Bitcoin: Rally Rejected!

Bitcoin: Rally Rejected!

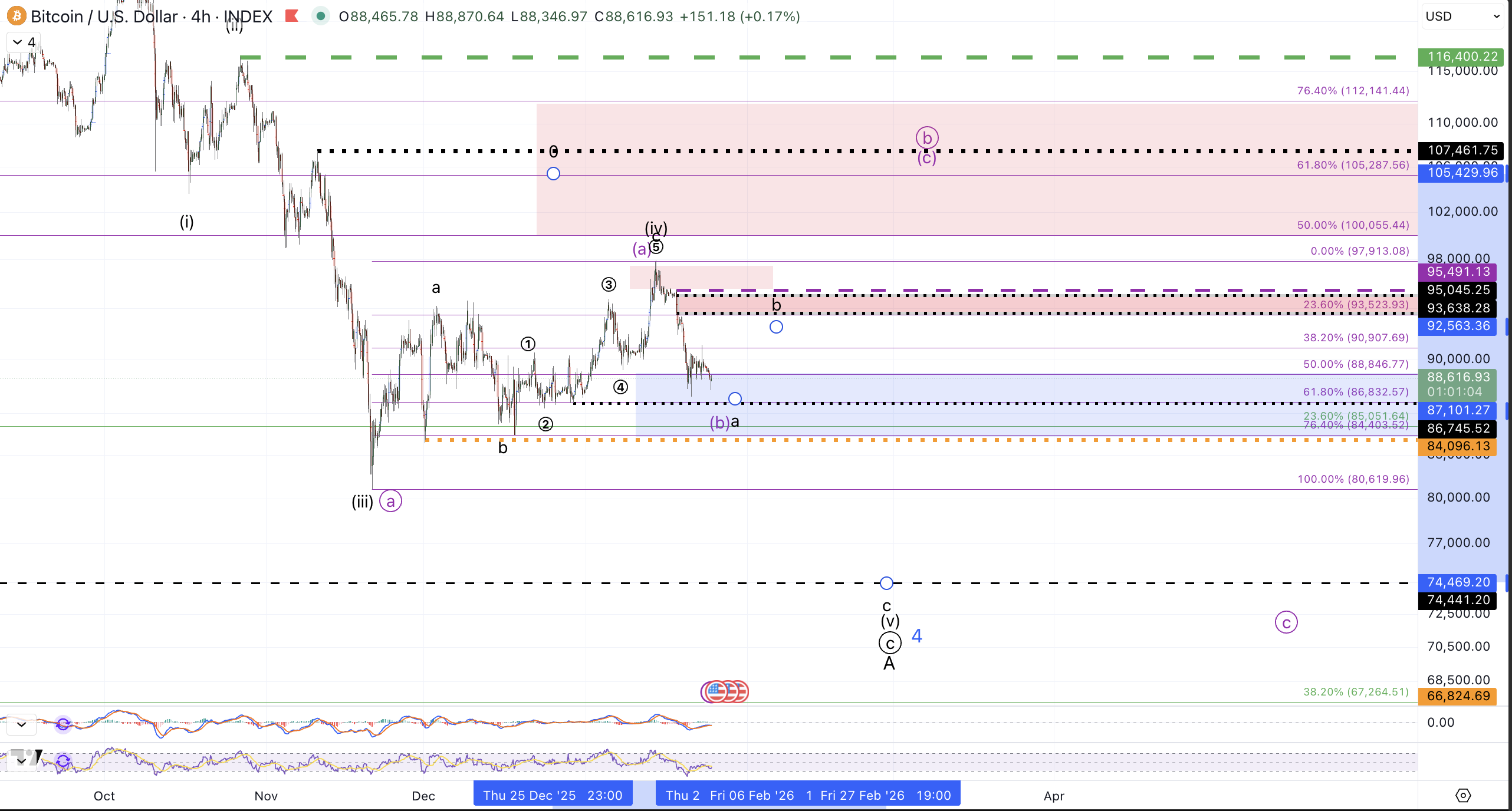

Bitcoin consolidated between the November low, $80k, and the early December high around $94.2k struck on 12/3 for nearly 8 weeks. As mentioned last week, the 3 subsequent attempts to break out of the consolidation region to the upside failed until 1/13 where price finally made a meaningful and sustained break above the consolidation reaching a high on 1/14 just shy of $98k.

Based on the aforementioned action, in last week's article I considered more direct upside followthrough to $107.5k as the primary scenario. This has proven incorrect however. On Sunday afternoon 1/18, a few hours after penning the article, Bitcoin got a strong decline and in the subsequent days, price continued down below $89,225, the 1/8 low, thus invalidating the immediate rally in a bigger (c) wave as was forecasted.

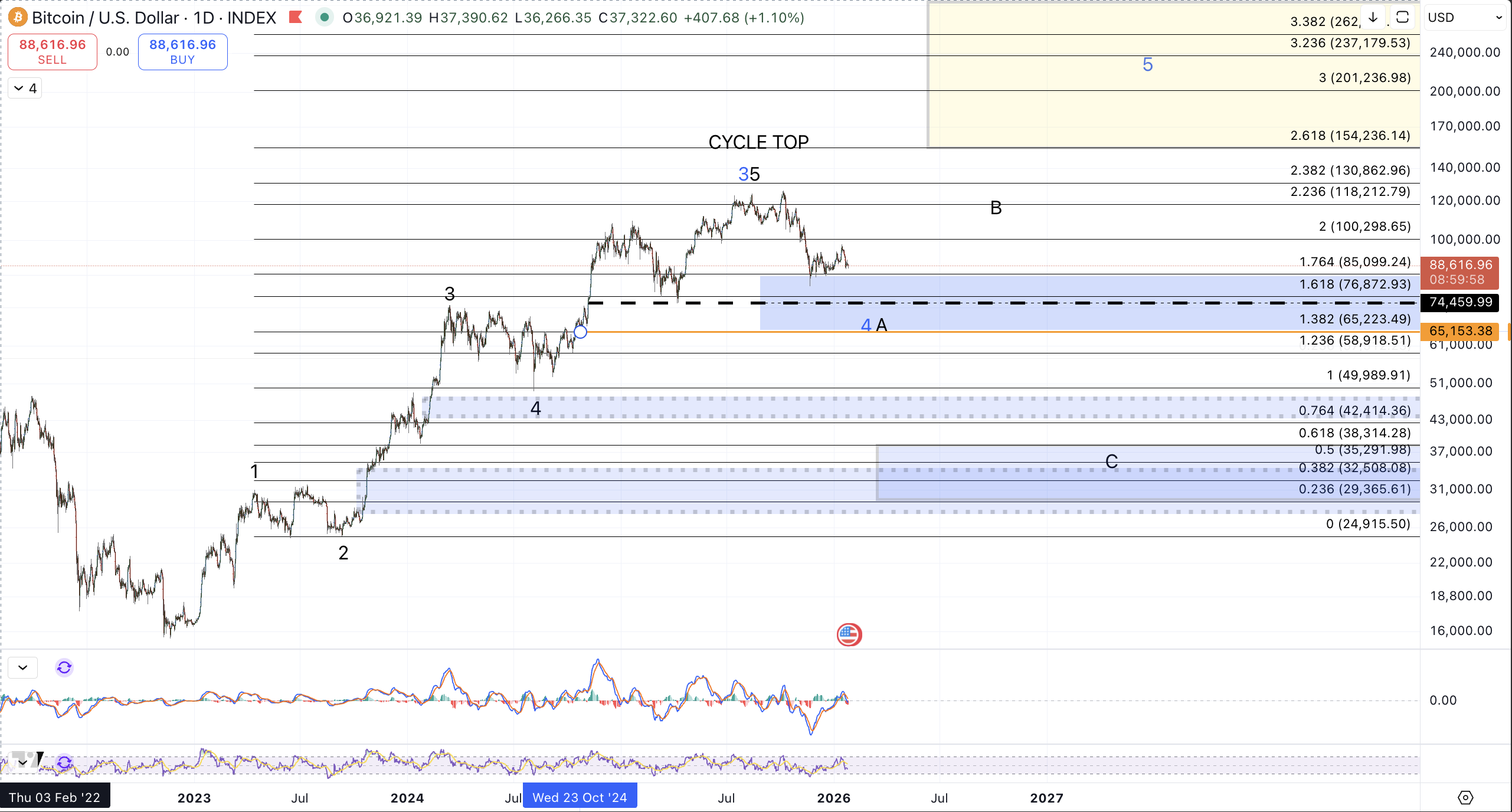

Considering the broader bearish context for price action since the October 2025, a retest of the April 2025 low, $74.4k has been favored and continues to be. The pertinent question for lower timeframe traders is how price gets there.

Given the strong rejection of price sustaining trade above the 7-8 week consolidation zone, $80k-$94k and the relatively steep decline since the January high, a more near term and direct decline to retest the April low has become the primary, ie. preferred scenario.

As discussed last week: "if price makes a sustained break below $89k, a more immediate move down to retest the April 2025 low ($74k) and likely lower will become preferred. For the purple count to become operative, price should form a corrective decline and make a brief break below $89k followed by a quick recovery."

So far price has failed to meaningfully bounce from the 1/21 low, $87.2k, and as such the bearish count is favored. While that does not rule out corrective bounces from current levels, it does suggest that the 1/14 high should be left unbroken before heading back below the November low and ultimately retesting $74.4k.

The micro action since the 1/21 low is rather ambiguous, obfuscating whether price has bottomed in either count (black or purple) and so an immediately lower low down to the $86k-$87k is reasonable. Once price establishes a bottom we can measure for Fibonacci resistance but for now, the two areas I'm watching are $91.3k-$92.6k and $93.6-$95k. So long as any subsequent bounces remain corrective and the upper resistance is region is not breached, the black count will remain favored. However, should we see an impulsive rally develop or see price make its way back above $95.5k on a sustained basis, then the wider circle b wave is back on track and we may see $107.5k struck before the November low is retested.

The larger and more significant debate - between whether the cycle from the 2022 low has completed vs another swing high targeting $200k+ - remains intact and fully unresolved as price chops around the $85k-$95k region. Though a completed cycle is slightly favored, the door for higher remains open until the bears can resoundingly break the $65k-$67k area around the pre-2024 election lows.