Bulls Back In Control

As we noted last weekend, "Price has gone higher without much of a pullback over the last couple of weeks.. so it makes sense to look for some kind of reset in coming days.. And the Fed could be the catalyst for that. I am on the lookout for either a sell signal to materialize in the 4140 area.. OR for an add on buy signal to happen on a pullback toward the 4050/30 area. Does not matter which of these happens.. whatever it is, we will react accordingly.. Right now however, the path of least resistance remains higher.. we hold longs until that changes."

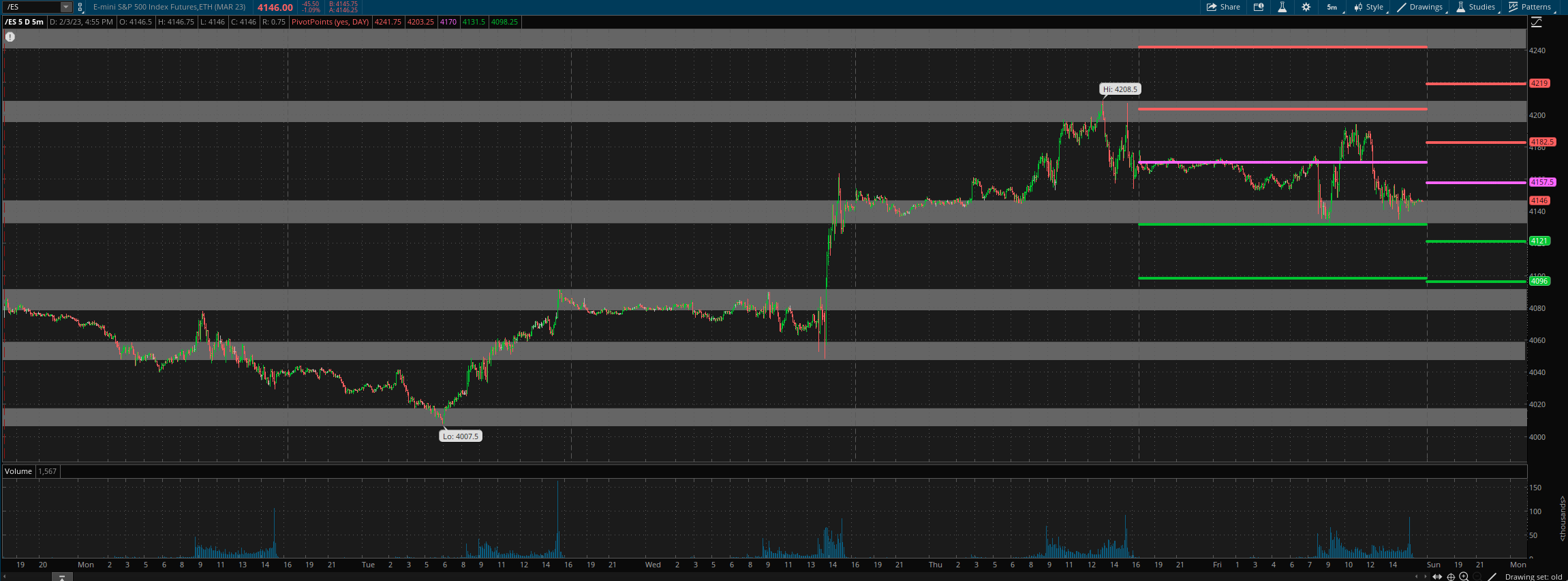

What actually happened is that there was not much of a reset with price continuing higher ("the path of least resistance") for most of the week. It was a strong week for the bulls before some consolidation to end the week. Most internal measures stayed on buys except for the very short term which went to a sell. There was a window for the bears to take price lower last week but they could not capitalize on it … and now the bulls are back in control.

We may see a bit more consolidation next week, maybe lower into the 4100-4080 area before continuing back north toward 4240+. The path of least resistance remains higher, but we are likely to continue seeing minor pullbacks to reset sentiment within the context of this bigger picture uptrend.

Price action is bullish/neutral short term, bullish medium term and bullish/neutral long term. We are long in both trading and LT accounts.

Grey zone resistance at 4194/4207 and then 4241-55. Support is at 4146-33 and then 4091-79.

For Monday, daily pivot is at 4157.5. Resistance R1 is at 4182.5 and R2 at 4219. Support S1 is at 4121 and S2 at 4096.