Benefit of Doubt to the Bears

In last weekend's report, I wrote: "This can play out either way - strong rebound to 3150 area killing all shorts before the actual downside begins once OPEX is out of the way. OR we just directly crash. Either way, I am expecting more downside - the only thing is if we are going to get a big rebound rally first. On price, I put out a pullback target of 2850-2750 last week - no change in this - this looks like the most likely area for an initial low for this pullback."

What actually happened:

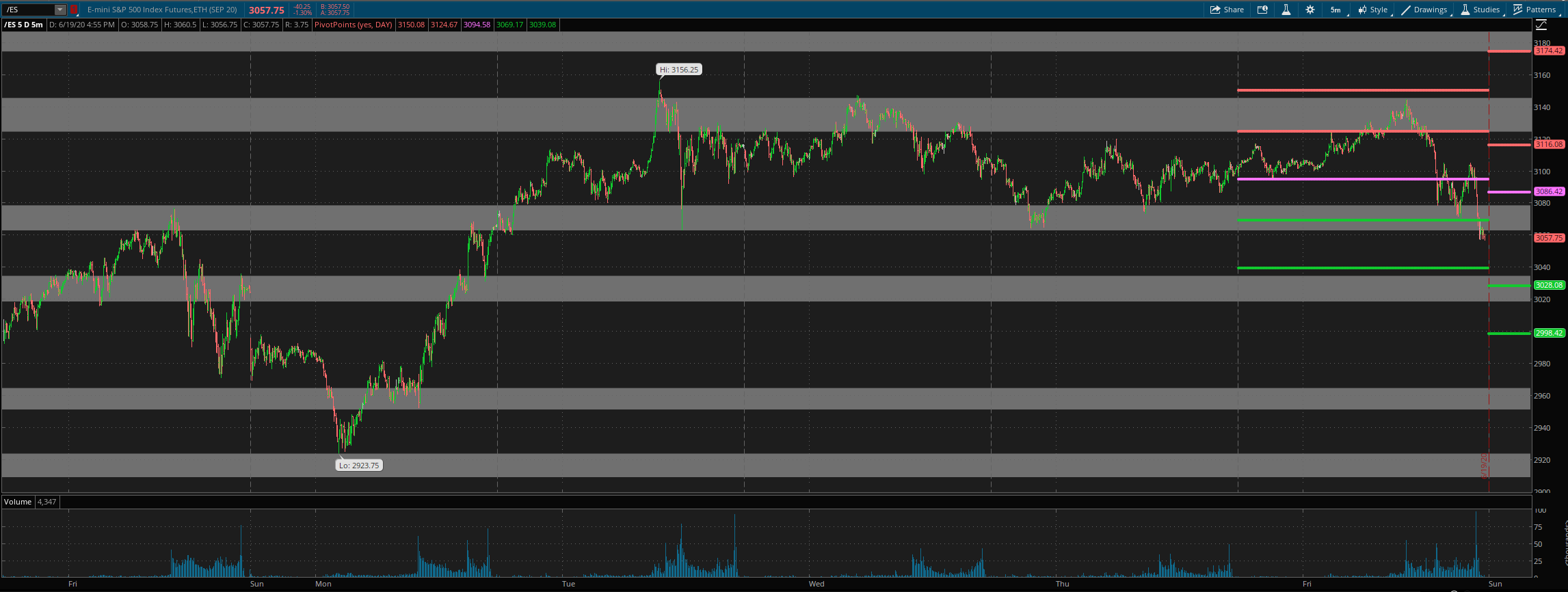

Quite an interesting week. Most of the action happened in the beginning of the week with the strong rebound to 3150 on the Emini S&P 500 (ES) and we just held there until end of the week. And dumped hard once OPEX was done, closing the week 100 points lower.

What's next for this week?

Even after all of this, we do not have a clear idea yet on the bigger picture. Short term, with price breaking below the 3060s, odds are for a move down to test the 2960/50 area first. And then make a decision on what next. Options data looks somewhat bullish on review today. And Internal data looks to be on the bearish side short term. Price action was clearly bearish on Friday. And with the Smart Money Composite Signal (Trading Signal made up from the Micro1, Micro2 and Secret Indicator Combo Indicators) pointing down, let's give the benefit of the doubt to the bears for now and looking for some more immediate downside until the signal turns back up again.

Pivots/Zones:

Grey zone resistance at 3062-78 and then at 3124-45. Support is at 3034-18, 2964-50 and then at 2924-08.

For Monday, daily pivot is at 3086.5. Resistance R1 is at 3116 and R2 at 3174.5. Support S1 is at 3028 and S2 at 2998.5.

All the best to your trading week ahead.