Bringing It All Together

Bringing it all together

Some of you know what we do in the smart money room.. follow market internals based systems specifically high low systems to create mechanical entries in and out of trades. We do not guess... we do NOT try to impose our will on the market. We just do what the systems tell us. In other word trade what is actually happening vs what you want to see happen...

New high new low index in the main internal measure we use. This is the new highs over a rolling 12 month period. I built the NYHL1M indicator using this principle but based on a 1 month period. New highs - new lows within a rolling 1 month period on a cumulative basis. Plot this against an EMA and you have a simple but very good trading system. The NYHL1M indicator is a bigger timeframe indicator and best used for positional trade making decisions. To adjust with the potential lag in decision making here for shorter term trades, I introduced a smaller timeframe version/model of this indicator called the micro signal. And this is what I use as the driver in my trading decisions in the SM room.

Now, one of the biggest issues with the NYHL1M and GDX/USO micro signals is that there is a significant lag especially in periods of crazy volatility like we have right now. So a lot of times, we have a good profit but then we watch that profit disappear because the signals did not yet turn ... or tell us to exit..

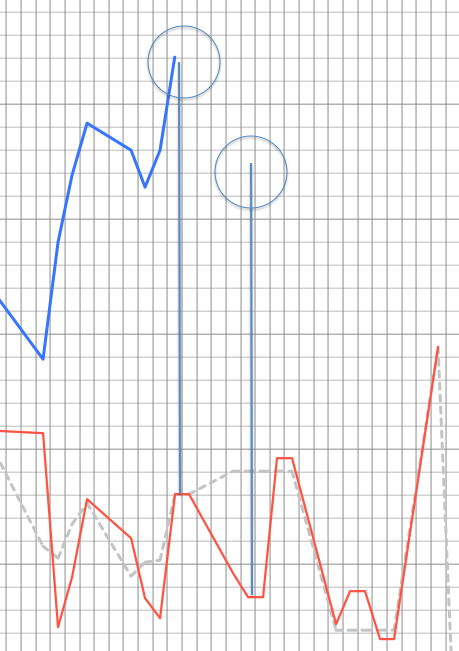

After seeing this happen multiple times, I decided to incorporate some timing into the trades and this resulted in a dramatic difference in P&L, trade quality with respect to drawdown, MAE etc.. All in all, a big difference. Since we were using the razzmatazz waves which are based on open interest... and we have been doing this for a while... I decided to combine both methods together i.e the razzmatazz wave and the high-low internals method... so far, this has created a big difference in the trade results.

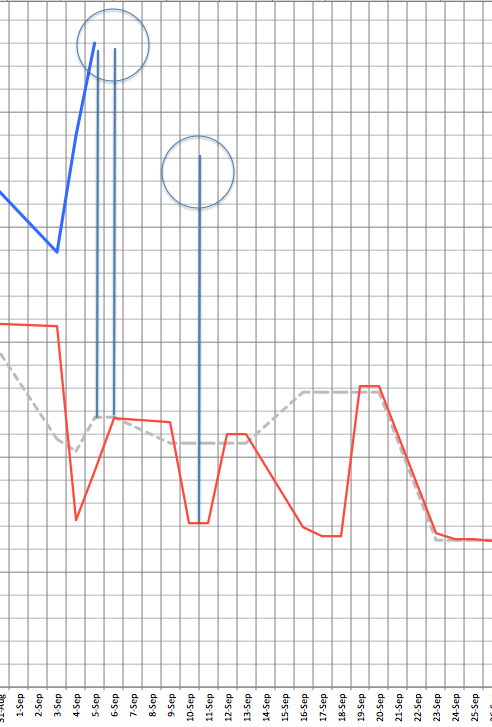

I wanted to share an example in ES/SPX where this was used almost perfectly...

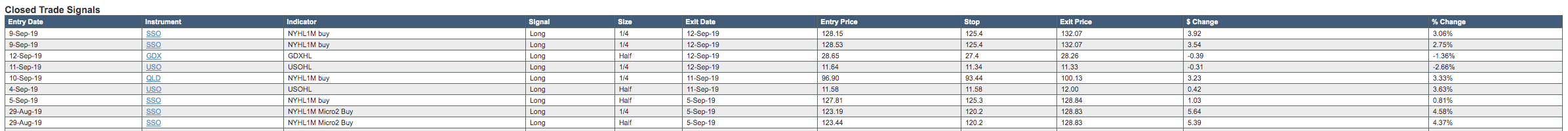

The NYHL1M micro signal first went to a buy on Aug 29th. We entered positions long SSO - 2X SPX - at 123.44 and 123.19.

On Sep 5th, based on the posture of the razzmatazz wave outlined below, we were in the first circle on the chart, I decided to take a profit... SSO was closed at 128.83 for 4.5% profit... with the plan of rebuying it back at the 2nd circle below... in other words timing the entry based on the razzmatazz wave...

After this, we entered back into SSO and QLD on the 9th and the 10th based on the timing chart above... QLD at 96.9 and SSO at 128.53, 128.15. QLD was booked yesterday at the close and SSO at ES 3017 today... right before this little swoon we are seeing.... for 3.33% on QLD, 2.75% and 3% on SSO...

Once again based on the timing chart shown below...

Almost perfect execution there based on the two methods combined...

On the whole this looks very promising... so just wanted to share with the main room... Below are the trade results since incorporating the timing method based on the razzmatazz wave into the internals based trading system...

We managed to catch most of the the recent upmove without much of a drawdown... and also managed to time the recent dip with an exit and re-entry...

Note - we also have the razzmatazz charts for GDX and USO now being tracked in the Smart Money room... timing on these while not as good as ES all the time... does offer a significant advantage there as well... on trade entry and exit timing..

Best.