Consolidation Ahead Of Another Move Higher

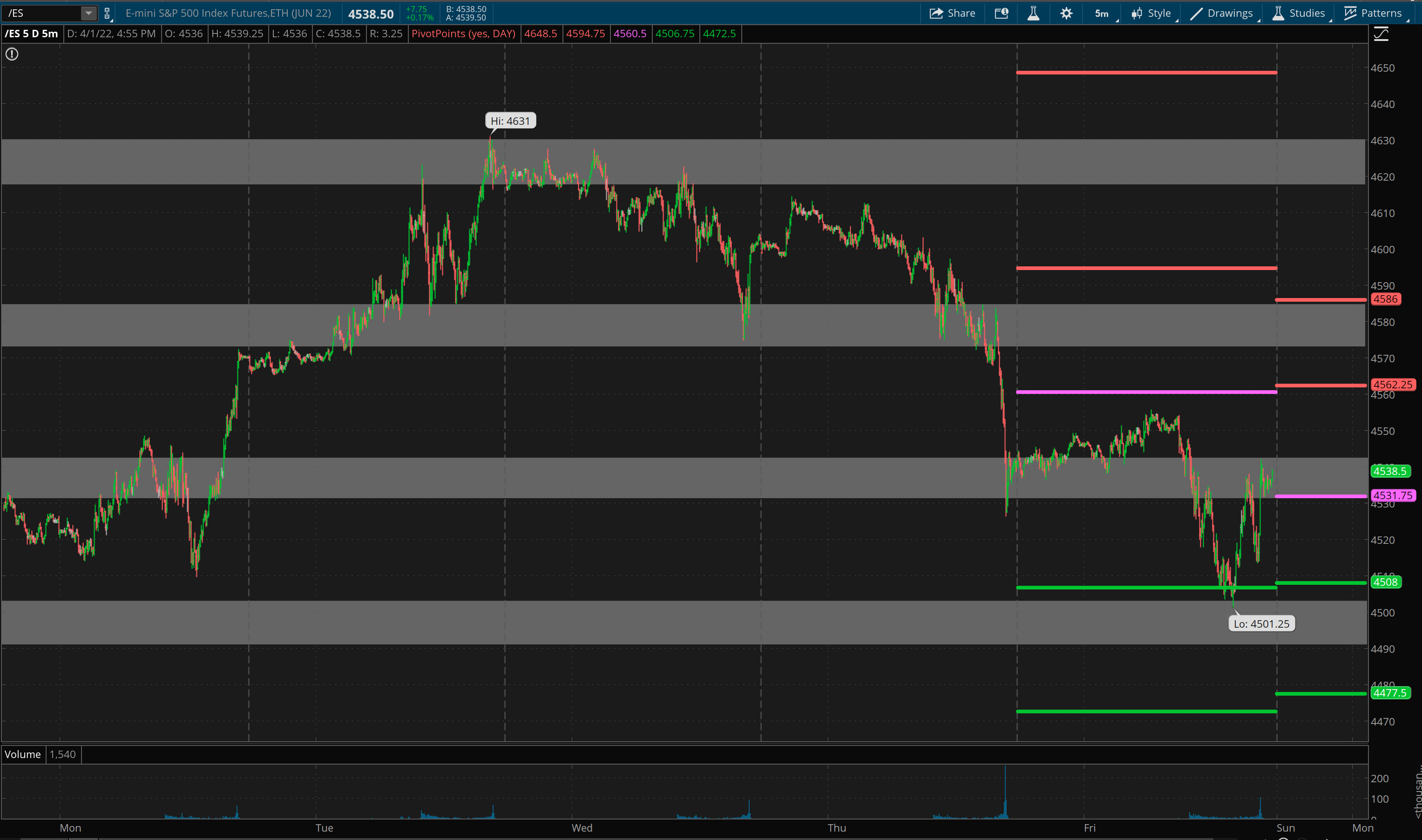

Last weekend I noted that if we had a slower corrective pullback toward the 4400/4350 area on the S&P 500 which then holds, I could see another leg higher toward 4650+. Price went on to test above 4600 before beginning a pullback.

Looking ahead, price action is bearish short term, bullish medium term and neutral to bullish long term. With last week a sideways week, in which price digested recent gains, this type of consolidation is healthy for a continued advance, and I think we can remain in this mode for a few more days before attempting another move higher.

My primary is for us to test the 4560-80 area and then another leg lower toward 4450/4420 area before an attempt to take out the recent local high at 4631. IF 4400 goes, then new lows become a much higher probability, but until that happens, my bias is for higher once this correction we are in completes.

Grey zone resistance at 4531–43 and then 4573-85. Support is at 4502/4490, 4460-44 and then 4415-01.

For Monday, daily pivot is at 4532. Resistance R1 is at 4562 and R2 at 4586. Support S1 is at 4508 and S2 at 4477.5.

All the best to your trading week ahead.