Bitcoin: How Much More Will Price Correct From The Highs?

Bitcoin: How much more will price correct from the highs?

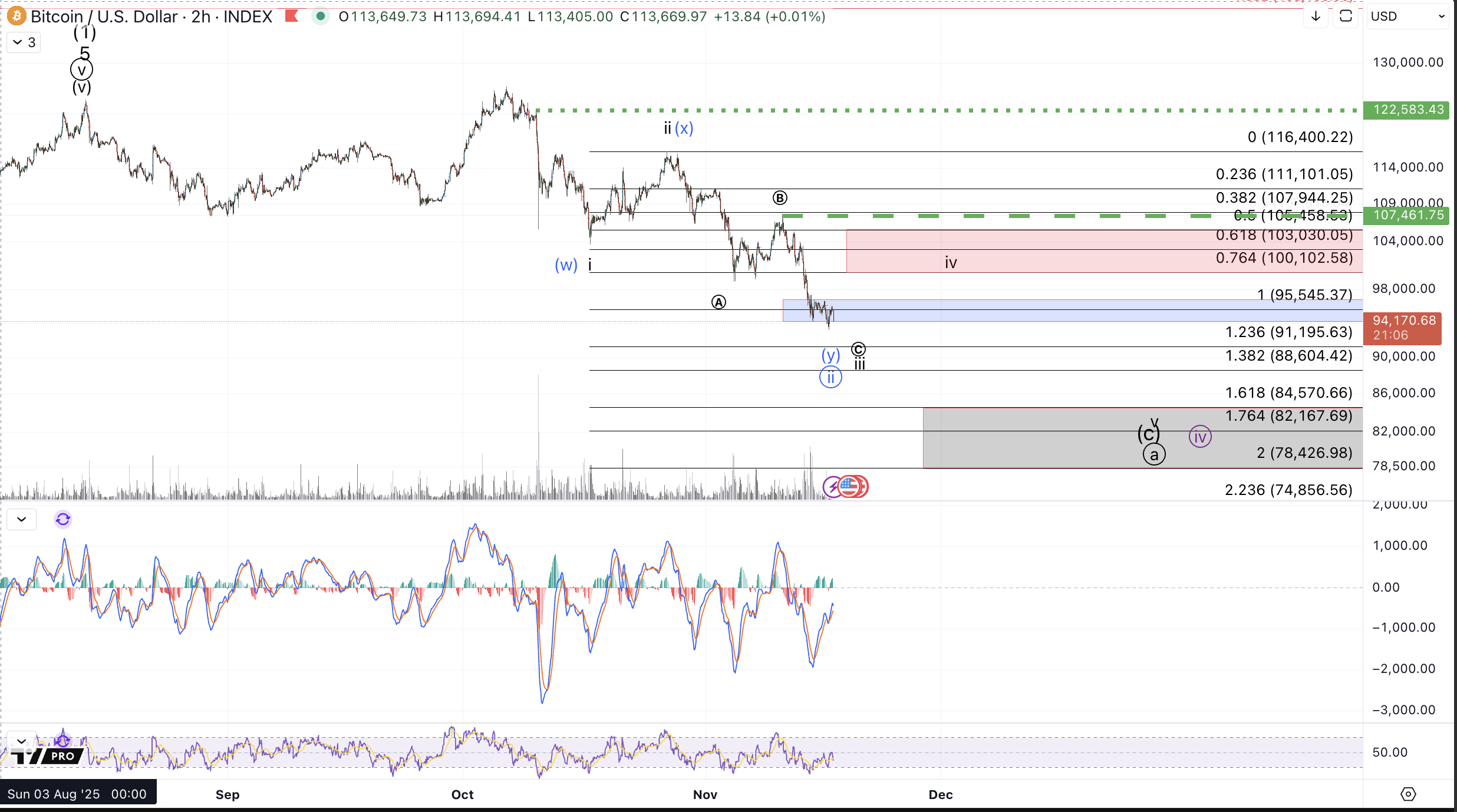

Since last week's article Bitcoin's price declined strongly in impulsive fashion and as of this weekend's low in the $93.1k region it's quite clear that the primary expectations for a move down to $95k (or below) have been satisfied. On the shorter timeframes price is both very oversold and looks to be nearing a very full 5 wave C wave decline from last Monday's high from $107.5k

The ideal region to strike for the wave iii within the black count shown on the micro 2hour chart is $90k-$91.5k. My expectation for early in the week, is that price can head down to test that region, so long as no bounce prior to it exceeds $96.6k.

Even in the black count which is clearly more immediately bearish, a bounce from $90k~ is quite reasonable and should such a bounce develop this week, we'll need to discern whether Bitcoin is completing all of of the correction from the October high or whether the bounce will merely put in a temporary bottom before more downside fills in.

Assuming price does provide the expected bounce this week whether from $90k, which is preferred, vs. more directly higher from the $93k low, resistance for further continuation within the downside pattern, is in the $100k-$105.5k region. Should that region hold and send price down it further favors the black and purple counts and the next target for this decline sits in the $82k-$85k region.

In order for a more significant bottom to be posited with some reasonable confidence, the expected bounce from $90k will need to impulsively rally through $107.5k on a sustained basis. Should such a move develop in the coming week, it would be a strong signal of a low in place and that price is primed for a run to new All-time highs whether within the blue or purple count. However, at this time the onus is on that more immediately bullish count to prove its case given that it would require a more exotic completion to this correction. It would be foolish however not to be ready for that potential though given Bitcoin's penchant for irregular and / or exotic intermediate corrections within a larger bullish cycle.

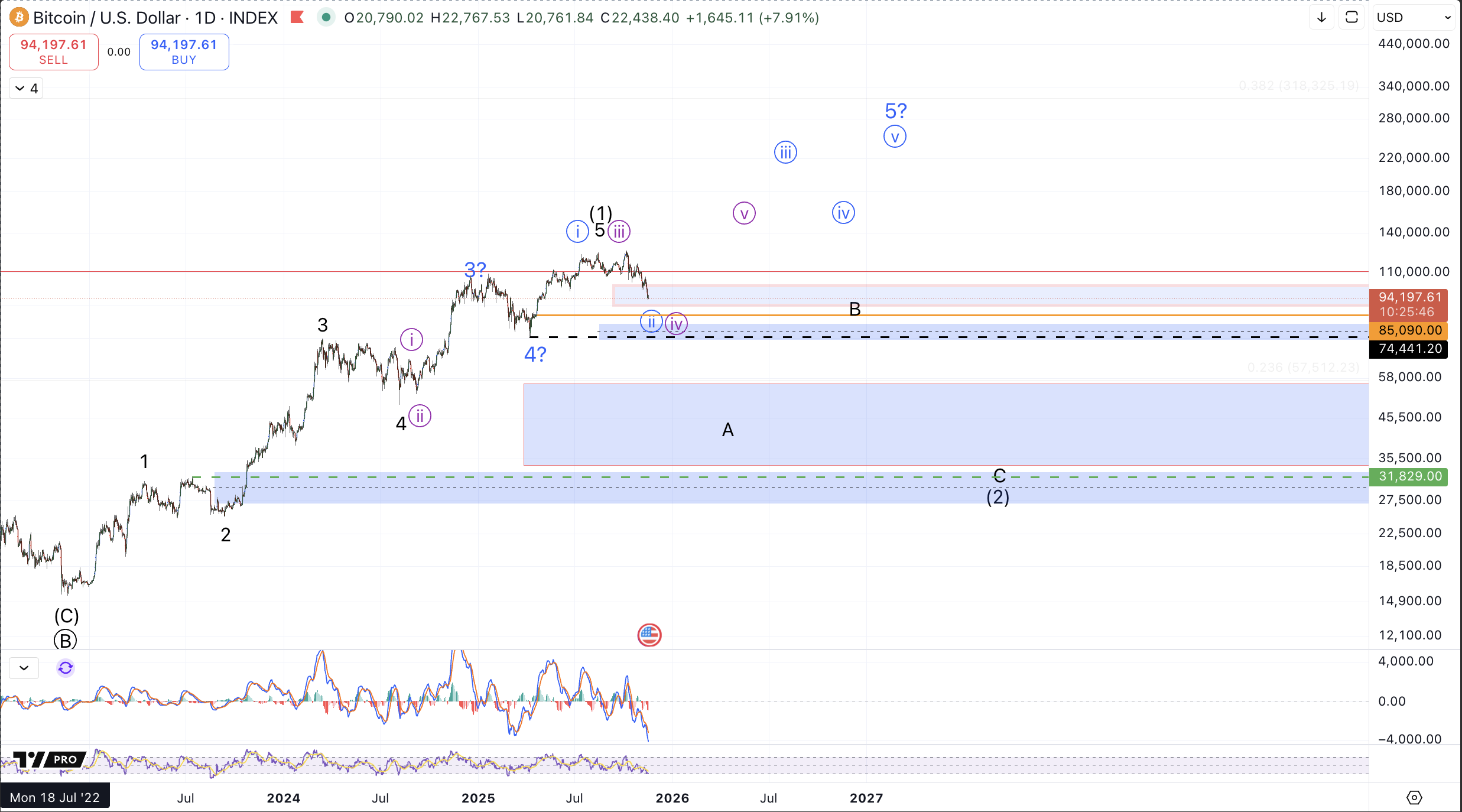

All the above conjecture aside, the standard pattern entails a failure from the $100k-$105.5k region and continuation down to new lows in the $82k-$85k region. As discussed in the previous week's articles, that region represents lowest acceptable levels for a possible blue wave circle ii in the larger potential for a bigger minor wave 5 off the April low targeting $200k+. Instead, should price get any sustained break below $85k, it's much more likely that new all-time highs within this cycle would be limited to a run to $140k-$160k as per the purple count.

And lastly, though not unexpected, I have written since August that the subwave activity from the 2022 low is quite sufficient for a reasonable completion to the cycle and price did satisfy without qualification the $125k target. As such it's quite reasonable that price is still just within the very early stages of a larger bear market pullback which I'd minimally expect to test the August 2024 lows around $50k but would prefer tests the October 2023 breakout region between $29k-$35k. A move below the April low of this year, $74.4k does not rule out the prospects of immediate reversal back up to new all-time highs as per the purple count, but it would invalidate the blue count and the longer price maintains below the April low and the lower it goes, the more increasingly likely it is that the bull cycle from the 2022 low has completed.

Considering the drawdown that's entailed I still have not re-entered any swing trade long positions in Bitcoin since de-risking in the $115k-$125k region exercising risk management in midst of a very reasonable larger degree completion. Personally I will only consider light entries around the $90k-$91.5k region as an initial long but will wait to see some confirmation of a low in place before adding any significant weight.