BTCUSD: Will Price Take the Long Path or the Short Path to Complete the Rally from the April Lows?

BTCUSD: Will price take the long path or the short path to complete the rally from the April lows?

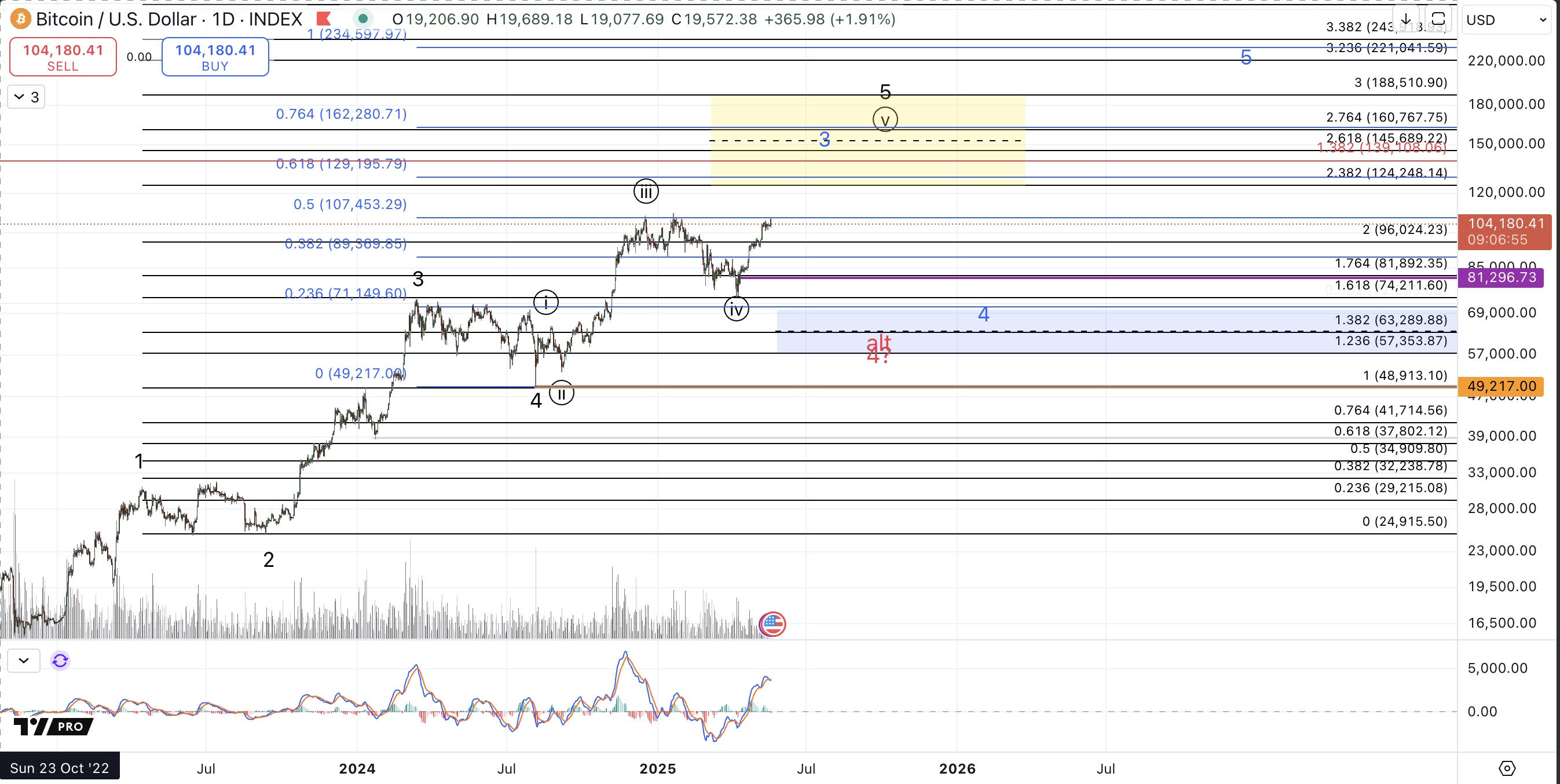

My longer term target in this bullish cycle that began at the 2022 low has been $125k-$140k and that has been the case for a few years now. Considering price is now within a relatively short distance from that region, especially in terms of Bitcoin's volatility, traders would be very wise to mind their risk particularly as price closes in on the target. I'll note that in my perception of sentiment, current conditions do not align with the peak euphoria seen at other larger degree cycle tops, like 2017 and 2021. But, it's worth noting how quickly sentiment spiked in 2017 and price along with it, rapidly reaching its high around $20k and providing little chance to exit in that region before a massive rejection. So, from an action standpoint, this entails for me, taking off some profits when price reaches the target region and trailing a stop to protect gains but allow for capturing some larger gains should price extend within this trend past the target.

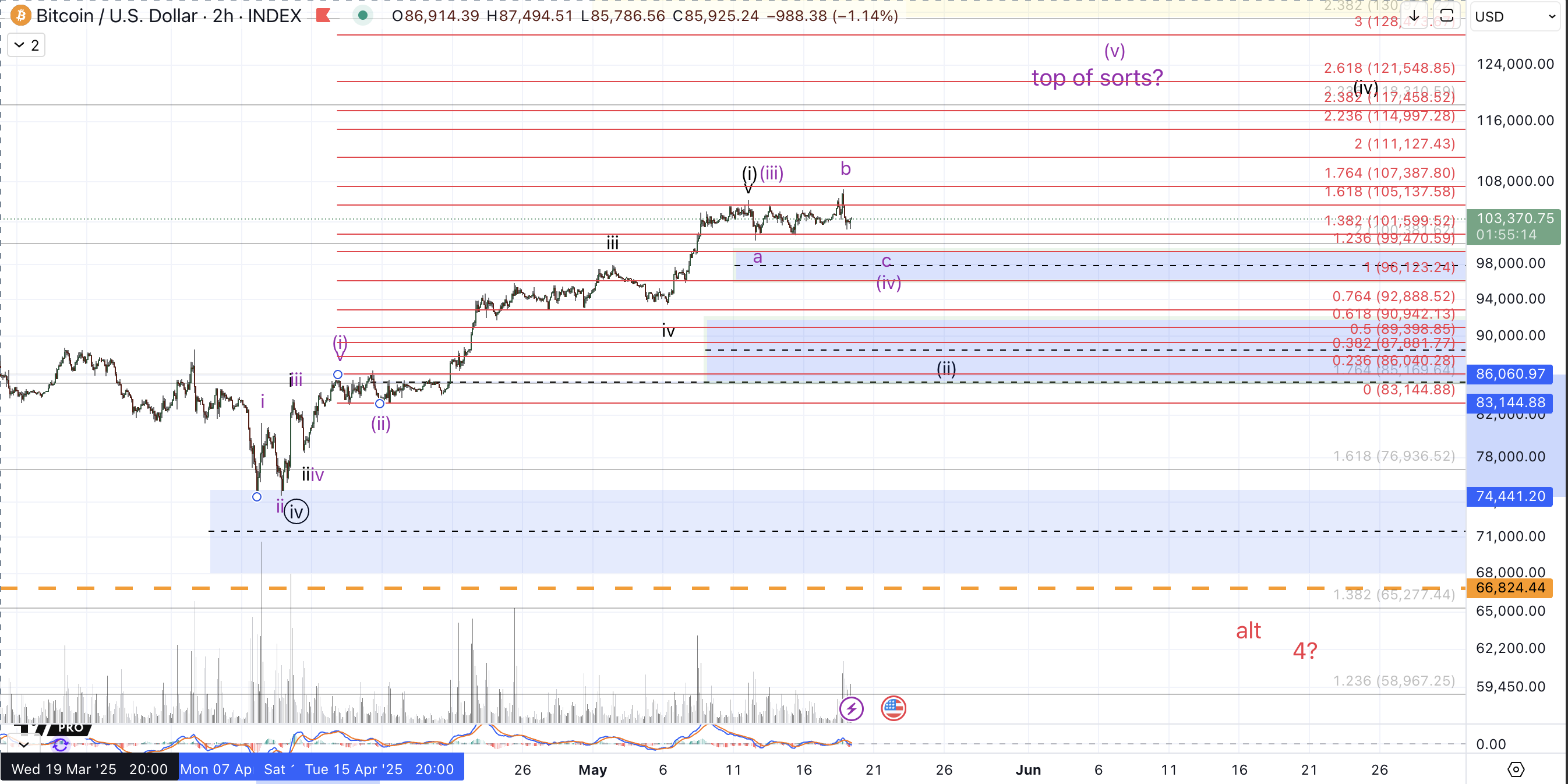

From the 2022 low, we have what can reasonably count as 5 waves, and in the primary count, noted in black, price is in the final portion of the wave 5 from the August low and within that shorter cycle, price is within the final wave circle v of 5 from the April low.

The primary view on the smaller timeframe chart shows price nearing completion of the initial wave (i) of the circle v. The first alternative is that price is further along within the wave circle v which could complete in more direct fashion. This perspective is shown in purple. However, I should note that this "favor" of the black count is based more on the larger degree expectations for Bitcoin to reach $125k (and more ideally $140k) whereas the smaller timeframe chart without any larger degree context more so favors the purple count. One of the issues with aligning the purple count with the larger degree is that price will need some serious extensions within this rally from the April low to reach the higher timeframe targets. This of course is possible and might create the level of euphoria needed to strike a more long term top. But for now, with price maintaining below the all-time high struck in January, I'm tentatively favoring the black count.

On the smaller scale

The higher high made over the weekend occurred on what looks like a 3 wave rally from the little 5/12 pullback low. While this does not rule out the black count, it does increase odds of the purple count as the weekend high looks like an expanded b of (iv). Micro resistance for downside continuation is $104k-$105.9k. Should price get back up above $106k, odds of a more immediate higher high printing, increase. That said, my expectation at this time is for price to continue down to upper support in the $96k-$100k region.

To more effectively rule out the purple count, price should break down below $93.4k which would be more distinct as a 5 up / 3 down for a (i)-(ii) of a larger wave circle v from the April low. Otherwise this circle v might be completing its progression much more directly.

Should price followthrough directly higher to new all-time highs without any break below the upper support region, the odds that Bitcoin is completing the move off the April low increase. At that degree, the primary count is for price to be completing the entirety of the rally from the 2022 low which would entail a more extended bear market - after the last micro cycles complete - to consolidate some of the gains from the 2022 low. However, a reasonable case could be made for Bitcoin to be just completing wave 3 from the 2022 low which would entail a larger 4-5 that could take price north of $200k. This prospect is shown in blue. Please note though that from a risk management perspective, proper trading for the blue count might look like trading for the black / purple counts. That is because even if price does fulfill the blue path, it entails an approximate 50% pullback for wave 4 and that's the larger bullish case for another extension within this cycle from the 2022 lows.

We will continue to closely monitor the action, and want to highlight the two support areas for the prospective paths. $96k-$100k is the upper support for wave (iv) in purple, the more direct path to $125k. A meaningful break below $93.4k is needed to more effectively rule out this path in favor the currently favored black path entailing a more protracted and larger wave (v) from the April low in its early stages rather than nearing its final stages. Support for upwards continuation within that path is roughly $85k-$90k