Bitcoin: Blastoff or Fakeout?

Bitcoin: Blastoff or Fakeout?

Before I answer that question, it's important to note that ultimately, I don't see it as likely that Bitcoin has topped in the rally from the 2022 low. My target from the beginning of this rally has been $125k+ and in recent weeks I've shown a reasonable path for further extension up to $200K+ Nothing in the recent weeks development of price action warrants letting go of that perspective.

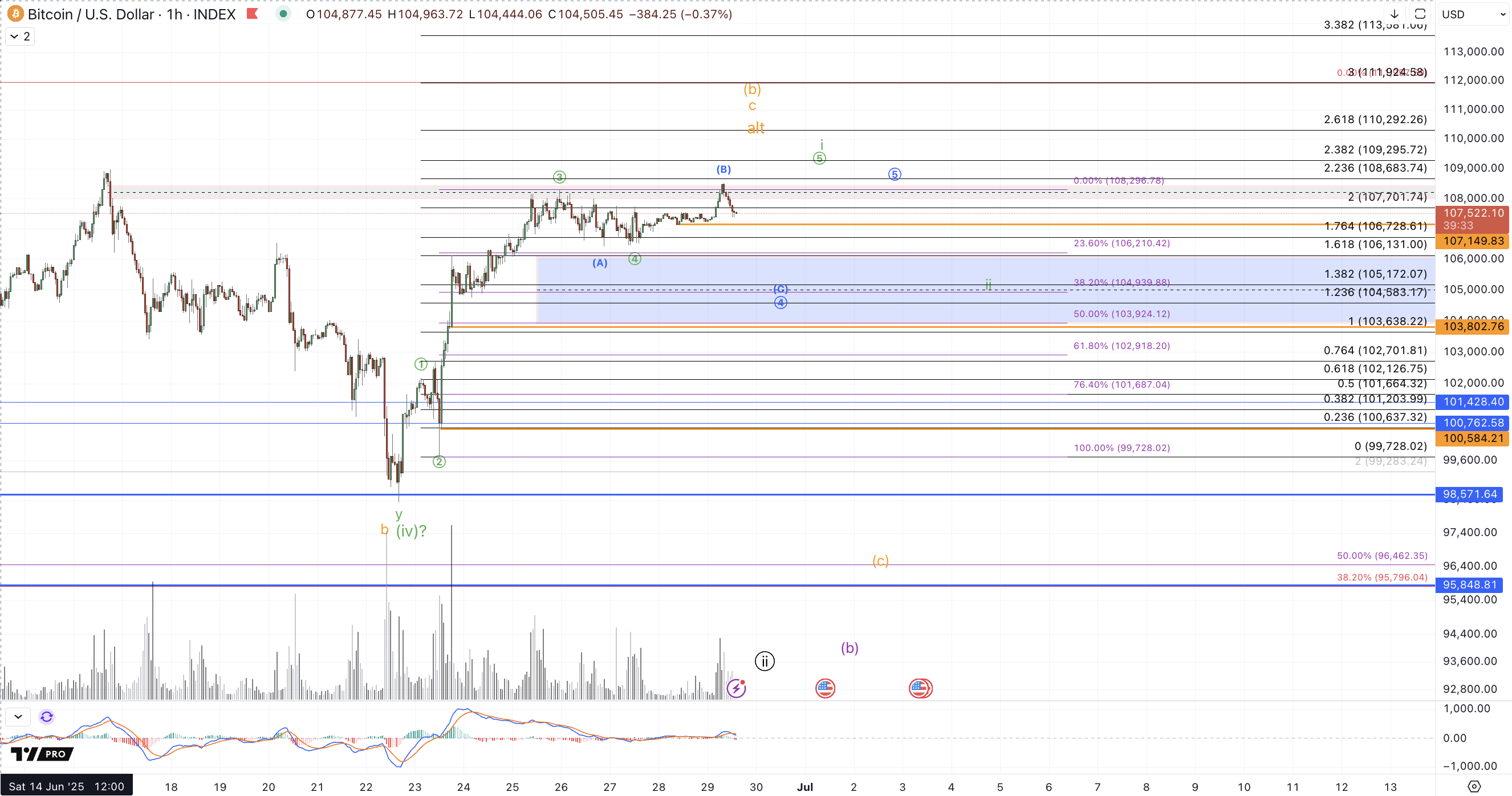

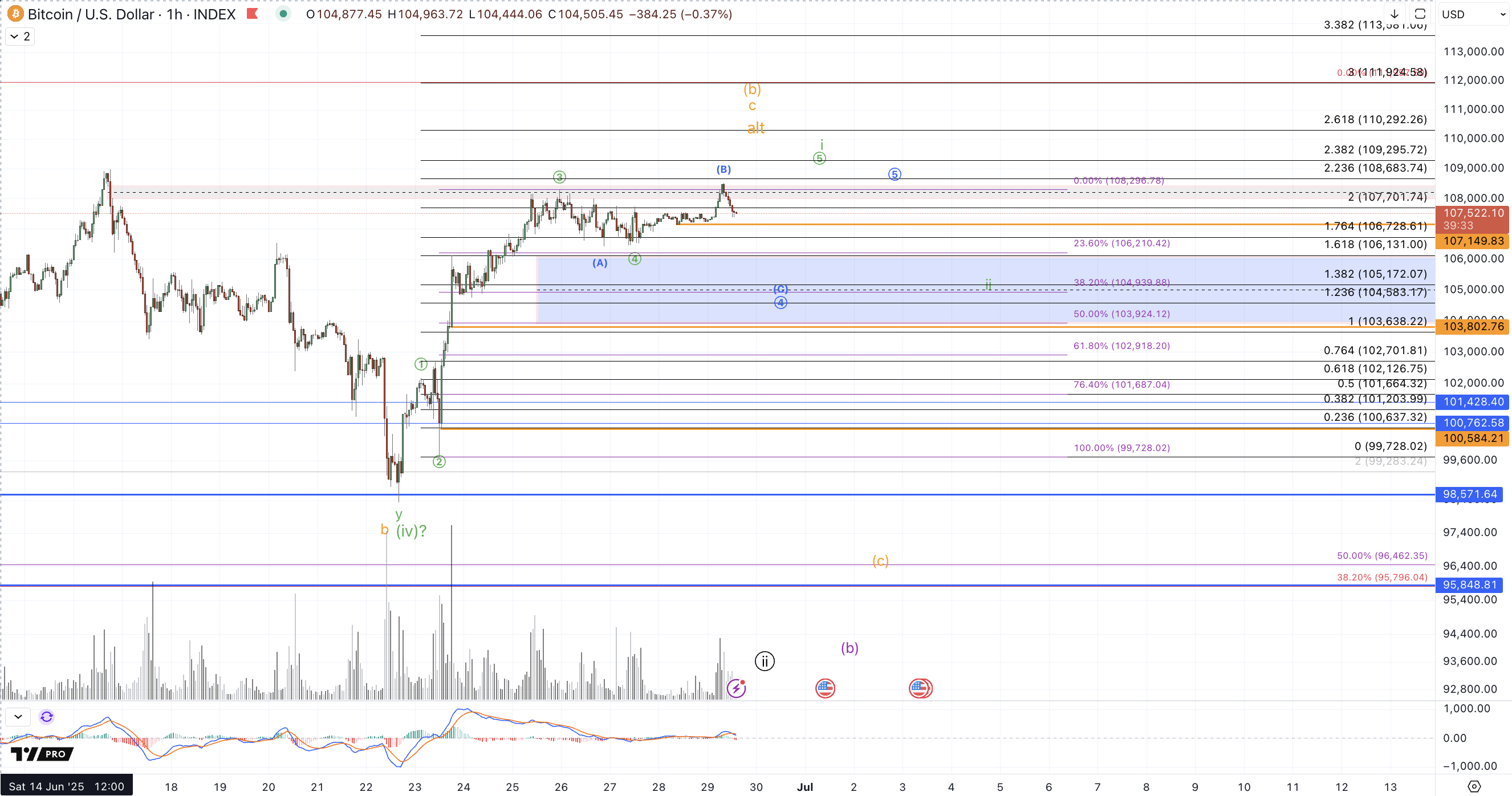

As of the writing of last week's article, Bitcoin was getting very near to what ended up being the low for the week. At the time, the expected micro path that the initial decline suggested, entailed a corrective bounce from the $98k-$98.5k region up to $100k before turning down to $96k to complete potentially all of the decline (green) or just the 3rd wave in black (see screenshot below from 6/22). However, instead of stopping at $100k, the bounce continued all the way up to $108.5k leaving the downside looking very incomplete.

Also, even though Bitcoin broke below the June 5th low, price has remained well above the $96k level that distinguishes this pullback from the late May high as a large wave (iv) (in green) vs. the larger degree wave circle ii in black or (b) wave in purple. Essentially, rather than last week's move rendering one of the potential paths invalid, the stick save and subsequent bounce has left all three counts firmly intact.

In order to embrace the green count as the primary thesis for a more direct move up to $125k+ without a retest of last Sunday's low, we initially need an impulsive micro 5 wave rally. The move up from last Sunday's low has maintained a potentially impulsive path but I can not say that price has provided a clear micro 5 waves and thus the initial condition for making the green count primary has not yet been met. Also, beyond getting a micro 5 waves up, price then needs to hold a corrective retrace of this rally from the 6/22 low, which would mean a successful retest of support in the $101.7k-$105k region without a break below it, followed by a rebound and takeout of the price that forms a high to this initial 5 wave rally for wave i in green. That's still a tall order.

So while the recent action this week has made a mess of the potentially tidy completion of the correction that was forecasted in last week's article, Bitcoin is not in a substantially different stance. That is to say, that without all of the above conditions being met for the green count, the prospect of a move down to the $90k region still looms largely.

At this point, price needs to hold above last Sunday's low at all times to preserve the green count. At the very micro level, if price can maintain above $107.2k and print a higher high above today's (6/29) 8AM eastern time zone high, that would be the minimum number of waves needed to consider a complete 5 up for wave i off of last Sunday's low. If instead price breaks back below $107.1k on a sustained basis, the $103.9k-$106.2k region comes into focus as Fibonacci support for a prospective wave circle 4 of i. If price breaks back below $103.8k on a sustained basis without a new high (above 108.5k) then we are left without a clear 5 up from last Sunday's low and the $90k zone (or below) is back on track for a wider / deeper correction off the May high.

As a reminder from previous articles: $87k-$96k is larger degree Fibonacci support for the run higher to $125k+. As stated above, should price break back below $103.8k resoundingly without resoundingly exceeding $108.5k first, a test of the larger support region becomes quite favored. Further, should price break back below last week's low, $98.3k, a test of the larger degree support region becomes extremely likely.

From the 6/15 article

What if $87k breaks?

Technical invalidation of further upside from the April low requires a break of that low which was struck in the $74k region. Clearly we'll want to see standard Fibonacci support hold ($87k-$96k) but I would certainly allow for a bit of overthrow before jettisoning the bullish thesis. Bitcoin trading back below the 4/21 low, $85k~, starts to become cause for concern, and concerns increase should price break below $82k (the .764 retrace). Specifically, I'm watching the $81.3k level, which is an untested hourly low in the rally up from early April. So, below $85k is a warning shot of the potential that a much larger degree top might have been struck and below $81.3k signals likely impending invalidation of further bullish continuation up from April.

Please keep in mind that this cycle from the 2022 low has rallied as much as 624%, trough to peak, (so far) and has what can count as a complete 5 waves up [already having completed]. This larger degree posture outlined in the 6/4 article should be considered regarding the overall risk and that in a larger sense we would be wise to prepare for a more significant top and subsequent bear market.