Bulls in Charge in Short-Term NQ Pattern

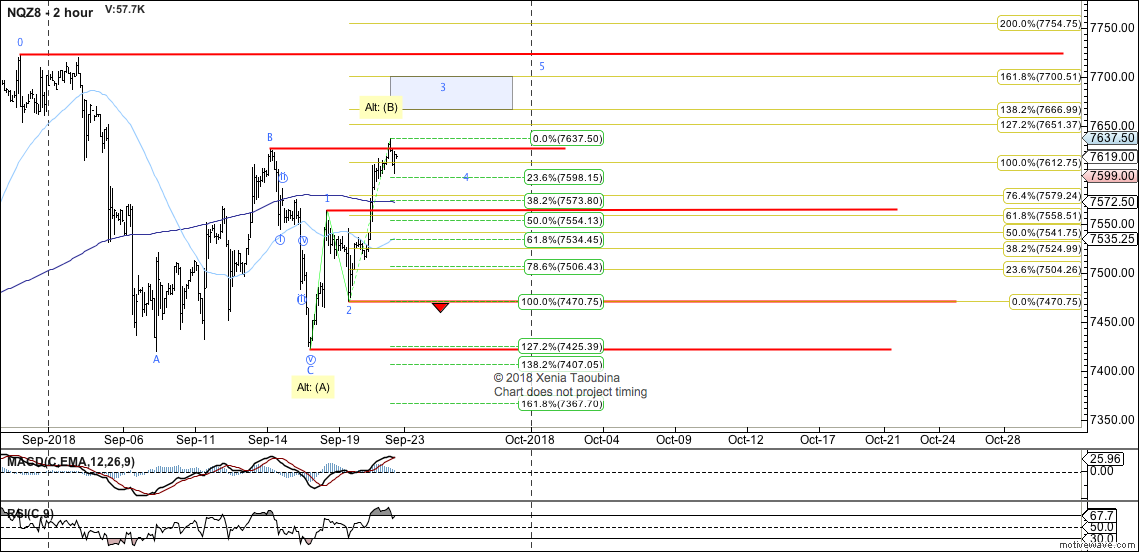

By breaching 7627 overnight, the Nasdaq 100 Futures (NQ) has invalidated the bearish count on the 2-hour chart, suggesting that the impulse that bottomed on Sept 17 was a slightly truncated wave C rather than wave i of C.

This leaves NQ with no reliable bearish interpretation, and puts bulls in charge.

While potential for the move down to subdivide as a larger ABC remains for as long as NQ is below 7723.5 (labeled as Alt), the absolute minimum needed to open up that potential is a sustained break below 7564.25, with confirmation below 7470.75.

Until then, potential exists that NQ is in the midst of an impulse up. I want to note that while ideally, wave 3 reaches at least 7667, I view these extensions as unreliable, because of the drastic mismatch with NDX cash extensions.

So, it will be structure, rather than fibs, that will determine whether we have an impulse off the low.

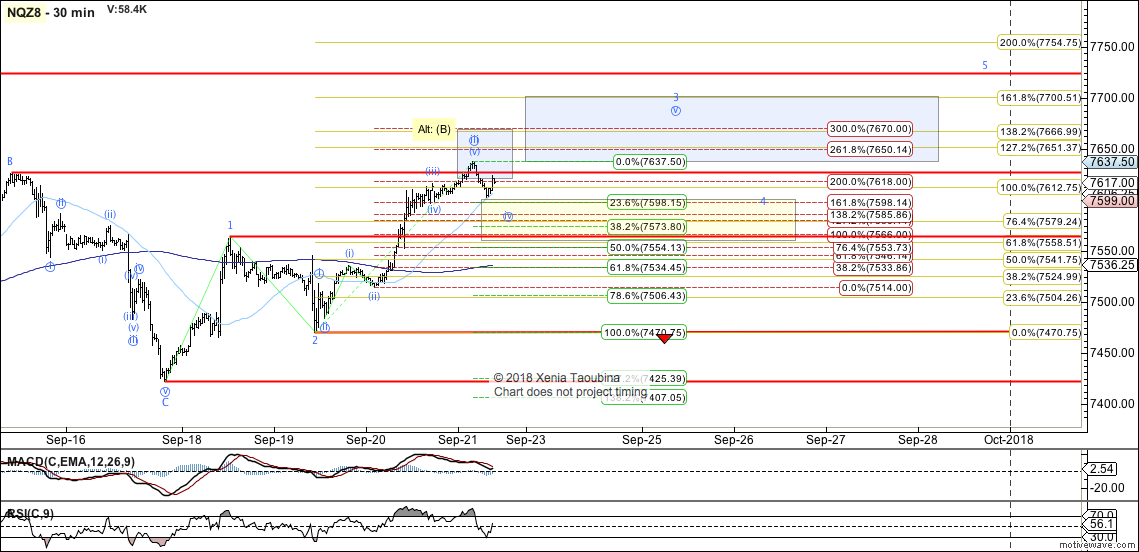

On a micro scale (30-min chart), NQ is doing what it needs to for the impulsive bullish count. Support for any pullback that we may see today stretches to 7558 under the impulsive bullish count.

One more high is needed to view NQ as having completed wave 3/C, at which point 7564.25 will become must-hold support for the impulsive count.

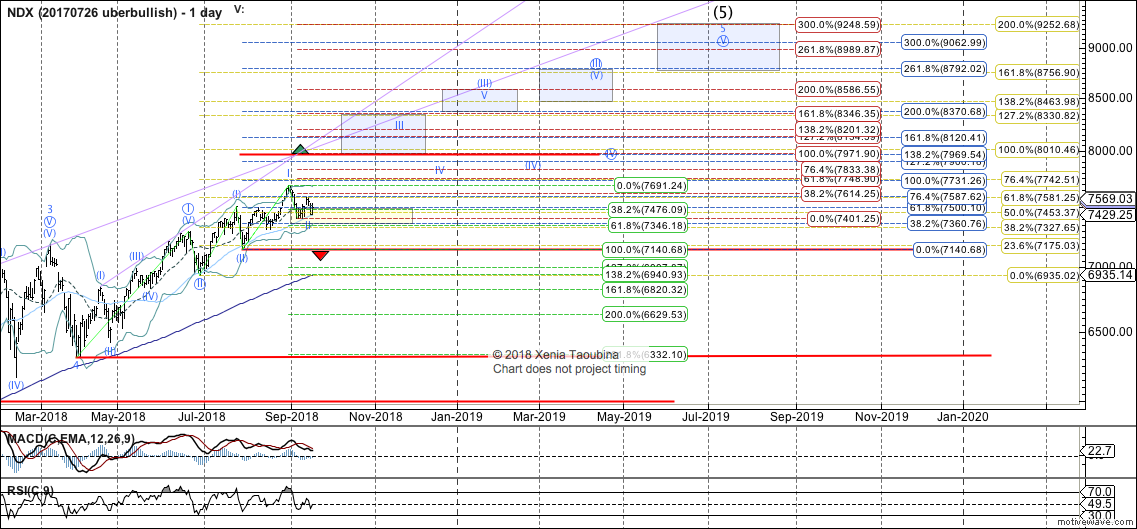

Also presented in the charts below are bigger-picture views of the Nasdaq 100 (NDX), one an "uberbullish" 1-day chart and the other a bearish 2-day chart.

To make it likely that bearish subdivision of the rally off April low is operative, NDX will need to break below its July 30 low (7140), though break below 7308, if seen, will be a fairly good indication.

For as long as NDX is holding 7346, potential for it to reaccelerate higher under the count shown on the "uberbullish" chart remains; however, for me to view acceleration as likely, I will need to see a strong move to new highs which reaches at least the red 1.0 extension.