Bitcoin: No Route Yet Selected

In last week's article all of the paths (displayed on the attached charts) were presented with commentary on how the price action has aligned with the expectations of each path. Please review those roadmaps and their parameters there.

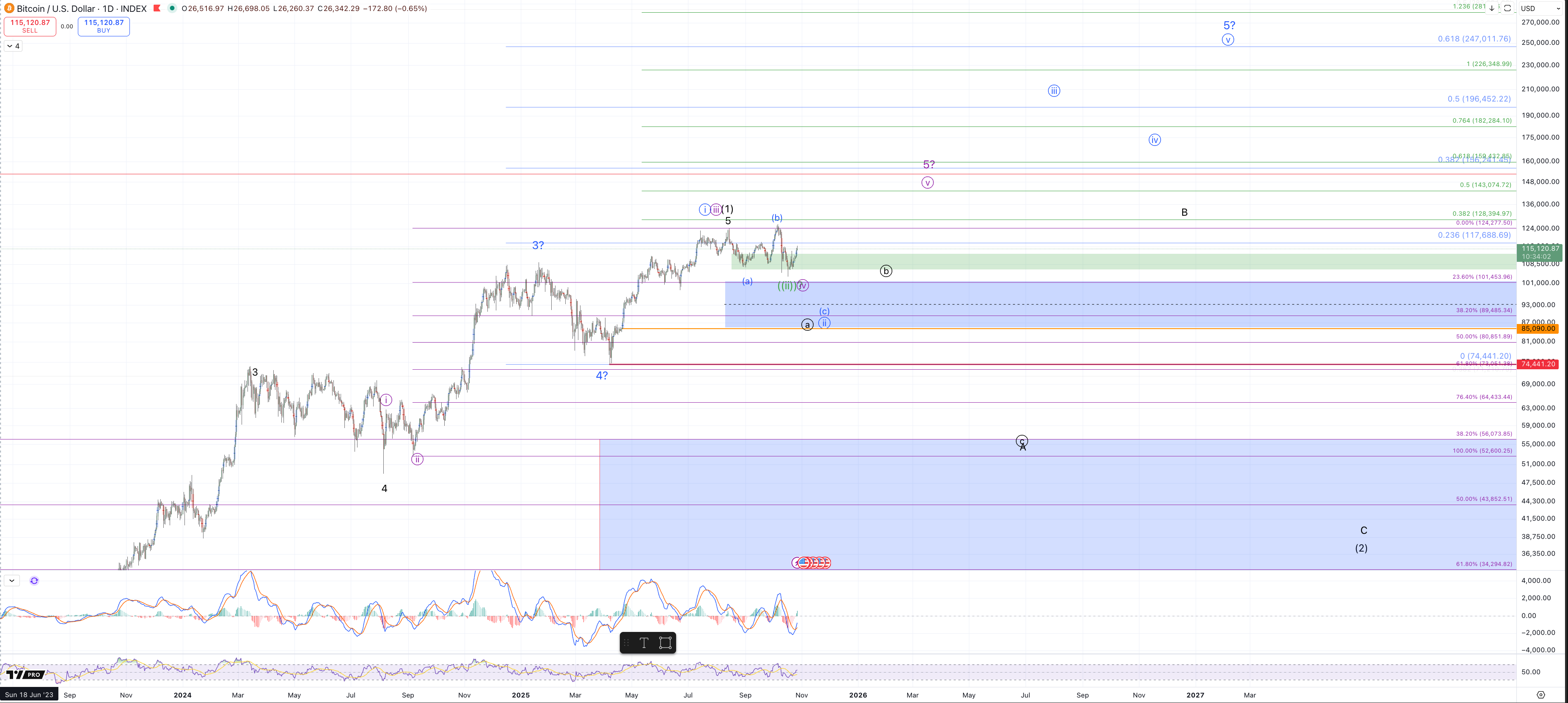

The structure from the Friday 10/17 low now has a clear 3 wave rally which has taken price higher into resistance but is still contained for a very reasonable downside setup. In the context of a potential i-ii down as suggested by the black count, a bit of an extension higher up to the $117k-$120k region is acceptable but sustained break beyond that become problematic for this interpretation. Last week's commentary on this was as follows:

"In the coming week, the key thing to watch for will be wave structure off the Friday 10/17 low. Should we see a micro impulsive 5 waves up develop, this action will strongly favor a completed a-b-c (or (a)-(b)-(c)) as per the purple/green counts. On the other hand, a corrective 3 wave bounce into this resistance or a move back below Friday's low will strongly favor the black/blue counts and expectations will favor continuation down to $85k-$100k."

Considering that the pattern up from 10/17 does appear corrective this detail alone clearly favors a reversal (down) to develop from this region. However I want to sound a small note of caution to those looking to aggressively short for this setup. It must be noted that the upper support zone (green box) with a low end of its range at 106.5k has not been meaningfully broken or sustained below. Should price have provided a more meaningful break below, and then come back up into resistance I'd consider the downside prospects a more confident setup, whereas right now the pattern from the August high to the October low counts very reasonably as a completed a-b-c flat as the green/purple counts suggest.

The problem with embracing the green / purple interpretations here is that the bounce up from the 10/17 low appears to be rather corrective. I'll note that sustained rallies have started with worse micro structures but what's developed from the low does not inspire confidence for immediate upside followthrough to new All-Time Highs as the green/purple counts suggest. However, in the coming week should price continue up through $122.6k, odds are for extension higher to $130k+. At the moment I have no clear micro structure to show how price might develop towards that target.

I'll recapitulate my tone from the previous week with a note of caution about this current region as price is stuck in a range that's developed since early July. The corrective bounce up does favor downside but I'm not going to pound the table yet for a drop under $100k just yet. An impulsive reversal from the current resistance region back below $110k, however, will change that and have me more strongly favoring a breakdown below $100k.