Bearish Internals and Short-Term Price Action

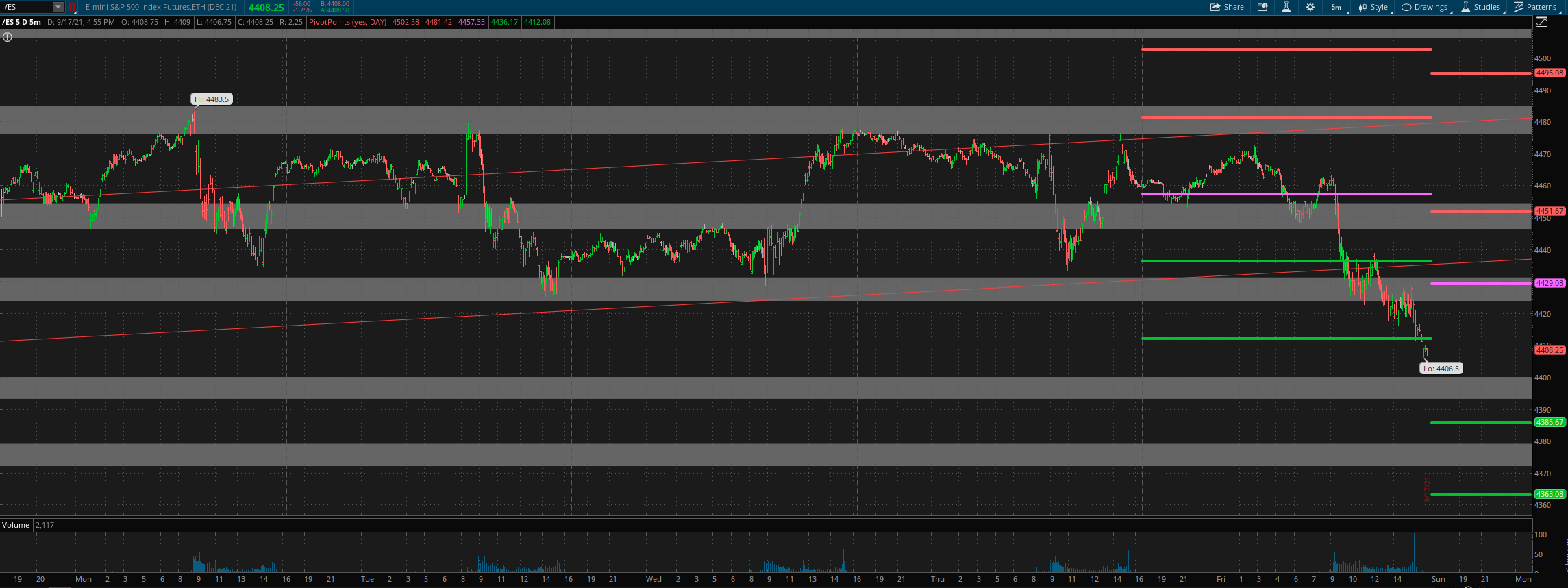

In last weekend's report, we noted: "The system is on the lookout for support coming in somewhere within the 4420/4400 area. If this happens, then an Odds buy can trigger and IF this happens, we will exit shorts and move into an A-Class long. If that support area cannot hold, then lower toward the 4200 area is likely and it can happen very fast. This is because of the longer term trendline support in the 4400 area which has held for the last one year. IF it goes, we will see a quick move lower -- so need to be on the lookout for this. For now, system continues to support the short side … so we hold our short trade until that changes."

What actually happened was that after chopping in a range for most of the week, price dropped hard to end the week at the lows.

Looking ahead, options data is neutral on review today. Internals are bearish. Price action is short term bearish, medium term bearish and long term bullish.

Our Odds indicator is flat. After staying short into Thursday, we went long via a B-Class trade. Friday’s dump makes this long trade early, but at the same time this is now a risk-reward play. On the downside as long as the 4370/75 area holds, we can attempt a move higher into the 4500 area. If it goes, then 4300 and maybe lower become quite likely. If stopped out on this long trade, we should have an A-Class long coming along soon after. This is just another trade. The selloff on Friday likely had a lot to do with options expiring/ quarterly OPEX. We saw a similar move for June expiry as well -- and price bottomed Sunday overnight and rallied hard from there. Let’s see if something similar plays out this time also OR if the market goes for a more complex bottoming process lasting a few more days.

Grey zone resistance at 4431-24, 4454-46, 4477-85 and then at 4506-13. Support is at 4400-4393, 4379-72 and then in the 4350 area.

For Monday, daily pivot is at 4429. Resistance R1 is at 4451.5 and R2 at 4495. Support S1 is at 4385.5 and S2 at 4363.

All the best to your trading week ahead.