Bitcoin: Refining our Roadmap for 2026

Bitcoin: Refining our roadmap for 2026

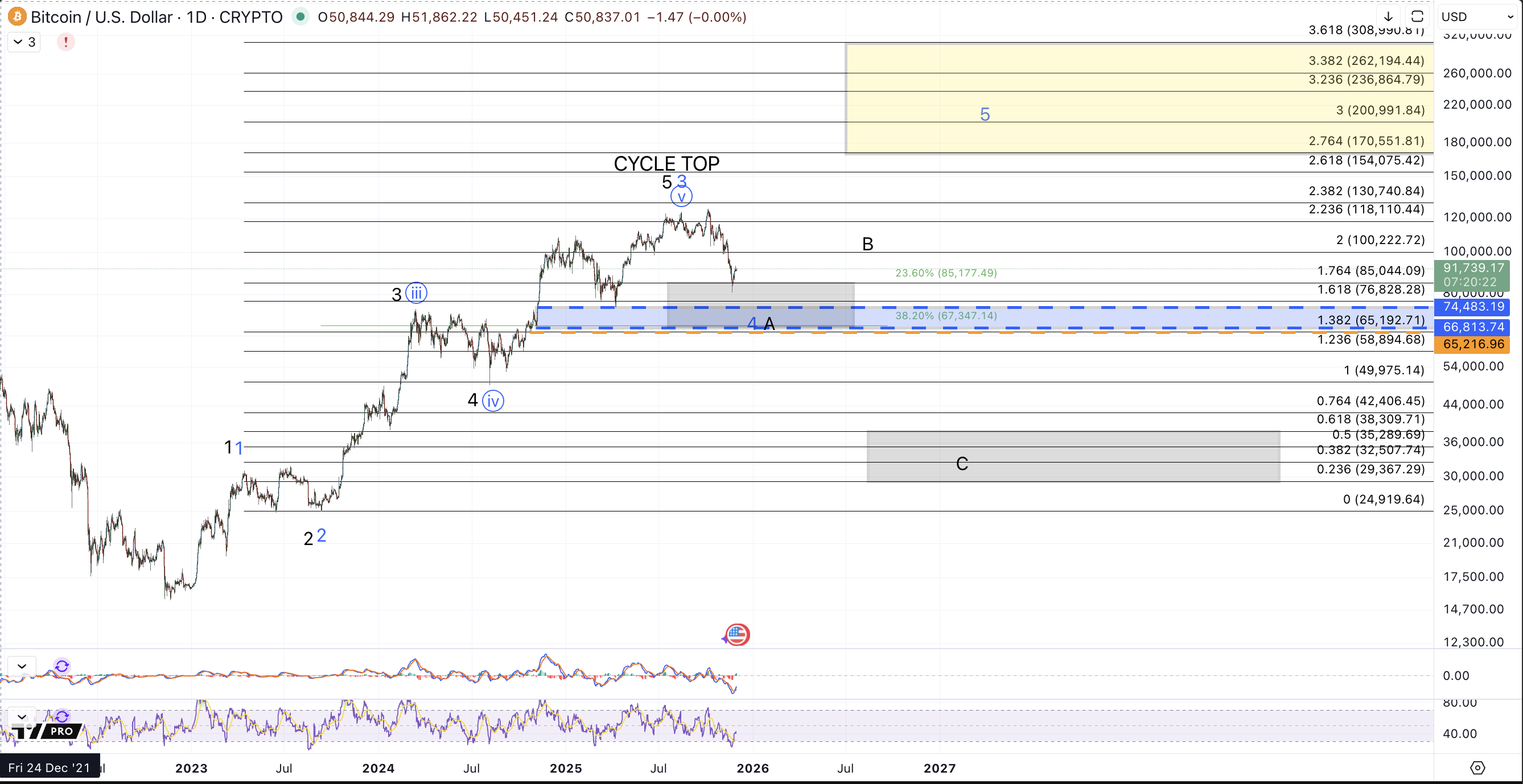

In the October 12th update: ...Establishing a Roadmap for the Next Several Weeks various bullish and bearish market perspectives were presented and endeavored to cluster all possible near term paths into a discreet set of reasonable prospects. From that update, the last paths remaining in this elimination game are the black path, which has very cleanly aligned with price action since October, and the blue path, which is technically valid but on life support. The conditions for its validity require that price remains above the April low, $74.4k, at all times. While that has not yet been breached, the overall appearance of price action dating back to April no longer cleanly resembles a probable circle i-ii. See the attached: BTC Previous Blue Count chart for a visual aid. This decline is just too deep and too protracted to nicely align with a "base" for a direct rally to $200k+, though it remains a valid perspective.

Does all the above definitively mean that the bullish cycle from the 2022 low is complete and a larger bear market is underway? No, not necessarily.

Since the August $124k print, I've endeavored to express the duality here between keeping an open mind for further extension in this bull market while advancing a cautious highly risk managed or even risk averse approach. In the more granular posts and webinars I've conveyed my having de-risked / taking profits in the $115k-$120k region after the $124k high and failure to continue breaking out. Additionally, for the past several weeks, I've mentioned my aversion from participating in new swing longs until $90k was struck. All this is to say that while I've endeavored to give a bullish outcome the benefit of the doubt in the analysis, what's been advanced here was to treat the black count as operative from a trading perspective.

So what bullish prospects remain after price action has eliminated or strongly reduced all but the black count from the October 12th update?

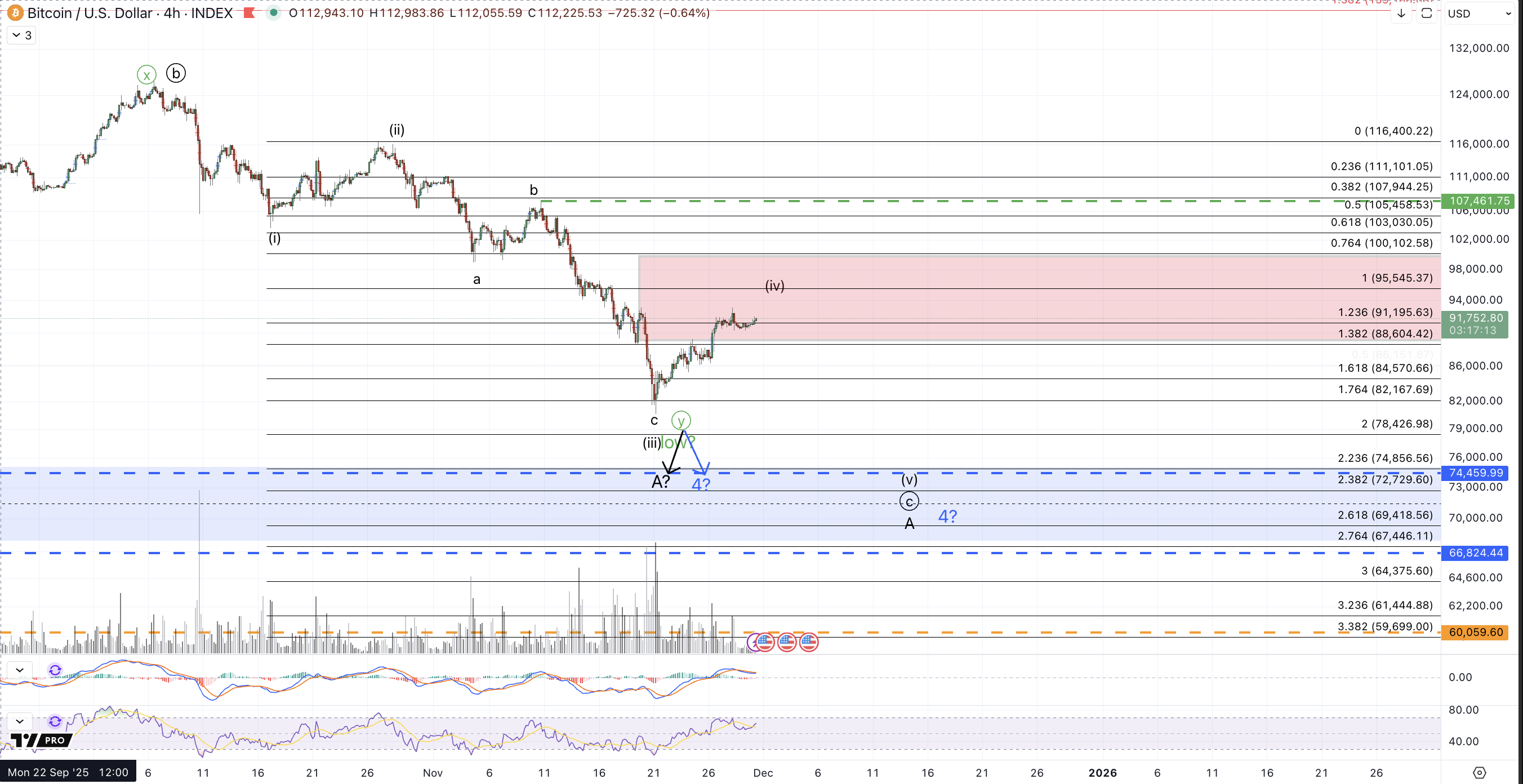

Near the end of last week's update I addressed the display of a purple variation on the daily chart labeled alt 4?. In this week's update, this is presented as the remaining bullish alternative. For the sake of simplicity, this week's daily chart shows the black primary count and the (current) bullish alternative in blue.

Please keep in mind what has been stated repetitively in this article series: Price has a very reasonable 5 wave structure complete at all degrees from the 2022 low and Bitcoin struck the $125k target region, thus satisfying all conditions for the bullish cycle. Additionally, price has now corrected 36% peak to trough (thus far) from the October All-time high to the November low.

The bullish potential that remains considers the October high a very extended 3rd wave within a very resilient uptrend from the 2022 low. In this count, price has wicked into the upper portion of standard support for a bigger 4th wave. Standard support is defined by the .236-.382 retrace which from the September 2023 low to the August 2025 high, sits approximately between $67k-$85k.

Though not invalidating of the black count, I'm still uneasy with the higher high made within the A wave of that interpretation. While it doesn't break any rules, it is relatively uncommon to see an expansion within a subwave of the initiating move to the downside, ie, the A wave.

As for the April low: From an analysis perspective a break below that will still provide additional strength to the thesis of a complete cycle but from a trading perspective this region may provide a very high quality risk/reward entry for aggressive longs. Essentially this approach is following the same logic described near the highs in mid-October: The analysis incorrectly slightly favored the blue circle i-ii count but provided guidance of approaching trading it from the perspective of the black count. Now, the black count looks increasingly favorable from an analysis perspective, however the risk / reward of approaching longs from the perspective of the new blue count has increased dramatically.

Personally I'm going to consider another small long tranche upon a move to new lows ESPECIALLY if price tests the April low. This counterintuitive approach often provides the best trades, provided that one is entering lightly and awaiting some confirmation with a break of resistance before filling in a remaining position on a higher low with very tights stops below the preceding low. In other words, the very level that provides additional confirmation of a top, may be the last downside target in the initial move down before a sizable bounce, even if just a B wave. The reason a light entry or even no - entry is considered at these levels is that there's no clear level to trade against for a stop out. If participating there, please be mindful of size and risk.

As for the micro structure: While price has broken initial upside resistance to at least provide a good signal of a wave (iii) in place, the structure down from the October high appears rather odd for completion, even considering Bitcoin's penchant for exotic corrective structures. As such, I'd really prefer one more low, which should minimally target $78.4k, but more ideal would entail a hit of the $70k-$75k region to complete 5 down from the all-time high either as a circle c of A or blue wave 4. Micro resistance for the lower low is $91.2k-$100.2k. So long as this region is containing upside advances, a lower low is still preferred. However, should a sustained break above $100.2k develop, I'm neutral on the prospects of immediately lower lows unless $107.5k, the 11/10 high is breached. Should price make a sustained break above $107.5k, I must consider a low of sorts in place but this will be treated as a bear market rally, ie, a B wave unless we see a clear impulsive structure develop off the 11/21 low.

Assuming price does followthrough on the micro count down to a lower low to the aforementioned $70k-$75k region, a sizable bounce is expected, at least as a B wave in black. Assuming price does not break $65k though, and reverses back up impulsively, that will start to shift odds back in favor of the new blue count as wave 4 bottoming and developing a very bullish setup for 2026 in a new 5th wave.