terms of reduced liquidity (and probably worse), but turned towards drawing on customer funds to get through it and hide it. They bailed out some of their own lenders, and also seemingly convinced firms they bailed out to transfer assets over to FTX. So, while positioning himself like John Piermont Morgan of 1907, SBF was really bailing out his own firms, was far weaker than he let on, and was pulling more capital into his own contagion.

According to Alameda’s CEO, Caroline Ellison, Alameda had taken on loans to make illiquid venture capital investments, and then when they couldn’t pay the loans, tapped into customer deposits to do so:

Meanwhile, at a meeting with Alameda employees on Wednesday, Ms. Ellison explained what had caused the collapse, according to a person familiar with the matter. Her voice shaking, she apologized, saying she had let the group down. Over recent months, she said, Alameda had taken out loans and used the money to make venture capital investments, among other expenditures.

Around the time the crypto market crashed this spring, Ms. Ellison explained, lenders moved to recall those loans, the person familiar with the meeting said. But the funds that Alameda had spent were no longer easily available, so the company used FTX customer funds to make the payments. Besides her and Mr. Bankman-Fried, she said, two other people knew about the arrangement: Mr. Singh and Mr. Wang.

This level of wrongdoing was not yet known to the public. In August 2022, Fortune Magazine put SBF on the cover with the headline, “The Next Warren Buffett?”

In September 2022, Sequoia published an article about their interactions with SBF, which they since deleted. Fortunately it’s archived by the Way Back Machine. If you want to read what is a (unintentionally) hilarious article, I suggest it. Sequoia is one of the largest and most successful venture capital firms in the world, and they were fawning over the fact that SBF was playing video games while taking a call with them, and considered him to be a genius with a grand vision.

In recent months, SBF began positioning himself in favor of anti-DeFi regulation (which indirectly benefits FTX, a centralized exchange). He also seemingly tried to turn regulators against Changpeng Zhao (commonly called “CZ”), who is the founder and CEO of Binance (the world’s largest crypto exchange), as well as being the wealthiest executive in the crypto industry and one of the richest people in the world.

On October 28th, SBF tweeted (and since deleted) “Excited to see [CZ] repping the industry in DC going forward! Uh, he is allowed to go to DC, right?” This sarcastic remark referred to the fact that CZ’s (far larger) Binance empire is offshore and also has unclear regulatory/jurisdiction details.

To put the sheer scale into perspective, CZ’s Binance has exposure all over the world and does about 8x the trading volume that Coinbase (COIN) does, with Coinbase being the largest onshore US crypto exchange. Binance also controls the fourth-largest cryptocurrency, Binance Coin, “BNB”. Additionally, CZ has the biggest social media following of any crypto executive/personality, with 7.7 million Twitter followers (more than Vitalik Buterin, Brian Armstrong, and SBF combined).

On November 2th, Alameda’s balance sheet was leaked to Coindesk, a crypto media company. And what it revealed was bad- Alameda held billions of dollars worth of highly-illiquid FTX tokens “FTT”. They also held billions of dollars of other illiquid tokens, particularly a lot of Solana-related assets. Meanwhile, they had serious debt levels. When the FTX tokens were factored out (after all, they were literally printed out of thin air by Alameda’s sister company FTX, and it would crash the price if they were ever sold), Alameda didn’t really have any equity. There was a significant lack of cash or bitcoin on the asset side of their books. They had soft assets and hard liabilities.

But it was still not fully clear- was that the full and real balance sheet? SBF of course dismissed growing concerns about his firm’s solvency by the market.

CZ went on Twitter on November 6th and reminded the market that Binance still held over $500 million worth of FTX tokens from their initial investment in the years prior. Citing the leaked balance sheet, he publicly said he felt it was prudent to sell them, and drew similarities between FTX tokens and Luna, spooking the market.

Alameda’s CEO, Caroline Ellison, publicly responded to CZ on Twitter (which was weird) and offered that Alameda would buy all of Binance’s FTX tokens directly for $22 each (which happened to be a major technical support level, below which there was nothing but air). CZ declined the offer, and began market-selling Binance’s FTX tokens.

That was a kill shot on FTX/Alameda. Speculators then piled on.

During November 7th and November 8th, the FTX token price unraveled. FTX and Alameda deployed their resources to try to prop it up, but it wasn’t enough. This wrecked the solvency of Alameda, as well as FTX’s own token. During these days, SBF kept saying the funds were safe, that there was no problem, etc. Many of those tweets have since been deleted. SBF spent these days trying and failing to raise capital from investors.

On November 8th, both CZ and SBF posted on Twitter, announcing that SBF reached out to CZ for help, and that CZ signed a letter of intent to have Binance acquire FTX, to help protect customer funds from the pending insolvency. However, the deal was non-binding and subject to due diligence. A day later, upon initial due diligence, CZ/Binance pulled out of the deal, since the situation was too far gone.

On November 11th, SBF’s FTX/Alameda empire declared bankruptcy. Billions of dollars of customer funds are now at severe risk, in bankruptcy proceedings and with a huge hole in the balance sheet. To add fuel to the fire, FTX was then also hacked for at least hundreds of millions of dollars, and some high net worth investors found legal loopholes in the Bahamas to pull some money out of the exchange despite the fact that withdraws were frozen. The whole situation is now being investigated by the US Department of Justice and other agencies. I believe “absolute shitshow” is the proper technical term to describe this situation.

The Solana blockchain has become heavily impaired during this process. FTX/Alameda held a lot of Solana-related assets, and puked them out during the downward spiral, crushing the prices. In addition, FTX custodies soBTC and soETH, the wrapped BTC and ETH tokens on Solana DeFi, and so those are now basically worthless. (Much of DeFi is not really decentralized; it’s heavily built around leveraging and trading custodial stablecoins and custodial wrapped assets). SBF and his FTX/Alameda empire were big investors and proponents of the Solana ecosystem.

Aside from the problems with Solana, several crypto hedge funds and a number of crypto project teams stored their assets on FTX, and are now severely impaired. The various crypto lenders that managed to make it through the spring/summer 2022 contagion are now impaired.

Even Genesis, which is at the core of the crypto lending ecosystem and is used by all sorts of other services to offer yield products to customers, halted withdraws as they seek to raise fresh capital.

On November 14th, amid crypto bank runs and a devastated crypto industry, CZ went on Twitter and declared that he would basically attempt a “JP Morgan 2.0” to backstop the flailing crypto industry as the biggest potential lender of last resort, referencing back to my Panic of 1907 comparison. As he put it:

To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis. More details to come soon. In the meantime, please contact Binance Labs if you think you qualify.

Also welcome other industry players with cash who wants to co-invest.

Crypto is not going away. We are still here. Let’s rebuild.

-CZ, November 14th

It remains to be seen if this will be effective or not. Binance is far larger than FTX/Alameda with tons of liquidity, and while CZ claims that Binance has no debt, their overall accounting is opaque as a private offshore company.

Tether also continues to process redemptions normally. They have issued statements claiming no exposure to FTX or Genesis. Tether always faces a significant amount of regulatory risk, but thus far it has seemingly not had its solvency or liquidity impaired by the spring/summer contagion, or this FTX contagion. My base case, and this is limited by the fact that private balance sheets only have a limited amount of clarity, is that Tether will not face solvency issues in this cycle.

FTX’s Apparent Outright Fraud

It’s one thing for failed trading firms to collapse due to bad bets and leverage. It’s another thing to commit fraud with customer funds. It looks like FTX did the latter.

Lawyers will be sorting through the FTX/Alameda rubble for years, so I’ll add a disclaimer that it’s all “alleged” and “appears to be” and “looks like” at this point, but there are countless reports about it now that the books are open, and Alameda’s CEO Caroline Ellison has outright admitted some of it.

It turns out that Alameda was a heavy borrower from FTX, and used their FTX tokens as collateral for loans. FTX had $16 billion in customer funds, and apparently lent over $10 billion in customer funds to Alameda, and Alameda is now insolvent. There’s a multi-billion dollar hole where customer funds are supposed to be.

Ellison said this began in the springtime after the Luna collapse, but it could turn out to have been occurring prior to that. There are allegations of software backdoors between Alameda and FTX, known only to SBF, Ellison, and senior executives, where funds could be transferred between FTX and Alameda.

In a recent Vox interview, SBF said that many customer deposits never really even made it to FTX. Apparently for years there was no segregation for customer funds. Customer funds sent to FTX would go through Alameda and often just stay there.

With what we know now, it’s arguable that FTX was basically a giant front for Alameda since FTX’s founding in 2019. The exchange was never particularly profitable despite being very large, and was apparently a source of cheap (and apparently fraudulent) capital for Alameda to trade with. FTX was leveraging user funds, unbeknownst to the users, as well as signing massive advertising deals, paying celebrities and world leaders, and making massive political donations with money they didn’t have.

This kind of thing would be almost impossible to do if it was a US onshore regulated entity.

For example, FTX has $1.4 billion in BTC liabilities and $600 million in ETH liabilities, but doesn’t own any BTC or ETH.

All of that customer demand for BTC didn’t actually go into BTC; it was just used by Alameda to trade crypto with. Those were fake BTC IOUs that customers thought they had. The FTX/Alameda empire was basically shorting BTC and ETH to trade other cryptos. Along with USD liabilities and other liabilities, there are billions of dollars worth of liabilities that FTX doesn’t have assets to pay.

Earlier this year, I noticed from on-chain analysis firm Glassnode’s data that FTX hardly held any bitcoin, unlike Binance, Bitfinex, Coinbase, Kraken, Gemini, and others that do clearly hold a lot of bitcoin according to Glassnode’s data. I had assumed that it was because FTX’s customer base was heavily interested in altcoins instead, but it turns out that some of their customers were indeed interested in bitcoin, but SBF wasn’t interested in actually holding any bitcoin for them!

A number of crypto hedge funds held assets at FTX, using that as their main exchange. A number of crypto development projects held their treasuries at FTX. Their funds are frozen now. The crypto VC industry will be heavily impaired amid the sell-offs. There have been bank runs on other sketchy exchanges, especially ones that are offshore with an attackable token. And as previously mentioned, the whole lender ecosystem has been essentially frozen.

The Silver Lining

The crypto industry is reeling from this, and the full contagion is not known yet.

Many bitcoin-focused proponents, however, have warned about this type of problem for years. SBF was basically the antithesis to the bitcoin ecosystem, and was instead a big proponent of the broader ex-bitcoin crypto ecosystem, especially centralized exchanges, proof-of-stake coins, and Solana specifically. And it turns out he was short bitcoin by $1.4 billion with customers’ funds at risk, due to not holding any for his customers and instead using those funds for leveraged crypto trading.

To many industry outsiders, it’s all one industry. Within the industry, however, there are significant separations. There is a large bitcoin-focused ecosystem that considers the multi-crypto ecosystem, and especially entities like SBF, to be among their primary opposition. The bitcoin-focused ecosystem emphasizes self-custody, long-term holding, limited or no trading, no offshore unregistered securities, and a focus on payments and savings.

There has basically been this giant, leveraged, rehypothecating, parasitic casino crypto industry built alongside bitcoin for years, and now a big percentage of it has imploded or been heavily impaired.

I’ve been critical of most coins in the digital asset industry, outside of bitcoin and stablecoins. My Digital Alchemy piece was a summary of it, in addition to other articles I’ve written. Here’s what I said about the state of crypto VC earlier this year (with a note that FTX was one of two big crypto companies with stadium naming rights, and underwent significant digital seigniorage with its own FTX tokens):

Bitcoin-Focused Startups

VCs and developers that build things on top of bitcoin today are consciously forgoing digital seigniorage when they do so.

Projects in the bitcoin ecosystem tend to have a pretty high utility-to-speculation ratio, meaning they are trying to solve real-world problems rather than focusing on speculation or financialization. Bitcoin-focused companies tend to work on things like collaborative custody solutions, better wallets, payment solutions, peer-to-peer information transfer, mining-related liquidity provision, and so forth.

Startups in this bitcoin-only industry use the established startup route of issuing normal illiquid seed and venture equity with a long-term exit horizon, rather than initial coin offerings. The Impervious browser is a good example; this is a company that is basically offering all the popularized applications of Web3, but doing so without a speculative token attached to it and instead is just doing it on the bitcoin network. Have most people heard of it yet? No.

The downside of this long duration approach is that the seed/venture deals in this ecosystem are much smaller; we likely won’t see bitcoin-only firms named on major sports stadiums any time soon like what we’re seeing with broad crypto firms. And without a speculative incentive mechanism, it generally means slower adoption based on needs, rather than immediate adoption based on arbitrage opportunities and VC-funded temporary incentives to get users in quick.

Altcoin-Focused Startups

In contrast, VCs and developers on more recent blockchains tend to emphasize more speculative sorts of things, like DeFi, play-to-earn gaming, NFT trading, paid incentives for initial use, and so forth.

Going the token route provides fast exit liquidity for VCs, in contrast to traditional long illiquid holding periods for startup seed/venture investors. It also creates gambling/gaming opportunities to incentivize speculators to participate from the day of launch.

This approach pays off bigger in the near term, with much more capital raised for these types of entities, and being able to afford naming rights of sports stadiums and that sort of thing, but a lot of what gets built becomes self-enriching rather than fixing an actual problem. It remains to be seen what percentage of the products built by this industry will have long-term staying power.

-Lyn Alden, April 3rd 2022 premium report

Some have been more blunt about it. Cory Klippsten, the CEO of Swan Bitcoin, has been publicly critical of SBF for a long time, and then began outright publicly calling him a fraud weeks before the FTX/Alameda collapse occurred, and before the Alameda balance sheet leak. This was after Cory warned about both Luna and Celsius prior to their collapses this spring/summer as well.

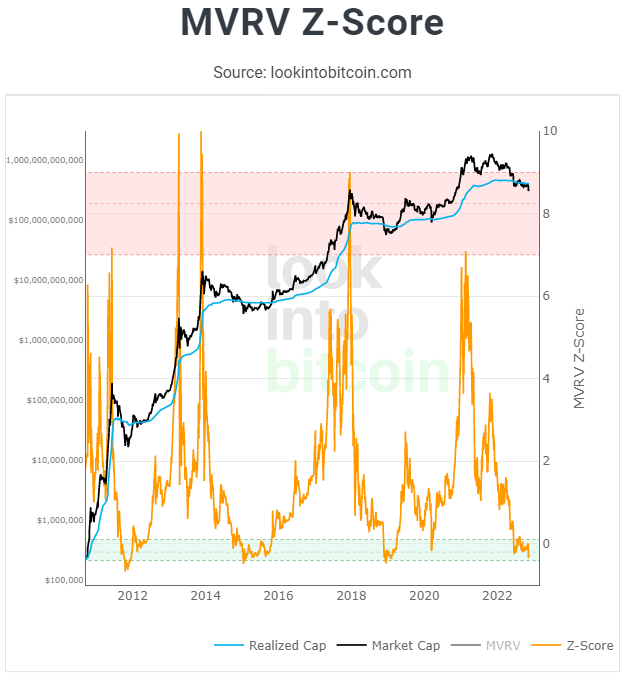

In the intermediate-term, this FTX/Alameda catastrophe has been bad for bitcoin’s price, resulting in a deep capitulation with high volume. But in some sense, all of this type of malinvestment had to eventually burn down anyway, so this was like ripping a band-aid off.

I remain bullish on bitcoin with a 3-5 year view, but continue to be uncertain for it in the months ahead due to macro headwinds. Proper position sizing continues to be important.

For people interested in holding a nonzero amount of bitcoin, I think it’s worthwhile to learn how to self-custody at least some of it. I think the Trezor T is a good introductory hardware wallet. Research the process before you do it, start with small amounts, and work up from there. This is a useful skill to understand the technology.

Another thing you can do is to download a Lightning wallet as a free mobile app. Wallet of Satoshi is the easiest one, although it’s custodial. You can then download non-custodial ones like Breez. You can transfer bitcoin from an exchange to your Wallet of Satoshi app, and then send it over the Lightning network to Breez in seconds. This can occur on your own phone, or can occur between users in different countries, since it uses entirely separate rails than the banking system (after onboarded to bitcoin). Getting used to these interfaces, and sending around a bearer asset that is entirely outside of the traditional banking system, is a worthwhile experience to have.

Most macro investors just view bitcoin as a speculative price chart, but the real power is the fact that you can self-custody a digital bearer asset with no counterparty risk, and send it anywhere in the world.

Lastly, I’ll point readers towards a recent note written by Ross Stevens, the executive chairman of NYDIG and the CEO of Stone Ridge, who tends to be a source of signal through the noise. In the note, Stevens reiterated why his multi-billion dollar Manhattan-based firm NYDIG is focused on bitcoin, and not other digital assets.

Therefore, in the strongest possible terms, I repeat, with humility: do not invest in non-Bitcoin crypto. Do not invest in non-Bitcoin DeFi. This is why NYDIG is a bitcoin company. Always has been, always will be.

-Through the Looking Glass: The FTX and Alameda Saga

Portfolio Updates

The portfolios are available in my Google Drive.

Newsletter Portfolio

-No current changes.

Fortress Income

-No current changes.

ETF-Only Portfolio

-No current changes.

No Limits Portfolio

-No current changes.

Top 12 List

-No current changes.

Other Holdings

-No current changes.

Brazilian Equity Update

My January 23, 2022 report made the long case for Brazilian equities, and I provided an update on September 18. Now that elections have taken place, I’m doing one more update here on Brazilian equities.

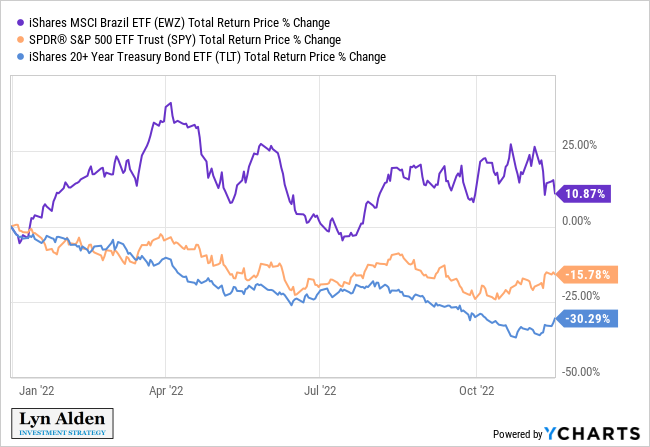

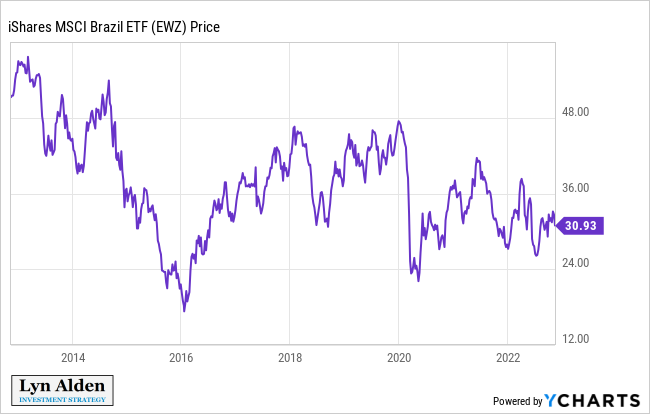

It has been a good year for Brazilian equities overall, shown here via the dollar-denominated ETFs:

Brazil’s former President Lula defeated current incumbent President Bolsonaro in a very close election result, and therefore will become President for a non-consecutive third term. Bolsonaro did not concede defeat, and protests in support of Bolsonaro erupted in many parts of the country based on claims of election fraud. Bolsonaro did, however, begin the process to transfer power despite not conceding defeat. A week ago, the Brazilian military released a report saying that while they couldn’t completely rule out the possibility of it, that they found no signs of election fraud.

The base case, therefore, points towards a peaceful transition of power.

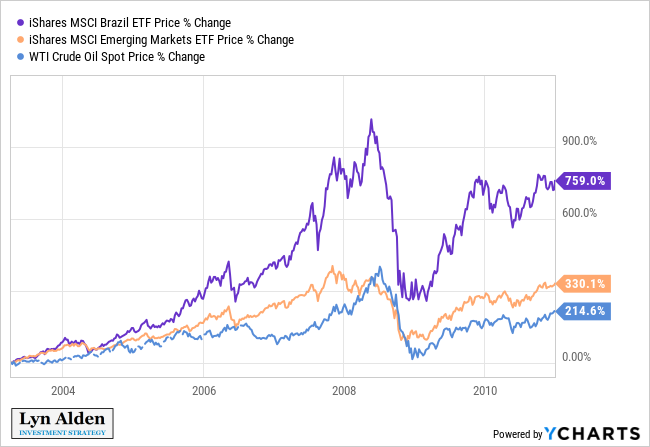

Some investors have expressed concern about what a Lula presidency means for asset prices. While of course we cannot know for sure, we can look back on his prior two-term administration and see how they did:

Lula’s prior time in charge, from the start of 2003 to the end of 2010, benefited from a structural bull market in commodities and a weakening dollar. Equities were cheap at the beginning, and expensive by the end.

The story since 2014, however, has of course been a lot rougher for Brazil. The strong dollar and low commodity prices (until recently) resulted in what as an outright economic depression for the country, which they may now be emerging out of. The country has a lower dollar-denominated GDP now than they did a decade ago, which speaks to how challenging things have been.

I have a positive view on energy prices and many other commodity prices over the next five years due to supply-side underinvestment, and the dollar index has recently been very strong but is showing initial signs of weakness from that strong level. All of this suggests a solid foundation for good long-term performance of Brazilian equities, as long as the country’s international politics don’t derail that potential.

Inflation, Interest Rates, and Valuations

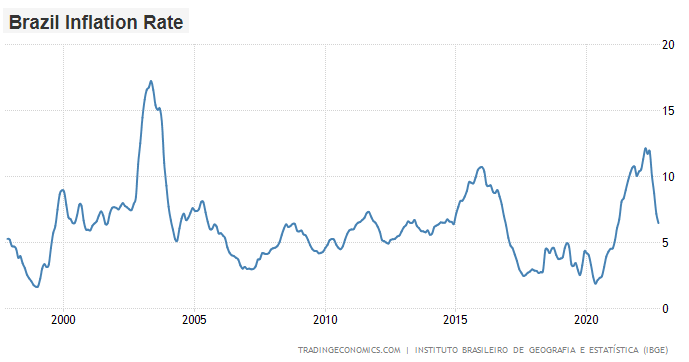

Brazil’s inflation rate is in good shape currently, rapidly rolling over from a price spike earlier this year.

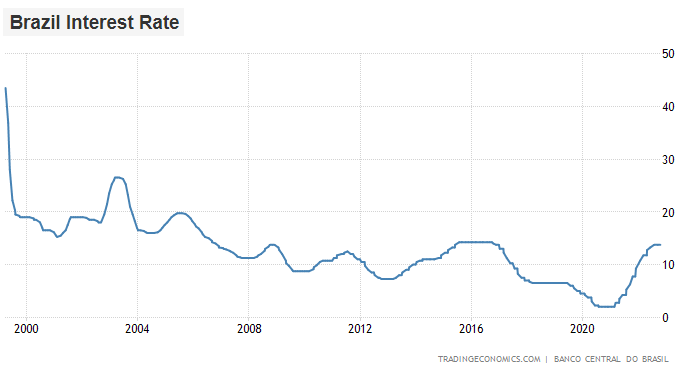

The Central Bank of Brazil was quick to begin raising interest rates in early 2021, front-running the Fed to protect their currency, and they ended up raising rates from 2% to nearly 14%. They are likely hitting the cycle peak at the current time, with strongly positive real rates already in place.

The last time rates reached a peak in Brazil was in late 2015 into early 2016, and that coincided with a significant bottom in Brazilian equities.

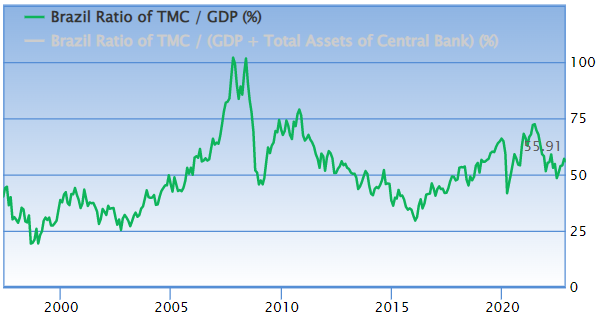

Brazilian equities in general aren’t quite as cheap as they were in early 2016 based on a variety of metrics, but they are aren’t in a bubble either.

Chart Source: Guru Focus

When we consider the fact that oil prices and many other commodity prices are a lot higher than they were in 2016, many of the companies are indeed extremely cheap. By many metrics including actual earnings, they could be considered cheaper than they were in 2016.

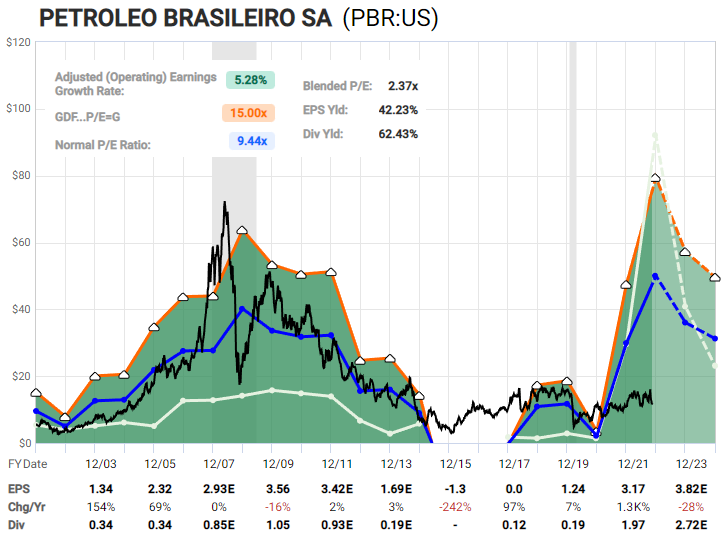

Petrobras (PBR), for example, trades at a low single-digit earnings multiple and offers a substantial double-digit dividend yield. It is shunned by investors, and barely participated in the energy rally:

Chart Source: F.A.S.T. Graphs

The dividend is going to come back down significantly, and earnings may not remain at these levels, but even if earnings get cut in half and the company pays out a quarter of its earnings in dividends, it’s still an attractively-valued a cash machine for years into the foreseeable future at these low share price levels.

However, there is no free lunch, and Petrobras is a junk-rated company with substantial political tail risk from the upcoming Lula administration.

Right now, despite very high earnings, its stock is priced similarly to how it was priced years ago when it had no earnings. I view the political risks as material but well-discounted, and so I like the company as part of the iShares MSCI Brazil ETF (EWZ). Obviously, I wouldn’t put capital that I can’t afford to lose into a company like Petrobras.

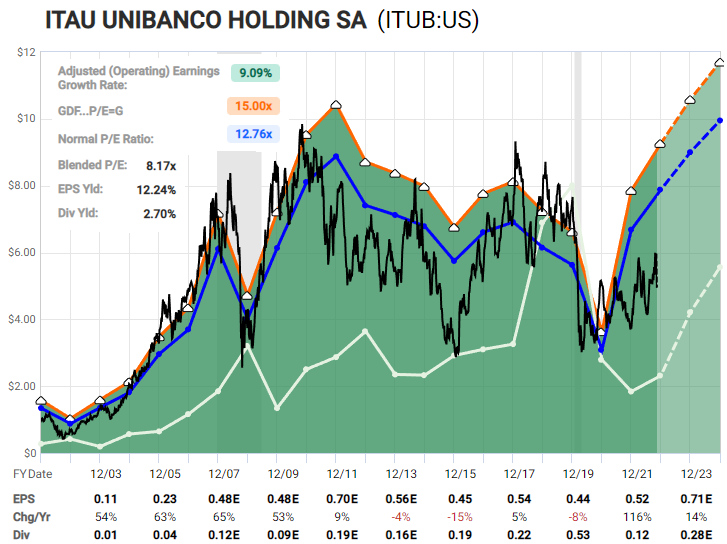

Brazil’s largest bank, Itau Unibanco (ITUB), has a triple bottom in place for its dollar ADR price. Since its third bottom, it has been making a series of higher highs and higher lows. Consensus analyst expectations point towards rising earnings and dividends in the next couple of years.

Chart Source: F.A.S.T. Graphs

This 2014-present economic depression has obviously been challenging for Brazil’s banking sector. Going forward, with what I think could be a multi-year commodity bull market that benefits Brazil’s economy, I view the big bank as offering interesting return potential as part of a Brazilian ETF.

There are plenty of other companies like these in Brazil. The MSCI Brazil index and its associated iShares ETF currently have an average price/earnings ratio of around 6x.

Debt Analysis

According to the Bank for International Settlements, Brazil has government debt-to-GDP ratio of 90%, household debt-to-GDP ratio of 34%, and corporate debt-to-GDP ratio of 51%. Putting it together, the government debt is on the high side for an emerging market country, but private sector debt levels are reasonable.

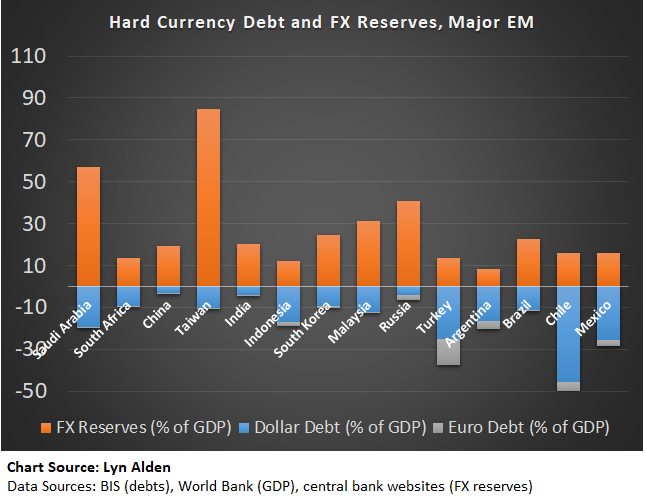

Each year I do a checkup on some select emerging markets to compare their FX reserves to their dollar-denominated and euro-denominated debts, and Brazil performs moderately well by that ratio. This chart is from this summer, although the data haven’t changed much since then:

Overall, Brazil faces risks associated with many emerging markets, with commodity prices and political interference being near the top of the list. The leading equities, however, are very cheap relative to earnings and dividends, discounting a lot of that risk, and Brazilian assets in general are under-owned by global investors.

I continue to view Brazilian assets to be a contrarian opportunity that could perform well for the remainder of the decade *if* they can avoid major tail risks or “own goals”.

Final Thoughts

In the concluding section of my October 30th report, I singled out Apple (AAPL) and Tesla (TSLA) as being expensive and with various headwinds against them. Their stock price charts also looked heavy, with negative momentum.

Since then, the S&P 500 has been flattish or mildly positive, while AAPL is down over 5% and Tesla is down over 18%.

While these stocks may occasionally rally from oversold conditions, my base case is that they’ll struggle to regain prior all-time highs for a number of years. Going forward, I think sector allocation will be very important, and that Big Tech isn’t likely going to be the best place to have much exposure.

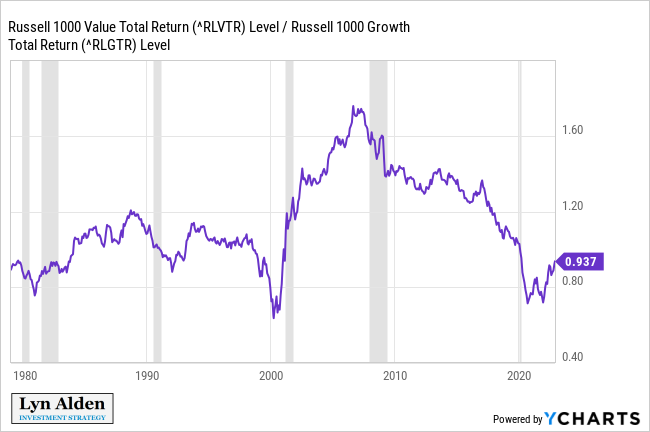

After significant underperformance in the 2010s business cycle, the value factor has been outperforming the growth factor since the 2020 market bottom. This chart shows the ratio of value stocks to growth stocks, and when it’s going up, it means the value factor is outperforming:

I think it’s likely that this value-to-growth ratio, inclusive of dividends, will continue to make higher highs and higher lows for a while.

Jurrien Timmer of Fidelity recently put out a great chart that compares the top 50 stocks in the S&P 500 to the other 450 stocks. When this line is rising, it means the mega-caps are doing better, and when it’s falling it means that the rest are outperforming. I expect this to generally keep heading flat-to-downward:

Source: Jurrien Timmer, Fidelity

The structurally low interest rate environment over the past decade has led to overinvestment in the high-valuation tech sector, and underinvestment in the low-valuation physical economy. I continue to view the 2020s decade as being one where investment in the physical economy will be the driving force for returns.