Bitcoin: Bull-Market Target Officially Reached Without Qualification and a Surprise to the Upside

Bitcoin: Bull-Market Target Officially Reached Without Qualification and a Surprise to the Upside.

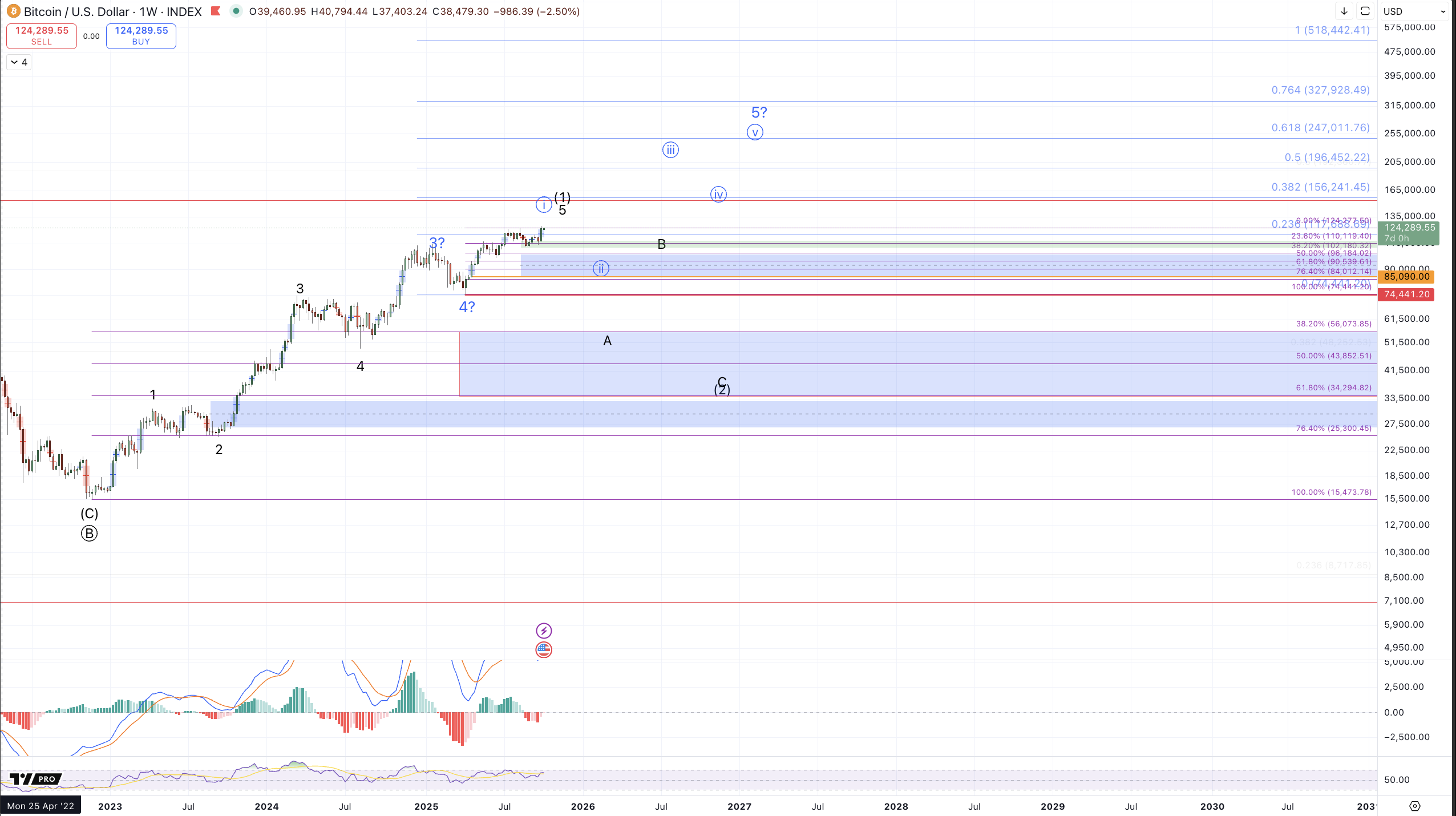

For the past several weeks in this series of articles I have expressed a primary thesis that Bitcoin has enough upside to consider the move from the 2022 low complete on all timeframes. Additionally, even though the $125k target we've been tracking since 2022 was not technically reached, the August high only missed it by a few hundred dollars so I was considering it "close enough." As such, my recent bias has favored downside continuation to target the $85k-$100k region before a larger degree path could be determined. ie, would price continue down through the April low, $74k, and retrace the rally from 2022 or would we see another medium timeframe swing higher to push price up to $200k+ as per the blue count.

The secondary or alternative thesis, which has been displayed in green, described that the lower timeframe price action was out of accord with a more immediately bullish run to new all-time highs with the singular exception of maintaining support for that prospect.

From last week: "The alternative prospect of the green count, which entails more direct extension to a new all-time high has still not yet been ruled out. Price has continued to respect the green box (on the higher timeframe chart) and until this breaks resoundingly, I can not ignore the possibility of the more direct run to $130k+. That said, as described above, none of the action on the lower timeframe aligns with a reasonable likelihood for price to run directly to new all-time highs from the current stance."

Our view of markets is one of non-linearity, meaning that we understand outcomes to be probabilitistic or even stochastic rather than deterministic. That is to say, forecasted outcomes will be described as "favored" or "more likely" but certainly not guaranteed. This week price took what I viewed as the lower probability path based on what nearly all of the lower and higher timeframe action suggested which in this case proved to be an incorrect forecast for Bitcoin. Specifically, instead of Bitcoin following through in the expected decline to $100k (and below), we got a surprise move to the upside to new all time highs which officially struck north of $125k, thus satisfying the expectations from the 2022 lows, now without qualification.

How do we adjust the path from here?

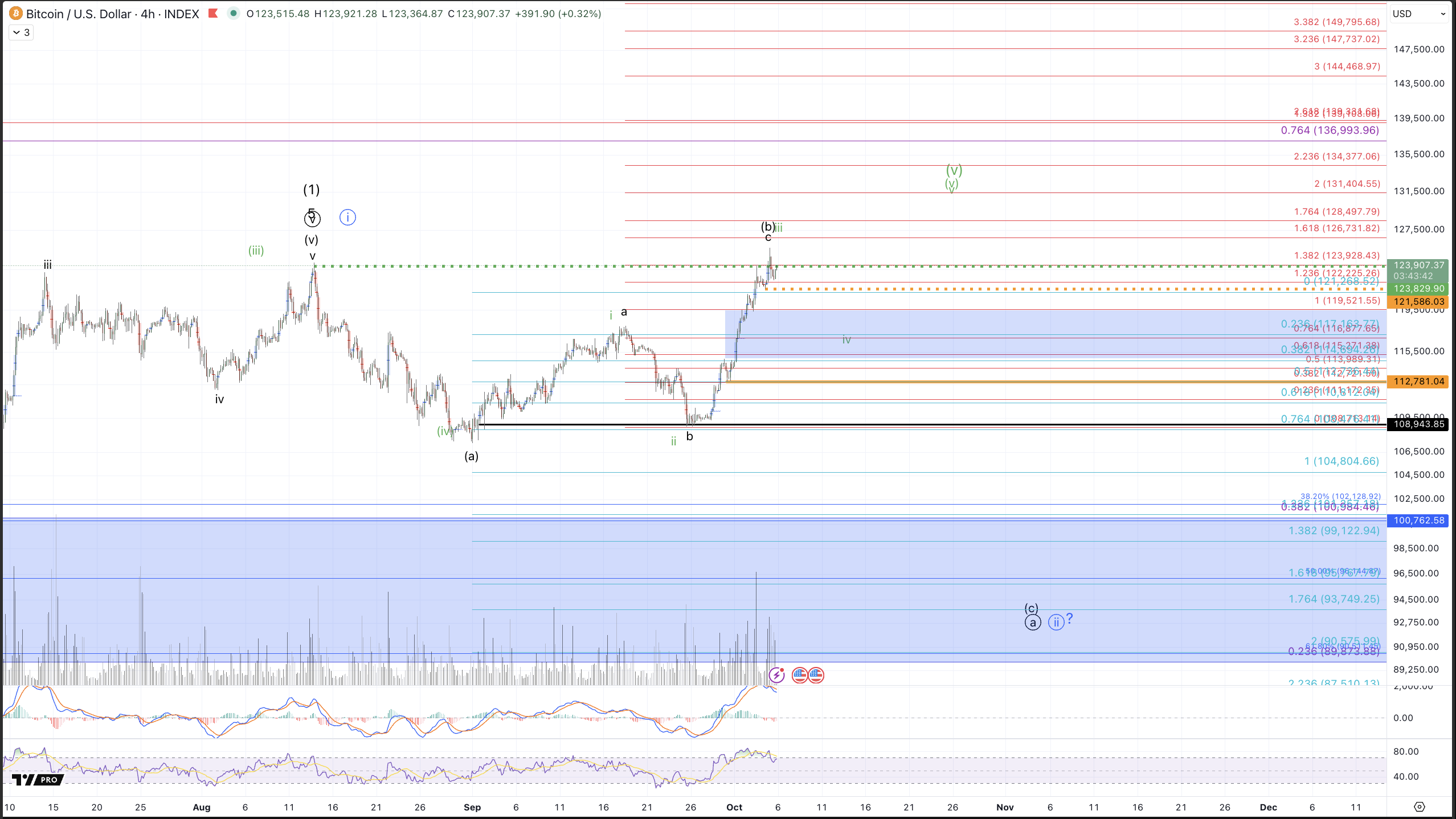

In the current stance, which contains a violated downside setup, accompanied by a run to new all-time highs which have not sustained nor been resoundingly rejected, we have something of an ambiguous posture. That is to say, if price were strongly reject from a new high and we saw a steep $5k-$10k drop, we could reasonably favor that the expected path from last week is more or less intact, albeit with a detour to satisfy the $125k target. Conversely, if price ran up through the August highs and continued higher we would obviously favor upside continuation for Bitcoin until some supports break to provide reasonable evidence of a top. Instead, we have a new high and a small (thus far) rejection with price consolidating around the August (former all-time) high. As of writing this article, price is trading in the middle of a small range that's developed this weekend between $122.4k-$125.7k. As such, we don't have an obvious tilt towards one path vs the other.

To reasonably establish that some kind of pullback is underway, we'll need to see a sustained break below $121.5k at which point our attention turns to the $114.6-$119.5k region in which we have Fibonacci support for a wave iv pullback and breakout / fair value gap area from this past week. Should this region hold, we can reasonably expect another rally up to target minimally $128k but I would not rule out much greater extensions in the current environment, even as high as $156k.

On the downside, shown in black, we still have just three waves up from the September low in a corrective formation (albeit one that has reached new highs) and as such I can not cleanly rule out this rally trapping a bunch of new bulls before slamming down to the $85k-$100k region. That said, in order to revive this count as "favorable" we'll need to see price form an impulsive move back through support, $114.6k and then ideally continue directly through $112.8k on a sustained basis.

As such, the most likely path, from the current stance entails some continued consolidation, followed by a retest of upper support and then up to $128k+

While the lower timeframe action has certainly shifted, my larger degree interpretations remain relatively unchanged. I see BTC as "topping" but it's unclear as of yet, whether another run to $200k+ is in the cards for this cycle. A drop down to the major bull market support in the $85k-$100k region would provide much better risk / reward entries vs. FOMO'ing in at current levels to play for what's potentially a somewhat limited upside to complete the cycle. By the same token, nimble traders may consider how to interpolate the smaller timeframe analysis to play for upside in an advantageous way regarding risk vs. reward so long as lower time frame support, $114.6k - $119.5k, is respected and risk is managed should this support region resoundingly break with a sustained breach below $112.8k.