Bitcoin: Setting Up For a Decline to Retest Support Below $100k

Bitcoin: Setting up for a decline to retest support below $100k

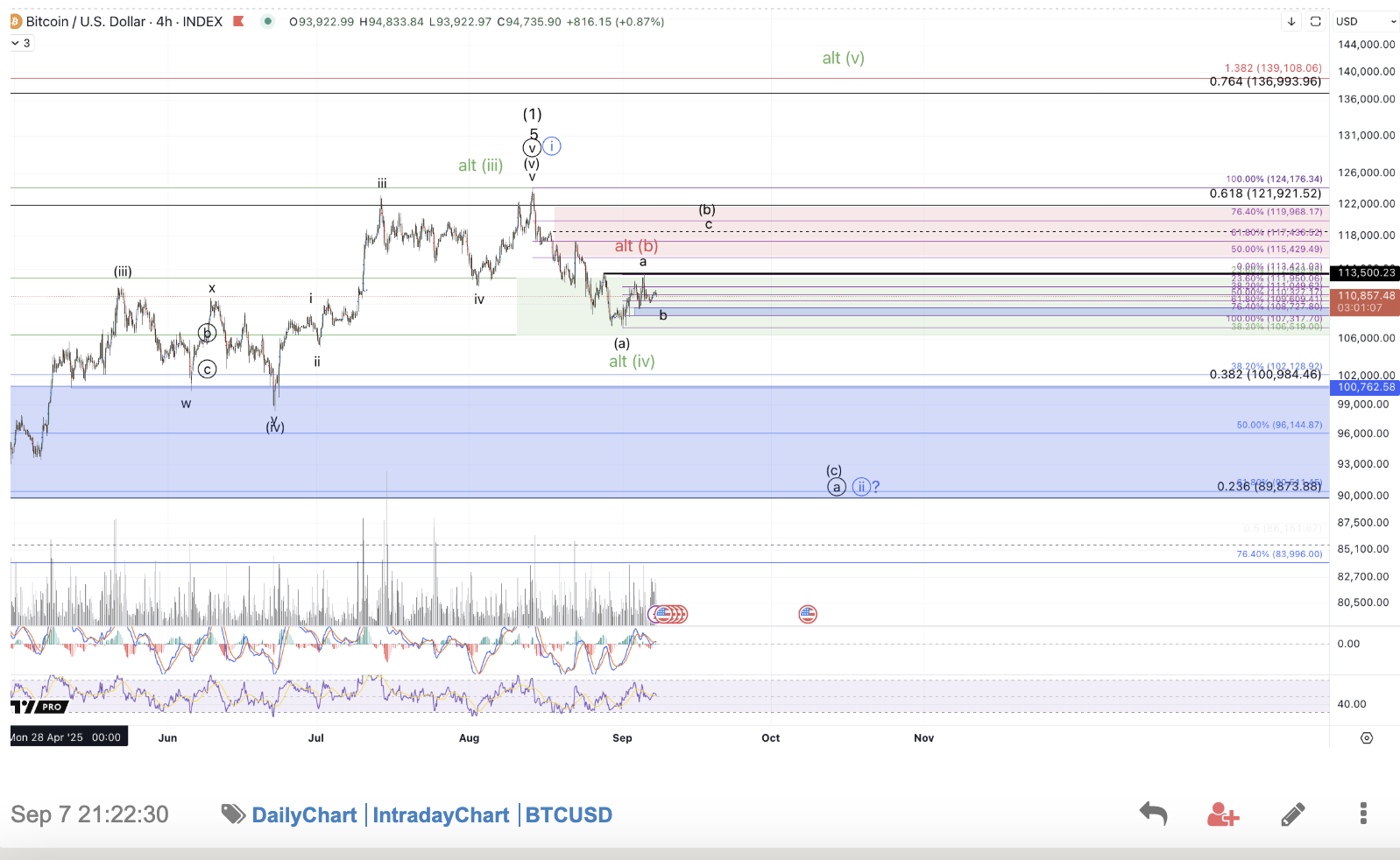

Over the month of September we've tracked a bounce from the upper support, with price having bottomed around $107.3k and the subsequent action has followed the expectations very nicely. The primary interpretation since price broke the highest support in late August was for an (a)-(b)-(c) decline into the $85k-$102k zone that's been outlined as the major support for prospective continuation of this bull market from the 2022 low.

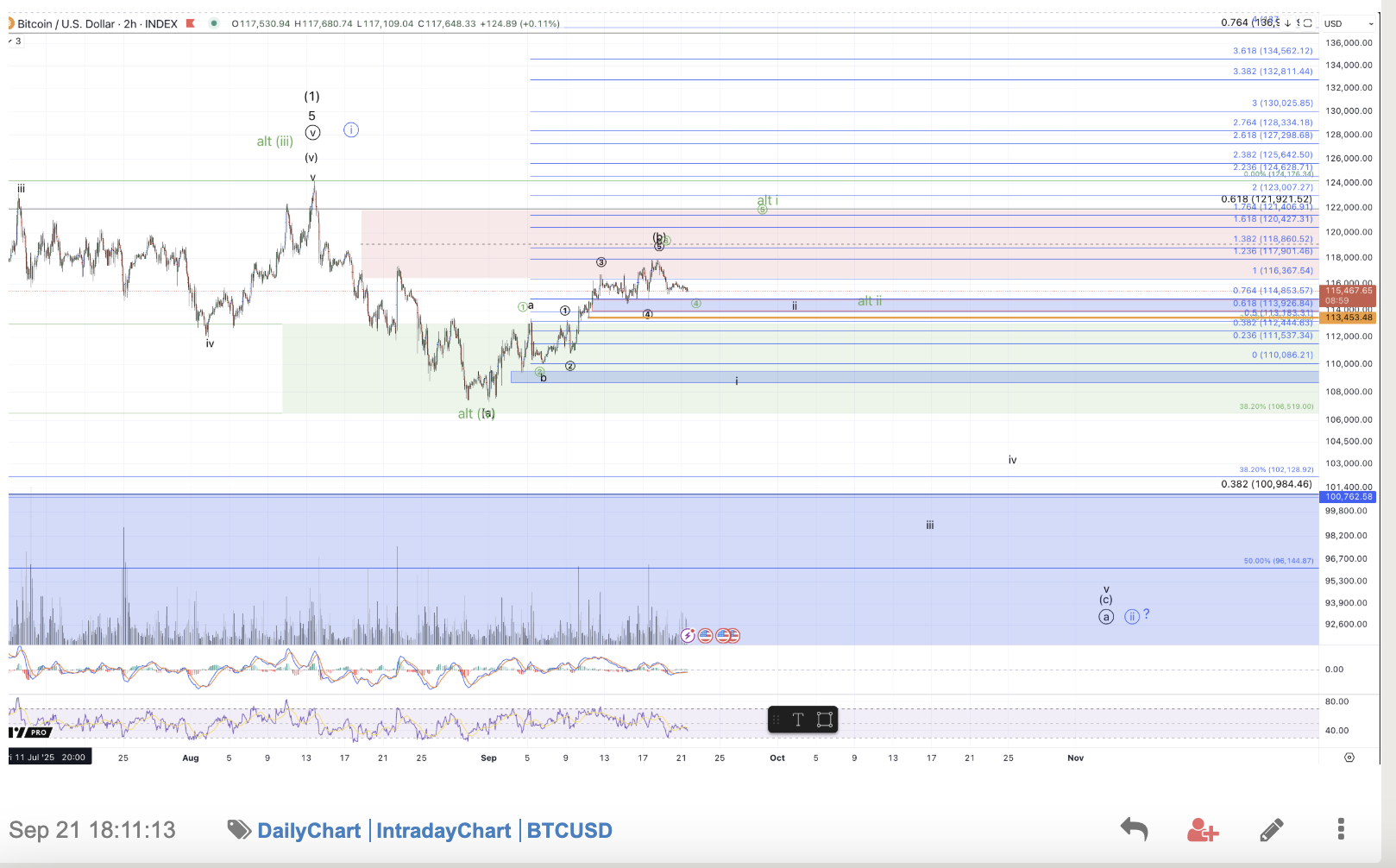

Please see the attached screenshot below from the September 7th article. At that time we had an (a) wave low and had started the initial stages of the (b) wave bounce which filled in nicely to the expected resistance target. Please also see the screenshot of last week's micro chart which suggested that the (b) wave top was in and that price had started (c) down.

From last week: "Preferred action for the coming week entails downside continuation in impulsive fashion that ideally fils in a micro 5 wave decline through $110k. Such a move would resoundingly favor the (already) primary perspective that this bounce in September is corrective and price will decline into the bull market support zone, $85k-$100k, before making a new high."

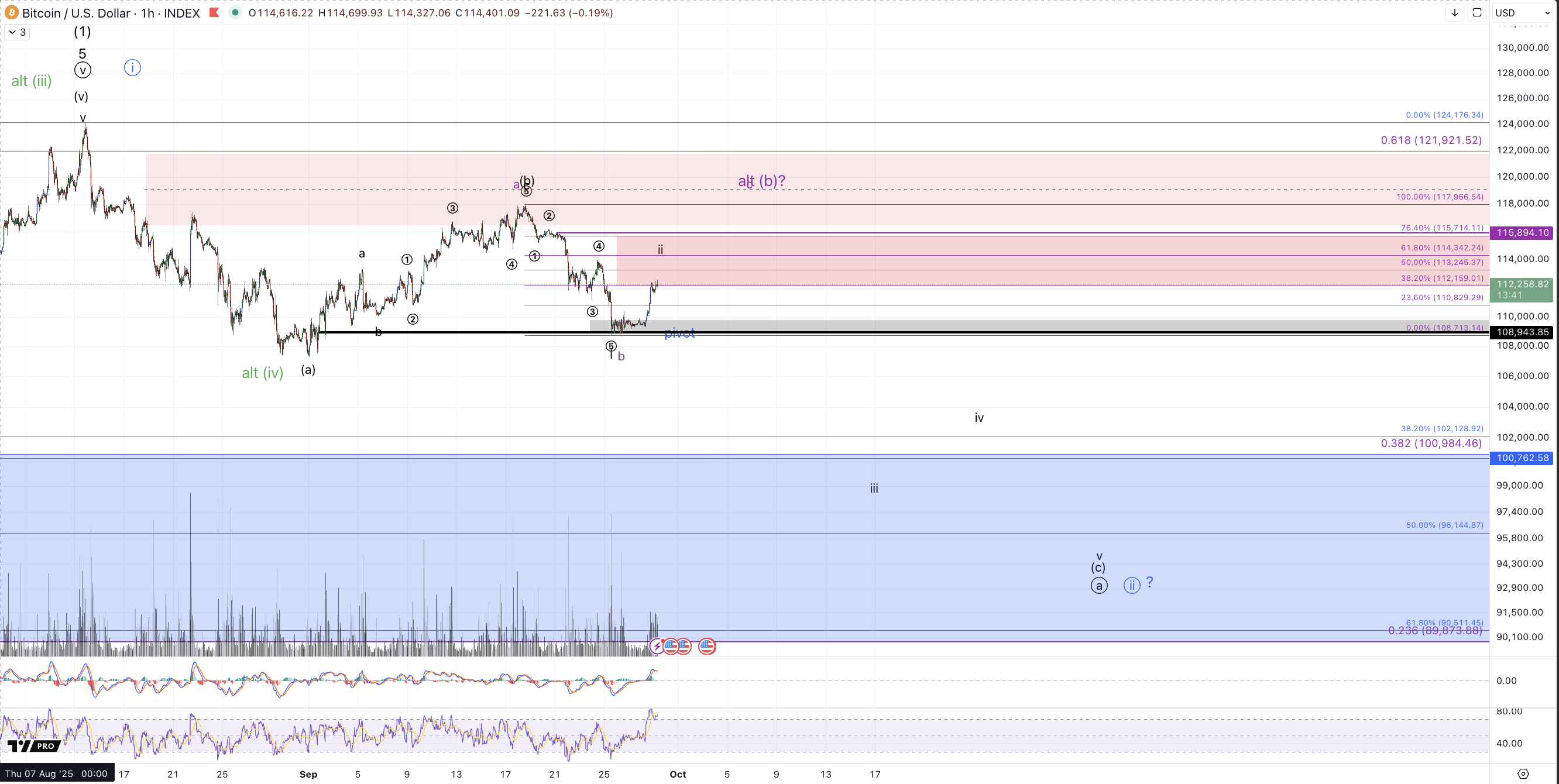

That's exactly what developed this past week, with price striking a low of $108.7k on Thursday, 9/25. This development is another piece of the puzzle here which once again increases odds of price following through down to $85k-$102k. So far a nice bounce has developed from Thursday's low with a rally this past weekend after 3 days of sideways consolidation. My interpretation of this rally though is that it's likely to be a bull trap of sorts for the lower timeframe. From the 9/18 (b) wave high price is tracing an Elliott Wave i-ii downside setup with resistance for ii in the $112.1k-$115.7k region. As of this writing, price is testing the lower end of resistance. So long as this resistance is respected, expectations for the coming week are to see additional strong downside develop to drop Bitcoin to sub $100k levels. Ultimately the target for this decline will be partially determined by where this prospective wave ii tops but I expect to see $98.5k tested at a minimum for the confident portion of the decline. The ideal scenario entails a break down to around $88k-$90k but that's a less confident extension than the $98.5k target.

The alternative prospect of the green count, which entails more direct extension to a new all-time high has still not yet been ruled out. Price has continued to respect the green box (on the higher timeframe chart) and until this breaks resoundingly, I can not ignore the possibility of the more direct run to $130k+. That said, as described above, none of the action on the lower timeframe aligns with a reasonable likelihood for price to run directly to new all-time highs from the current stance. As such, what's being considered as the most reasonable alternative now to the primary perspective (a decline to $85k-$102k) is a bigger (b) wave rally from the early September low. This low confidence prospect is shown in purple on the current lower timeframe chart and entails a test of $118k-$122k region before turning down to sub $100k levels. In order for this prospect to become favored, we'll need to see a sustained break above $115.9k this week. Otherwise, all of the action continues to support the thesis for $85k-$102k to be tested.

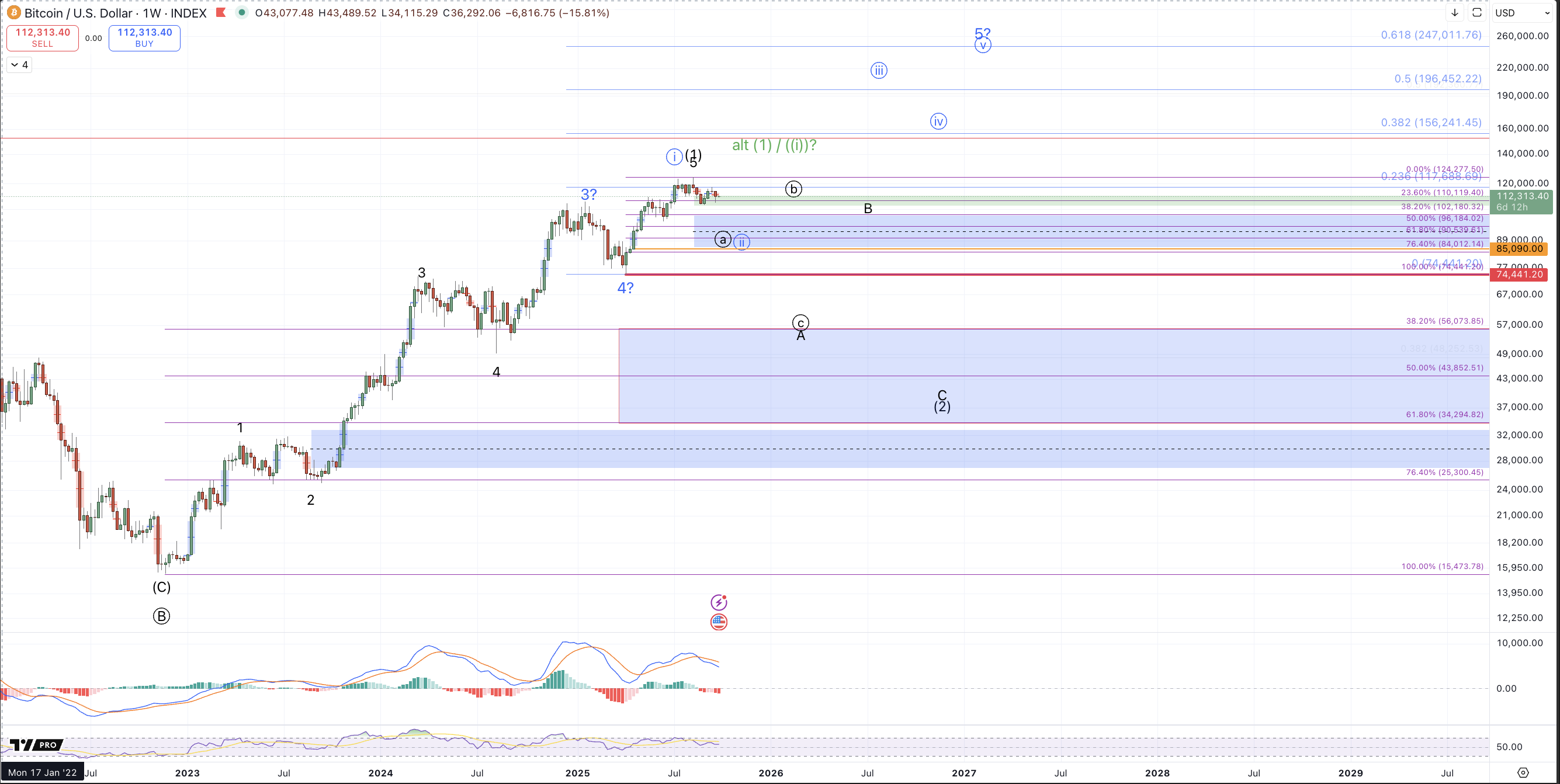

Regarding the higher timeframe, I'm not expecting a break below $85k on this decline but should we see stronger downside develop that slices swiftly through $85k, the April low, $74.4k would be the next target and should that level be breached, the immediate upside prospects for extension to $200k+ (the blue count) would be invalidated.