Bitcoin: 2026 Roadmap - Market Analysis for Feb 8th, 2026

Bitcoin: 2026 Roadmap

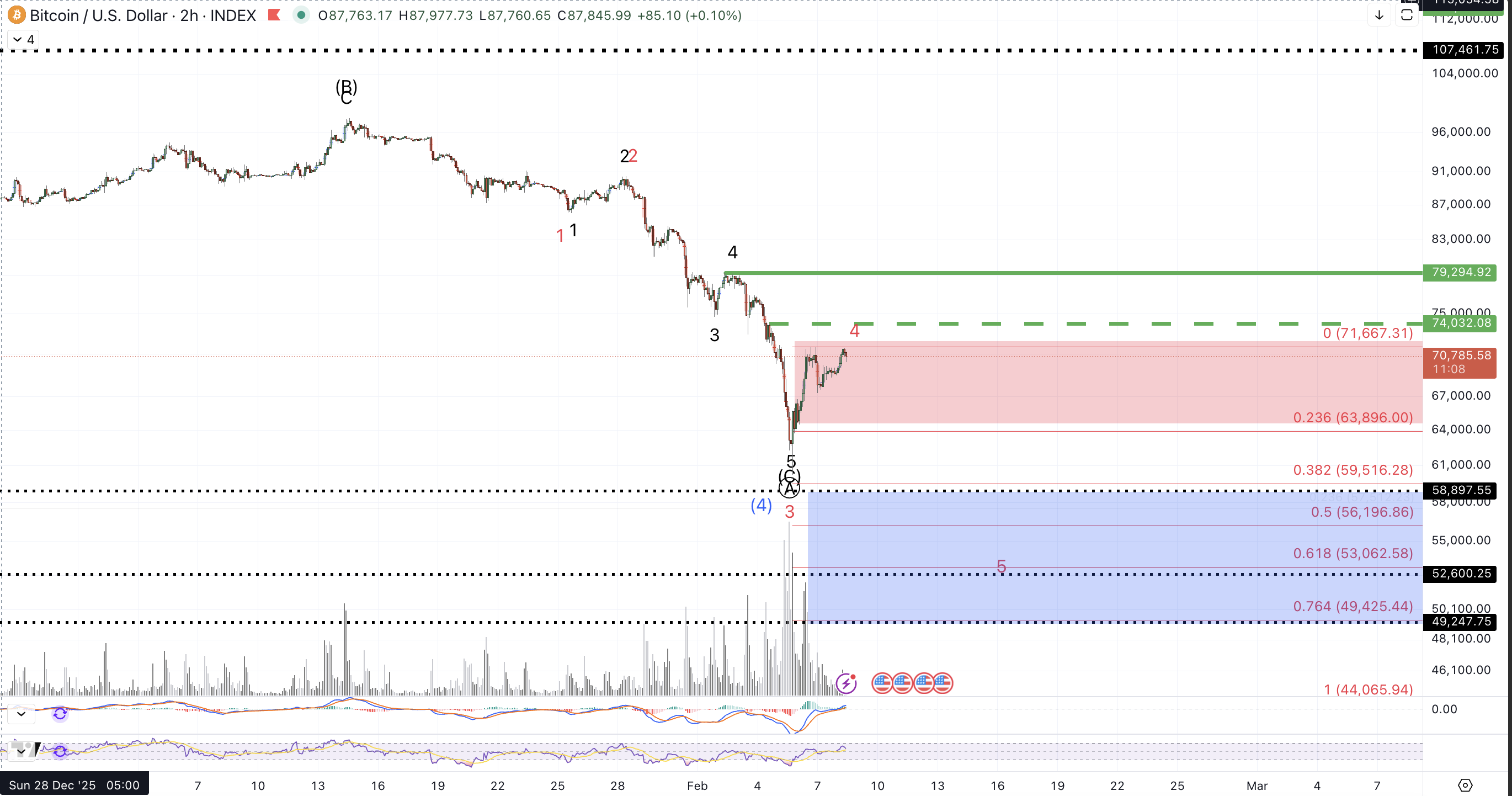

The action this past week fulfilled the most recent article's title in strong form. The 2/1 update was entitled Breakdown! and price did just that, falling nearly 25% from the 2/1 opening print to the Thursday night low.

While this article will primarily discuss the larger degree ramifications of this recent move, let's get the micro count out of the way first:

My primary count favors a low in place with a break above lower resistance for immediately lower levels. Also, price has more than satisfied all of the expectations for this drop, ie, a hit of the $67k-$74k region and a possible 5 down from the January high. That said, with such a large final extension down - while characteristic for Bitcoin near major lows - the drop into Thursday's low opens the possibility of considering one more 4-5 lower to complete this (likely initial) decline from the October 2025 high as a reasonable alternative to the immediate bounce thesis. In order to shake-off the specter of a more immediate lower low, I'll want to see price make a sustained break above $74k. Should price fail to exceed $74k, we can see another drop that would very likely target at least $59k but I'd conservatively expect $52.6k to be reached and potentially a retest of the August 2024 low around $49.2k

Now, regarding the larger degree ramifications of this drop:

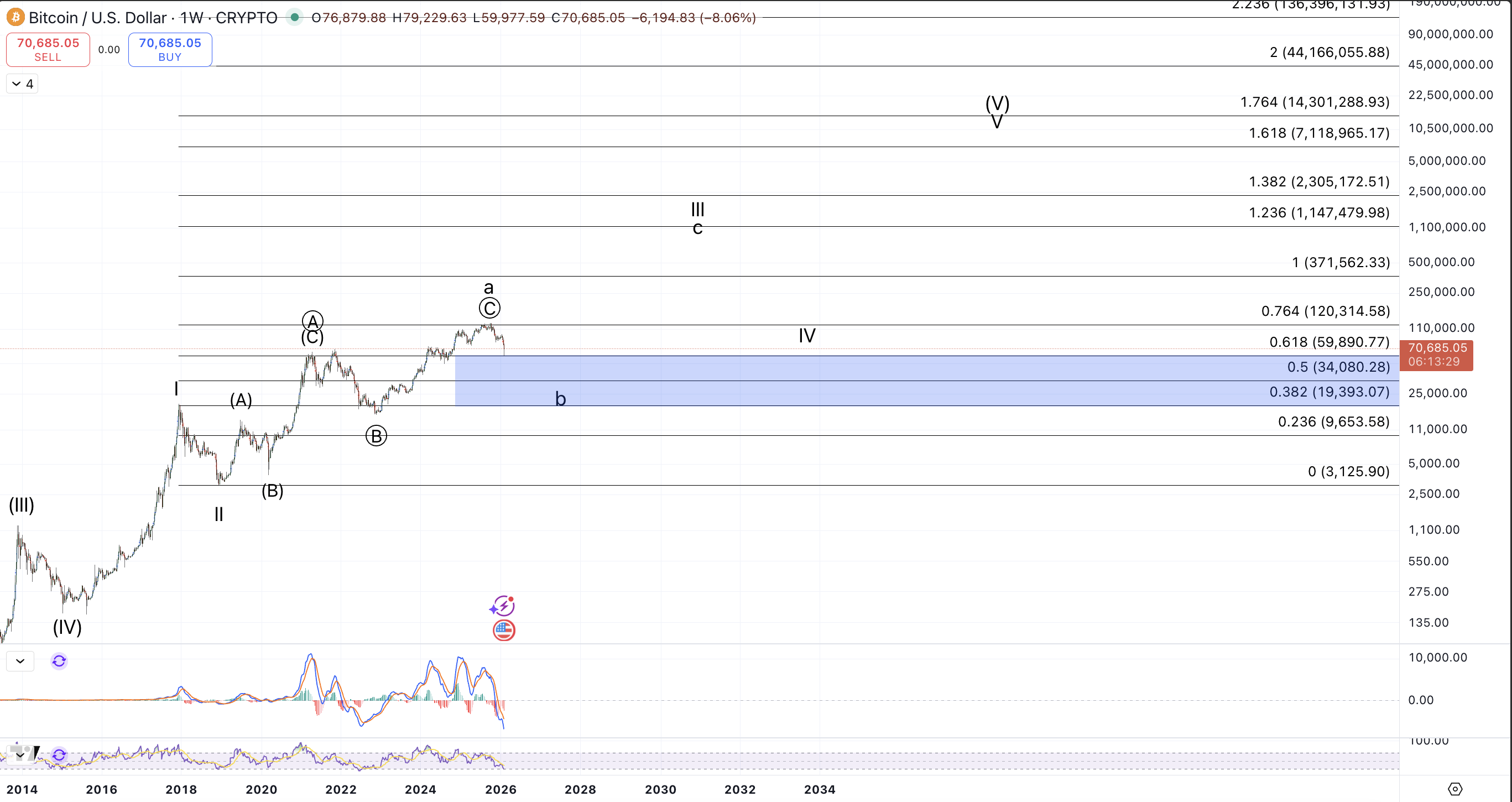

In previous articles and webinars I've stated that I'd want to see the immediately pre-2024 US Presidential election lows, $66.8k, left untouched in order to support my blue count as a reasonable thesis. As a reminder, the blue count entails that the bullish cycle from the 2022 low has not completed and is due one more high and that the recent drop was a wave (4). While the depth of this past week's drop has not invalidated that prospect, the decline has come too low for me to entertain a run to new all-time highs starting from $60k~ as a solid hypothesis. As such I favor that price has reached the completion of the first wave (Primary A) of a bear market that will take shape as a 3 wave move noted with the labels Primary (Circle) ABC on the Daily and Weekly Charts.

All that said, the blue count is not entirely ruled out. If in the coming weeks, we see a clear impulsive rally taking price above $77k, I'll maintain this prospect on the chart as a contender and follow a potential bullish development for a more near term run to new all-time highs.

Overall the expectation is for the rest of 2026 to provide corrective action. This first entails a corrective primary B wave bounce that I suspect will retest the January high, $97k~, in a 3 wave rally, as an (A)-(B)-(C). From there, I'll be looking for a big bad Primary C wave down to develop later this year and possibly not until 2027. Expectations for the Primary C entail a drop to the lower half of support for the larger degree Cycle b wave, marked on the Weekly chart, $19k-$34k.

The coming months should provide some excellent trading opportunities for those following the space closely but I don't expect new ATHs yet for a few years to come. If a reason to become more bullish develops, I will update that here.