Bitcoin: The Waiting Continues

Bitcoin: The Waiting Continues

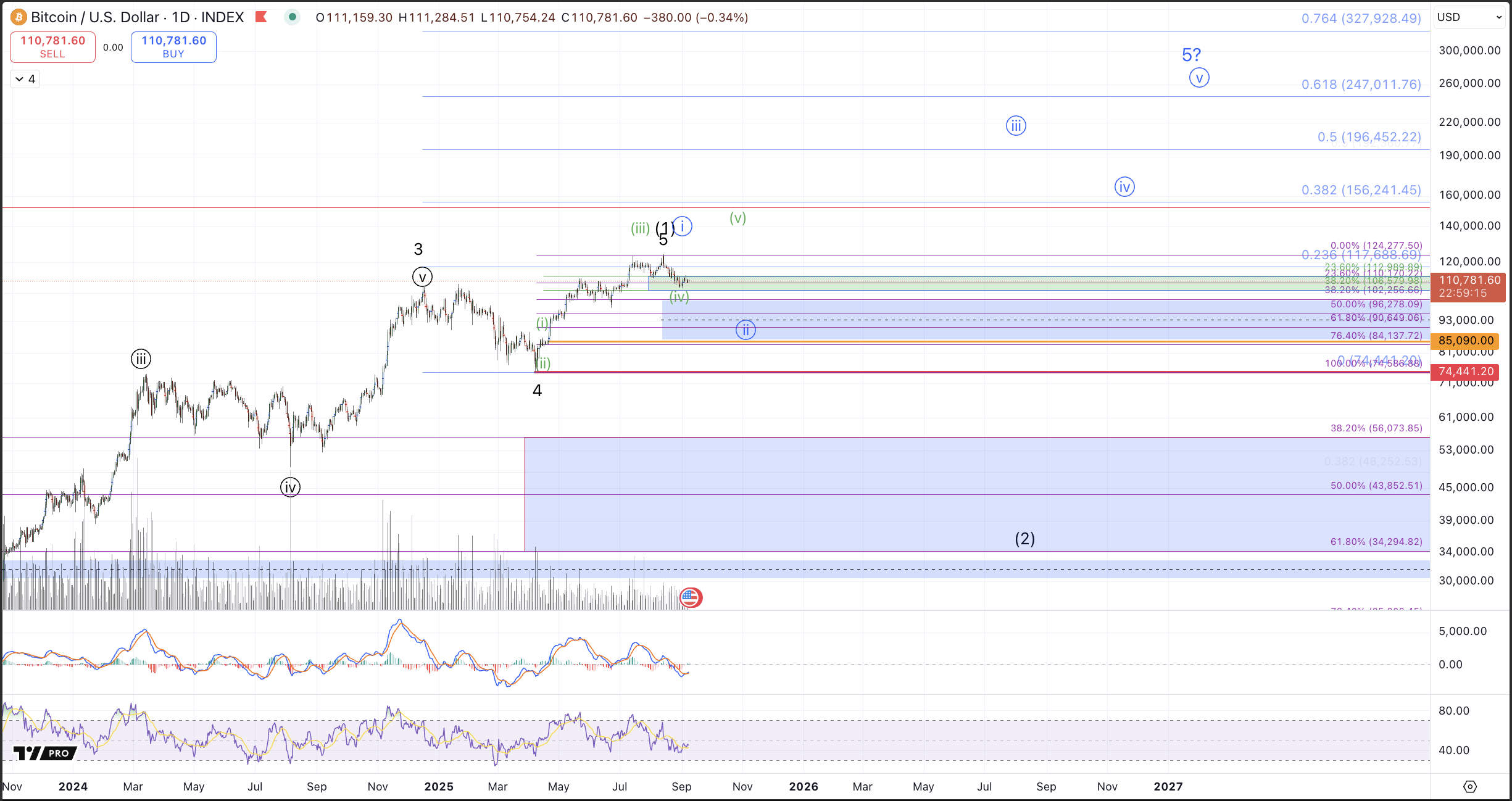

In last week's article, "Waiting" we discussed how BTC has formed a top of some significance but we have not yet determined whether this bull market cycle from the 2022 low has completed or whether price is taking a breather before another 100+% rally. The black count is showing a prospective completion of the entire rally from the 2022 low and while this is being treated as "primary" I'm still relatively neutral in terms of discerning between the blue / black counts.

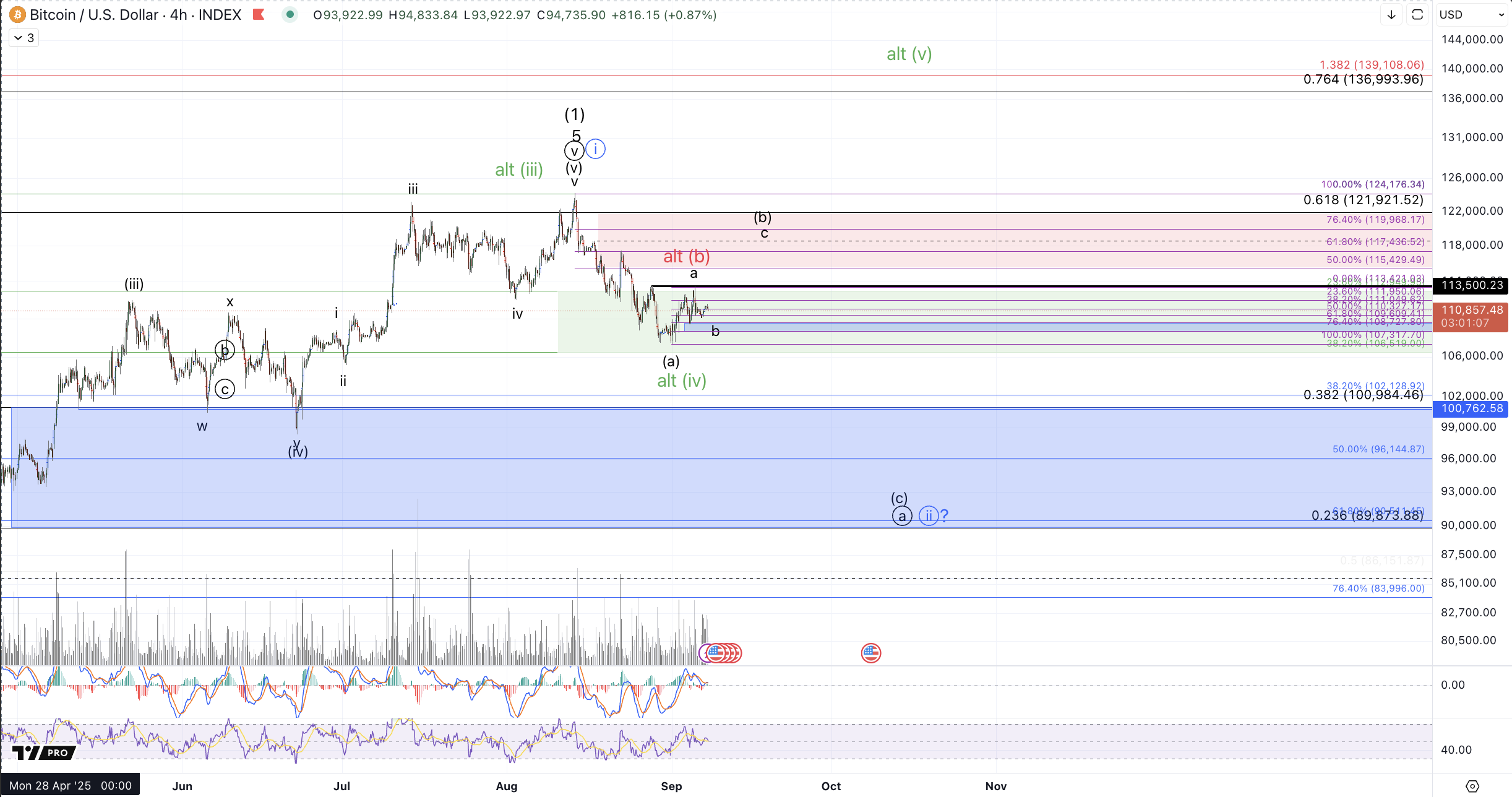

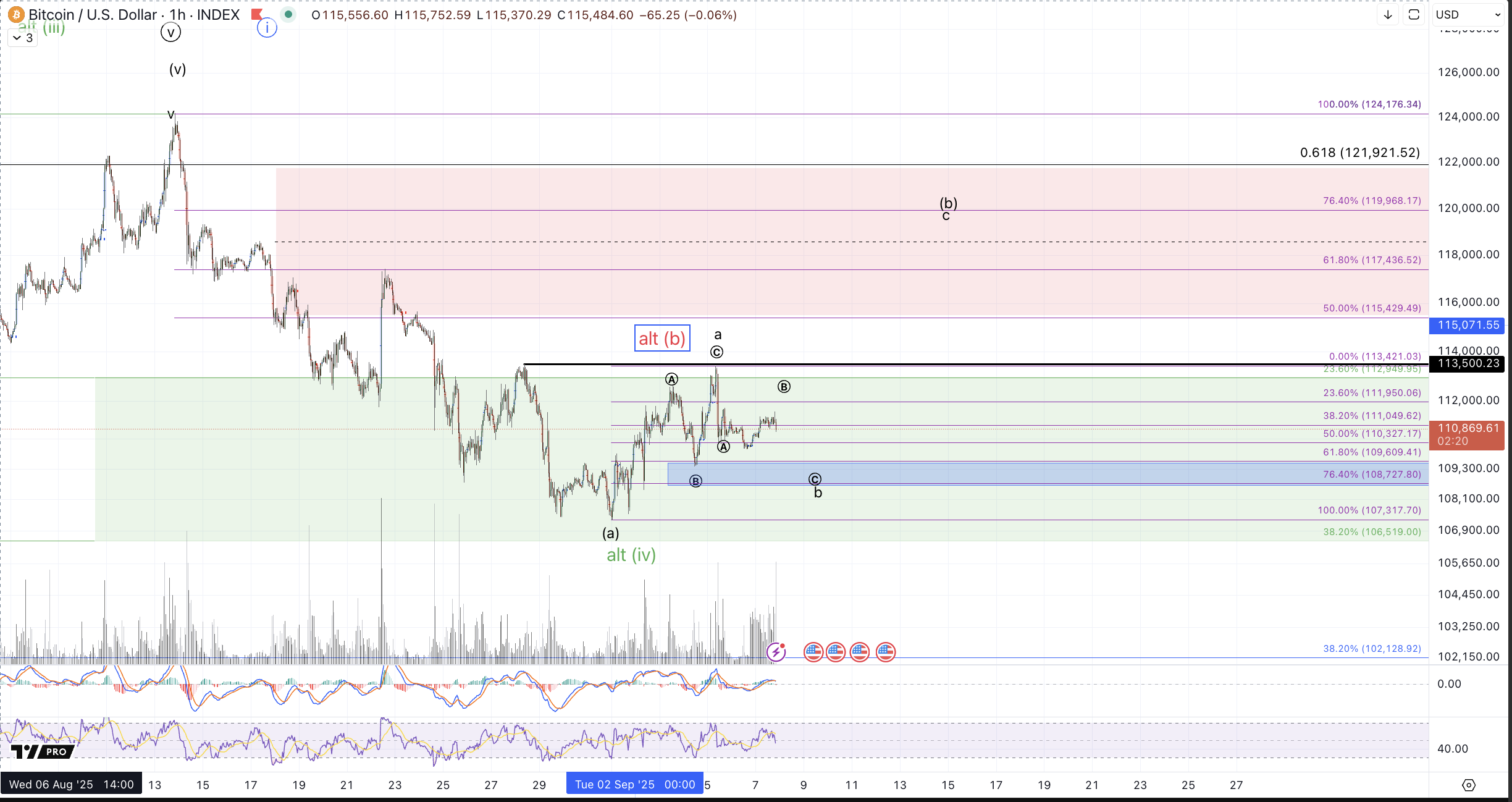

Overall in the last week price has done very little in terms of defining what's next or narrowing our field of possibilities in any substantive way. The immediate decline potential has come undone but it's also plenty reasonable that price is completing a higher degree (b) as shown in the alternative red count on the 1h chart. This potential will become favored should price head back directly below the September low and would set up a (c) wave down to below $98k.

Though the immediate action does not convey anything that I'd call a confident setup, my tentative expectations are to see price hold the micro b of (b) support, 108.7k-109.7k with or without another test of that region and then provide another swing higher for a wider flat off the September low to fill in a more substantial (b) wave which can ideally test the $117k-$120k region and complete the corrective bounce in that region. For a more extended view, nothing has changed from the previous article so let's review the key regions and displayed roadmaps.

Upper support is $106.5k-$113k. So long as this region holds, I can not rule out a more immediate run to higher highs to complete a bigger impulse off the April low as shown in green. This count remains viable and price's stubbornness to break any meaningful support gives this thesis some weight but for it to be confident we'd need to see a micro impulse develop from this support region and so far the bounce from the September low is quite corrective looking.

Lower / Larger Support for continuation of the bull cycle from the 2022 low is $85k-$102k. So long as this region holds, the blue count which portends further extension into 2026 up to $200k+ is quite live. A sustained break below $85k will be needed for the black count to have a strong advantage. Ultimately the April low is the key level for us to discern between these counts. So, below $74.4k the blue count becomes technically invalidated. That said, there are still other bullish potentials to entertain as alternatives in that situation but the black count which is already the primary becomes strongly favored in that instance.

Overall a break below $74.4k would strongly suggest that we're in the bearish correction of at least the cycle from the 2022 low. My larger degree expectations favor all pullbacks to hold above that $15.4k low but I think it's quite reasonable that a sustained break below $74.4k eventually leads to a test of the $27k-$34k region.

As always, we'll take things one step at a time. And as a reminder, nothing is broken yet but price did satisfy expectations set out in 2022 for price to reach $125k in this cycle. While that was technically not achieved, the rally did come close enough with the hit of $124.2k in August.

The best prospects for continuation higher would be for price to follow the shorter term path shown with the (a)-(b)-(c) to test the key support region, $85k-$102k and then to find a low there and rally impulsively. Should we see that type of action develop in the coming weeks, I will become quite bullish in favor of the larger blue count. But in the current view, I'm treating the shorter term view with a risk averse stance