Market Analysis for May 19th, 2021

BTCUSD, possible options

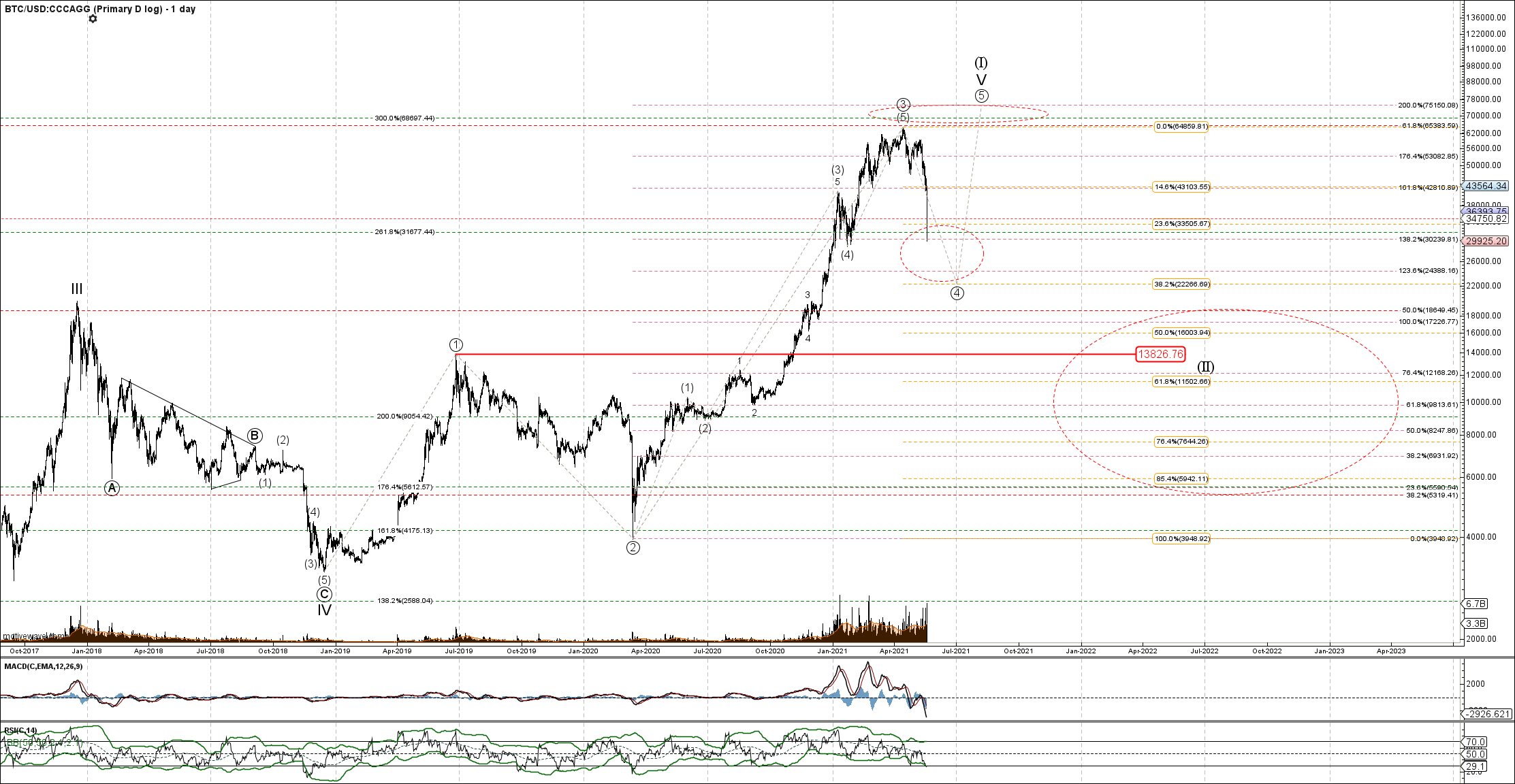

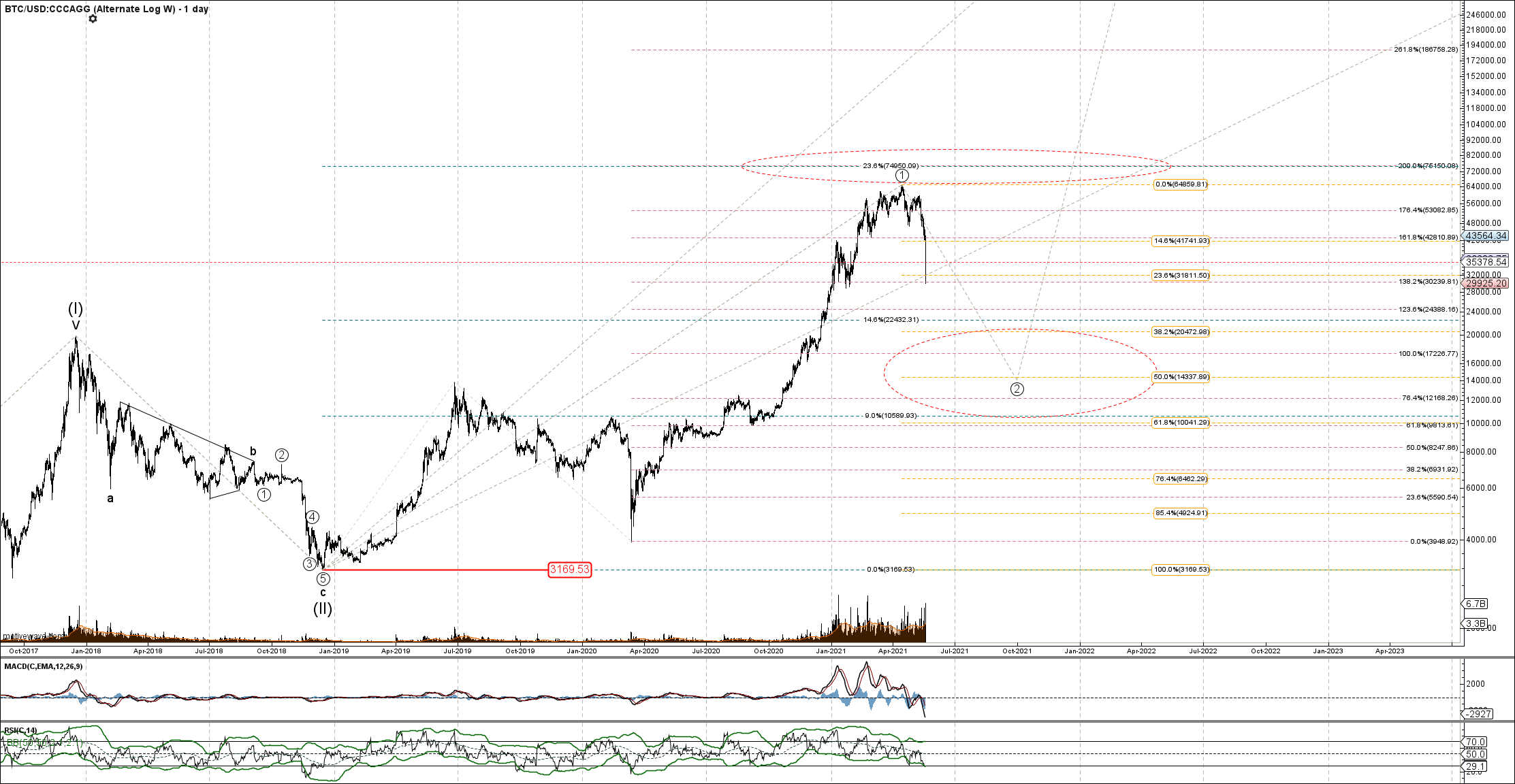

This devastating drop very well might be a part of a larger degree wave (II) (in terms of the Alternate Log counts) or a part of correction in the wave circled 4 (the Primary D log chart and the Alternate D Linear chart).

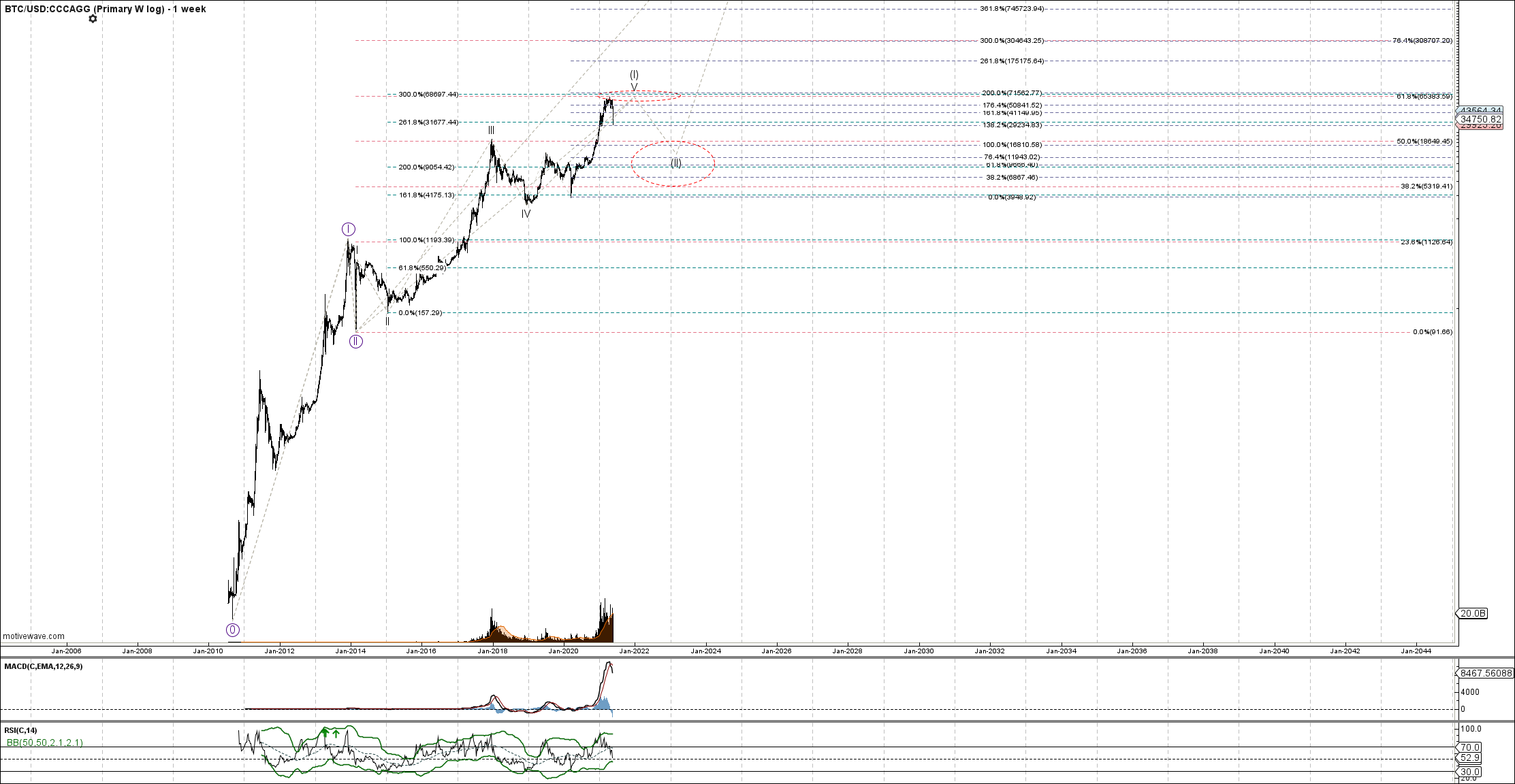

Right now these major options seem to be of equal probability - though further extension to the downside would certainly make the case for the larger degree wave (II) scenario; the Alternate 1 Micro Log chart presents some details - and until 42200 resistance region is taken out we may be facing MUCH stronger decline I have presented a few months back.

The 4th wave counts still suggest an extension to a higher high - but below 75150 I maintain the counts of larger degree posted earlier - BTC still has lower targets to be reached in the larger degree second wave in order to set up further advance to the upside. This perspective would only be negated by sustained rally over 75150 area.