Deep Dive: Macro Update

The macro portion of this report provides an update on the virus, monetary policy, the recent jobs report, and overall risks of stagflation. It then moves onto an update for Bitcoin and Ethereum and portfolio updates. The second part dives into the uranium industry, which has some interesting developments.

Macro View

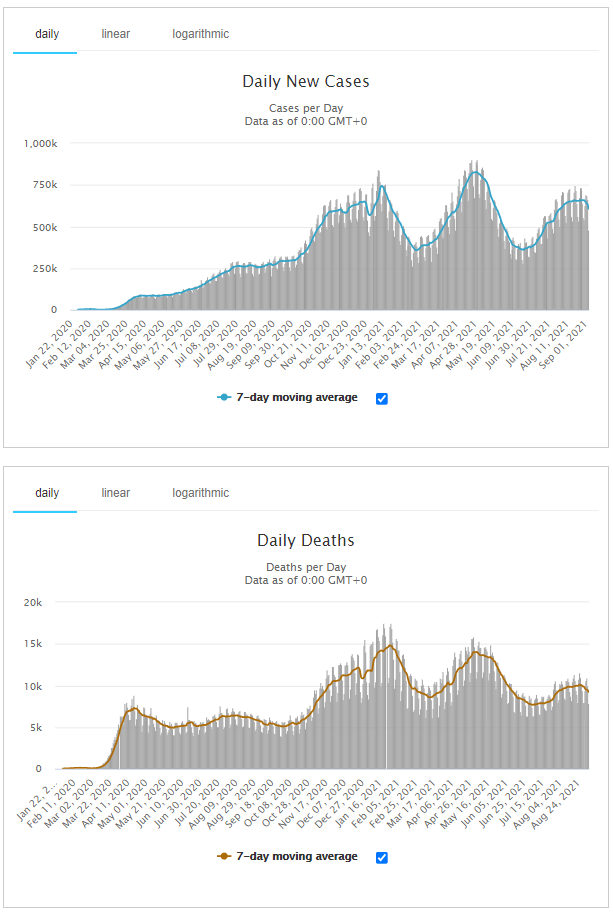

The current virus wave seems to have peaked in terms of global new daily cases:

Chart Source: Worldometer

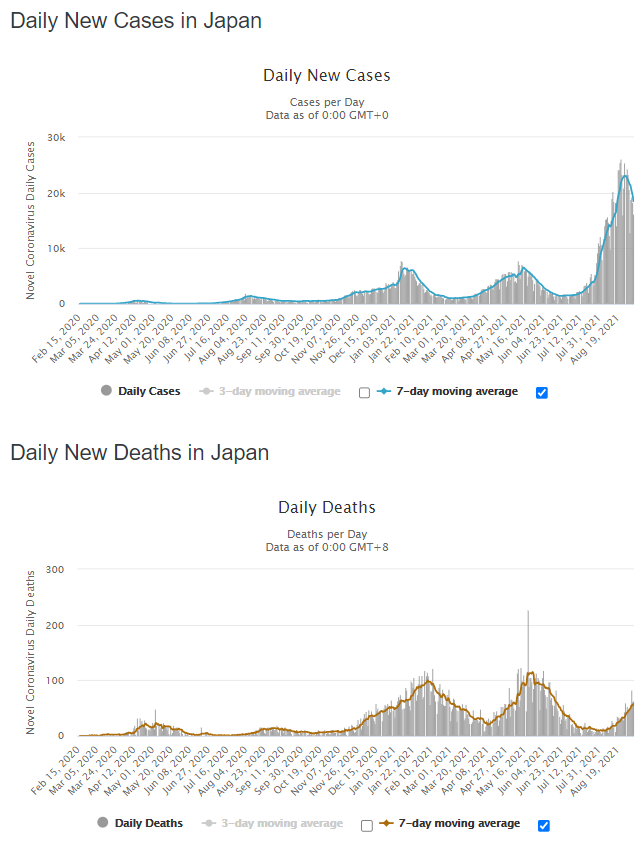

Deaths come with a bit of a lag but for example Japan looks to be over the peak:

Chart Source: Worldometer

Southeast Asia which was the epicenter of this wave, seems to be over the peak as well. Indonesia, Malaysia, and Thailand seem to be over the peak. Probably not Vietnam yet.

Monetary Policy Update

In my previous report, I discussed the upcoming Jackson Hole Symposium where central bankers from multiple countries gather annually. The big thing that participants were waiting for is to see if Chairman Powell would say anything clear on the Fed’s plan to taper asset purchases. My thoughts were:

I’ll be looking for comments from Fed Chairman Powell at the Jackson Hole event on August 27, since that has been the consensus day on when he might announce an asset purchase tapering plan. Recent comments by Kaplan and others have made that a bit less likely. All else being equal, a delay in tapering, if it were to occur, should be somewhat dollar bearish and gold bullish.

My base case, loosely held, is that the Fed will discuss conditions for tapering at the Jackson Hole event, rather than announce a specific tapering date. In other words, they might define more specifically what triggers in terms of unemployment and/or inflation would lead them to taper. If it works out that way, this would in some sense be a tapering delay, citing the delta variant.

-August 22nd report

And that’s pretty much what happened. A number of Fed officials came out with somewhat hawkish statements about starting taper right away and finishing early in 2022, meaning the Fed’s balance sheet would be flat from there. But Powell, in his key speech, struck a dovish tone. He emphasized that broad measures of unemployment are still high, labor participation is still low, that there remains uncertainty with the virus, etc. He talked about the appropriateness of eventually reducing asset purchases, maybe even this year, but gave no clear timeline. Basically, markets got the good-cop-bad-cop routine, with Powell playing the good cop.

The speech was well-written but strategically said very little. Basically, it explained the well-known risk of tightening monetary policy against transitory inflation effects vs the risk of being too slow and letting persistent inflation run hot.

He did make a couple things clear from his perspective. First, the Fed still isn’t committed to whether they will begin tapering their monthly rate of asset purchases within this year or not, and are looking at incoming data. They’re still emphasizing inflation as transitory, and labor conditions are improving but still unsatisfactory. Second, even when they do taper their rate of asset purchases, they will not raise interest rates until, to use his words, maximum employment is achieved.

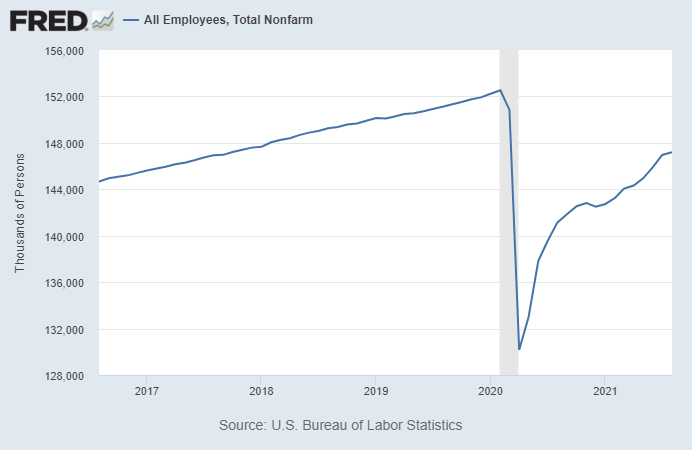

Disappointing Jobs Report

Friday’s monthly jobs report for this past month came in well below all polled economists’ expectations. Only 235k jobs were created in August, vs the consensus estimate average of 750k. Prior months were revised up slightly but not nearly enough to account for the gap. The big area of weakness was in service sector jobs, while other areas were okay, suggesting an impact from the delta variant and associated policy/behavioral changes around that.

Chart Source: St. Louis Fed

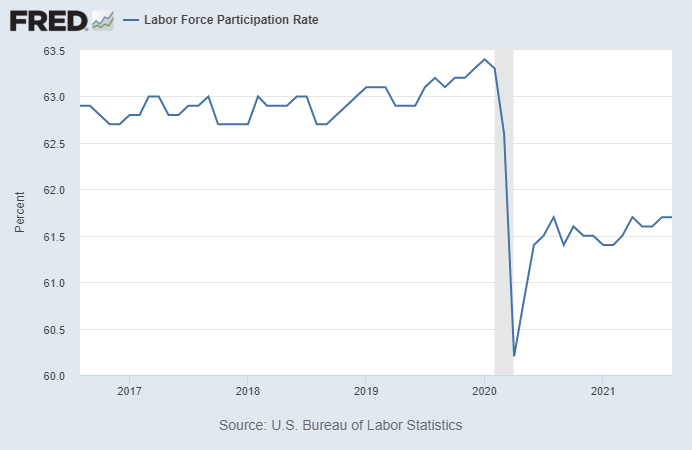

Official measures of unemployment ticked down a bit, but the labor participation rate remained flat at 61.7%:

Chart Source: St. Louis Fed

The US has had a lower labor participation rate than Japan for more than a year now since the pandemic began, despite Japan having a far older median age for the population.

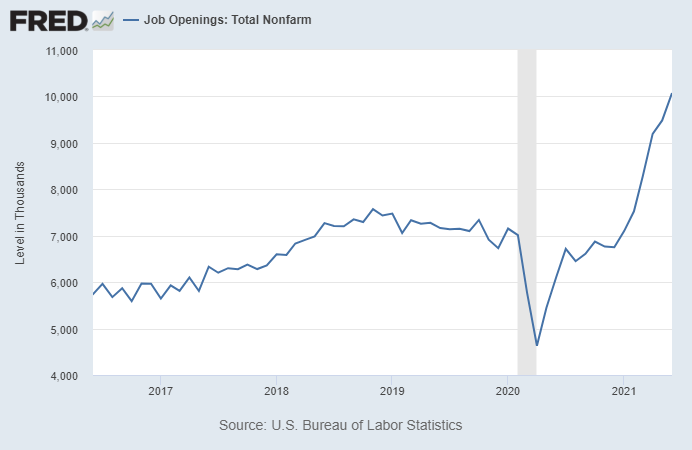

This is interesting, because the US does have a record number of job openings, and we have a well-known labor shortage especially among service staff in recent months:

Chart Source: St. Louis Fed

The Fed’s next FOMC meeting to potentially announce a tapering of asset purchases is on September 22nd, and this is the latest jobs report they’ll have until then. This reduces the probability that the Fed will announce a tapering of asset purchases at that meeting, although it does not rule out the possibility that they will. Their asset purchases likely are having limited effect at this moment anyway, now that so much excess liquidity is flowing back into the Fed’s reverse repo operations.

Upon the news of the weak jobs report, the dollar index declined a bit, precious metals had a strong bounce, and 10-year Treasury yields went up.

Why The Jobs Disconnect?

A common narrative for a while has been that because the federal government is paying enhanced unemployment benefits, it entices people not to work. Hence, labor participation remains low, despite job openings being at record highs, because people are paid to stay home. Sounds right.

However, many US states did cease providing unemployment benefits in May 2021, which cut off the federal aid in those states as well. As the WSJ recently reported, there was minimal difference in the rate of job creation from that point over the subsequent few months between states that ended the benefits and those that kept them:

States that ended enhanced federal unemployment benefits early have so far seen about the same job growth as states that continued offering the pandemic-related extra aid, according to a Wall Street Journal analysis and economists.

Several rounds of federal pandemic aid boosted the amount of unemployment payments, most recently by $300 a week, and extended them for as long as 18 months. The extra benefits are set to expire nationwide next week. But 25 states ended the financial enhancement over the summer, and most of them also moved to end other pandemic-specific unemployment programs such as benefits for gig and self-employed workers.

Nonfarm payrolls rose 1.33% in July from April in the 25 states that ended the benefits and 1.37% in the other 25 states and the District of Columbia, the Journal analysis of Labor Department data showed.

Now that the enhanced benefits all expired nationwide anyway as of this weekend, why should we care about this difference (or lack thereof) between states? Well, mainly because it shows that the labor shortage likely won’t magically fix itself overnight simply because the enhanced unemployment benefits go away, as half of the states have already shown for months now.

Instead, I think the labor shortage is more structural than that. Wages haven’t kept up with housing prices, healthcare, childcare, and other capital goods and services for a while. Hedonic adjustments and cheaper electronics/attire out of Asia that keep official CPI low, don’t make up for the fact that the essentials in life have gone up a lot. Now used car prices have increased a lot too.

Overall, I think the 2020s are shaping up to be a decade of higher average wage growth than the 2010s. Globalization (measured as global trade as a percentage of global GDP) has likely peaked for a while, wages haven’t kept up with the real cost of living, and it’ll take some financial enticement to get people back to full work levels and fill in the labor gaps.

That bodes bullish for inflation remaining above the Fed’s target level for longer than some analysts seem to expect, although we could get periodic dips along the way.

Cyclical Stagflation is Here

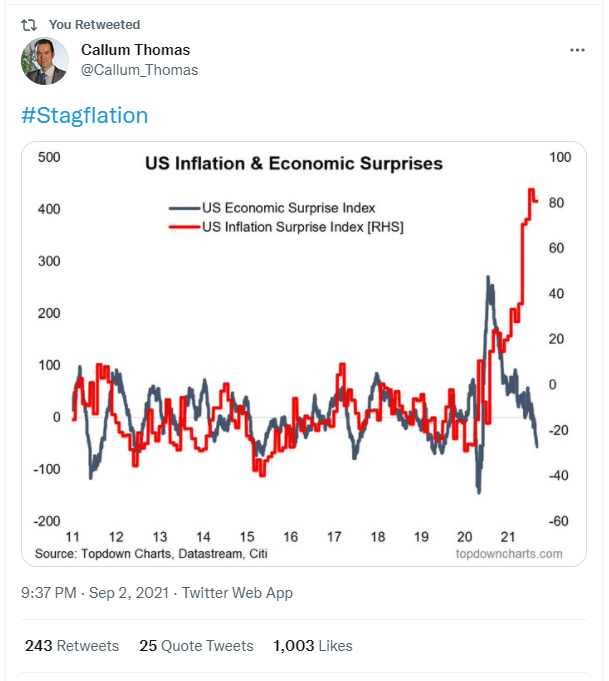

Economic reports have been surprising consensus economists to the downside, while inflation has been surprising them to the upside:

Source: Callum Thomas

Stagflation is a relatively rare situation (for developed markets) where economic growth is low but inflation is high.

The worst type of stagflation is when the GDP is actually contracting into a recession while inflation is running hot. A milder version of stagflation is when economic growth is positive but decelerating, while inflation is hot.

The second situation (mild stagflation) is happening now in the US. Most indicators of economic growth are slowing down, and some indicators like retail sales are in actual contraction, while inflation remains hot. It remains unclear how long this period will persist but that’s the current data.

The Federal Reserve has two mandates: maximize employment and maintain stable prices. Usually during recessions when unemployment goes up, inflation goes down due to declining demand for things, so the Fed becomes more simulative to try to improve the employment situation. And usually during economic booms when unemployment goes down, inflation heats up a bit due to rising demand for things, so the Fed tightens monetary policy to try to tame it.

But stagflation is tough, because employment isn’t maximized while inflation is running hot anyway. What does the Fed do in that situation? Try to boost unemployment, or try to tame inflation? It’s hard to do both at the same time with the tools they have.

So far, they’ve made it clear via their statements over the past year that they will pick employment over price stability when push comes to shove. And this is to be expected, given where we are in the long-term debt cycle.

In the late 1970s, faced with stagflationary conditions (but low debt levels relative to GDP), Fed Chairman Paul Volcker chose to prioritize inflation reduction even if it meant putting the economy into a recession and spiking unemployment levels. In the 2020s, faced with stagflationary conditions (and high debt levels relative to GDP), Powell is kind of forced into the other direction; prioritizing employment even if it means letting inflation run hot.

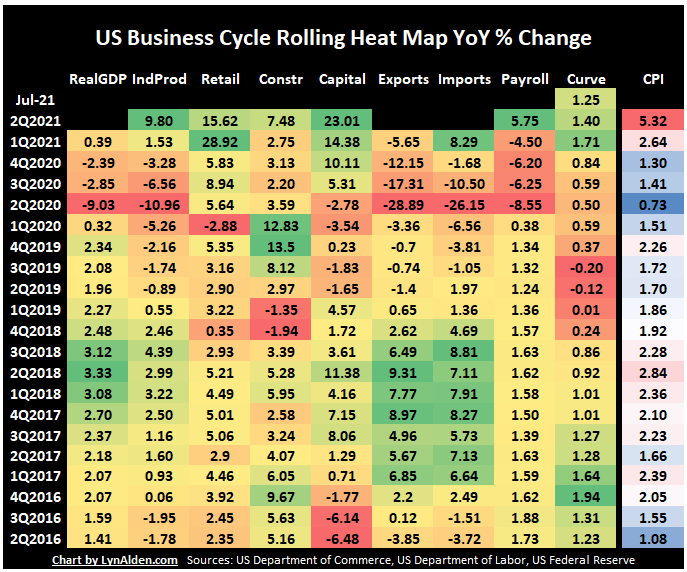

My economic heatmap from a little over a month ago discussed economic deceleration. Here’s an excerpt and the chart:

Here is my updated heatmap of various economic indicators for the U.S. economy over the past five years, measured in year-over-year percent change terms. This lets us see a broad spectrum of the economy rather than cherry pick good or bad data points to fit a narrative.

The economy is at a high peak but showing initial signs of entering a soft patch in rate-of-change terms, largely due to harder base effects along with fiscal stimulus wearing off.

-July 25th report

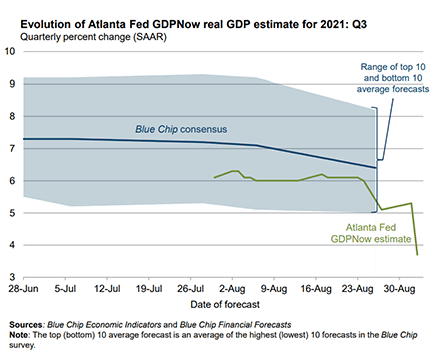

Well since then, there has been more confirmation of economic deceleration. The Atlanta Fed, based on a variety of incoming weekly data, revised down their GDPNow model this past week for estimated annualized real GDP growth in Q3 (July through September, the quarter we’re currently in) from 5.3% to 3.7%:

Chart Source: Atlanta Fed

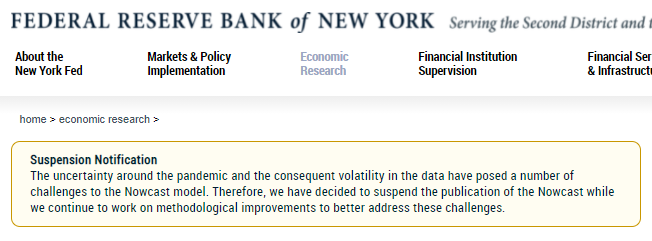

And, in a rather unusual twist, the New York Fed actually suspended their Nowcast GDP estimate model until further notice, instead of updating as usual last week:

Image Source: New York Fed

Their latest estimate prior to this suspension was 3.8% annualized real GDP growth for Q3.

The US had strong economic growth in the first half of this year but as stimulus wore off, as the delta variant hit, and as China slowed down (with its associated rippling effects around the world), the US economy is decelerating.

On the bright side, with delta variant having likely peaked in terms of daily cases in much of Southeast Asia and Japan, that bodes reasonably well for that region. They have been under stricter lockdowns than most of the US for a while now.

As a result, the dollar index has another opening here to potentially weaken. I’m watching a few levels to see if we reach lower lows to start another down move in this range or not:

The USD/EUR chart, which makes up over half of the dollar index by weight, has a similar pattern, as it nears key levels.

The last few months have been characterized by the “American Exceptionalism” trade, referring to periods of time where the US stock market and dollar outperform most of the rest of the world. However, that trade seems to be fading. US fiscal stimulus is wearing off, and the virus wave that has led to tighter lockdowns in many non-US regions is fading.

Bitcoin Note

Bitcoin has been relatively flat for a week or so, with the $50k level providing some amount of overhead resistance. At the moment it is trying to break out of that:

The Lightning network continues to experience a rapid burst of adoption. Twitter is now beta testing integrating Lightning-based tips into its interface, which CEO Jack Dorsey has been talking about doing for a while. According to the beta test, they’ll be using Strike as their wallet for it in the US, and Dorsey seemed to confirm in a tweet that they will partner with other wallets for other parts of the world. There’s no specific launch date or final release details since it’s still in testing. Any of it could change.

El Salvador is about to formalize bitcoin as legal tender in a couple days, in a plan that was announced back in June. It’ll co-exist with the US dollar as legal tender, meaning that bitcoin transactions are not taxed for capital gains and so forth. A few hundred people protested the measure in recent weeks, in part because they are political opponents of the El Salvadorian president and in part because there is still insufficient education for people about how bitcoin works and what the risks are. Fortunately, merchants and other people can instantly convert between bitcoin and dollars with a lot of the apps they’ll be using, so if they want to, they can choose to use dollars as their asset to hold, with Bitcoin/Lightning merely serving as the payment network.

Alex Gladstein and Peter McCormack, among others, have been down in El Salvador during this past week documenting the reaction on the ground. Alex, for example, filmed himself using Lightning to pay for a drink, and then provided the barista’s Strike address online (with her consent) so that people could send her tips over Lightning from around the world, from multiple different open source Lightning wallets and nodes. People from over 20 countries sent her tips. That sort of international peer-to-peer payment can’t be done with something like Venmo, which is only domestic. The fees are low for the Lightning network, so people could easily send fifty cents or a dollar and pay less than a penny in transaction fees.

Additionally, around 200 oil and gas executives met at a conference in Texas recently, focused on the topic of using stranded natural gas to mine bitcoin. This refers to natural gas that is produced in small quantities alongside oil deposits, meaning too little to build a pipeline for, and so it gets burnt into the atmosphere (flared/wasted) as the oil is collected. I explained this topic a few weeks ago in my bitcoin energy article; instead of burning the gas into the atmosphere with no utility, the gas can be used to power on-site bitcoin miners. Mining bitcoin with stranded natural gas has already been happening for a few years but the overall market is still significantly untapped and energy producers are starting to get familiar with it.

Vast Bank became the first chartered bank in the United States to offer bitcoins (and seven other cryptocurrencies) to its customers. As Forbes reports:

According to the CEO Brad Scrivner, the bank’s move into offering crypto was approved by the OCC, but also included discussions with the Federal Reserve as well. Vast Bank, N.A. is now the first federally chartered bank in the U.S. to offer the ability to buy, sell, and custody cryptocurrencies – directly from a checking account – all under one roof.

Overall, I remain long-term bullish on bitcoin, but near-term price action is unclear. With bitcoin continuing to be withdrawn from exchanges into cold storage, I remain bullish in the intermediate term as a base case; it looks to me like a coiled spring.

Ethereum/Cardano/Solana Note

Smart contract tokens have been on fire lately in terms of sentiment and price action in recent weeks. Ethereum, Solana, Cardano, etc.

This is despite the fact that Ethereum had another unintended chain split due to a software bug, and Cardano has run into some initial problems when testing its decentralized applications.

Overall, Ethereum still remains under a persistent supply squeeze at the moment (one-way staking until Ethereum 2.0 is launched, with about 7.4 million locked-up ETH at the moment), so I remain somewhat tactically bullish on price despite being long-term cautious about some of the technical fundamentals, use-cases, competitors, etc.

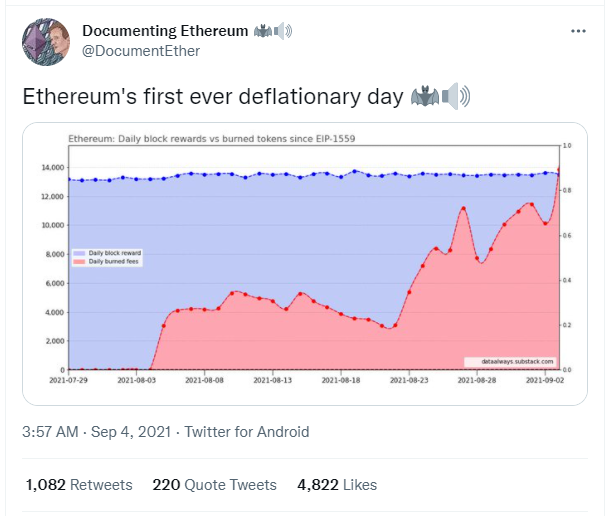

The EIP 1559 update, along with high volumes related to NFT trading, recently made it so that Ethereum burned away more tokens in a day than were generated that day, resulting in a day that was deflationary in terms of supply:

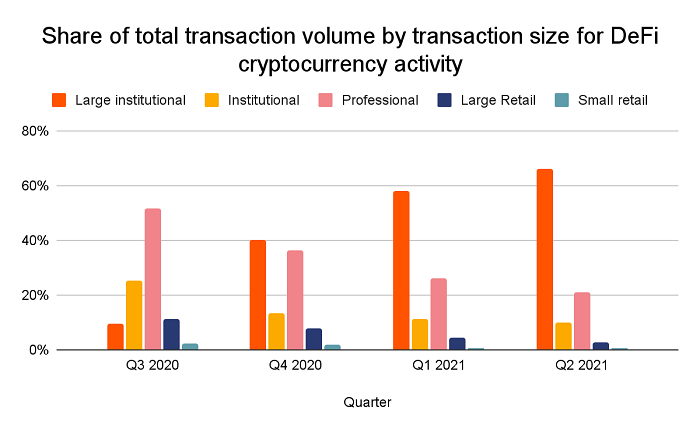

DeFi activity, referring to various semi-decentralized crypto exchanges and semi-decentralized lending/borrowing platforms that run mainly on Ethereum, has been pretty lackluster in recent months. And as Chainalysis determined, DeFi lately has increasingly been a playground for institutional/large investors, with retail investors virtually absent:

Chart Source: Chainalysis

It’s generally true across the board that on-chain cryptocurrency activity centers around large transactions. This is because smaller buyers instead tend to buy coins on Coinbase, Kraken, or similar exchanges, and often keep those coins there, so they aren’t taken out of the exchange’s balance and onto their own on-chain custody. Therefore, many of those smaller buyers don’t show up for on-chain analysis, and instead stay within the exchange’s ledgers.

But as Chainalysis found, the concentration towards large institutional-scale transactions is bigger among DeFi activity than the rest of the cryptocurrency space. Small retail traders can’t pay hundreds of dollars in Ethereum fees to make an economic trade with an on-chain exchange or participate in an on-chain lending protocol, which leaves those activities for the whales making multi-million dollar transactions where large fees don’t matter as a percentage. That’s not bullish, in my view.

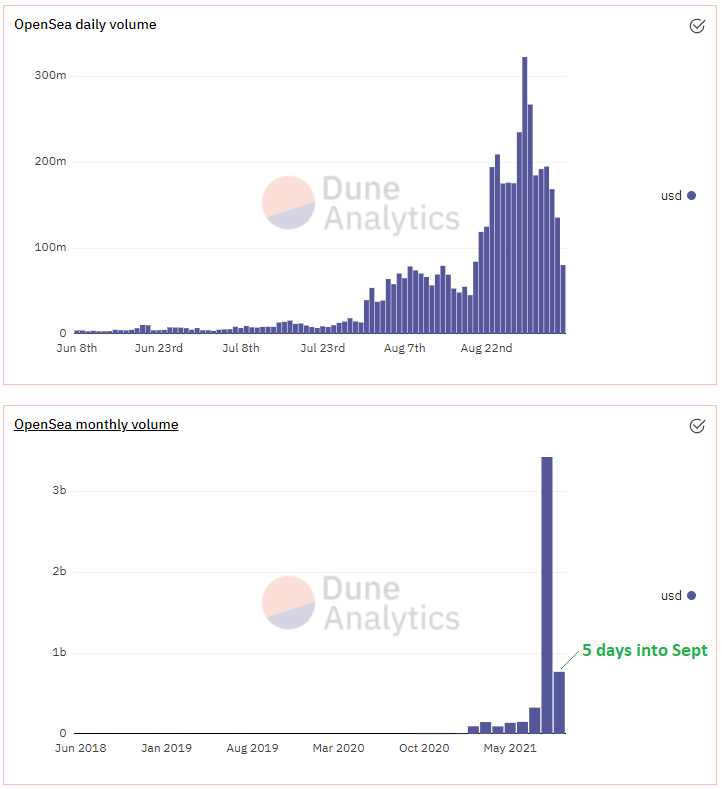

However, as DeFi has cooled off a bit, the non-fungible token or “NFT” market has been absolutely explosive lately, particularly among crypto millionaires and VCs. The market generated $3 billion of volume in August on OpenSea, and still pretty strong activity in early September although it may have already peaked at this point:

Chart Source: Dune Analytics

Art is the biggest application for NFTs at the moment. An art NFT is a pointer to an image file that is basically “signed” on the blockchain. The NFT grants no copyright claims to the image, and anyone can copy the image, but the owner has the pointer/receipt/certificate to it, which they can resell. Maybe I’ll be wrong, but I suggest caution with these assets; they have a lot of characteristics of the initial coin offering or “ICO” mania of 2017 that didn’t survive very well in 2018 and beyond.

For example, a set of 100 images of rocks from 2017 are available, called “Ether Rocks: Pet Rocks on the Blockchain”. People like them because they are among the earliest NFTs. The cheapest Ether Rock that’s currently for sale is over 700 ether or $2.7 million USD, although it’s not a very liquid market. I’d personally rather buy 1,500 gold coins, or 50 bitcoins, or 120,000 shares of Enterprise Products Partners (EPD), or 7,800 shares of Roku (ROKU), or a small mansion, for that money.

Image Source: Ether Rock

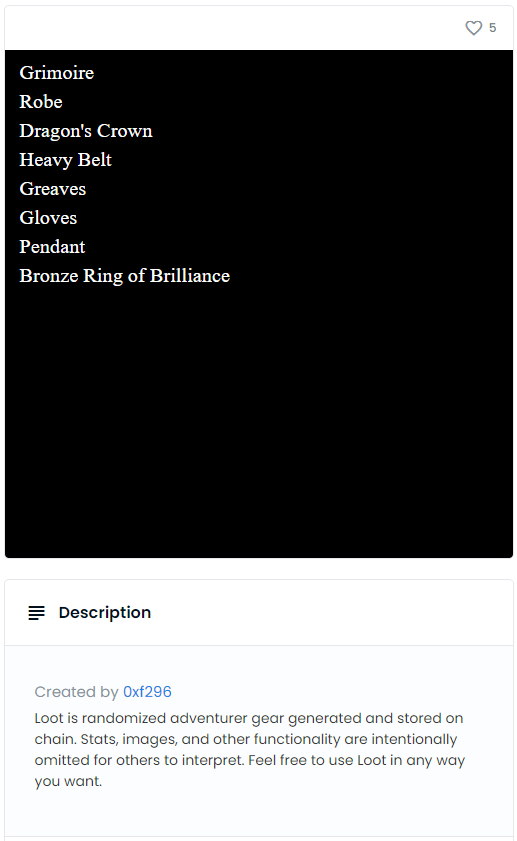

One of the latest big hits in the NFT space, created about a week ago, is called “Loot (for Adventurers)”. It’s a set of over seven thousand virtual bags, as they are called, and each bag is simply a list of loot items, referencing things you might find in an adventuring video game.

However, they have no functionality; it’s literally just a written list of items. This one is called Bag #7274, and it recently traded hands for over $50,000 USD, although again this market is not very liquid:

Image Source: OpenSea

People began quickly copying that Loot concept for derivative works. Someone made “Stats (for Adventurers)” that looks the same, except it’s a list of character stats for an adventure game, rather than loot. People have made NPCs (for Adventurers) as well.

And then a couple days ago, they made Adventure Gold or “AGLD”, a new token that runs on Ethereum and represents the type of currency that one might find in an adventure game (but unlike a gold-backed stablecoin like PAXG, AGLD is not backed by actual gold). AGLD is a governance token for a the Loot project; holders can use it to potentially vote on storylines or other aspects. So Loot participants have got their lists of loot, stats, NPCs, along with storyline votes. No gameplay yet.

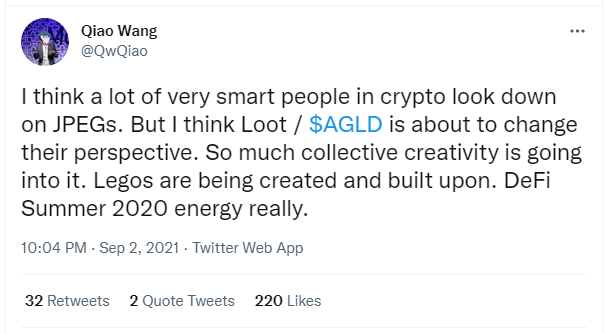

The bullish narrative for this adventure theater among some folks in the crypto community is that they are basically building an adventure game from the bottom up. For example, here’s the former head of the crypto unit at Citigroup:

And here’s Qiao Wang, formerly of Messari, and a very smart guy:

I wrote about something like this back in my January 2021 article on Ethereum, when discussing CryptoKitties and other games:

Nowadays, there are a number of crypto-based games. I’m not as much of a gamer as I used to be, but if I were, I could certainly see why blockchains can potentially add something of value to the gaming ecosystem. The idea of having items/pets/characters that the user can hold independently of the game publisher, and maybe even have those items/pets/characters recognized by other games as well, certainly is cool.

However, I was referring to functional game items; not items that merely show a list of words for $50,000 USD. Of course the argument among the loot/crypto bulls is that this just the exploratory stage rather than the usable stage.

There’s a dilemma that has been known for a while in the gaming industry. It takes a lot of work to make a well-designed game that is fun and addictive in terms of gameplay. You pay to play it, rather than get paid by playing it. In contrast, usually games that reward monetary prizes are not as fun, because the design quality is sacrificed to stick monetization in there, and people grind at them to get money. And then people often write programs to play the games for them to make money, which degrades the fun for the other human players more.

A blockchain game made bottom-up by the community sounds neat. The problem is that such games are unlikely to be fun, especially when a bag of loot in text form costs $50,000. Right now, it’s about narratives and culture and people thinking about what types of things this space could create in the long run, and it mainly boils down to price speculation.

For the price of a few books, and maybe a low-cost subscription to some online material, people can instead play Dungeons and Dragons Fifth Edition in a vibrant online community if they want a well-designed player-driven adventure game, and skip the blockchain. Many of the D&D games are made bottom-up by the players. A blockchain is a remarkably inefficient thing; it’s only ideal when you absolutely need decentralization.

Basically, owning NFTs is a way to display one’s crypto wealth, along with price speculation. Collectibles have always been popular, and displaying digital collectibles on Twitter and elsewhere seems to enhance that popularity, at least for the moment. While I think NFTs offer interesting future potential, I would be very cautious with prices of these current items for the long run. The space is very speculative, not very liquid, and has a high probability of looking like a lot of previous crypto busts of history.

Selective Crypto Recovery

Back in my May 9th 2021 report, when multiple meme coins were skyrocketing, I gave a warning:

So far, 2021 has had an inverse relationship between quality and price action for the crypto space. Bitcoin and Ethereum have lagged Ethereum Classic, Dogecoin, and one called Cumrocket in terms of percent price gains. A lot of this is… very bubbly. When Ethereum Classic, Bitcoin Cash, and meme coins are going vertical, it’s a good time to check risk management for the space overall.

We ended up getting a big washout in the space, with many coins down 50-80% from their highs. Over the past six weeks there has been a significant recovery, but the good news is that the recovery is more selective. Bitcoin recovered a significant part of its losses, Ethereum is back near its highs, there’s euphoria around NFTs, and Ethereum’s attempted-competitors like Cardano and Solana broke to new all-time highs. Meanwhile, meme-coins like Doge and Safemoon, as well as things with little active community like Ethereum Classic and Bitcoin Cash, have barely recovered at all and remain well off their highs from earlier this year.

Basically, it seems that retail speculators have been largely washed out, while bigger players are the ones back in, focusing on bitcoin and smart contract platforms and five or six or seven figure NFTs.

In other words, it’s a more specific type of euphoria focused on smart contracts and NFTs among larger investors, rather than broad-based euphoria across the board. This is good; it suggests that bitcoin likely still has more room to run in this cycle, rather than the whole space looking extremely toppy like it did back in May 2021. There is an indication that participants in the market are separating and pricing coins based on underlying application potential, rather than buying across the board.

I think Solana (currently the 7th largest crypto by market cap) has a decent shot of catching up with Cardano (currently the 3rd largest) in terms of market capitalization, although I don’t invest in either of them. The main draw for Solana right now is that they are building out semi-decentralized exchanges and other applications, and their fees are much lower than Ethereum.

Bitcoin bulls often criticize Ethereum for being insufficiently decentralized. Ethereum bulls lately have been criticizing Solana for being insufficiently decentralized. And that in my view is correct on both counts; each blockchain makes certain trade-offs, and usually some of the decentralization is sacrificed in favor of additional functionality and efficiency. The problem is that the primary application of a blockchain is to make something decentralized. That can cause a slippery slope towards greater and greater centralization like we see with Solana currently. Solana has semi-decentralized projects running on top of a very centralized base layer.

Ethereum offered more application functionality on its base layer than Bitcoin, but at a cost of more complexity and higher node requirements, along with difficulty bombs that keep control more in the hands of Ethereum’s developers, allowing them to change monetary policy and implement hard forks.

Solana, with new technology, has similar functionality and much higher transaction throughput than Ethereum, and thus much lower transaction fees, but this too comes at the cost of far higher node requirements. You need datacenter-level hardware and bandwidth to run a Solana validator. And although Solana is open-source, it has centralized organizations and VC capital behind it, making the leadership and ownership of the coins rather centralized, which is of particular concern for a proof-of-stake protocol. Plus, Solana is still in beta mode and does manual stake slashing by developers; meaning their whole proof-of-stake consensus model is still totally centralized at the moment. It’s decentralized in name only, rather than in real terms. And yet its market capitalization is $40 billion, despite still being in beta mode.

That’s why I consider bitcoin to be a form of digital money, while I view most other coins to be varying shades of digital equities, with centralized development hubs, technical roadmaps, marketing budgets, and in some cases outright manual blockchain overrides by developers. Some have this problem more than others. This is why I primarily hold bitcoins as my digital asset, and only do some experimentation for research purposes with ether, DeFi, etc to make sure I stay on top of how the space is evolving.

Do users care about Solana’s high level of centralization? So far, no. With Ethereum’s fees skyrocketing, making it unsuitable for most small users, Solana is a cheaper DeFi alternative. Solana’s total-value locked or “TVL” in DeFi projects is up about 180% over the past month to $4.2 billion. Ethereum’s TVL is only up about 15% during that timeframe, although from a much larger base. Solana is taking a small but growing market share of the smart contract space, and it remains to be seen if that will taper off or continue.

Portfolio Updates

I have a few minor changes for this week. The portfolios are available in my Google Drive.

Newsletter Portfolio

-Reduce EBAY and BAM from 4% to 3% in the dividend stock pie. They have done very well lately and are less attractively-valued.

-Increase CVS and CERN from 3% to 4% in the dividend stock pie. I like the valuation of these stocks a bit more at this time.

Fortress Income

-Reduce EBAY from 4% to 3%. Increase CERN from 3% to 4%.

ETF-Only Portfolio

-No current changes.

No Limits Portfolio

-No current changes.

Top 12 List

-No current changes.

Other Holdings

-Move the small percentage of bitcoin I have in BlockFi back into personal custody. The interest rates have dropped recently and the risk/reward is no longer attractive. I earned a considerable amount of interest income at BlockFi this year when rates were higher, but the industry has arbitraged a lot of that opportunity away by now.