Bitcoin: All Routes Are Still Open

Bitcoin: All routes are still open

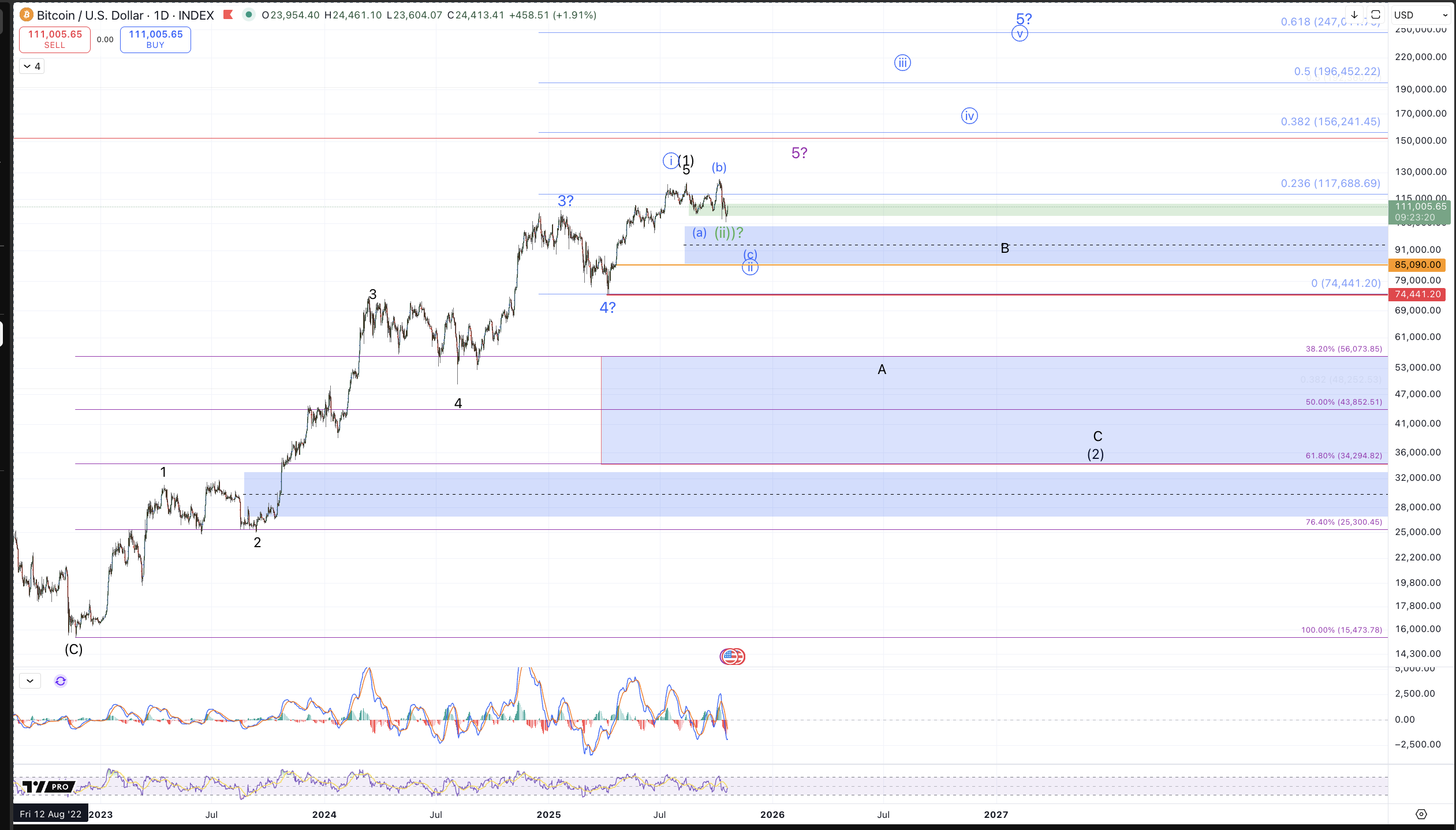

In last week's update, 4 paths were shown for the near to medium term price action in Bitcoin. In this week's update we'll comment as to how price is "behaving" in terms of the 4 respective roadmaps. As a summarized note though, nothing in the past week's action has occurred to rule out any of the paths, which is to say that all remain well intact, so this article will deal with more subtle cues.

The more immediate bullish paths:

Purple/Green: As a recap, both entail a more imminent bottom forming as an expanded flat correction off the August high followed by price developing another impulse up to the $130k-$150k region. They differ in that the purple count suggests that a rally to the aforementioned target region would terminate the move from the 2022 lows whereas the green count would consider a hit of the target region a wave (i) of circle iii of an extended 5th up from the April lows, that will ultimately target $200k+

In the past week, price maintained micro resistance and sent Bitcoin down to lower lows but failed to substantively break the larger support for a wider (iv) that's been tracked for a few months. The key level to break was $106.5k and while that we certainly breached, this level was not an invalidation point and the manner in which it was breached and the lack of downside followthrough leave a wave (iv) (purple) or completed circle ii in the uber-bullish green count quite intact.

The more immediately bearish paths:

Black/Blue: As a recap, both entail price working its way down to test larger support of the breakout from the April low, very generally in the $85k-$100k region. Both counts favor a bottom to develop from that region, though the black does not require it. The blue count needs price to remain above the April low, $74.4k to remain valid. Their key difference is that the black count favors any bounces from support to ultimately fail to reach new highs before breaking down below the April low whereas the blue count suggests a successful test of support followed by a run to $200k+.

While price got some downside followthrough (as expected) from last week's update, the decline has been rather lackluster in its failure to resoundingly break the upper support region (106.5k). My read on the current downside setup is as a larger i-ii developing with resistance for ii in the $111k-$121k region. In order for downside followthrough to remain a reasonable prospect, Bitcoin should remain below $122.6k on this bounce.

In the coming week, the key thing to watch for will be wave structure off the Friday 10/17 low. Should we see a micro impulsive 5 waves up develop, this action will strongly favor a completed a-b-c (or (a)-(b)-(c)) as per the purple/green counts. On the other hand, a corrective 3 wave bounce into this resistance or a move back below Friday's low will strongly favor the black/blue counts and expectations will favor continuation down to $85k-$100k.

In the meantime, this is a good region to exercise caution for shorter term traders, and as a reminder regarding the larger degree, it's quite reasonable to consider the rally off the 2022 low complete, with 5 waves up and price having satisfied expectations with a hit of the $125k target. The coming month should clear up all of the ambiguity of this region and provide a more narrow field of reasonable roadmaps for the next several months.